PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928887

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928887

Almond Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

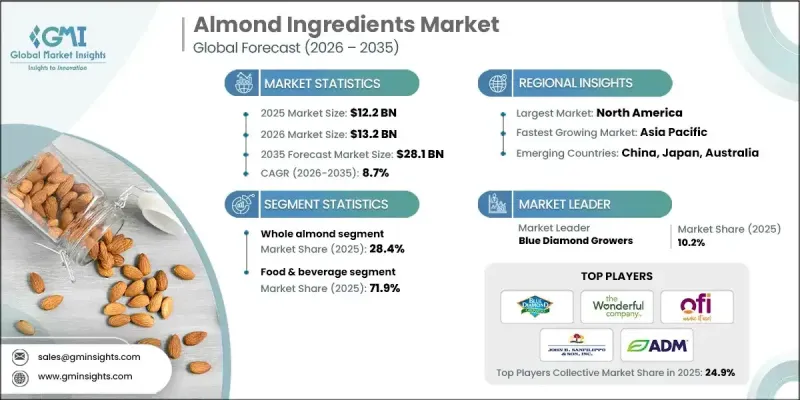

The Global Almond Ingredients Market was valued at USD 12.2 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 28.1 billion by 2035.

Almond ingredients encompass processed products such as almond flour, butter, oil, milk, and paste, widely used in bakery, confectionery, beverages, and dairy alternatives. Market growth is driven by rising health consciousness and increasing nutritional awareness among consumers. Almonds are recognized for their high protein, fiber, and healthy fat content, making them a preferred choice for nutrient-dense diets. Research indicates that almonds are a rich source of plant-based protein and vitamin E, supporting heart health and immunity. Rising adoption of plant-based diets, coupled with government dietary recommendations, is driving demand for dairy-free and lactose-free products. Consumers are also prioritizing clean-label and organic options, prompting manufacturers to innovate in organic almond products. Regulatory standards by agencies such as the USDA and European Commission are further encouraging transparency and quality in this sector.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.2 Billion |

| Forecast Value | $28.1 Billion |

| CAGR | 8.7% |

The whole almonds segment accounted for 28.4% share in 2025 and is expected to grow at a CAGR of 8.6% through 2035. Their versatility and minimal processing appeal to health-conscious consumers seeking natural snack options. Whole almonds are increasingly marketed as premium, nutrient-rich ingredients, boosting global demand.

The food & beverage sector held a 71.9% share in 2025. Almond ingredients are widely used in bakery, confectionery, snacks, and dairy alternatives. The rise of plant-based, gluten-free, and vegan formulations has driven innovation in beverages, protein bars, and desserts, solidifying the sector's leading position.

North America Almond Ingredients Market is forecast to grow at a CAGR of 8.7% between 2026 and 2035. Consumer preference for plant-based, allergen-free, and clean-label products has fueled demand across food, beverage, and nutraceutical applications. Growing health and wellness awareness encourages companies to invest in research and development to enhance the sustainability, functionality, and quality of almond ingredients, aligning with evolving consumer expectations.

Key companies operating in the Global Almond Ingredients Market include Blue Diamond Growers, ADM, Olam Food International, The Wonderful Company, Barry Callebaut Group, Kanegrade, Borges Agricultural & Industrial Nuts, John B. Sanfilippo & Son, Inc., Treehouse California Almonds, Royal Nut Company, and Harris Woolf Almonds. To strengthen their position, companies in the Almond Ingredients Market are focusing on product innovation and diversification, developing value-added almond products such as fortified flours, protein-enriched butters, and functional beverages. Many firms are expanding their direct-to-consumer channels and e-commerce capabilities to reach wider audiences. Sustainability initiatives, including eco-friendly sourcing, organic certifications, and traceability programs, enhance brand credibility. Partnerships with food and beverage manufacturers support the co-development of new formulations. Strategic geographic expansion targets emerging markets with growing plant-based product demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness & nutritional awareness

- 3.2.1.2 Plant-based diet adoption & dairy alternative demand

- 3.2.1.3 Clean-label & organic product preference

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Almond price volatility & supply uncertainty

- 3.2.2.2 Competition from alternative plant-based ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Organic almond market expansion

- 3.2.3.2 Almond protein in plant-based meat & dairy

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Whole almond

- 5.3 Almond pieces

- 5.4 Almond flour

- 5.5 Almond paste

- 5.6 Almond milk

- 5.7 Almond oil

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.2.1 Bakery products

- 6.2.2 Confectionery

- 6.2.3 Dairy alternatives

- 6.2.4 Frozen desserts

- 6.2.5 Ready-to-eat (RTE) cereals

- 6.2.6 Snacks

- 6.2.7 Nut & seed butters

- 6.2.8 Beverages

- 6.2.9 Cooking oils & culinary applications

- 6.2.10 Others

- 6.3 Cosmetics & personal care

- 6.3.1 Skin care products

- 6.3.2 Hair care products

- 6.3.3 Massage & aromatherapy

- 6.3.4 Soaps & cleansers

- 6.3.5 Cosmetic formulations

- 6.3.6 Others

- 6.4 Pharmaceutical & nutraceutical

- 6.4.1 Animal feed

- 6.4.2 Livestock feed

- 6.4.3 Poultry feed

- 6.4.4 Pet food

- 6.4.5 Others

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hypermarkets/supermarkets

- 7.3 Convenience stores

- 7.4 Online retail

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 Blue Diamond Growers

- 9.3 Olam Food International

- 9.4 John B. Sanfilippo & Son, Inc

- 9.5 Kanegrade

- 9.6 Borges Agricultural & Industrial Nuts

- 9.7 Treehouse California Almonds

- 9.8 Harris Woolf Almonds

- 9.9 The Wonderful Company

- 9.10 Royal Nut Company

- 9.11 Barry Callebaut Group