PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928996

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928996

Electric Propulsion Satellites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

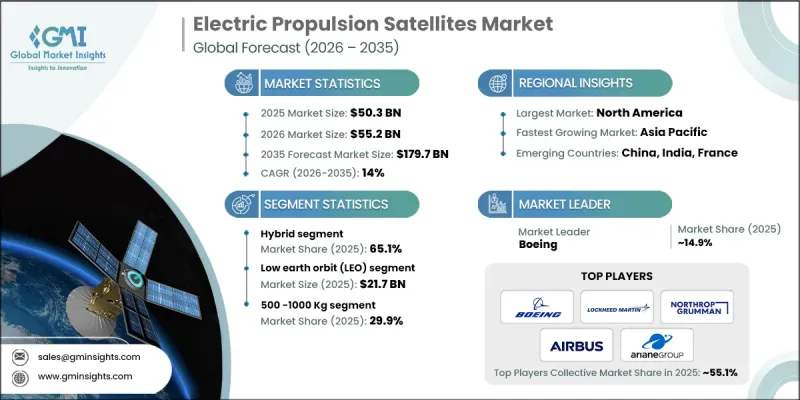

The Global Electric Propulsion Satellites Market was valued at USD 50.3 billion in 2025 and is estimated to grow at a CAGR of 14% to reach USD 179.7 billion by 2035.

Market growth is supported by accelerating demand for large-scale satellite constellations, continuous improvements in electric propulsion efficiency, and rising preference for cost-optimized launch and in-orbit operation solutions. Increased deployment of satellites for communication, observation, and security purposes is reinforcing the need for propulsion systems that offer extended mission life and reduced operational costs. Advancements in electric propulsion technologies are enhancing thrust efficiency and operational flexibility, enabling satellites to perform complex missions with lower fuel mass. Growing emphasis on environmentally responsible space operations is also encouraging the adoption of cleaner propulsion alternatives. Expansion of the commercial space ecosystem, combined with rising participation from both public and private stakeholders, is further stimulating demand. Cost efficiency remains a key priority across satellite programs, driving interest in propulsion architectures that balance performance, scalability, and long-term mission economics, thereby supporting sustained market expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $50.3 Billion |

| Forecast Value | $179.7 Billion |

| CAGR | 14% |

The hybrid propulsion segment accounted for 65.1% share in 2025. This segment benefits from combining electric and chemical propulsion systems to meet diverse mission requirements. Demand for hybrid configurations continues to grow as satellite operators seek reliable propulsion solutions that support both maneuverability and endurance while maintaining cost efficiency.

The low Earth orbit segment generated USD 21.7 billion in 2025. Strong demand for LEO satellites is being driven by their suitability for large constellations requiring frequent deployment, efficient propulsion performance, and reliable operational coverage across a wide range of applications.

North America Electric Propulsion Satellites Market held 36.7% share in 2025. Market leadership in the region is supported by sustained investment in satellite technology, strong demand for advanced communication infrastructure, and continued development of propulsion innovations backed by public and private funding.

Key companies operating in the Global Electric Propulsion Satellites Market include Airbus, Boeing, Lockheed Martin, Northrop Grumman, Thales Alenia Space, Safran Group, Aerojet Rocketdyne, L3Harris Technologies, ArianeGroup, OHB System, Accion Systems, Bellatrix Aerospace, Busek, ThrustMe, Sitael, and Ad Astra Rocket. Companies in the Electric Propulsion Satellites Market are strengthening their competitive position through technology innovation, strategic partnerships, and capacity expansion. Many players are investing in advanced propulsion systems that improve efficiency, reduce mass, and extend satellite operational life. Expanding hybrid propulsion portfolios is a key strategy to address diverse mission profiles and customer requirements. Firms are also collaborating with satellite manufacturers and launch providers to integrate propulsion solutions early in spacecraft design.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Orbit trends

- 2.2.2 Satellite type trends

- 2.2.3 Satellite mass trends

- 2.2.4 Propulsion trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Regional

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for global satellite constellations

- 3.2.1.2 Progress in electric propulsion technology efficiency

- 3.2.1.3 Increasing demand for affordable launch solutions

- 3.2.1.4 Surge in space launches for defense, commercial

- 3.2.1.5 Increased investment in space infrastructure development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial development and implementation costs

- 3.2.2.2 Technical limitations and performance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for sustainable space technologies

- 3.2.3.2 Advancements in miniaturization of satellite components

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense Budget Analysis

- 3.11 Global Defense Spending Trends

- 3.12 Regional Defense Budget Allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Supply Chain Resilience

- 3.14 Geopolitical Analysis

- 3.15 Workforce Analysis

- 3.16 Digital Transformation

- 3.17 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.18 Risk Assessment and Management

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Orbit, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Low earth orbit (LEO)

- 5.3 Medium earth orbit (MEO)

- 5.4 Geostationary orbit (GEO)

Chapter 6 Market Estimates and Forecast, By Satellite Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Full electric

- 6.3 Hybrid

Chapter 7 Market Estimates and Forecast, By Satellite Mass, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Less than 100 kg

- 7.3 100 -500 KG

- 7.4 500 -1000 Kg

- 7.5 Above 1000 Kg

Chapter 8 Market Estimates and Forecast, By Propulsion, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Electrothermal

- 8.3 Electrostatic

- 8.4 Electromagnetic

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Earth observation

- 9.3 Navigation

- 9.4 Communication

- 9.5 Weather monitoring

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Government

- 10.2.1 Military

- 10.2.2 Others

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Boeing

- 12.1.2 Lockheed Martin

- 12.1.3 Northrop Grumman

- 12.1.4 Airbus

- 12.1.5 ArianeGroup

- 12.2 Regional key players

- 12.2.1 North America

- 12.2.1.1 Aerojet Rocketdyne

- 12.2.1.2 Busek Co. Inc.

- 12.2.1.3 L3Harris Technologies

- 12.2.2 Asia Pacific

- 12.2.2.1 Bellatrix Aerospace

- 12.2.3 Europe

- 12.2.3.1 OHB System

- 12.2.3.2 Safran Group

- 12.2.3.3 Sitael Spa

- 12.2.3.4 Thales Alenia Space

- 12.2.3.5 ThrustMe

- 12.2.1 North America

- 12.3 Niche Players/Disruptors

- 12.3.1 Accion Systems Inc.

- 12.3.2 Ad Astra Rocket