PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928888

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928888

Xylitol Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

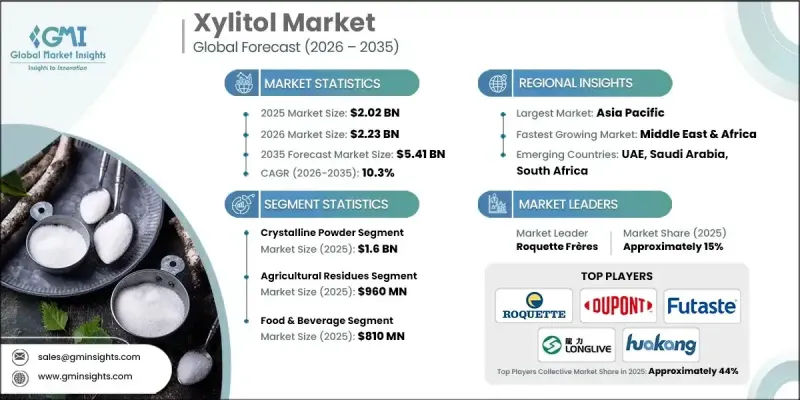

The Global Xylitol Market was valued at USD 2.02 billion in 2025 and is estimated to grow at a CAGR of 10.3% to reach USD 5.41 billion by 2035.

Market expansion is supported by the rising preference for sugar-free and reduced-calorie sweetening solutions across food and beverage formulations. Consumers are increasingly focused on healthier dietary patterns, prompting manufacturers to replace conventional sugar with alternatives that deliver sweetness without contributing to blood sugar spikes. This shift is especially pronounced in urban and developed markets, where awareness of nutrition and wellness continues to rise. The market is further benefiting from the growing focus on preventive health, as xylitol aligns well with reduced-sugar initiatives and wellness-oriented product positioning. Its functional characteristics, combined with consumer acceptance, are driving broader incorporation across processed food categories. In addition, policy-level encouragement aimed at lowering sugar consumption is indirectly strengthening demand. Xylitol is also gaining traction beyond food applications, reinforcing its role as a multifunctional ingredient with expanding relevance across health-focused industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.02 Billion |

| Forecast Value | $5.41 Billion |

| CAGR | 10.3% |

Rising rates of metabolic health conditions are contributing to higher adoption of xylitol in formulations designed for sugar-conscious consumers. Food manufacturers are increasingly integrating it into baked goods, confectionery, and functional nutrition products to meet evolving demand for better-for-you alternatives. This trend is reinforcing xylitol's position as a preventive-health ingredient rather than a niche sweetener. Demand is also being supported by its functional benefits in personal care formulations, where its properties enhance product appeal and differentiation.

The crystalline powder segment generated USD 1.6 billion in 2025 and is projected to grow at a CAGR of 10.1% from 2026 to 2035. Its popularity is driven by formulation flexibility, ease of handling, and compatibility with established processing systems. Expanding demand for sugar-free food products is encouraging manufacturers to scale production while maintaining standardized quality and cost efficiency.

The agricultural residues segment was valued at USD 960 million in 2025 and is expected to grow at a CAGR of 10% through 2035. Producers are increasingly relying on agricultural by-products and cereal-based inputs to improve sustainability and reduce dependency on conventional raw materials. Advancements in extraction and fermentation technologies are improving yield stability, supporting a gradual transformation in sourcing strategies across the value chain.

United States Xylitol Market reached USD 424.3 million in 2025. Growth in the country is supported by rising health awareness and increasing adoption of sugar alternatives across multiple industries. Higher demand for advanced purity grades is emerging from pharmaceutical and nutraceutical producers seeking enhanced functionality, while innovation in functional foods and supplements continues to stimulate market momentum.

Key companies operating in the Global Xylitol Market include Ingredion Incorporated, Roquette Freres, DuPont, Merck KGaA, ZuChem Inc., Foodchem International Corporation, Shandong Futaste Co., Ltd., Zhejiang Huakang Pharmaceutical Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., Yusweet Xylitol Technology Co., Ltd., and other regional participants. Companies in the Xylitol Market are focusing on capacity expansion and process optimization to meet rising global demand while maintaining cost competitiveness. Many players are investing in sustainable raw material sourcing and advanced production technologies to align with environmental goals and circular economy principles. Product differentiation through improved purity levels and tailored grades supports penetration into high-value applications. Strategic collaborations with food, pharmaceutical, and nutraceutical manufacturers help secure long-term supply agreements.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product grade

- 2.2.3 Source

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product grade

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Grade, 2022 - 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Crystalline powder

- 5.2.1 Fine grade

- 5.2.2 Coarse grade

- 5.2.3 Extra coarse grade

- 5.3 Directly compressible grades

- 5.3.1 Co-processed with dextrin

- 5.3.2 Co-processed with CMC

- 5.4 Others

- 5.4.1 Pharmaceutical grade

- 5.4.2 Food grade

- 5.4.3 Cosmetic grade

Chapter 6 Market Estimates and Forecast, By Source, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Agricultural residues

- 6.2.1 Corncob

- 6.2.2 Corn husk

- 6.2.3 Sugarcane bagasse

- 6.3 Wood-based sources

- 6.3.1 Hardwood

- 6.3.2 Birch wood

- 6.4 Cereal by-products

- 6.4.1 Oat hulls

- 6.4.2 Wheat straw

- 6.4.3 Rice straw

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Chewing gum

- 7.2.2 Confectionery (candies, marshmallow)

- 7.2.3 Sugar-free foods

- 7.2.4 Bakery products

- 7.3 Pharmaceutical

- 7.3.1 Oral dosage forms

- 7.3.2 Medicated confectionery

- 7.3.3 Coating applications

- 7.3.4 Drug formulations

- 7.4 Oral care products

- 7.4.1 Toothpaste

- 7.4.2 Mouthwash

- 7.4.3 Dental health claims & regulatory status

- 7.5 Cosmetics & personal care

- 7.5.1 Moisturizing products

- 7.5.2 Face & neck products

- 7.5.3 Skincare

- 7.5.4 Bath products

- 7.6 Nutraceuticals & dietary supplements

- 7.6.1 Diabetic foods

- 7.6.2 Weight management foods

- 7.6.3 Dietary supplements

- 7.7 Others

- 7.7.1 Anti-quorum sensing / anti-biofilm agent

- 7.7.2 Veterinary products

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Roquette Freres

- 9.2 DuPont

- 9.3 Shandong Futaste Co., Ltd.

- 9.4 Shandong Longlive Bio-Technology Co., Ltd.

- 9.5 Zhejiang Huakang Pharmaceutical Co., Ltd.

- 9.6 Ingredion Incorporated

- 9.7 ZuChem Inc.

- 9.8 Merck KGaA

- 9.9 Foodchem International Corporation

- 9.10 Yusweet Xylitol Technology Co., Ltd.