PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928994

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928994

Pick and Place Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

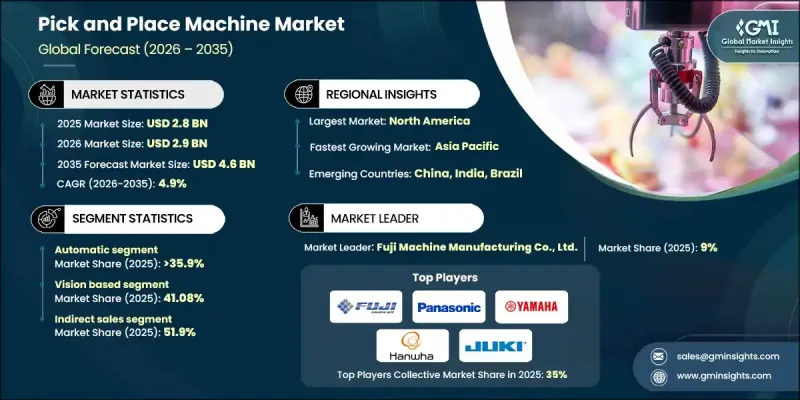

The Global Pick and Place Machine Market was valued at USD 2.8 billion in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 4.6 billion by 2035.

The market's expansion is driven by the increasing demand for high-speed, precise surface-mount technology (SMT) placement systems, which are essential for modern electronics manufacturing. Efficiency gains, accuracy, and the need for consistent quality have encouraged industry consolidation, as leading companies merge or acquire competitors to expand their capabilities. This consolidation has resulted in broader product portfolios, increased R&D investments, and stronger global market presence. Traditional manual component placement or semi-automatic machines are increasingly unable to meet the precision and speed requirements of miniaturized electronics, especially in the 5G, automotive, and EV sectors. Fully automated systems with energy-efficient servo motors and thermally stable materials offer reduced operational power loss and align with sustainable, high-tech manufacturing practices. Adoption of these advanced machines allows manufacturers to meet high-volume production targets while maintaining precision and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 4.9% |

The automatic pick and place segment accounted for 35.9% share in 2025, generating USD 1 billion. Automatic machines dominate because they provide sub-micron placement accuracy, high-speed operation, and scalability required by modern electronics manufacturing. These systems are integral to Industry 4.0 implementations, enabling seamless integration with robotics, smart factory networks, and predictive maintenance platforms. The increasing production of smartphones, EVs, and electronic control units in the automotive and aerospace industries further drives the demand for high-performance automated placement systems. Their ability to reduce human error, optimize throughput, and ensure consistent quality makes them essential for high-volume manufacturing.

Vision-based pick and place systems held 41.08% share, generating USD 1.2 billion in 2025. Vision systems provide real-time optical recognition, alignment, and defect detection for small, high-density components, ensuring extremely high yield rates. This technology is critical for placing fine-pitch components and handling complex assemblies with exceptional accuracy. Its ability to integrate inspection and placement simultaneously reduces rework and waste, improving overall production efficiency. Manufacturers increasingly rely on vision-based systems to achieve faster cycle times, lower error rates, and compliance with stringent quality standards required in aerospace, medical device assembly, and automotive electronics.

U.S. Pick and Place Machine Market held 84.5% share in 2025. This dominance is fueled by early adoption of advanced robotics, AI-integrated assembly systems, and high-precision manufacturing technologies. Strong demand comes from the automotive and aerospace sectors, where pick and place machines are essential for assembling complex electronic control units, sensors, and high-density boards. Additionally, the medical device segment is contributing to growth, requiring specialized machines capable of cleanroom operation and extreme precision. North America's well-established electronics manufacturing ecosystem, combined with high R&D investment and adoption of smart factory concepts, continues to propel the market forward.

Major players operating in the Global Pick and Place Machine Market include ASM Pacific Technology Ltd., Yamaha Motor Co., Ltd., ASM Assembly Systems GmbH & Co. KG, Juki Corporation, Panasonic Corporation, Hanwha Techwin, Mycronic AB, Nordson Corporation, Universal Instruments Corporation, Speedline Technologies, Inc., Europlacer Group, Essemtec AG, Viscom AG, Hanwha Corporation, and others. These companies lead through continuous innovation, global expansion, and the development of automated, vision-integrated systems that meet evolving electronics manufacturing needs. Companies in the Pick and Place Machine Market are adopting multiple strategies to strengthen their market position. They focus heavily on mergers and acquisitions to consolidate technological expertise and expand regional reach. Product innovation, including AI-assisted placement, vision-based defect detection, and energy-efficient servo motors, enhances performance and sustainability. Firms invest in Industry 4.0 solutions to integrate machines into smart factories and provide connected, data-driven platforms for predictive maintenance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Miniaturization of electronic components

- 3.2.1.2 Transition to industry 4.0 and smart factories

- 3.2.1.3 Rise in electric vehicle (EV) electronics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital expenditure

- 3.2.2.2 Complexity of programming for high-mix production

- 3.2.3 Opportunities

- 3.2.3.1 Ai-driven predictive maintenance

- 3.2.3.2 Expansion of 5G and satellite communication

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Semi-automatic

- 5.4 Automatic

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Vision based

- 6.3 Force based

- 6.4 Laser based

- 6.5 Hybrid

Chapter 7 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trend

- 7.2 Upto 10,000 CPH

- 7.3 10,000-20,000 CPH

- 7.4 Above 20,000 CPH

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Packaging industry

- 8.5 Pharmaceutical

- 8.6 Logistics

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ASM Assembly Systems GmbH & Co. KG

- 11.2 Fuji Machine Manufacturing Co., Ltd.

- 11.3 Juki Corporation

- 11.4 Panasonic Corporation

- 11.5 Yamaha Motor Co., Ltd.

- 11.6 Hanwha Corporation

- 11.7 Mycronic AB

- 11.8 Nordson Corporation

- 11.9 Hanwha Techwin

- 11.10 ASM Pacific Technology Ltd.

- 11.11 Universal Instruments Corporation

- 11.12 Europlacer Group

- 11.13 Essemtec AG

- 11.14 Viscom AG

- 11.15 Speedline Technologies, Inc.