PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928957

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928957

Automotive Fastener Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

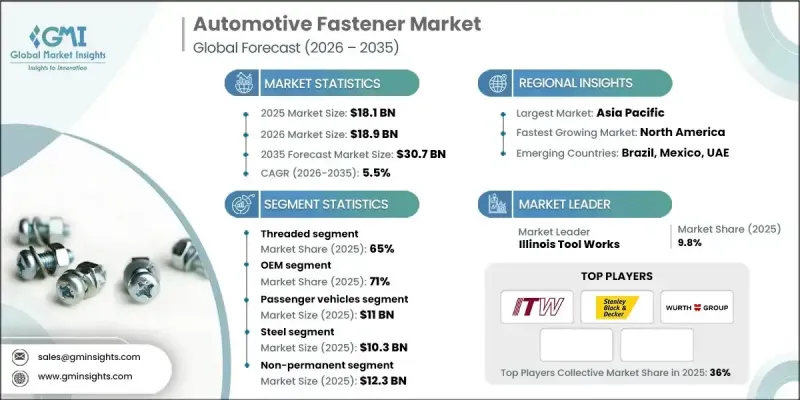

The Global Automotive Fastener Market was valued at USD 18.1 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 30.7 billion by 2035.

Market growth is fueled by the rapid expansion of global vehicle production, the increasing adoption of electric and hybrid vehicles, and growing consumer demand for enhanced safety, durability, and performance. Manufacturers, OEMs, and aftermarket providers are prioritizing efficient vehicle assembly and lifecycle cost reduction, which has increased the importance of technologically advanced fastener solutions. Innovations in high-strength materials, lightweight components, and smart fastening technologies are reshaping the market, enabling automakers to optimize load-bearing capacity, maintain structural integrity, and monitor assembly stress in real time. The evolution of the market is also supported by digital torque monitoring, predictive maintenance, and AI-driven assembly optimization, all of which contribute to improved vehicle performance, extended component life, and more efficient production processes across passenger, commercial, and electric vehicle segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $18.1 Billion |

| Forecast Value | $30.7 Billion |

| CAGR | 5.5% |

The threaded fasteners accounted for 65% share in 2025 and are expected to grow at a CAGR of 5.9% through 2035. Their dominance is driven by the need for secure, reusable, and high-strength connections across vehicle assemblies. Demand for these fasteners spans passenger vehicles, light and heavy commercial vehicles, and electric vehicles, ensuring safety, precision, and cost-efficient maintenance.

The OEM segment held 71% share in 2025 and is forecasted to grow at a CAGR of 5.2% through 2035. OEMs rely on advanced fastening solutions, including self-locking nuts and EV-optimized systems, to support high production volumes while maintaining structural reliability and assembly efficiency.

China Automotive Fastener Market generated USD 1.46 billion in 2025. Its status as a global automotive manufacturing hub, rapid expansion in electric and hybrid vehicle production, and adoption of advanced fastening technologies contribute to strong market demand. Major automotive clusters across eastern and southern China are increasingly implementing high-performance fasteners, reinforcing the nation's leadership within the region.

Key players in the Global Automotive Fastener Market include Bossard, Wurth, Illinois Tool Works (ITW), ARaymond, Nedschroef, Bulten, Pentair Automotive Fasteners, Stanley Black & Decker, KAMAX, and LISI Automotive. Companies in the Global Automotive Fastener Market are employing multiple strategies to strengthen their position and expand their footprint. They are investing heavily in research and development to create lightweight, corrosion-resistant, and smart fastening solutions. Strategic partnerships with OEMs and aftermarket providers help secure long-term contracts and broaden market access. Firms are also focusing on regional expansion to tap into emerging automotive hubs, particularly in Asia-Pacific. Adoption of digital and AI-based assembly monitoring tools enhances product differentiation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Capacity

- 2.2.3 Vehicle

- 2.2.4 Material

- 2.2.5 Characteristics

- 2.2.6 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Adoption of electric and hybrid vehicles (EVs/HEVs)

- 3.2.1.3 Focus on vehicle safety and durability

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 High competition from regional and low-cost manufacturers

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in electric vehicles and lightweight vehicle segment

- 3.2.3.2 Integration of smart and connected fastening solutions

- 3.2.3.3 Digitalization and smart assembly

- 3.2.3.4 Lightweight and modular vehicle platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Federal Motor Vehicle Safety Standards (FMVSS)

- 3.4.1.2 Canada Motor Vehicle Safety Standards (CMVSS)

- 3.4.2 Europe

- 3.4.2.1 Germany TUV & BaFin Compliance

- 3.4.2.2 France DGITM Guidelines

- 3.4.2.3 UK Vehicle Certification Agency (VCA) Regulations

- 3.4.2.4 Italy Ministry of Infrastructure & Transport Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MIIT Guidelines

- 3.4.3.2 Japan MLIT Standards

- 3.4.3.3 South Korea MOLIT Regulations

- 3.4.3.4 India Ministry of MoRTH & BIS Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil DENATRAN & ANFAVEA Regulations

- 3.4.4.2 Mexico SCT & NOM Standards

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Roads & Transport Authority (RTA) Guidelines

- 3.4.5.2 Saudi Arabia General Authority for Transport (GAT) Regulations

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Use case scenarios

- 3.14 EV-Specific Fastening Requirements

- 3.14.1 Battery pack & enclosure fastening

- 3.14.2 Thermal expansion & vibration challenges

- 3.14.3 High-voltage insulation & isolation fasteners

- 3.14.4 Fastener demand shift per EV vs ICE vehicle

- 3.15 Lightweighting & Material Substitution Trends

- 3.15.1 Steel, aluminum, composites, plastics

- 3.15.2 Trade-off: strength vs weight vs cost

- 3.15.3 OEM lightweighting targets

- 3.15.4 Impact on fastener volume per vehicle

- 3.16 Fastening Technology by Vehicle System

- 3.17 Smart Fasteners & Industry 4.0 Integration

- 3.18 OEM Sourcing & Supplier Selection Criteria

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Capacity, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Threaded

- 5.2.1 Nuts

- 5.2.2 Bolts

- 5.2.3 Washers

- 5.2.4 Others

- 5.3 Non-threaded

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Plastic

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Characteristics, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Non-permanent

- 8.3 Permanent

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.4.9 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ARaymond

- 11.1.2 Bossard

- 11.1.3 Bulten

- 11.1.4 Illinois Tool Works (ITW)

- 11.1.5 KAMAX

- 11.1.6 LISI Automotive

- 11.1.7 Nedschroef

- 11.1.8 Pentair Automotive Fasteners

- 11.1.9 Stanley Black & Decker

- 11.1.10 Wurth

- 11.2 Regional Player

- 11.2.1 Al Ameen Fasteners

- 11.2.2 Anchors Fasteners

- 11.2.3 Clavos y Tornillos

- 11.2.4 Fastenright

- 11.2.5 Gunther Fasteners

- 11.2.6 Jorfast

- 11.2.7 SAE Fasteners

- 11.2.8 Sundaram Fasteners

- 11.2.9 Topfast Fasteners

- 11.2.10 Yuyama Manufacturing

- 11.3 Emerging Players

- 11.3.1 EcoFast Automotive

- 11.3.2 EVFast Fastening Solutions

- 11.3.3 GreenBolt Solutions

- 11.3.4 NextGen Fasteners

- 11.3.5 Titan Fasteners