PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928921

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928921

Autonomous Last Mile Delivery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

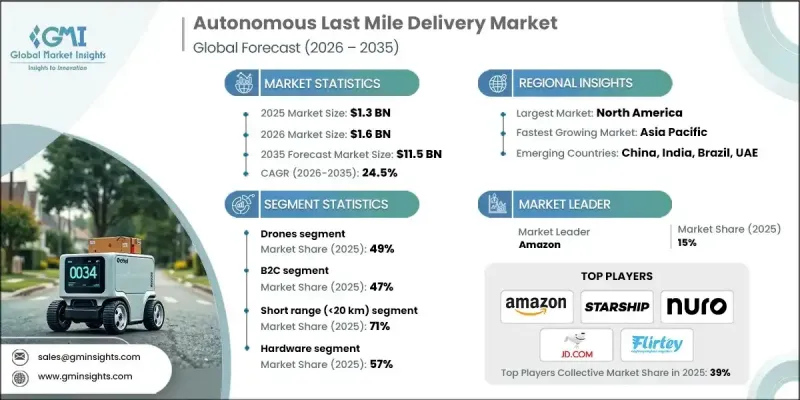

The Global Autonomous Last Mile Delivery Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 24.5% to reach USD 11.5 billion by 2035.

Autonomous last-mile delivery is widely recognized as a transformative logistics solution that relies on artificial intelligence, robotics, and self-operating vehicles to move goods from fulfillment points to end users without human intervention. The technology spans a range of platforms designed to operate efficiently across varied delivery environments. Market growth is being fueled by the rapid expansion of digital commerce, escalating workforce expenses, and continuous improvements in autonomous system capabilities. Rising online purchasing activity has significantly increased demand for scalable and flexible delivery models. At the same time, declining technology costs and improved operational efficiency are enhancing the economic viability of autonomous delivery solutions, allowing them to compete more effectively with conventional delivery methods. Regulatory progress is also supporting commercialization, as clearer policy frameworks are reducing uncertainty for operators. Together, these dynamics are reshaping logistics strategies, influencing consumer delivery expectations, and prompting changes in urban and suburban infrastructure planning.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 24.5% |

The drone-based delivery segment held a share of 49% in 2025 and is forecast to grow at a CAGR of 22.8% from 2026 to 2035. Drone platforms are gaining traction due to their ability to support rapid deliveries while avoiding ground-level congestion, particularly in less densely regulated airspace. Ongoing improvements in power systems, navigation software, and operational reliability are expanding their practical use cases and delivery efficiency.

The business-to-consumer segment accounted for 47% share in 2025 and is projected to grow at the fastest pace, with a CAGR of 24.2% through 2035. Growth in this segment is attributed to increasing consumer expectations for faster fulfillment and flexible delivery windows. Autonomous delivery solutions are well-suited to meet these requirements through continuous operation and reduced delivery costs.

North America Autonomous Last Mile Delivery Market captured 36% share in 2024 and is expected to grow at a CAGR of 22.1% during 2035. The region's leadership is supported by advanced digital retail infrastructure, favorable regulatory developments, increasing automation adoption, and a strong concentration of technology developers. The United States remains the primary contributor to regional growth due to early adoption and large-scale deployment initiatives.

Key companies operating in the Global Autonomous Last Mile Delivery Market include Starship Technologies, Amazon, Wing Aviation, Nuro, Zipline, UPS, JD.com, Kiwibot, and Flirtey. Companies active in the Autonomous Last Mile Delivery Market are strengthening their positions through technology development, pilot deployments, and strategic partnerships. Many players are investing heavily in artificial intelligence, navigation systems, and fleet management platforms to improve reliability and scalability. Collaborations with retailers, logistics providers, and local authorities are helping accelerate real-world deployment and regulatory alignment. Firms are also expanding geographic coverage through phased rollouts and focusing on cost optimization to improve commercial viability. Continuous testing, data-driven optimization, and modular platform design are enabling companies to adapt quickly to evolving delivery requirements and secure long-term market footholds.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 Research trail and confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Best estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Platform

- 2.2.3 Delivery Mode

- 2.2.4 Range

- 2.2.5 Solutions

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 E-commerce growth boosts last-mile delivery demand

- 3.2.1.3 Rising labor costs favor automation

- 3.2.1.4 AI and robotics advancements improve efficiency

- 3.2.1.5 Urbanization and traffic congestion increase need for autonomous delivery

- 3.2.1.6 Sustainability initiatives promote electric autonomous vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and legal barriers slow deployment

- 3.2.2.2 High initial investment limits adoption

- 3.2.3 Market opportunities

- 3.2.3.1 Smart city integration for delivery corridors

- 3.2.3.2 Healthcare and pharmaceutical deliveries

- 3.2.3.3 Fleet-as-a-service models

- 3.2.3.4 Cross-industry partnerships

- 3.2.3.5 Expansion in emerging markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US - Federal Motor Vehicle Safety Standards (FMVSS) exemption templates for sidewalk robots under 400 pounds, replacing waiver-by-waiver process.

- 3.4.1.2 Canada - Anticipated updates to beyond-visual-line-of-sight (BVLOS) operations regulations and new weight regulations for drone delivery with enhanced safety rules for urban operations.

- 3.4.2 Europe

- 3.4.2.1 Germany - Federal Ministry of Transport and Digital Infrastructure autonomous vehicle testing infrastructure framework with €3.2 billion investment and dedicated autonomous vehicle zones in Hamburg and Munich Emergen Research

- 3.4.2.2 UK - Automated Vehicles Act 2024 establishing comprehensive legal framework with secondary regulations expected by 2027

- 3.4.2.3 France - Black-box recorder requirement for all self-driving cars starting 2025 to establish accident responsibility and transparency

- 3.4.3 Asia Pacific

- 3.4.3.1 China - Beijing Autonomous Vehicle Regulation (April 2025) outlining procedures for AV pilot applications and Ministry of Industry and Information Technology regulations addressing safety concerns

- 3.4.3.2 India - Draft Civil Drone (Promotion and Regulation) Bill 2025 mandating registration, Unique Identification Numbers (UIN), type certification for drone manufacturers, and 5% GST on commercial UAVs

- 3.4.3.3 Japan - National METI roadmap (2025) to scale higher-capability autonomous last-mile delivery solutions beyond low-speed models legalized in 2023

- 3.4.4 Latin America

- 3.4.4.1 Brazil - Regional autonomy with Sao Paulo Level 3 autonomous taxi pilots (2024), no national framework yet established

- 3.4.5 MEA

- 3.4.5.1 Saudi Arabia - Vision 2030 initiative targeting 50% increase in autonomous vehicle presence on public roads with government-driven investment and regulatory reforms to remove AV deployment barriers

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Use cases & success stories

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Platform, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Drones

- 5.2.1 Multi-rotor drones

- 5.2.2 Fixed-wing drones

- 5.2.3 Hybrid VTOL drones

- 5.3 Robots

- 5.3.1 Sidewalk delivery robots

- 5.3.2 Autonomous ground vehicles (AGVs)

- 5.3.3 Indoor delivery robots

- 5.4 Trucks & vans

Chapter 6 Market Estimates & Forecast, By Delivery Mode, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 B2B

- 6.3 B2C

- 6.4 C2C

Chapter 7 Market Estimates & Forecast, By Range, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Short range (<20 km)

- 7.3 Long range (>20 km)

Chapter 8 Market Estimates & Forecast, By Solution, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Hardware

- 8.2.1 Vehicle platforms

- 8.2.2 Sensors (LiDAR, cameras, ultrasonic, radar)

- 8.2.3 Batteries / Power systems

- 8.3 Software

- 8.3.1 Autonomous navigation software

- 8.3.2 Fleet management platforms

- 8.3.3 AI / Machine learning algorithms

- 8.4 Services

- 8.4.1 Maintenance & support

- 8.4.2 System integration & consultancy

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 E-commerce

- 9.3 Food and grocery

- 9.4 Parcel & courier services

- 9.5 Pharmaceutical

- 9.6 Furniture & appliance

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Amazon

- 11.1.2 DHL

- 11.1.3 Flirtey

- 11.1.4 JD.com

- 11.1.5 Matternet

- 11.1.6 Nuro

- 11.1.7 Starship Technologies

- 11.1.8 UPS

- 11.1.9 Wing Aviation

- 11.1.10 Zipline

- 11.2 Regional Players

- 11.2.1 JD Logistics

- 11.2.2 Kiwibot

- 11.2.3 Postmates

- 11.2.4 RoboSense

- 11.2.5 Segway Robotics

- 11.2.6 SF Express

- 11.2.7 Swiggy

- 11.2.8 TeleRetail Robotics

- 11.2.9 Yandex Delivery

- 11.2.10 Zomato

- 11.3 Emerging Technology Innovators

- 11.3.1 Flytrex

- 11.3.2 Manna Aero

- 11.3.3 Ottonomy.IO

- 11.3.4 Refraction AI

- 11.3.5 Serve Robotics