PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928925

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928925

Aluminum Pigments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

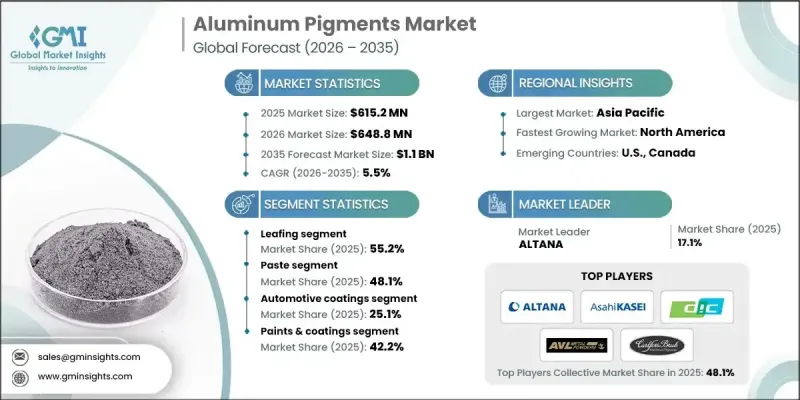

The Global Aluminum Pigments Market was valued at USD 615.2 million in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 1.1 billion by 2035.

The market is expanding due to rising demand across sectors such as automotive, packaging, cosmetics, and paints & coatings. Aluminum pigments are prized for their metallic sheen and reflective properties, which not only enhance visual appeal but also improve functional performance in end-use products. They deliver a mirror-like finish, increase durability, boost corrosion resistance, and enhance thermal stability. These pigments offer high opacity, brightness, and metallic effects, making them ideal for decorative and functional coatings. Their reflective capabilities also contribute to energy efficiency by reducing heat absorption. Chemical stability and environmental resilience further add to the longevity of finished products. Increasing use in automotive coatings and luxury personal care items continues to drive adoption, supported by demand for high-quality finishes in various industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $615.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.5% |

The leafing aluminum pigments segment held 55.2% share in 2025 and is projected to grow at a CAGR of 5.6% through 2035. This segment is gaining traction due to its ability to form ultra-thin reflective layers, producing highly metallic and glossy surfaces. Such properties make leafing pigments a preferred choice for premium coatings in automotive and decorative applications.

In terms of product form, the paste aluminum pigments segment held 48.1% share in 2025 and is expected to grow at a CAGR of 5.6% between 2026 and 2035. Paste pigments are widely used in industrial coatings, automotive finishes, and decorative paints because they provide excellent dispersibility, uniform distribution, and easy blending. These features ensure smooth, reflective surfaces and enable manufacturers to enhance both the visual appeal and durability of their products.

North America Aluminum Pigments Market accounted for 26.1% share in 2025 and continues to exhibit strong growth. The region's demand is driven by applications in automotive, coatings, and packaging sectors. Sustainability and eco-friendly practices are increasingly influencing production, leading manufacturers to focus on low-VOC and water-based formulations. Automotive remains a key sector, with consumers and manufacturers seeking high-gloss and reflective finishes to elevate product aesthetics.

Key players in the Global Aluminum Pigments Market include Metaflake Ltd, DIC CORPORATION, ALTANA, Asahi Kasei, SCHLENK SE, Carlfors Bruk, TOYO ALUMINIUM K.K., Zhangqiu Metallic Pigment Co., Ltd., ZuXing New Materials Co., Ltd., Kolortek Co., Ltd., and AVL METAL POWDERS n.v. Market participants are adopting several strategies to strengthen their presence and expand market share. Companies are investing in advanced manufacturing technologies and eco-friendly processes to meet sustainability requirements. They are increasing production capacities, enhancing R&D for high-performance pigments, and diversifying product portfolios. Strategic collaborations, partnerships, and regional expansions allow firms to access new markets and serve emerging applications. Focus on product innovation, quality improvement, and operational efficiency further solidifies the market position and ensures long-term competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Leafing

- 5.3 Non-leafing

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Paste

- 6.3 Powder

- 6.4 Pellets

- 6.5 Others (flakes, etc)

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive coatings

- 7.3 Industrial coatings

- 7.4 Architectural/decorative coatings

- 7.5 Gravure inks

- 7.6 Flexographic inks

- 7.7 Industrial plastic

- 7.8 Nail products

- 7.9 Face makeup

- 7.10 Hair care products

- 7.11 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Paints & coatings

- 8.3 Printing inks

- 8.4 Plastics

- 8.5 Personal care & cosmetics

- 8.6 Others (construction, electronics, etc)

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ALTANA

- 10.2 Asahi Kasei

- 10.3 AVL METAL POWDERS n.v.

- 10.4 Carlfors Bruk

- 10.5 DIC CORPORATION

- 10.6 Kolortek Co., Ltd.

- 10.7 Metaflake Ltd

- 10.8 SCHLENK SE

- 10.9 Shan Dong Jie Han Metal Material Co., Ltd

- 10.10 TOYO ALUMINIUM K.K.

- 10.11 Zhangqiu metallic pigment co.,ltd.

- 10.12 ZuXing New Materials Co., Ltd.