PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928979

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928979

Steam Trap Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

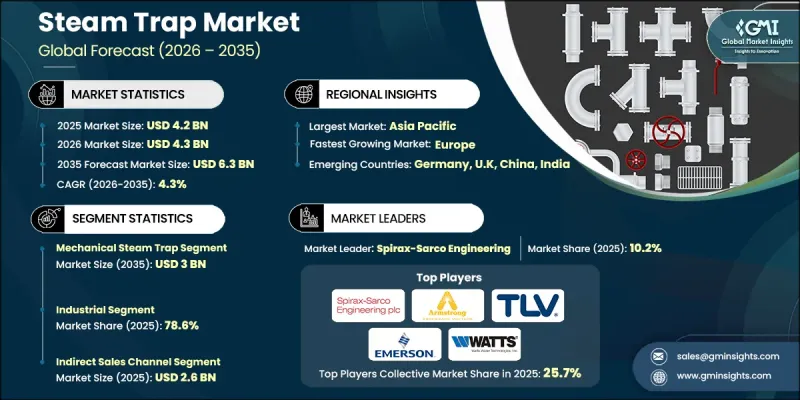

The Global Steam Trap Market was valued at USD 4.2 billion in 2025 and is estimated to grow at a CAGR of 4.3% to reach USD 6.3 billion by 2035.

Market expansion is driven by rising adoption of energy-efficient technologies and increased automation across industrial steam systems. Steam traps play a critical role in maintaining optimal steam performance by efficiently removing condensate while preventing steam loss within distribution networks. Improved system efficiency directly supports reduced energy waste, lower operating costs, and enhanced process reliability. Growing emphasis on automated monitoring and data-driven maintenance is reshaping how steam systems are managed, allowing operators to improve performance while minimizing unexpected downtime. Regulatory pressure and policy-driven energy conservation initiatives continue to accelerate the replacement of outdated equipment with advanced solutions. Efficiency improvements in steam systems can reduce overall energy consumption by 10% to 15%, reinforcing the economic value of modern steam trap deployment. As industries prioritize sustainability, operational optimization, and emissions reduction, steam traps remain essential components in achieving long-term energy management goals across a wide range of industrial environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.2 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 4.3% |

The mechanical steam traps generated USD 1.9 billion in 2025 and are projected to reach USD 3 billion by 2035. This segment maintains leadership due to its durability, operational reliability, and suitability for demanding industrial conditions. These traps are designed to discharge condensate efficiently while retaining steam, supporting consistent system performance. Inefficient steam trap operation can result in losses of up to 20% of total steam generation, highlighting the importance of proper system selection and maintenance.

The industrial applications accounted for 78.6% share in 2025. Growth in this segment is supported by stricter energy-efficiency regulations, increasing demand for real-time system monitoring, and wider adoption of predictive maintenance practices. Government-led sustainability initiatives further encourage the deployment of advanced steam management solutions across industrial facilities.

United States Steam Trap Market held 79.4% share in 2025. Strong industrial modernization efforts, high automation adoption, and rigorous efficiency standards continue to drive demand. Ongoing focus on reducing energy losses and emissions supports continued investment in advanced steam trap technologies.

Key companies operating in the Global Steam Trap Market include Armstrong International, Spirax-Sarco Engineering, Emerson Electric, Forbes Marshall, TLV International, ARI-Armaturen, Thermax, Ayvaz, Miura, Velan, Watson-McDaniel, Watts Water Technologies, Yoshitake, Miyawaki, and Hoffman Specialty. Companies active in the Steam Trap Market strengthen their competitive position through product innovation, digital integration, and service-oriented strategies. Investment in intelligent monitoring capabilities and predictive maintenance solutions enhances system reliability and customer value. Manufacturers focus on improving durability, efficiency, and ease of integration with automated control systems. Strategic partnerships with industrial operators and energy service providers support long-term adoption and recurring revenue. Geographic expansion into emerging industrial regions broadens market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Function

- 2.2.4 Material

- 2.2.5 Connectivity

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased industrial automation and process efficiency demands

- 3.2.1.2 Rising adoption of energy-efficient solutions in manufacturing

- 3.2.1.3 Government regulations on energy conservation and emissions reduction

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial installation and maintenance costs

- 3.2.2.2 Limited awareness and expertise in steam trap maintenance

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of smart & IoT-enabled steam trap solutions

- 3.2.3.2 Rising demand driven by industrial growth & energy-efficiency regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter';s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical steam trap

- 5.3 Thermodynamic steam strap

- 5.4 Thermostatic steam trap

Chapter 6 Market Estimates & Forecast, By Function, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Steam distribution

- 6.3 Condensate recovery

Chapter 7 Market Estimates & Forecast, By Material, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cast/ductile iron

- 7.3 Carbon steel

- 7.4 Stainless steel

- 7.5 Alloy/specialty

Chapter 8 Market Estimates & Forecast, By Connectivity, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Smart/monitored traps

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Process industry

- 10.3 Power generation

- 10.4 HVAC & district heating

- 10.5 Pharmaceuticals & healthcare

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 UK

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 ARI-Armaturen

- 13.2 Armstrong International

- 13.3 Ayvaz

- 13.4 Emerson Electric

- 13.5 Forbes Marshall

- 13.6 Hoffman Specialty

- 13.7 Miura

- 13.8 Miyawaki

- 13.9 Spirax-Sarco Engineering

- 13.10 Thermax

- 13.11 TLV International

- 13.12 Velan

- 13.13 Watson-McDaniel

- 13.14 Watts Water Technologies

- 13.15 Yoshitake