PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928951

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928951

North America Micronutrient Fertilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

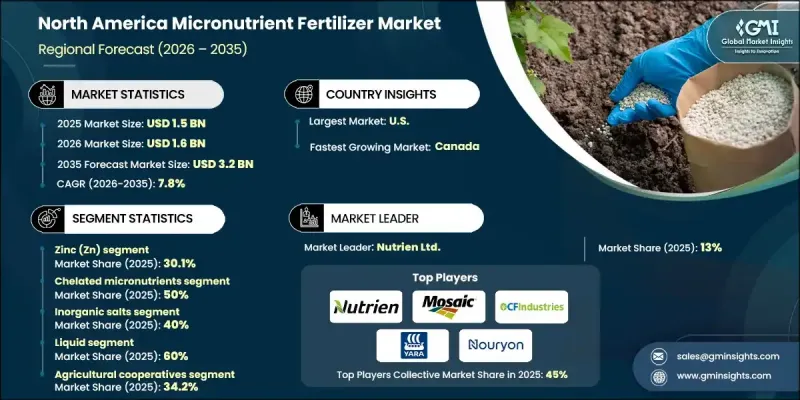

North America Micronutrient Fertilizer Market generated USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 7.8% to reach USD 3.2 billion by 2035.

Growth is driven by increasing efforts from growers and agribusinesses to restore soil vitality and address micronutrient deficiencies that limit crop yields. These fertilizers are widely adopted across cereals, oilseeds, fruits, and vegetables to support balanced crop nutrition and long-term soil productivity. The region is increasingly shifting toward sustainable and precision-based farming approaches that maximize nutrient efficiency while minimizing environmental impact. Innovation and sustainability frameworks are shaping product development, with advanced formulations designed to meet stricter environmental standards and support resource-efficient agriculture. Micronutrient fertilizers are now viewed as essential tools for improving soil resilience, crop strength, and overall farm sustainability. Their role continues to expand as regulatory pressure increases and regenerative farming practices gain wider acceptance, reinforcing their importance in modern agricultural systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 7.8% |

The zinc segment represented a significant 30.1% of the North America micronutrient fertilizer market in 2025 and is projected to expand at a CAGR of 6.8% through 2035. Zinc remains essential for enzyme activation, growth regulation, and overall crop health, particularly in cereals and oilseeds. Alongside zinc, other key micronutrients like iron, manganese, and boron continue to support vital crop processes. Iron is crucial for chlorophyll synthesis and efficient photosynthesis, manganese enhances metabolic activity and disease resistance, and boron plays a pivotal role in reproductive development and fruit quality, especially in orchards and high-value vegetable crops.

The inorganic salts segment held a 40% share in 2025 and is expected to grow at a CAGR of 4.7% through 2035. This category's sustained growth is driven by its cost-effectiveness, easy handling, and compatibility with conventional farming practices. Inorganic salts deliver essential nutrients in readily available forms, providing quick correction of deficiencies, although they can be less effective in soils with poor retention or high leaching potential. Their reliability and affordability continue to make them a staple in crop nutrition strategies.

North America Micronutrient Fertilizer Market benefits from the strong adoption of precision and regenerative agriculture practices. Farmers and agribusinesses increasingly focus on nutrient-efficient applications, leveraging advanced formulations to optimize soil health, comply with stringent environmental regulations, and support sustainable production. These practices, coupled with technological innovations in fertilizer delivery and monitoring, are driving demand for micronutrient fertilizers while ensuring long-term soil fertility and crop productivity.

Key companies active in the North America Micronutrient Fertilizer Market include Nutrien Ltd., Yara International ASA, The Mosaic Company, CF Industries Holdings, Inc., Koch Agronomic Services, Haifa Group, Nouryon, Wilbur-Ellis Company LLC, The J.R. Simplot Company, Helena Agri-Enterprises, LLC, GreenPoint AG, BioAg (Novozymes), and Down To Earth Distributors, Inc. Companies operating in the North America Micronutrient Fertilizer Market are strengthening their competitive position through investments in advanced formulation technologies that improve nutrient uptake and reduce environmental losses. Many players are expanding precision agriculture solutions and digital advisory services to support optimized application practices. Strategic collaborations with growers, distributors, and ag-tech providers help enhance market reach and customer engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Nutrient type

- 2.2.3 Product type

- 2.2.4 Formulation type

- 2.2.5 Form

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-yield crops to meet food security needs

- 3.2.1.2 Rising awareness among farmers about soil nutrient deficiencies

- 3.2.1.3 Government initiatives promoting sustainable agricultural practices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs associated with micronutrient fertilizers

- 3.2.2.2 Limited awareness in remote farming regions

- 3.2.3 Market opportunities

- 3.2.3.1 Self-healing & smart sealant technologies

- 3.2.3.2 Expansion of organic farming practices requiring micronutrient inputs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By nutrient type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Nutrient Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Zinc (Zn)

- 5.3 Iron (Fe)

- 5.4 Manganese (Mn)

- 5.5 Boron (B)

- 5.6 Copper (Cu)

- 5.7 Molybdenum (Mo)

- 5.8 Chlorine (Cl)

- 5.9 Nickel (Ni)

- 5.10 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Chelated micronutrients

- 6.2.1 EDTA chelates

- 6.2.2 DTPA chelates

- 6.2.3 EDDHA chelates

- 6.2.4 Others (HBED & advanced)

- 6.3 Non-chelated micronutrients

Chapter 7 Market Estimates and Forecast, By Formulation Type, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Inorganic salts

- 7.3 Synthetic chelates

- 7.4 Organic complexes

- 7.5 Nano-formulations

Chapter 8 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid

- 8.3 Dry/Granular

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Agricultural cooperatives

- 9.3 Independent distributors & retailers

- 9.4 Direct-to-farm sales

- 9.5 E-commerce & online platforms

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

Chapter 11 Company Profiles

- 11.1 Nutrien Ltd.

- 11.2 The Mosaic Company

- 11.3 CF Industries Holdings, Inc.

- 11.4 Yara International ASA

- 11.5 Nouryon (formerly AkzoNobel)

- 11.6 Haifa Group

- 11.7 Koch Agronomic Services

- 11.8 Helena Agri-Enterprises, LLC

- 11.9 The J.R. Simplot Company

- 11.10 Wilbur-Ellis Company LLC

- 11.11 GreenPoint AG

- 11.12 BioAg (Novozymes)

- 11.13 Down To Earth Distributors, Inc.