PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928893

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928893

Asia Pacific Electric Vehicle Contactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

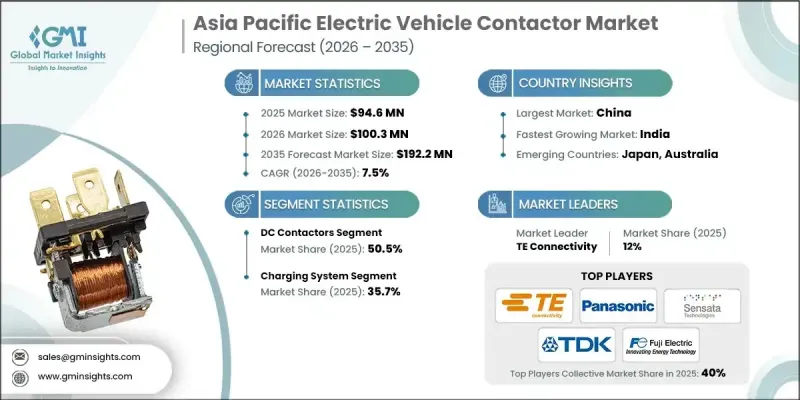

Asia Pacific Electric Vehicle Contactor Market was valued at USD 94.6 million in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 192.2 million by 2035.

Expansion is driven by increasingly strict efficiency and decarbonization policies that are accelerating the rollout of electrified vehicles across the region. Governments are steadily tightening emission thresholds for new vehicles, prompting automakers to broaden their portfolios of battery electric, plug-in hybrid, and hybrid models. This regulatory momentum is also accelerating approval timelines and expanding model variants, which increases the need for contactors with different current capacities and installation formats. As electric mobility ecosystems mature, procurement demand remains consistent for advanced, sealed contactors across both vehicle platforms and charging infrastructure. Public charging policies are promoting higher power capabilities, which raises technical requirements for contactors used in vehicles and charging stations alike. Higher charging speeds require components with greater interruption capacity, improved arc control, and stronger thermal performance. Standards related to installation quality, safety, and urban noise levels are also influencing design priorities, favoring sealed constructions and quieter operation to ensure reliable load isolation during frequent switching cycles.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $94.6 Million |

| Forecast Value | $192.2 Million |

| CAGR | 7.5% |

The DC contactors segment accounted for 50.5% share in 2025 and is expected to grow at a CAGR of 8% through 2035. Rising system voltages across electric vehicle platforms are increasing performance requirements related to insulation strength, arc suppression, and short-circuit tolerance. As electrified powertrains gain wider adoption, the number of DC contactors integrated per vehicle continues to rise, directly supporting segment growth.

The charging system segment held a 35.7% share in 2025 and is forecast to grow at a CAGR of 7.6% by 2035. Expansion of high-capacity charging networks is increasing demand for both DC and AC switching components. Growth in charging infrastructure raises requirements for safety isolation, monitoring capability, and long-term reliability across charger assemblies and distribution systems.

China Electric Vehicle Contactor Market held 38% share in 2025, generating USD 36.6 million. Ongoing regulatory enhancements are raising technical standards for fault management and electrical isolation, which continues to support demand for high-performance contactors in both vehicles and charging applications.

Key companies active in the Asia Pacific Electric Vehicle Contactor Market include Schneider Electric, Siemens, ABB, Mitsubishi Electric, Panasonic Industry Co., Ltd., Eaton Corporation, LS Electric, TE Connectivity, Fuji Electric, Toshiba, Sensata Technologies, Rockwell Automation, Albright International, Song Chuan, Carlo Gavazzi, LOVATO Electric, HONGFA, TDK, L&T, and GEYA. Companies operating in the Asia Pacific Electric Vehicle Contactor Market focus on strengthening their position through technology advancement and regional expansion strategies. Manufacturers invest in research and development to improve contactor durability, voltage handling, and thermal stability to meet evolving electric vehicle and charging standards. Strategic partnerships with automotive OEMs and charging infrastructure providers help secure long-term supply agreements. Firms also expand localized manufacturing and service capabilities to improve responsiveness and cost efficiency. Portfolio diversification across DC and AC contactors enables suppliers to address a wider range of applications. Compliance with regional safety regulations and customization for local market requirements further enhance competitive differentiation and customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 Voltage trends

- 2.1.4 Application trends

- 2.1.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2025

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 DC contactor

- 5.3 AC contactor

Chapter 6 Market Size and Forecast, By Voltage, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 High

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Battery management systems

- 7.3 Inverters

- 7.4 Heating, Ventilation, and Air Conditioning (HVAC)

- 7.5 Charging systems

Chapter 8 Market Size and Forecast, By Country, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 China

- 8.3 India

- 8.4 Japan

- 8.5 Australia

- 8.6 South Korea

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Albright International

- 9.3 Carlo Gavazzi

- 9.4 Eaton Corporation

- 9.5 Fuji Electric

- 9.6 GEYA

- 9.7 HONGFA

- 9.8 L&T

- 9.9 LOVATO Electric

- 9.10 LS Electric

- 9.11 Mitsubishi Electric

- 9.12 Panasonic Industry Co., Ltd.

- 9.13 Rockwell Automation

- 9.14 Schneider Electric

- 9.15 Sensata Technologies

- 9.16 Siemens

- 9.17 Song Chuan

- 9.18 TDK

- 9.19 TE Connectivity

- 9.20 Toshiba