PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928936

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928936

Natural Oil Polyols Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

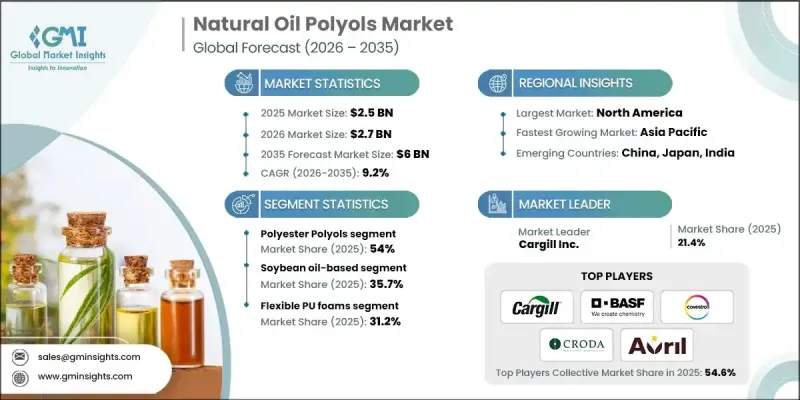

The Global Natural Oil Polyols Market was valued at USD 2.5 billion in 2025 and is estimated to grow at a CAGR of 9.2% to reach USD 6 billion by 2035.

The market is driven by stricter environmental regulations, rising consumer demand for sustainable products, and increasing use across automotive, construction, furniture, and industrial sectors. Manufacturers are focusing on bio-based formulations that improve mechanical, thermal, and chemical performance, enabling high-performance applications while reducing carbon emissions. The growing demand for eco-friendly solutions has accelerated the adoption of bio-polyols, fueled by global environmental legislation and consumer preference for socially responsible products. Industries are increasingly incorporating natural polyols in the production of polyurethane foams, adhesives, coatings, and elastomers to enhance sustainability and reduce their carbon footprint. Recent developments include bio-based polyols for premium foam, coating, adhesive, and elastomer applications, allowing companies to diversify portfolios, enter high-end product markets, and drive innovation in eco-conscious production and procurement processes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.5 Billion |

| Forecast Value | $6 Billion |

| CAGR | 9.2% |

The polyether polyols segment is forecasted to grow at a CAGR of 10.3% between 2025 and 2035. Growth is supported by increasing consumer focus on sustainable, high-performance materials, especially in automotive applications, along with advances in bio-based formulation technologies and customizable polyol functionality.

The flexible polyurethane foams segment held a 31.2% share in 2025 and is expected to grow at a CAGR of 7.1% by 2035. The segment benefits from the foam's softness, resilience, and eco-friendly properties, making it popular in applications like mattresses, cushions, and seating.

North America Natural Oil Polyols Market reached USD 821.8 million in 2025 and is expected to show robust growth during the forecast period. The high adoption of sustainable materials in the U.S. and Canada drives demand for bio-based polyols used in PU foams, adhesives, coatings, and sealants. Government initiatives supporting green chemistry and strong R&D ecosystems further strengthen the region's market leadership and adoption of eco-friendly alternatives.

Major players operating in the Global Natural Oil Polyols Market include BASF SE, Biobased Technologies LLC, Cargill, Incorporated, Covestro AG, Croda International Plc, Econic Technologies, Emery Oleochemicals, Global Bio-chem Technology Group, Oleon Novance (Arvil), and The Dow Chemical Company. Companies in the Natural Oil Polyols Market are employing strategies to expand their market presence by focusing on R&D for high-performance, bio-based polyols and diversifying their product portfolios for premium applications. Collaborations with automotive, construction, and industrial manufacturers are boosting adoption across sectors. Firms are investing in sustainable production processes to reduce carbon footprints and improve eco-certifications, enhancing brand reputation. Regional expansion into North America, Europe, and Asia Pacific, combined with strategic acquisitions, strengthens market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Source

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for eco-friendly and sustainable polyols across multiple industries

- 3.2.1.2 Increasing usage of polyols in flexible and rigid polyurethane foams

- 3.2.1.3 Government incentives promoting bio-based chemicals and products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs compared to petroleum-based polyols

- 3.2.2.2 Limited availability of consistent, high-quality feedstocks

- 3.2.2.3 Technical limitations in performance compared to synthetic polyols

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in coatings, adhesives, sealants, and elastomers

- 3.2.3.2 Increasing awareness and adoption of green building materials

- 3.2.3.3 Expansion of global bio-based chemical market

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyester Polyols

- 5.3 Polyether Polyols

Chapter 6 Market Estimates and Forecast, By Source, 2022-2035 (USD billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Soybean Oil-Based

- 6.3 Castor Oil-Based

- 6.4 Palm Oil-Based

- 6.5 Canola/Rapeseed Oil-Based

- 6.6 Sunflower Oil-Based

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Flexible PU Foams

- 7.3 Rigid PU Foams

- 7.4 Coatings

- 7.5 Adhesives

- 7.6 Sealants

- 7.7 Elastomers

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Biobased Technologies LLC

- 9.3 Cargill, Incorporated

- 9.4 Covestro AG

- 9.5 Croda International Plc

- 9.6 Econic Technologies

- 9.7 Emery Oleochemicals

- 9.8 Global Bio-chem Technology Group

- 9.9 Oleon Novance (arvil)

- 9.10 The Dow Chemical Company