PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928986

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928986

Truck Platooning Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

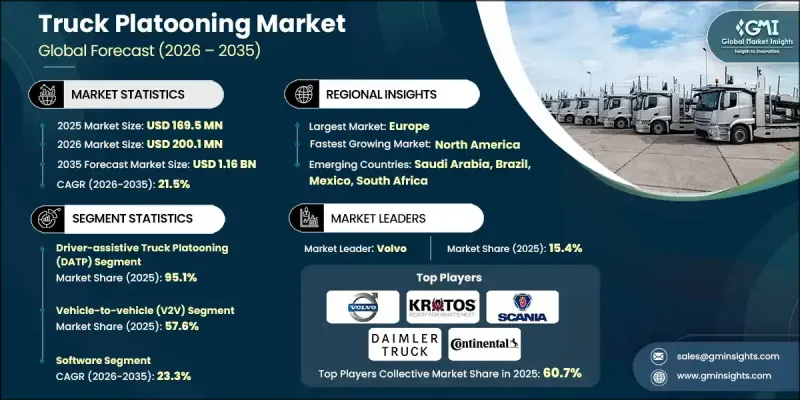

The Global Truck Platooning Market was valued at USD 169.5 million in 2025 and is estimated to grow at a CAGR of 21.5% to reach USD 1.16 billion by 2035.

The market growth is driven by increasing interest from logistics and transportation companies seeking efficiency, fuel savings, and safety improvements along frequently used routes. Governments worldwide are actively supporting pilot programs and on-road trials, carefully evaluating factors such as road infrastructure, deployment costs, safety, and risk management. As truck platooning technology matures and becomes commercially viable, major logistics and e-commerce players are expected to be early adopters, deploying platooning in their fleets to improve operational efficiency. Regions with strong regulatory support, robust transportation networks, and higher freight volumes are poised to experience faster adoption. The market is also benefiting from the rise of connected vehicle technologies, increasing digitalization in freight operations, and the ongoing push toward sustainability in the logistics industry.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $169.5 Million |

| Forecast Value | $1.16 Billion |

| CAGR | 21.5% |

The driver-assistive truck platooning (DATP) segment held a 95.1% share in 2025. DATP systems require at least one driver to lead the convoy, while following trucks remain semi-automated. This dominance is expected to continue in the near term as fully autonomous platooning faces challenges due to road infrastructure limitations, traffic density, and regulatory constraints. The reliance on a human operator ensures safety while allowing logistics operators to benefit from reduced fuel consumption and improved convoy efficiency. DATP also provides a practical transition stage for fleets as technology and regulatory frameworks mature toward fully autonomous solutions.

The vehicle-to-everything (V2X) communication technology segment is projected to grow at a CAGR of 23.1% from 2026 to 2035. V2X enables seamless connectivity between vehicles, infrastructure, and driver assistance systems, allowing real-time coordination within platoons. Its adoption is driving efficiency, safety, and precision in convoy operations, enabling smoother acceleration, braking, and route management. As V2X matures, it is expected to integrate with advanced technologies such as digital twin simulations and autonomous vehicle controls, further enhancing the performance and scalability of truck platooning systems.

U.S. Truck Platooning Market reached USD 53 million in 2025. The market is transitioning from closed-track testing to actual freight operations on public highways, supported by government policies and collaborative efforts between federal and state agencies. The U.S. Department of Transportation has identified truck platooning as one of the earliest applications of automated vehicles in freight, encouraging partnerships between states to align safety regulations, develop infrastructure, and plan operational strategies. Growth is driven by the adoption of driver-assistive systems, supportive legislation, and the need for greater efficiency and cost savings in long-haul transportation networks.

Major players operating in the Global Truck Platooning Market include MAN Truck & Bus, Daimler Truck, Volvo, IVECO, Robert Bosch, Kratos, Scania, Knorr-Bremse, Continental, and DAF Trucks. These companies lead through technological innovation, strategic partnerships, and early involvement in pilot programs, ensuring strong positions in the emerging truck platooning market. They continue to invest in R&D, autonomous driving technologies, and connected vehicle systems to meet evolving market demands and regulatory requirements. Companies in the Global Truck Platooning Market are employing several strategies to strengthen their foothold. They focus on technological innovation, including the development of V2X-enabled systems, driver-assistive solutions, and autonomous-ready platooning platforms. Strategic partnerships with logistics operators, e-commerce companies, and government agencies accelerate testing, adoption, and infrastructure readiness. Mergers and acquisitions are used to consolidate expertise, expand geographic reach, and enhance product portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Platooning

- 2.2.3 Component

- 2.2.4 Communication Technology

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising fuel cost reduction imperative

- 3.2.1.2 Advancements in vehicle-to-vehicle (V2V) communication

- 3.2.1.3 Growing adoption of advanced driver assistance systems (ADAS)

- 3.2.1.4 Government support for connected and autonomous mobility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cybersecurity and data privacy concerns

- 3.2.2.2 Limited infrastructure readiness in emerging economies

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with level 2-4 autonomous trucking solutions

- 3.2.3.2 Deployment in dedicated freight corridors

- 3.2.3.3 Partnerships between OEMs, fleet operators, and tech providers

- 3.2.3.4 Adoption by large logistics and e-commerce fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Federal AV Policy Guidance (NHTSA Guidelines)

- 3.4.1.2 Federal AV Legislation Bills

- 3.4.1.3 Transport Canada Guidelines

- 3.4.1.4 State Autonomous Vehicle Laws

- 3.4.2 Europe

- 3.4.2.1 UN Regulation No. 157 - Automated Lane Keeping Systems (ALKS)

- 3.4.2.2 EU Regulation (EU)

- 3.4.2.3 Automated Driving Act

- 3.4.3 Asia Pacific

- 3.4.3.1 China Autonomous Driving Road Test Regulations

- 3.4.3.2 Japan Road Traffic Act & Road Transport Vehicle Act

- 3.4.3.3 ASEAN Autonomous Vehicle Landscape

- 3.4.4 Latin America

- 3.4.4.1 Brazil Autonomous Vehicle Testing Guidelines

- 3.4.4.2 Chile Autonomous AV Pilot Approvals

- 3.4.4.3 RCEP Regional Tech Collaboration Framework

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE / Dubai Autonomous Transportation Strategy & Truck Framework

- 3.4.5.2 South Africa Automated/Connected Vehicle Policy Drafts

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Sustainability and environmental impact

- 3.9.1 Environmental impact assessment

- 3.9.2 Social impact & community benefits

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable finance & investment trends

- 3.10 Case studies

- 3.11 Fleet economics, ROI & payback analysis

- 3.12 Commercial readiness & deployment maturity assessment

- 3.13 High-potential corridors & use-case prioritization

- 3.14 Hardware architecture & upfront investment analysis

- 3.15 Software & service monetization model

- 3.15.1 Platooning software stack

- 3.15.2 Pricing models used by vendors

- 3.15.3 Subscription & recurring fee structure

- 3.15.4 Operational service costs

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Platooning, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Driver-Assistive Truck Platooning (DATP)

- 5.3 Autonomous Truck Platooning

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Radar

- 6.2.2 Lidar

- 6.2.3 Camera

- 6.2.4 Other Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates & Forecast, By Communication Technology, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Vehicle-to-Vehicle (V2V)

- 7.3 Vehicle-to-Infrastructure (V2I)

- 7.4 Vehicle-to-Everything (V2X)

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 Light Commercial Vehicle (LCV)

- 8.3 Medium Commercial Vehicle (MCV)

- 8.4 Heavy Commercial Vehicle (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.4.10 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 Daimler Truck

- 10.1.2 Volvo

- 10.1.3 Scania

- 10.1.4 Continental

- 10.1.5 IVECO

- 10.1.6 MAN Truck & Bus

- 10.1.7 DAF Trucks

- 10.1.8 ZF Friedrichshafen

- 10.1.9 Robert Bosch

- 10.1.10 Knorr-Bremse

- 10.1.11 Plus (PlusAI)

- 10.2 Regional companies

- 10.2.1 Kratos Defense & Security Solutions

- 10.2.2 Waabi

- 10.2.3 Gatik

- 10.2.4 Bendix Commercial Vehicle Systems

- 10.2.5 Denso

- 10.2.6 Hyundai Motor

- 10.3 Emerging companies

- 10.3.1 UD Trucks

- 10.3.2 Hino Motors

- 10.3.3 Cohda Wireless