PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936490

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936490

Precision Agriculture Drone Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

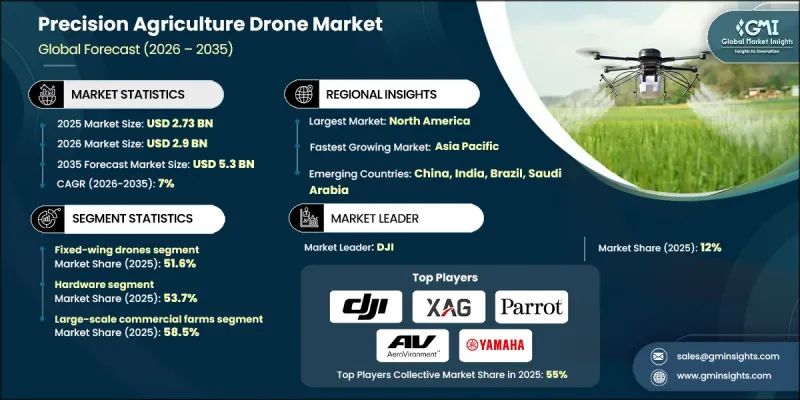

The Global Precision Agriculture Drone Market was valued at USD 2.73 billion in 2025 and is estimated to grow at a CAGR of 7% to reach USD 5.3 billion by 2035.

Market growth is driven by increasing awareness around crop lifecycle management, yield optimization, and the need for higher operational efficiency across modern farms. Demand for advanced aerial monitoring and spraying solutions is rising as growers seek real-time insights and accurate field assessments. Industry momentum is further supported by an increase in strategic collaborations and consolidation activities among leading manufacturers, which has accelerated innovation and broadened solution offerings. The strengthening market presence of established drone developers, combined with agricultural intelligence providers, has enhanced technological capabilities and expanded product portfolios across the sector. Traditional crop inspection methods are increasingly viewed as inefficient for large-scale farming operations, prompting a shift toward automated drone-based systems. Advances in connectivity, artificial intelligence-driven analytics, and cloud-enabled data processing are improving decision-making accuracy while helping farmers reduce input waste and improve overall productivity.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.73 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 7% |

In 2025, the hardware segment accounted for 53.7% share, generating USD 1.5 billion. Core hardware components, including advanced sensors, extended-life power systems, and lightweight structural designs, provide the essential performance and payload capacity required for precision farming tasks. Enhanced positioning technologies are improving navigation accuracy and operational reliability. The dominance of the hardware segment reflects the industry's dependence on robust physical infrastructure to support automated mapping, monitoring, and application activities aligned with data-driven agricultural practices.

The large-scale commercial farms segment held 58.5% share in 2025. Adoption within this segment is driven by the need to manage extensive farmland efficiently while minimizing labor requirements. These operations prioritize drone solutions for rapid field assessment, automated data collection, and consistent application processes across large and continuous agricultural areas, reinforcing strong demand for high-performance precision drone systems.

United States Precision Agriculture Drone Market held 75.6% share in 2025. Market leadership is supported by early technology adoption, a favorable regulatory environment, and widespread utilization of drone-based monitoring across large farming enterprises. Emphasis on automated farm management and data-driven input optimization continues to drive demand as agricultural operators seek to improve efficiency, control costs, and enhance productivity across extensive crop areas.

Key companies operating in the Global Precision Agriculture Drone Market include DJI, PrecisionHawk, Parrot, AeroVironment, Inc., AGCO Corporation, AgEagle Aerial Systems, DroneDeploy, Yamaha Motor Co., Ltd., senseFly, Sentera, Quantum Systems, Delair, 3D Robotics, Agribotix, and Skeycatch. Companies in the precision agriculture drone market are reinforcing their competitive position through technology innovation, strategic partnerships, and targeted acquisitions. Leading players are investing in research and development to enhance flight endurance, data accuracy, and analytics capabilities. Many are expanding integrated software and hardware ecosystems to deliver end-to-end farming solutions. Firms are also focusing on geographic expansion and collaborations with agritech providers to strengthen distribution networks. Customization of drone platforms for specific crop types and farming scales, along with improved after-sales support and training services, is helping companies build long-term customer relationships and secure sustained market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Monitoring Process

- 2.2.4 Application

- 2.2.5 System

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift from manual to automated crop scouting

- 3.2.1.2 Proliferation of AI & Edge Computing

- 3.2.1.3 Government Subsidies & "Drone Shakti"

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial CAPEX for advanced payloads

- 3.2.2.2 Shortage of certified drone pilots

- 3.2.3 Opportunities

- 3.2.3.1 AI-Powered prescriptive analytics

- 3.2.3.2 Subscription-based "Data-as-a-Service"

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Fixed-wing Drones

- 5.3 Rotary-wing Drones

- 5.4 Hybrid Drones

Chapter 6 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By Farm Size, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Large-scale Commercial Farms

- 7.3 Small and Medium Farms

Chapter 8 Market Estimates and Forecast, By System, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Embedded

- 8.3 Vibration Analyzers

- 8.4 Vibration Meter

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Field mapping

- 9.3 Variable rate application

- 9.4 Crop Scouting

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3D Robotics

- 11.2 AeroVironment, Inc.

- 11.3 AGCO Corporation

- 11.4 AgEagle Aerial Systems

- 11.5 Agribotix

- 11.6 Delair

- 11.7 DJI

- 11.8 DroneDeploy

- 11.9 Parrot

- 11.10 PrecisionHawk

- 11.11 Quantum Systems

- 11.12 senseFly

- 11.13 Sentera

- 11.14 Skeycatch

- 11.15 Yamaha Motor Co., Ltd.