PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936478

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936478

Automotive AI Simulation and Synthetic Data Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

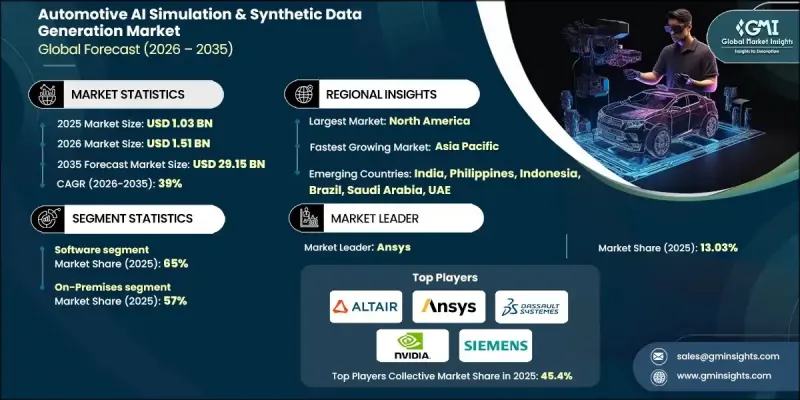

The Global Automotive AI Simulation & Synthetic Data Generation Market was valued at USD 1.03 billion in 2025 and is estimated to grow at a CAGR of 39% to reach USD 29.15 billion by 2035.

The rapid expansion reflects a fundamental transformation in how vehicles are designed and validated as advanced driver assistance systems and autonomous technologies move deeper into production. AI-driven simulation and synthetic data tools are becoming core enablers of virtual development, large-scale AI training, and safety validation for increasingly complex automotive software. These platforms allow manufacturers and suppliers to digitally replicate massive volumes of driving scenarios, sensor interactions, and environmental variables in controlled settings, significantly reducing dependence on costly and time-intensive real-world testing. The market is also benefiting from growing collaboration across the ecosystem, as vehicle manufacturers, Tier-1 suppliers, cloud and infrastructure providers, and simulation software vendors align to streamline development workflows. Sim-first development models are now widely embedded into autonomous and ADAS programs, while integrated solutions are helping reduce engineering complexity, improve model accuracy, and lower overall vehicle development costs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.03 Billion |

| Forecast Value | $29.15 Billion |

| CAGR | 39% |

The software segment accounted for 65% share in 2025 and is forecast to grow at a CAGR of 38.5% through 2035. This dominance reflects the industry's accelerated transition toward software-defined vehicles, where core driving intelligence is built, tested, and refined through digital environments rather than physical prototypes. Simulation software enables extensive virtual testing of vehicle behavior, sensor performance, and traffic dynamics, allowing millions of use cases to be evaluated efficiently and repeatedly.

The on-premises segment held 57% share in 2025 and is expected to grow at a CAGR of 37.9% from 2026 to 2035. This preference is driven by strict requirements around data privacy, intellectual property protection, and compliance with automotive safety and cybersecurity frameworks. Automotive manufacturers and Tier-1 suppliers manage highly confidential vehicle systems, perception logic, and proprietary datasets that are often restricted from external environments. On-premises infrastructure provides full ownership and governance over data, simulation assets, and AI workflows while aligning with internal security and regulatory standards.

North America Automotive AI Simulation & Synthetic Data Generation Market held 85% share and generated USD 328.3 million in 2025. Growth in the country is being fueled by strong investment in autonomous and ADAS technologies, alongside rising expectations for safety validation and regulatory readiness. The adoption of scenario-based simulation and virtual testing is accelerating as organizations seek to limit physical testing while maintaining high confidence in system performance.

Key companies active in the Global Automotive AI Simulation & Synthetic Data Generation Market include NVIDIA, Siemens, Dassault Systemes, Ansys, The MathWorks, dSPACE, Altair Engineering, PTC, Autodesk, and ESI Group. Leading companies in the Automotive AI simulation and synthetic data generation market are strengthening their positions through platform integration, strategic partnerships, and continuous innovation. Many vendors are expanding end-to-end simulation ecosystems that combine scenario creation, sensor modeling, AI validation, and regression testing into unified offerings. Collaboration with OEMs and Tier-1 suppliers is being used to tailor solutions to real-world development needs and accelerate adoption.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Simulation type

- 2.2.4 Synthetic data type

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Deployment mode

- 2.2.8 Vehicle

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for ADAS & autonomous vehicle development

- 3.2.1.2 Rising complexity of vehicle software systems

- 3.2.1.3 Surge in demand for virtual validation and scenario-based testing

- 3.2.1.4 Increase in AI/ML adoption for sensor fusion and perception systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity of simulation tools

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in cloud-based simulation-as-a-service models

- 3.2.3.2 Increase in demand for certified virtual validation frameworks

- 3.2.3.3 Rise in digital twin adoption for vehicle development

- 3.2.3.4 Expansion of simulation use beyond passenger vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: NHTSA ADS Guidance & AV TEST Initiative.

- 3.4.2 Europe

- 3.4.2.1 European Union: UNECE Regulation R157 (ALKS)

- 3.4.2.2 Germany: Autonomous Driving Act

- 3.4.2.3 United Kingdom: Connected and Automated Mobility (CAM) Regulations

- 3.4.2.4 France: Autonomous Vehicle Experimentation Framework

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Intelligent Connected Vehicle (ICV) Simulation Standards

- 3.4.3.2 Japan: MLIT Automated Driving Safety Guidelines

- 3.4.3.3 South Korea: Autonomous Vehicle Act

- 3.4.3.4 Singapore: Autonomous Vehicle Safety Assessment Framework

- 3.4.4 Latin America

- 3.4.4.1 Brazil: National Intelligent Mobility & IoT Strategy

- 3.4.4.2 Mexico: Smart Mobility & AV Pilot Regulations

- 3.4.4.3 Chile: Intelligent Transport Systems (ITS) Policy

- 3.4.5 MEA

- 3.4.5.1 United Arab Emirates: Dubai Autonomous Transport Strategy

- 3.4.5.2 Saudi Arabia: Vision 2030 Smart Mobility Framework

- 3.4.5.3 South Africa: Green Transport & Automated Mobility Policy

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Future outlook & opportunities

- 3.11 OEM implementation framework

- 3.11.1 Assessment & strategy

- 3.11.2 Infrastructure setup

- 3.11.3 Pilot program

- 3.11.4 Integration & scaling

- 3.11.5 Optimization & expansion

- 3.11.6 Critical success factors

- 3.11.7 Common pitfalls & mitigation

- 3.12 Use Cases & application scenarios

- 3.12.1 Urban autonomous driving simulation

- 3.12.2 Highway autopilot & truck platooning

- 3.12.3 Edge case generation for safety testing

- 3.12.4 Synthetic data for perception model training

- 3.12.5 Driver monitoring system validation

- 3.12.6. V2X communication simulation

- 3.12.7 Cold weather & extreme climate testing

- 3.12.8 Parking & low-speed maneuvering

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Simulation Type, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Sensor Simulation

- 6.3 Scenario Generation

- 6.4 Vehicle Dynamics

- 6.5 HIL/SIL Testing

Chapter 7 Market Estimates & Forecast, By Synthetic Data, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Image & Video

- 7.3 Tabular

- 7.4 Time-Series

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 ADAS Testing

- 8.3 Autonomous Vehicle Development

- 8.4 AI/ML Model Training

- 8.5 Safety & Compliance

- 8.6 Design Validation

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Tier 1 Suppliers

- 9.4 Technology Companies

- 9.5 Research Institutions

Chapter 10 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 On-Premises

- 10.3 Cloud-Based

- 10.4 Hybrid

Chapter 11 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 Passenger vehicle

- 11.2.1 Sedan

- 11.2.2 Hatchback

- 11.2.3 SUV

- 11.3 Commercial vehicle

- 11.3.1 LCV

- 11.3.2 MCV

- 11.3.3 HCV

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Belgium

- 12.3.8 Netherlands

- 12.3.9 Sweden

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.4.8 Singapore

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Altair Engineering

- 13.1.2 Ansys

- 13.1.3 Autodesk

- 13.1.4 Dassault Systemes

- 13.1.5 IBM

- 13.1.6 MSC Software (Hexagon)

- 13.1.7 NVIDIA

- 13.1.8 PTC

- 13.1.9 Siemens

- 13.1.10 Synopsys

- 13.1.11 The MathWorks

- 13.2 Regional Players

- 13.2.1 AVL List

- 13.2.2 AVSimulation

- 13.2.3 dSPACE

- 13.2.4 ESI Group (Keysight)

- 13.2.5 IPG Automotive

- 13.2.6 SIMUL8

- 13.3 Emerging Players

- 13.3.1 Anyverse

- 13.3.2 Applied Intuition

- 13.3.3 Cognata

- 13.3.4 Foretellix

- 13.3.5 Mechanical Simulation

- 13.3.6 MOOG

- 13.3.7 Parallel Domain

- 13.3.8 SimScale