PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928884

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928884

Electronic Ceramics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

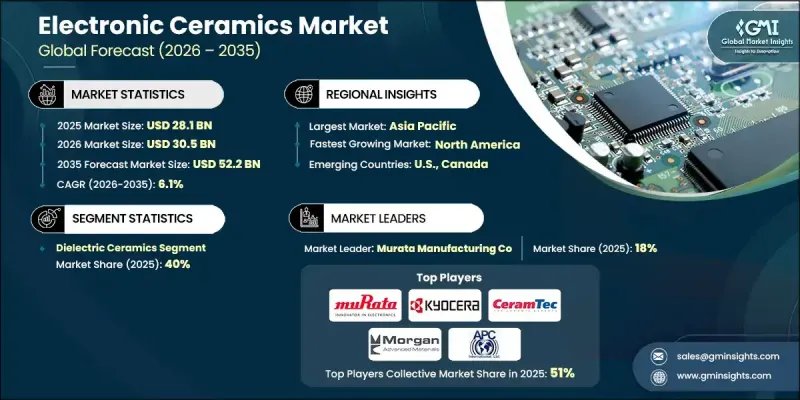

The Global Electronic Ceramics Market was valued at USD 28.1 billion in 2025 and is estimated to grow at a CAGR of 6.1% to reach USD 52.2 billion by 2035.

Market growth is supported by the continued expansion of advanced electronics, high-speed connectivity, electrified mobility, and power infrastructure upgrades. Large-scale production of connected devices drives sustained demand for ceramic-based components that enable signal integrity, energy efficiency, and thermal stability. Advancements in wireless communication and next-generation networks are increasing performance requirements for ceramic materials used in high-frequency and microwave applications. The automotive sector is reinforcing long-term demand as electric drivetrains, power electronics, and charging systems rely on ceramic substrates and insulators capable of operating at higher voltages and temperatures. Industrial power systems, grid modernization, and automation solutions further contribute to market expansion using ceramic materials for insulation, energy storage, and control systems. Asia Pacific represents nearly 60% of global market value due to its concentration of electronics manufacturing, while North America and Europe remain focused on high-reliability and specialty applications with premium pricing. Ongoing miniaturization, evolving memory technologies, automotive electrification, and regulatory-driven material innovation continue to widen application opportunities.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $28.1 Billion |

| Forecast Value | $52.2 Billion |

| CAGR | 6.1% |

By product category, the dielectric ceramics accounted for 40% share in 2025, supported by strong demand for multilayer ceramic capacitors, resonators, and radio-frequency components. Magnetic ceramic materials held close to 15% of the market, driven by their use in inductive components, electromagnetic interference control, and advanced communication systems.

The consumer electronics and home appliances represented the leading end-use segment, consuming high volumes of ceramic components used across connected devices, smart systems, and digital appliances. Growing adoption of intelligent, connected, and high-performance consumer products continues to stimulate demand for compact, reliable ceramic materials that support signal processing, energy storage, and heat management.

U.S. Electronic Ceramics Market reached USD 6.1 billion in 2025 and is expected to approach USD 12 billion by 2035, supported by reshoring initiatives, incentives for semiconductor and advanced manufacturing, and growth in electric vehicle production. The region emphasizes high-reliability applications across aerospace, medical technology, defense, and advanced power electronics, contributing to higher average selling prices and increased investment in supply chain security.

Key companies active in the Global Electronic Ceramics Market include Murata Manufacturing, Kyocera Corporation, CeramTec Holding, Morgan Advanced Materials, Maruwa, APC International, PI Ceramics, Sparkler Ceramics, Central Electronics, and Sensor Technology. Companies in the Global Electronic Ceramics Market are strengthening their market position by investing in advanced material research to improve dielectric performance, thermal conductivity, and reliability. Many players are expanding production capacity and regional manufacturing footprints to support supply chain resilience and meet local sourcing requirements. Strategic collaborations with electronics, automotive, and energy system manufacturers enable early integration into next-generation designs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Form factor

- 2.2.3 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Electronic Ceramics Market, By Product Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Ferroelectric ceramics

- 5.3 Piezoelectric ceramics

- 5.4 Pyroelectric ceramics

- 5.5 Dielectric ceramics

- 5.6 Magnetic ceramics

- 5.7 Insulating & substrate ceramics

- 5.8 Conductive & electrode ceramics

- 5.9 Others

Chapter 6 Electronic Ceramics Market, By Form Factor, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Bulk ceramics

- 6.3 Thin films

- 6.4 Powders

- 6.5 Nanoparticles

- 6.6 Composite materials

Chapter 7 Electronic Ceramics Market, By End Use Industry, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Home appliances & consumer electronics

- 7.3 Healthcare

- 7.4 Automotive & transportation

- 7.5 Telecommunication & power transmission

- 7.6 Aerospace & defense

- 7.7 Industrial automation & power electronics

- 7.8 Energy & power generation

- 7.9 IoT & wearables

- 7.10 Others

Chapter 8 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 APC International

- 9.2 CeramTec Holding

- 9.3 Central Electronics

- 9.4 Kyocera Corporation

- 9.5 Maruwa

- 9.6 Morgan Advanced Materials

- 9.7 Murata Manufacturing

- 9.8 PI Ceramics

- 9.9 Sensor Technology

- 9.10 Sparkler Ceramics