PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928926

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928926

Synthetic and Bio Emulsion Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

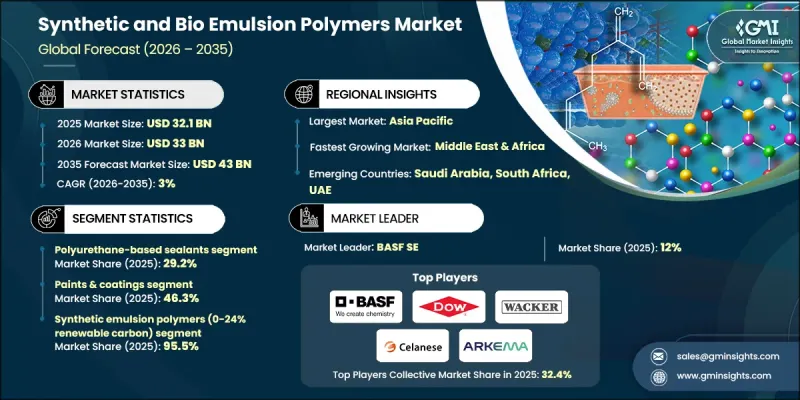

The Global Synthetic and Bio Emulsion Polymers Market was valued at USD 32.1 billion in 2025 and is estimated to grow at a CAGR of 3% to reach USD 43 billion by 2035.

Over the years, synthetic and bio emulsion polymers have evolved from niche product offerings into vital materials supporting modern maritime operations and industrial applications. Their role now extends beyond basic sealing to enhancing structural integrity, corrosion resistance, and long-term performance of marine vessels. Sustainability trends are reshaping industry priorities, and these polymers are at the forefront of eco-friendly, high-performance solutions that reduce environmental impact in shipbuilding, maintenance, and retrofitting. Hybrid formulations, low-volatile organic compound systems, and renewable content polymers are gaining traction as industries respond to strict environmental regulations and global decarbonization goals. Market growth is strongly influenced by regional production priorities, with Asia Pacific leading due to high shipbuilding activity and expanding commercial fleets, creating substantial demand for reliable, high-performance emulsion polymer solutions. Technological advancements continue to enhance durability, chemical resistance, and adaptability, positioning the market for steady long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $32.1 Billion |

| Forecast Value | $43 Billion |

| CAGR | 3% |

The paints and coatings segment accounted held 46.3% share in 2025 and is expected to grow at a CAGR of 3.2% through 2035. In this segment, polymers provide film-forming capabilities, durability, and resistance to environmental stress, making them essential for protective and decorative finishes. Strong bonding properties, particularly from acrylic and polyurethane dispersions, are highly valued in adhesives for industrial and structural applications.

The synthetic emulsion polymers, containing 0-24% renewable carbon, dominated the market in 2025 with a 95.5% share and are projected to grow at a CAGR of 2.4% through 2035. These formulations are widely preferred in coatings, adhesives, and construction for their mechanical strength, chemical resistance, and long-term stability in demanding environments, making them more relied upon than bio-based alternatives in many industrial sectors.

North America Synthetic and Bio Emulsion Polymers Market accounted for 21.9% share in 2025. The region's advanced manufacturing capabilities, supportive regulatory environment, and increasing adoption of sustainable practices have positioned it as a key center for synthetic and bio emulsion polymers. Industries in the region demand high-performance formulations that meet stringent environmental and innovation-driven standards, supporting applications in coatings, adhesives, and construction.

Key players operating in the Global Synthetic and Bio Emulsion Polymers Market include Wacker Chemie AG, Covestro AG, BASF SE, Trinseo PLC, Arkema S.A., Celanese Corporation, Synthomer PLC, The Dow Chemical Company, Dairen Chemical Corporation, Asahi Kasei Corporation, Mallard Creek Polymers, Encres Dubuit, Shenzhen Jitian Chemical, Organik Kimya, and Indulor Chemie GmbH. Companies in the Synthetic and Bio Emulsion Polymers Market strengthen their market presence by investing in research and development to create innovative, high-performance, and sustainable formulations. They focus on expanding production capabilities, diversifying product portfolios with hybrid and low-VOC polymers, and forming strategic partnerships with industrial end-users. Emphasizing regulatory compliance, sustainability certifications, and quality assurance helps build trust with clients, while targeting emerging regions and expanding distribution networks ensures long-term market growth and enhanced competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Polymer Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Renewable Content

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for eco-friendly and sustainable products

- 3.2.1.2 Rising applications in paints, coatings, and adhesives industries

- 3.2.1.3 Advancements in polymerization technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Stringent environmental regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Development of bio-based emulsion polymers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Acrylics

- 5.3 Vinyl acetate polymers

- 5.4 Styrene-butadiene latex (SBR)

- 5.5 Styrene-acrylic copolymers

- 5.6 Vinyl-acrylic copolymers

- 5.7 Polyurethane dispersions (puds)

- 5.8 Bio-based emulsion polymers

- 5.8.1 Bio-based acrylics (renewable monomers)

- 5.8.2 Bio-based styrene-butadiene

- 5.8.3 Natural latex (rubber tree derived)

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Paints & coatings

- 6.2.1 Architectural coatings (interior & exterior)

- 6.2.2 Industrial coatings

- 6.2.3 Protective coatings

- 6.3 Adhesives

- 6.3.1 Pressure-sensitive adhesives (psa)

- 6.3.2 Laminating adhesives

- 6.3.3 Assembly adhesives

- 6.3.4 Others

- 6.4 Paper & paperboard coatings

- 6.4.1 Paper coating (gloss, matte, silk)

- 6.4.2 Paperboard coating (folding carton, corrugated)

- 6.4.3 Others

- 6.5 Construction & cement modification

- 6.5.1 Cement additives & modifiers

- 6.5.2 Waterproofing membranes

- 6.5.3 Tile adhesives & grouts

- 6.5.4 Exterior insulation finishing systems (eifs)

- 6.5.5 Others

- 6.6 Textiles & nonwovens

- 6.6.1 Textile finishing & coating

- 6.6.2 Carpet backing

- 6.6.3 Others

- 6.7 Asphalt modification

- 6.7.1 Road construction & maintenance applications

- 6.7.2 Roofing applications

- 6.7.3 Others

- 6.8 Sealants

- 6.9 Others (printing inks, floor care, leather finishing)

Chapter 7 Market Estimates and Forecast, By Renewable Content, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Synthetic emulsion polymers (0-24% renewable carbon)

- 7.3 Bio-based emulsion polymers (≥25% renewable carbon)

- 7.3.1 Low bio-content (25-49% renewable carbon)

- 7.3.2 Medium bio-content (50-74% renewable carbon)

- 7.3.3 High bio-content (≥75% renewable carbon)

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 The Dow Chemical Company

- 9.3 Wacker Chemie AG

- 9.4 Celanese Corporation

- 9.5 Arkema S.A.

- 9.6 Trinseo PLC

- 9.7 Covestro AG

- 9.8 Synthomer PLC

- 9.9 Dairen Chemical Corporation

- 9.10 Asahi Kasei Corporation

- 9.11 Mallard Creek Polymers

- 9.12 Encres Dubuit

- 9.13 Organik Kimya

- 9.14 Shenzhen Jitian Chemical

- 9.15 Indulor Chemie GmbH