PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928901

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928901

Cosmetic Preservatives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

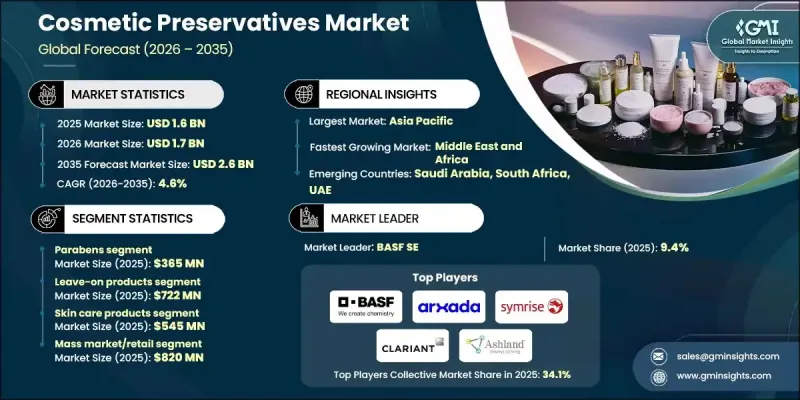

The Global Cosmetic Preservatives Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 2.6 billion by 2035.

Growth is supported by rising demand for safe, long-lasting cosmetic formulations and increasing consumer awareness around product hygiene and shelf stability. Cosmetic preservatives are described as essential formulation components that inhibit microbial growth and protect products from contamination during production, storage, and use. Their role is critical in maintaining product integrity, safety, and performance over time. As cosmetic formulations increasingly incorporate water-based systems, the need for effective preservation continues to rise. Regulatory oversight is also shaping market dynamics, as manufacturers must comply with strict safety standards while meeting consumer expectations. Advances in formulation science are supporting the transition toward safer and multifunctional preservation systems. Innovation in packaging and ingredient technology is further enhancing protection against contamination. Together, these factors are reinforcing the importance of preservatives as a core element in modern cosmetic product development.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 4.6% |

The parabens segment accounted for USD 365 million in 2025. This category, along with other widely used synthetic preservation systems, continues to be adopted due to reliable antimicrobial performance. At the same time, demand for alternative preservation solutions is increasing as consumers seek gentler and environmentally aligned options. A range of preservation chemistries is being used to meet diverse formulation requirements while ensuring compliance with safety regulations.

The skin care products segment generated USD 545 million in 2025. Growth in this category is being driven by heightened focus on personal wellness, daily care routines, and ongoing product innovation. Rising interest across other personal care categories is also contributing to broader preservative demand.

U.S. Cosmetic Preservatives Market reached USD 418.8 million in 2025. Regional growth is supported by strong consumer spending on beauty products, continued formulation innovation, and rising preference for clean-label and responsibly formulated cosmetics across North America.

Key companies operating in the Cosmetic Preservatives Market include BASF SE, Evonik Industries AG, Clariant International Ltd, Symrise AG, Lanxess Corporation, Ashland, Lonza Group AG, Arkema S.A., Stepan Company, Troy Corporation, Inolex Chemical Company, Galaxy Surfactants Ltd, Sharon Personal Care, Brenntag SE, Naturex (Givaudan), Akema S.r.l, Thor Group (part of Arxada), Kumar Organic Products Ltd, Minasolve, Micro Science Tech, Spec-Chem Industry Inc., Dadia Chemical Industries, Salicylates and Chemicals Pvt Ltd.Companies in the Cosmetic Preservatives Market are strengthening their market positions through innovation, regulatory alignment, and portfolio diversification. Manufacturers are investing in research to develop safer, multifunctional preservation systems that align with clean beauty trends. Expansion of natural and mild preservative solutions is helping brands meet changing consumer preferences. Strategic collaborations with cosmetic formulators are supporting customized solutions and long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Preservative Type

- 2.2.2 Product Form

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personal care products

- 3.2.1.2 Rising popularity of water-based formulations

- 3.2.1.3 Expansion of the global cosmetic industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of skin irritation and allergies

- 3.2.2.2 Limited efficacy of natural preservatives

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for natural and clean-label cosmetics

- 3.2.3.2 Technological advancements in preservation systems

- 3.2.3.3 Adoption of advanced packaging technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By preservative type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Preservative Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Parabens

- 5.2.1 Methylparaben

- 5.2.2 Ethylparaben

- 5.2.3 Propylparaben

- 5.2.4 Butylparaben

- 5.2.5 Paraben blends

- 5.3 Phenoxyethanol & alcohols

- 5.3.1 Phenoxyethanol

- 5.3.2 Benzyl alcohol

- 5.3.3 Chlorobutanol

- 5.3.4 Denatured alcohol

- 5.4 Formaldehyde-releasing agents

- 5.4.1 DMDM hydantoin

- 5.4.2 Imidazolidinyl urea

- 5.4.3 Diazolidinyl urea

- 5.4.4 Quaternium-15

- 5.4.5 Bronopol

- 5.5 Organic acids

- 5.5.1 Benzoic acid & sodium benzoate

- 5.5.2 Sorbic acid & potassium sorbate

- 5.5.3 Salicylic acid

- 5.5.4 Dehydroacetic acid

- 5.5.5 Citric acid & silver citrate

- 5.6 Isothiazolinones

- 5.6.1 Methylisothiazolinone (MIT)

- 5.6.2 Methylchloroisothiazolinone (MCI/MIT blends)

- 5.6.3 Benzisothiazolinone (BIT)

- 5.7 Quaternary ammonium compounds

- 5.7.1 Benzalkonium chloride

- 5.7.2 Cetrimonium chloride

- 5.7.3 Polyaminopropyl biguanide (PAPB)

- 5.7.4 Chlorhexidine & salts

- 5.8 Natural & botanical preservatives

- 5.8.1 Essential oils & plant extracts

- 5.8.2 Fermented ingredients

- 5.8.3 Organic acids from natural sources

- 5.8.4 Ecocert/COSMOS approved preservatives

- 5.9 Multifunctional preservatives

- 5.9.1 Caprylyl glycol

- 5.9.2 Pentylene glycol

- 5.9.3 Ethylhexylglycerin

- 5.9.4 Glyceryl caprylate

- 5.9.5 1,2-diols & polyols

- 5.10 Others

- 5.10.1 Zinc pyrithione

- 5.10.2 Triclosan (restricted markets)

- 5.10.3 Silver compounds

- 5.10.4 Iodopropynyl butylcarbamate

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Leave-on products

- 6.3 Rinse-off products

- 6.4 Water-based products

- 6.4.1 Emulsions (O/W & W/O)

- 6.4.2 Gels & aqueous solutions

- 6.5 Anhydrous products

- 6.5.1 Oil-based formulations

- 6.5.2 Powders & solid forms

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Skin care

- 7.2.1 Face creams & lotions

- 7.2.2 Moisturizers

- 7.2.3 Anti-aging products

- 7.2.4 Sunscreens & sun care

- 7.2.5 Facial cleansers

- 7.2.6 Serums & concentrates

- 7.2.7 Body lotions & butters

- 7.3 Hair care

- 7.3.1 Shampoos

- 7.3.2 Conditioners

- 7.3.3 Hair styling products (gels, mousses, sprays)

- 7.3.4 Hair dyes & colorants

- 7.3.5 Hair masks & treatments

- 7.3.6 Scalp care products

- 7.4 Color cosmetics (makeup)

- 7.4.1 Foundations & BB/CC creams

- 7.4.2 Lipsticks & lip glosses

- 7.4.3 Eye makeup (mascara, eye shadow, eyeliner)

- 7.4.4 Nail care (nail polish, removers)

- 7.4.5 Blush & bronzers

- 7.5 Toiletries

- 7.5.1 Deodorants & antiperspirants

- 7.5.2 Body washes & shower gels

- 7.5.3 Bath products (bath salts, bubble bath)

- 7.5.4 Intimate hygiene products

- 7.5.5 Hand sanitizers

- 7.6 Fragrances & perfumes

- 7.6.1 Perfumes

- 7.6.2 Colognes

- 7.6.3 Body mists

- 7.7 Baby care products

- 7.7.1 Baby lotions & creams

- 7.7.2 Baby shampoos & body wash

- 7.7.3 Baby wipes

- 7.7.4 Diaper rash creams

- 7.8 Others

- 7.8.1 Wet wipes (cosmetic use)

- 7.8.2 Oral care (non-medicinal mouthwash)

- 7.8.3 Men's grooming products

- 7.8.4 Tanning products

Chapter 8 Market Estimates and Forecast, By End Use, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Mass Market/Retail

- 8.3 Premium/Luxury

- 8.4 Professional/Salon

- 8.5 Contract Manufacturing/B2B

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Akema S.r.l

- 10.2 Arkema S.A.

- 10.3 Ashland Global Holdings Inc

- 10.4 BASF SE

- 10.5 Brenntag SE

- 10.6 Clariant International Ltd

- 10.7 Dadia Chemical Industries

- 10.8 Evonik Industries AG

- 10.9 Galaxy Surfactants Ltd

- 10.10 Inolex Chemical Company

- 10.11 Kumar Organic Products Ltd

- 10.12 Lanxess Corporation

- 10.13 Lonza Group AG

- 10.14 Micro Science Tech

- 10.15 Minasolve

- 10.16 Naturex (Givaudan)

- 10.17 Salicylates and Chemicals Pvt Ltd

- 10.18 Sharon Personal Care

- 10.19 Spec-Chem Industry Inc.

- 10.20 Stepan Company

- 10.21 Symrise AG

- 10.22 Thor Group (Part of Arxada)

- 10.23 Troy Corporation