PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928939

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928939

Liquid Hand Soap Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

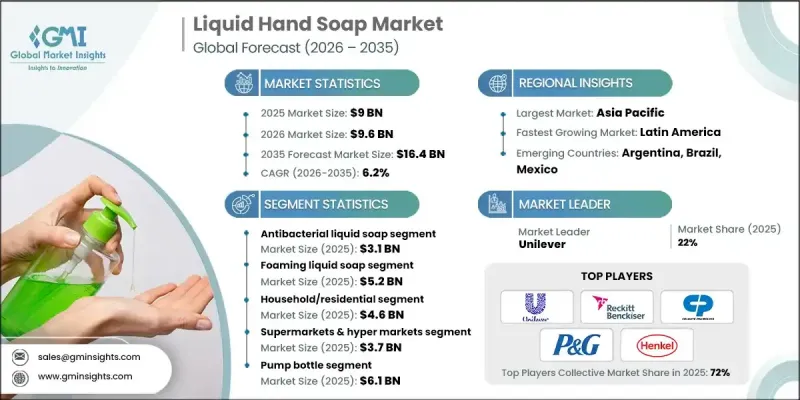

The Global Liquid Hand Soap Market was valued at USD 9 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 16.4 billion by 2035.

The market expansion is driven by heightened hygiene awareness, particularly following the COVID-19 pandemic, which has reinforced frequent handwashing as a daily habit across households and institutions. Regulatory emphasis on sanitation standards and ongoing public health campaigns have strengthened liquid hand soap's position as an essential hygiene product worldwide. Consumer preferences are shifting toward natural, plant-based, and eco-friendly formulations, with a significant portion of new product launches featuring organic or botanical ingredients. Companies are increasingly innovating with aloe vera, herbal extracts, and essential oils to appeal to health-conscious and environmentally aware consumers. Rising disposable incomes in emerging economies are further driving demand for premium liquid hand soaps that offer enhanced skincare benefits, appealing fragrances, and environmentally responsible packaging. The market continues to evolve with premiumization trends, sustainable formulations, and innovation in both household and institutional segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 6.2% |

The antibacterial liquid soap segment reached USD 3.1 billion in 2025. Its leadership is supported by high demand for germ protection in households, medical, and commercial settings. Regulatory compliance, frequent use, and brand loyalty sustain its strong market presence.

The foaming liquid soap segment accounted for USD 5.2 billion in 2025, making it the largest segment in terms of formulation. Its popularity is driven by convenient dispensing, controlled usage, hygiene perception, and cost efficiency. High adoption across healthcare, commercial, and hospitality sectors reinforces consistent demand and premium positioning.

North America Liquid Hand Soap Market contributed USD 2.5 billion in 2025, representing 28% share. The United States dominates the regional market due to a large consumer base and a robust institutional presence in healthcare, offices, schools, and foodservice establishments. The adoption of liquid and foaming soaps over bar formulations, along with antibacterial and skin-sensitive variants, supports rapid growth. Rising demand for dermatologist-tested, fragrance-free, and plant-based products further drives premiumization trends in the U.S. and Canada.

Major players in the Global Liquid Hand Soap Market include Henkel Corporation, Colgate-Palmolive, Unilever, Johnson & Johnson, 3M, Procter & Gamble, Medline Industries, Sigma Industries, Gojo Industries, JR Watkins & Co, ANUSPA Heritage Products Pvt Ltd, Wipro Consumer Care & Lighting, ITC Ltd, Vermont Soap, and Vanguard Soap. Companies in the Global Liquid Hand Soap Market are strengthening their positions through product innovation, focusing on natural, organic, and eco-friendly formulations to meet evolving consumer preferences. Strategic partnerships, mergers, and acquisitions allow firms to expand their geographic reach and broaden product portfolios. Premiumization strategies, including the introduction of fragrance-free, dermatologist-tested, and plant-based options, enhance brand positioning. Firms are also investing in sustainable packaging, marketing campaigns emphasizing hygiene and wellness, and tailored institutional solutions to capture B2B demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Formulation

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.2.6 Packaging

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Heightened hygiene awareness post-covid-19 pandemic

- 3.2.1.2 Growing demand for organic & natural personal care products

- 3.2.1.3 Rising disposable income & premium product adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Balancing antimicrobial efficacy with skin safety

- 3.2.2.2 Achieving cost-effectiveness in organic/natural formulations

- 3.2.3 Market opportunities

- 3.2.3.1 Development of eco-friendly & sustainable formulations

- 3.2.3.2 Innovation in refillable & zero-waste packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Million) (Kilo Ton)

- 5.1 Key trends

- 5.2 Antibacterial liquid soap

- 5.3 Moisturizing/nourishing liquid soap

- 5.4 Fragrance-free/sensitive skin liquid soap

- 5.5 Organic/herbal liquid soap

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Formulation, 2022 - 2035 (USD Million) (Kilo Ton)

- 6.1 Key trends

- 6.2 Foaming liquid soap

- 6.3 Regular liquid soap (non-foaming)

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million) (Kilo Ton)

- 7.1 Key trends

- 7.2 Household/residential

- 7.3 Commercial/institutional

- 7.3.1 Hotels & hospitality

- 7.3.2 Healthcare facilities

- 7.3.3 Offices & corporate spaces

- 7.3.4 Educational institutions

- 7.4 Industrial/manufacturing

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Million) (Kilo Ton)

- 8.1 Key trends

- 8.2 Supermarkets & hypermarkets

- 8.3 Convenience stores

- 8.4 Pharmacies & drug stores

- 8.5 E-commerce/online retail

- 8.6 Specialty stores

Chapter 9 Market Estimates and Forecast, By Packaging, 2022 - 2035 (USD Million) (Kilo Ton)

- 9.1 Key trends

- 9.2 Pump bottle

- 9.3 Refill pouch

- 9.4 Travel/portable size

- 9.5 Automatic dispenser

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Kilo Ton)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.3 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Henkel Corporation

- 11.2 Sigma Industries

- 11.3 ANUSPA HERITAGE PRODUCTS PVT LTD

- 11.4 Vanguard Soap

- 11.5 Vermont Soap

- 11.6 Colgate-Palmolive

- 11.7 Procter & Gamble

- 11.8 Unilever

- 11.9 3M

- 11.10 Reckitt Benckiser

- 11.11 Johnson & Johnson

- 11.12 Medline Industries

- 11.13 Wipro Consumer Care & Lighting, ITC Ltd

- 11.14 Gojo Industries

- 11.15 JR Watkins & Co