PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928907

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928907

Digital Shipyard Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

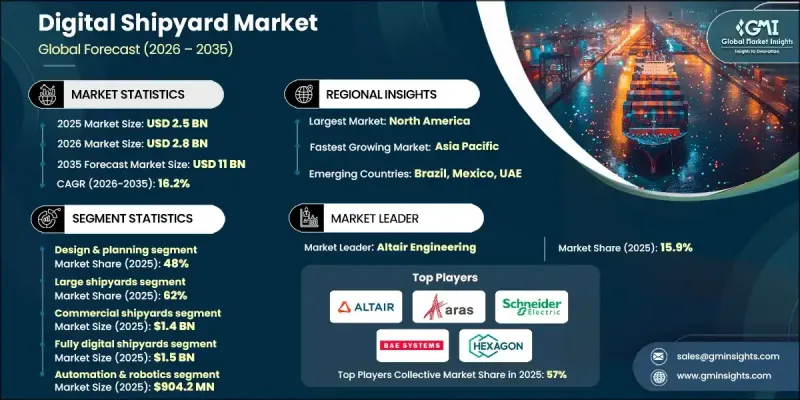

The Global Digital Shipyard Market was valued at USD 2.5 billion in 2025 and is estimated to grow at a CAGR of 16.2% to reach USD 11 billion by 2035.

The market growth is driven by the rising need for efficient shipbuilding and maintenance processes, increased reliance on connected and intelligent systems, and stricter regulatory and environmental compliance requirements. Shipbuilders, naval organizations, and commercial operators are increasingly focused on reducing costs, improving build accuracy, and shortening project timelines, which is accelerating the adoption of digital shipyard platforms. Data-driven decision-making is becoming central to shipyard operations, enabling higher productivity, improved safety standards, and optimized asset lifecycle management. As the industry modernizes, digital shipyard solutions are emerging as critical enablers that support real-time visibility, predictive capabilities, and coordinated workflows across the entire shipbuilding and repair ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.5 Billion |

| Forecast Value | $11 Billion |

| CAGR | 16.2% |

Advancements in artificial intelligence, machine learning, connected sensors, and virtual modeling are reshaping shipyard operations by replacing manual processes with intelligent, automated systems. Integrated digital platforms allow continuous monitoring, performance analysis, and simulation-based planning across design, construction, and maintenance activities. These capabilities reduce rework, improve compliance, and enable proactive maintenance strategies. The digital shipyard environment continues to mature as analytics, automation, and connected infrastructure become embedded into daily operations, supporting scalable and long-term production planning.

The design and planning segment held a 48% share in 2025 and is projected to grow at a CAGR of 16.8% through 2035. This segment leads due to its importance in enabling accurate modeling, coordinated workflows, and predictive scheduling. Digital planning tools support collaboration, reduce design errors, and improve delivery timelines across complex shipbuilding programs.

The large shipyards segment held 62% share in 2025 and is expected to grow at a CAGR of 16.7% between 2026 and 2035. Their leadership is supported by greater financial capacity, advanced infrastructure, and the ability to deploy comprehensive digital solutions across large-scale operations. High levels of automation and system integration position large facilities as primary adopters of end-to-end digital shipyard technologies.

U.S. Digital Shipyard Market accounted for 78% share in 2025, generating USD 754.7 million. Regional leadership is supported by advanced industrial capabilities, strong technology adoption, and early implementation of connected and intelligent shipyard platforms that enhance operational efficiency and safety.

Key companies active in the Global Digital Shipyard Market include Siemens, ABB, Dassault Systemes, Schneider Electric (AVEVA), Honeywell International, Hexagon, BAE Systems, Altair Engineering, Aras, and iBase-t. Companies operating in the Global Digital Shipyard Market are strengthening their competitive positions through continuous technology innovation and strategic collaboration. Providers are investing heavily in AI-driven design tools, real-time analytics, and integrated digital platforms to deliver end-to-end visibility across shipyard operations. Partnerships with shipbuilders, defense organizations, and technology firms are being used to accelerate the deployment and customization of solutions. Many players are expanding cloud-based offerings to support scalability and remote collaboration. Emphasis is also being placed on cybersecurity, compliance support, and predictive maintenance capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Process

- 2.2.4 Capacity

- 2.2.5 Digitalization Level

- 2.2.6 Technology

- 2.2.7 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Adoption of Advanced Digital Technologies

- 3.2.1.2 Need for Operational Efficiency and Cost Reduction

- 3.2.1.3 Growing Demand from Defense and Commercial Sectors

- 3.2.1.4 Regulatory Compliance and Environmental Standards

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Implementation and Maintenance Costs

- 3.2.2.2 Complex Integration with Legacy Systems

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive Maintenance and Lifecycle Optimization

- 3.2.3.2 Adoption by Medium and Small Shipyards

- 3.2.3.3 Cloud-Based and Integrated Platform Deployments

- 3.2.3.4 Expansion of Digital Twin and Predictive Maintenance Solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.: OSHA & US Coast Guard Guidelines

- 3.4.1.2 Canada: Transport & WorkSafe Guidelines

- 3.4.2 Europe

- 3.4.2.1 Germany: BMVI & DGUV Regulations

- 3.4.2.2 France: DGME & CNES Guidelines

- 3.4.2.3 UK: MCA & HSE Regulations

- 3.4.2.4 Italy: ENAC & INAIL Guidelines

- 3.4.3 Asia Pacific

- 3.4.3.1 China: CCS & Maritime Safety Regulations

- 3.4.3.2 Japan: JCAB & MLIT Guidelines

- 3.4.3.3 South Korea: MOLIT & Safety Guidelines

- 3.4.3.4 India: DG Shipping & Dock Safety Rules

- 3.4.4 Latin America

- 3.4.4.1 Brazil: ANTAQ & Ministry of Infrastructure Guidelines

- 3.4.4.2 Mexico: SEMAR & DGPM Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE: Ministry of Energy & Infrastructure Regulations

- 3.4.5.2 Saudi Arabia: Saudi Ports Authority Guidelines

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Digital Shipyard Architecture Framework

- 3.13.1 End-to-end digital shipyard reference architecture

- 3.13.2 IT-OT convergence layers

- 3.13.3 Data interoperability & integration standards

- 3.13.4 Cyber-physical systems in shipbuilding

- 3.14 Digital Maturity & Readiness Index

- 3.14.1 Shipyard digital maturity levels

- 3.14.2 Capability benchmarking: legacy vs smart shipyards

- 3.14.3 Regional maturity comparison

- 3.14.4 Readiness gaps by shipyard size

- 3.15 Buyer & Stakeholder Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Commercial shipyards

- 5.3 Military shipyards

Chapter 6 Market Estimates & Forecast, By Process, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Design & planning

- 6.3 Construction

- 6.4 Maintenance & repair

Chapter 7 Market Estimates & Forecast, By Capacity, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Large shipyards

- 7.3 Medium shipyards

- 7.4 Small shipyards

Chapter 8 Market Estimates & Forecast, By Digitalization Level, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Fully digital shipyard

- 8.3 Semi-digital shipyard

Chapter 9 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 Automation & robotics

- 9.3 Internet of Things (IoT)

- 9.4 Data analytics & big data

- 9.5 Digital twin technology

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 10.1 Key trends

- 10.2 Shipbuilders & shipyards

- 10.3 Defense & military

- 10.4 Ship Owners & Operators

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Belgium

- 11.3.7 Netherlands

- 11.3.8 Sweden

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 Singapore

- 11.4.6 South Korea

- 11.4.7 Vietnam

- 11.4.8 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Global Player

- 12.1.1 ABB

- 12.1.2 Altair Engineering

- 12.1.3 Aras

- 12.1.4 BAE Systems

- 12.1.5 Dassault Systemes

- 12.1.6 Hexagon

- 12.1.7 iBase-t

- 12.1.8 Mitsubishi Heavy Industries

- 12.1.9 Schneider Electric (AVEVA)

- 12.1.10 Siemens

- 12.2 Regional Player

- 12.2.1 Austal

- 12.2.2 China State Shipbuilding Corporation (CSSC)

- 12.2.3 Daewoo Shipbuilding & Marine Engineering

- 12.2.4 Fincantieri

- 12.2.5 Honeywell International

- 12.2.6 Hyundai Heavy Industries

- 12.2.7 Kongsberg Gruppen

- 12.2.8 Larsen & Toubro (L&T) Shipbuilding

- 12.2.9 Mitsui E&S

- 12.2.10 Navantia

- 12.3 Emerging Players

- 12.3.1 DNV Digital Solutions

- 12.3.2 Marine Technologies

- 12.3.3 MarineCFO

- 12.3.4 Navis Marine Solutions

- 12.3.5 ShipConstructor