PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928983

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928983

Automotive Door Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

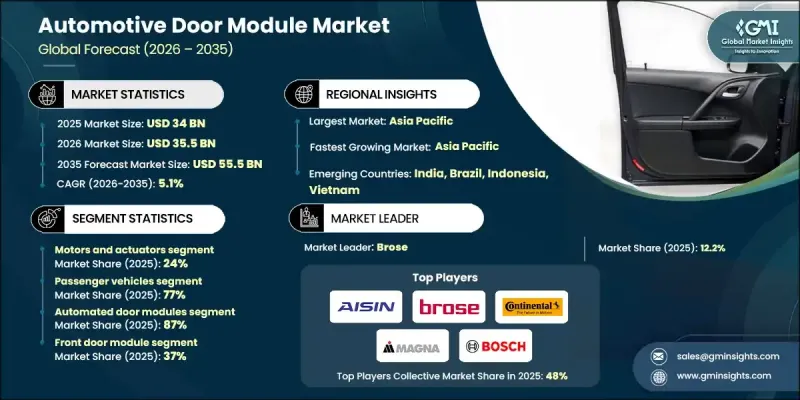

The Global Automotive Door Module Market was valued at USD 34 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 55.5 billion by 2035.

Market expansion is driven by steady growth in global vehicle production along with the rising integration of comfort, convenience, and safety technologies in modern vehicles. The accelerating shift toward electric mobility is reshaping door module design, encouraging the adoption of lightweight materials and advanced electronic systems to support efficiency and range optimization. Vehicle manufacturers are increasingly prioritizing modular vehicle architectures to reduce assembly time, streamline production workflows, and lower overall manufacturing costs. Integrating multiple door-related components into a single module allows faster installation, improved quality consistency, and scalability across high-volume vehicle platforms. Growing consumer expectations for enhanced safety and ease of use are further supporting market growth. Features related to access control, occupant protection, and automated functionality are becoming widely adopted across vehicle categories, encouraging higher-volume deployment of integrated door module solutions by original equipment manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $34 Billion |

| Forecast Value | $55.5 Billion |

| CAGR | 5.1% |

The motors and actuators segment held a 24% share in 2025 and is projected to grow at a CAGR of 6.1% from 2026 to 2035. Demand growth in this segment is being supported by rising vehicle electrification and increased use of automated functions, which require compact and energy-efficient electromechanical components that can be seamlessly integrated into door systems.

The automated door modules segment accounted for 87% share in 2025. Strong adoption is being driven by the widespread installation of electronically controlled access and window systems across vehicle segments. The continued growth of electric and premium vehicles is further increasing the electronic complexity of door modules, supporting sustained demand for automated solutions.

China Automotive Door Module Market held a 53% share and generated USD 8.5 billion in 2025. The country's dominance is supported by high vehicle production volumes and strong demand across both mass-market and premium passenger vehicles, including electric models.

Key companies operating in the automotive door module market include Magna International, Brose, Hyundai Mobis, Continental, ZF Friedrichshafen, Aisin, Inteva Products, Denso, Robert Bosch, and Hi-Lex. Companies active in the Global Automotive Door Module Market are strengthening their market position through continuous innovation, lightweight design development, and increased electronics integration. Many players are investing in research to improve module efficiency, reduce weight, and support electrified vehicle platforms. Expanding modular product portfolios that can be adapted across multiple vehicle architectures is a key strategy. Manufacturers are also forming long-term supply agreements with automakers to secure consistent demand. Enhancements in manufacturing automation and digital quality control systems are improving cost efficiency and scalability.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Module

- 2.2.5 Propulsion

- 2.2.6 Door

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising vehicle production volumes

- 3.2.1.3 Growth of electric and premium vehicles

- 3.2.1.4 Focus on modular vehicle architectures

- 3.2.1.5 Increasing safety and comfort features

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration complexity

- 3.2.2.2 Cost pressure on OEMs

- 3.2.3 Market opportunities

- 3.2.3.1 Lightweight material adoption

- 3.2.3.2 Smart door and access technologies

- 3.2.3.3 Expansion in emerging automotive markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States Vehicle Safety

- 3.4.1.2 FMVSS Side Impact Standards

- 3.4.1.3 California Vehicle Compliance

- 3.4.1.4 Canada Vehicle Guidelines

- 3.4.2 Europe

- 3.4.2.1 EU Vehicle Standards

- 3.4.2.2 Euro NCAP Guidelines

- 3.4.2.3 National Compliance

- 3.4.2.4 EN Door Module Standards

- 3.4.3 Asia Pacific

- 3.4.3.1 China Vehicle Regulations

- 3.4.3.2 India Safety Standards

- 3.4.3.3 Japan Module Guidelines

- 3.4.3.4 South Korea Standards

- 3.4.3.5 ASEAN Regional Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil Vehicle Standards

- 3.4.4.2 Argentina Compliance

- 3.4.4.3 Mexico Regulations

- 3.4.4.4 Regional Safety Guidelines

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Vehicle Standards

- 3.4.5.2 Saudi Arabia Regulations

- 3.4.5.3 South Africa Compliance

- 3.4.5.4 Regional Automotive Standards

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 OEM adoption & platform penetration analysis

- 3.14 Pricing, ASP & Cost Evolution

- 3.15 Impact of EV architectures on door module design

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Latches & handles

- 5.3 Window regulators

- 5.4 Speakers

- 5.5 Motors & actuators

- 5.6 Electrical connectors & wiring

- 5.7 Control units

- 5.8 Sealing systems

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs & crossovers

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCVs)

- 6.3.2 Medium Commercial Vehicles (MCVs)

- 6.3.3 Heavy Commercial Vehicles (HCVs)

Chapter 7 Market Estimates & Forecast, By Module, 2022 - 2035 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Manual door modules

- 7.3 Automated door modules

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 (USD Mn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 BEVs

- 8.4 Hybrid Vehicles

Chapter 9 Market Estimates & Forecast, By Door, 2022 - 2035 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Front door modules

- 9.3 Rear door modules

- 9.4 Sliding door modules

- 9.5 Liftgate door modules

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 (USD Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Netherlands

- 11.3.9 Sweden

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Aisin

- 12.1.2 Brose

- 12.1.3 Continental

- 12.1.4 Denso

- 12.1.5 Forvia

- 12.1.6 Hyundai Mobis

- 12.1.7 Magna International

- 12.1.8 Robert Bosch

- 12.1.9 Valeo

- 12.1.10 ZF Friedrichshafen

- 12.2 Regional Players

- 12.2.1 Flex-N-Gate

- 12.2.2 Grupo Antolin

- 12.2.3 Hi-Lex

- 12.2.4 Inteva Products

- 12.2.5 PHA Korea

- 12.3 Emerging Players/Disruptors

- 12.3.1 CIE Automotive

- 12.3.2 DaikyoNishikawa

- 12.3.3 Dura Automotive Systems

- 12.3.4 Hirotec

- 12.3.5 Kiekert