PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936481

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936481

In-Vehicle Assistant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

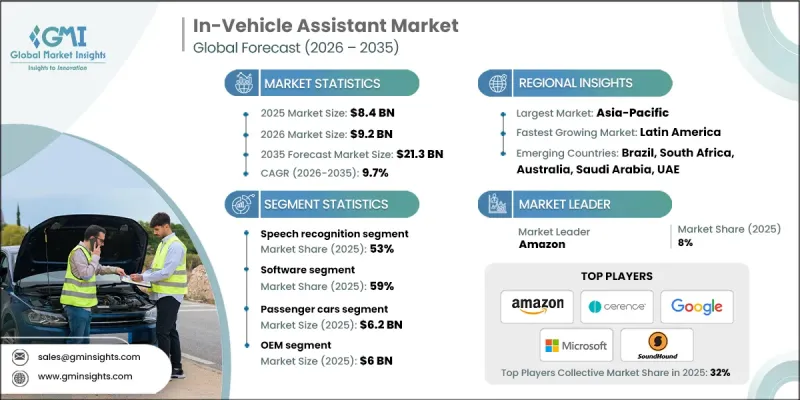

The Global In-Vehicle Assistant Market was valued at USD 8.4 billion in 2025 and is estimated to grow at a CAGR of 9.7% to reach USD 21.3 billion by 2035.

Market expansion is driven by increasing consumer demand for safe, convenient, and hands-free vehicle interactions, alongside OEM commitments to introduce large numbers of electric and automated vehicles. The emergence of multimodal Human-Machine Interfaces (HMIs) is reshaping the industry, as automakers integrate voice, touch, and gesture-based inputs into connected vehicles. Large Language Models (LLMs) are enabling the development of smarter platforms and devices, allowing for more intuitive driver interactions and adoption across premium and entry-level vehicles alike. While the COVID-19 pandemic temporarily disrupted vehicle production and delayed new vehicle rollouts, the long-term demand for integrated voice assistants and advanced in-car digital experiences remains strong, supported by ongoing investments in connected and smart vehicle technologies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.4 Billion |

| Forecast Value | $21.3 Billion |

| CAGR | 9.7% |

The speech recognition segment accounted for 53% share in 2025 and is expected to grow at a CAGR of 8.7% from 2026 to 2035. This technology forms the core of in-vehicle assistant systems, translating audio signals captured by microphones into actionable text via automatic speech recognition (ASR) algorithms. Revenue streams include specialized automotive ASR software licensing, beamforming microphones, and dedicated digital signal processor (DSP) chips for acoustic processing.

The software segment held a 59% share in 2025 and is anticipated to grow at a CAGR of 8.2% through 2035. Software platforms include cloud-based natural language processing, voice recognition engines, software update management systems, and APIs that integrate third-party applications. Licensing models vary, with traditional vendors often employing per-vehicle subscription arrangements.

China In-Vehicle Assistant Market generated USD 2.6 billion in 2025. The country produces over thirty million vehicles annually, and government initiatives, such as the New Infrastructure Policy and Smart City programs, are accelerating vehicle connectivity. Regulations mandating voice-based emergency call systems and dedicated funding for intelligent connected vehicles further reinforce the market's growth trajectory.

Key players in the Global In-Vehicle Assistant Market include Microsoft, Apple, Amazon, Cerence, Continental, Google, Nuance, Panasonic Automotive, Samsung, and SoundHound. Companies in the in-vehicle assistant market are strengthening their position by investing in AI-driven voice recognition, multimodal HMI systems, and cloud platform integration. Strategic partnerships with OEMs ensure early adoption and long-term contracts. Continuous R&D in natural language processing, edge computing, and DSP optimization enhances performance and reliability. Expanding regional footprints, particularly in emerging automotive markets, allows companies to tap new customer bases. Licensing strategies, software subscriptions, and integration with third-party platforms further increase revenue streams while establishing brand presence and technological leadership.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Component

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component suppliers

- 3.1.1.2 Technology platform providers

- 3.1.1.3 System integrators

- 3.1.1.4 Automotive OEMs

- 3.1.1.5 Aftermarket distributors

- 3.1.1.6 End-users

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of connected & smart vehicles

- 3.2.1.2 Rising consumer demand for safety & hands-free interaction

- 3.2.1.3 Expansion of electric and autonomous vehicle (EV/AV) market

- 3.2.1.4 Growth of aftermarket & software upgrades

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High OEM integration cost

- 3.2.2.2 Privacy & data security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI-driven assistants

- 3.2.3.2 Multimodal HMI adoption

- 3.2.3.3 Cloud connectivity and OTA updates

- 3.2.3.4 Regional adoption of smart assistants

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.2 Emerging technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.1.1 FMVSS Driver Distraction Guidelines

- 3.5.1.2 California ACC & ZEV Regulations

- 3.5.1.3 Transport Canada Connected Vehicle & Infotainment Guidelines

- 3.5.2 Europe

- 3.5.2.1 EU General Safety Regulation (GSR)

- 3.5.2.2 CE Certification for Automotive Infotainment

- 3.5.2.3 EU Vehicle Type Approval Directive

- 3.5.3 Asia-Pacific

- 3.5.3.1 Japan Automotive Electronics Safety Standards

- 3.5.3.2 China GB Standards for Connected Vehicles

- 3.5.3.3 India AIS / EMC Guidelines

- 3.5.4 Latin America

- 3.5.4.1 Brazil INMETRO Standards

- 3.5.4.2 Colombia Automotive Connected Systems Guidelines

- 3.5.4.3 Argentina Vehicle Electronics & Infotainment Regulations

- 3.5.5 Middle East & Africa

- 3.5.5.1 UAE Standards for Connected & Voice-Enabled Vehicles

- 3.5.5.2 Oman Automotive Electronics Guidelines

- 3.5.5.3 South Africa SABS Automotive Voice & Infotainment Standards

- 3.5.1 North America

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Price trends

- 3.8.1 OEM Pricing models

- 3.8.2 Aftermarket pricing trends

- 3.8.3 Subscription vs one-time purchase models

- 3.8.4 Regional price variations

- 3.9 Patent analysis

- 3.10 Supply chain analysis

- 3.10.1 Component sourcing strategies

- 3.10.2 Semiconductor chip supply constraints

- 3.10.3 Cloud infrastructure dependencies

- 3.10.4 Regional supply chain dynamics

- 3.11 Go-to-market strategies

- 3.11.1 Region-specific market penetration strategies

- 3.11.2 Key regulatory considerations for new entrants

- 3.11.3 Pricing, service, and differentiation strategies

- 3.12 Commercial viability & deployment

- 3.12.1 Cost competitiveness vs. premium audio upsell value

- 3.12.2 OEM sourcing attractiveness and platform scalability

- 3.12.3 Aftermarket upgrade potential and dealer fitment economics

- 3.12.4 Localization, supply resilience, and logistics practicality

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Speech Recognition

- 5.3 Natural Language Processing (NLP)

- 5.4 Artificial Intelligence (AI)

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Software

- 6.2.1 Embedded software

- 6.2.2 Cloud-based software

- 6.2.3 Ai-powered software

- 6.3 Hardware

- 6.3.1 Microphones

- 6.3.2 Speakers

- 6.3.3 Control units

- 6.3.4 Display panels

- 6.4 Service

- 6.4.1 Integration and deployment

- 6.4.2 Maintenance and support

- 6.4.3 Consulting services

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUVs

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Entertainment

- 8.4 Communication

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Technology Giants & AI Platform Providers

- 11.1.1 Amazon

- 11.1.2 Google

- 11.1.3 Apple

- 11.1.4 Microsoft

- 11.1.5 NVIDIA

- 11.1.6 Cerence

- 11.1.7 Nuance Communications

- 11.1.8 SoundHound

- 11.2 Tier 1 Automotive Suppliers

- 11.2.1 Robert Bosch

- 11.2.2 Continental

- 11.2.3 Denso Corporation

- 11.2.4 Samsung

- 11.2.5 Aptiv PLC

- 11.2.6 Panasonic Automotive Systems Company

- 11.2.7 Visteon Corporation

- 11.3 Automotive OEMs

- 11.3.1 Mercedes-Benz Group

- 11.3.2 Ford Motor Company

- 11.3.3 Hyundai Motor Company

- 11.3.4 BMW Group

- 11.3.5 General Motors

- 11.3.6 Tata Motors Limited

- 11.4 Emerging Players & Specialists

- 11.4.1 Baidu

- 11.4.2 Mihup Communications Private Limited

- 11.4.3 Sensory

- 11.4.4 NXP Semiconductors