PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936518

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936518

Upcycled Ingredients in Cosmetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

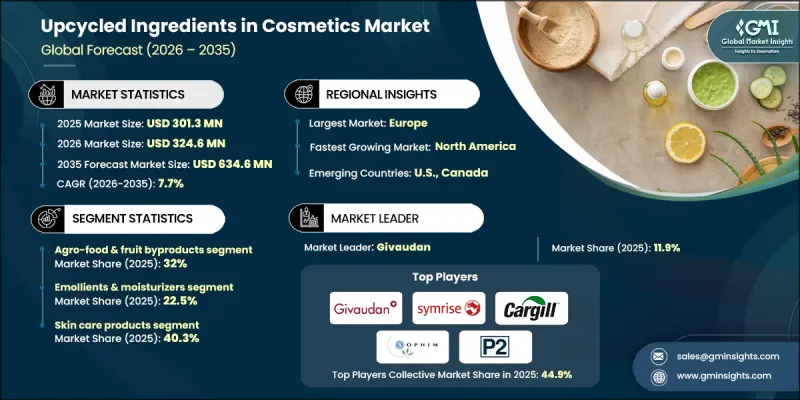

The Global Upcycled Ingredients in Cosmetics Market was valued at USD 301.3 million in 2025 and is estimated to grow at a CAGR of 7.7% to reach USD 634.6 million by 2035.

The cosmetics sector is witnessing strong momentum for upcycled ingredients as consumers increasingly prioritize sustainability and environmentally responsible purchasing decisions. Brands are incorporating materials recovered from food, beverage, and industrial by-products to create high-value cosmetic inputs while supporting circular economy objectives. This approach helps minimize waste, lowers environmental impact, and aligns with the growing demand for clean and ethically sourced beauty solutions. Upcycled ingredients deliver essential functional benefits, including hydration support, antioxidant protection, and age-defying properties, while reinforcing brand credibility among eco-conscious buyers. Manufacturers also gain cost efficiencies by repurposing materials that would otherwise be discarded, contributing to a more resilient and sustainable supply chain. Reduced waste generation and lower carbon emissions across production cycles further strengthen the business case for adopting upcycled cosmetic inputs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $301.3 Million |

| Forecast Value | $634.6 Million |

| CAGR | 7.7% |

The agro-food and fruit byproducts segment accounted for 32% share in 2025 and is forecast to grow at a CAGR of 7.8% through 2035. Demand for these inputs continues to rise as sustainability and clean beauty become increasingly influential in global purchasing behavior. These byproducts contain high concentrations of naturally occurring bioactive compounds, vitamins, and antioxidants that are highly valued in cosmetic formulations. Companies are advancing processing and recovery methods to extract functional ingredients efficiently, allowing the food processing sector to unlock additional revenue streams while reducing waste. Brands actively promote responsible sourcing practices, responding to consumer expectations for environmentally sound and ethically produced ingredients.

The skincare applications segment held 40.3% share in 2025 and is anticipated to grow at a CAGR of 8% by 2035. Growth is driven by rising consumer interest in multifunctional and naturally derived formulations that support skin health while reducing environmental impact. Upcycled botanical, seed, and plant-based materials are increasingly incorporated into creams, serums, and treatment products due to their moisturizing, antioxidant, and rejuvenating properties. Cosmetic brands continue to prioritize sustainable product development, combining performance enhancement with waste reduction. Clean beauty preferences strongly influence purchasing decisions, particularly for daily-use skincare products designed to balance efficacy with environmental responsibility.

North America Upcycled Ingredients in Cosmetics Market held 30% share in 2025, positioning the region as a key growth hub for upcycled cosmetic ingredients. High consumer awareness, combined with strong demand for sustainable personal care solutions, continues to drive adoption. Beauty brands across the region emphasize transparency, responsible sourcing, and environmentally friendly manufacturing practices to strengthen consumer trust. The presence of established distribution networks and a large base of sustainability-focused buyers supports rapid market expansion across skincare, hair care, and color cosmetics categories.

Key companies active in the Global Upcycled Ingredients in Cosmetics Market include Givaudan, Cargill, Symrise, Mibelle Ltd., OLVEA Group, SOPHIM IBERIA S.L., P2 Science, Inc, Innomost Oy, Lignopure, and Upcycled Beauty Ltd. To strengthen their position, companies operating in the upcycled ingredients in cosmetics sector are focusing on innovation-driven product development, strategic partnerships, and advanced sourcing capabilities. Many players are investing in proprietary extraction and processing technologies to enhance ingredient purity, functionality, and scalability. Collaboration with food processors and agricultural suppliers enables consistent access to high-quality byproducts while reinforcing circular supply chains. Brands are also expanding their portfolios to address multiple cosmetic applications, improving customer reach. Transparent sustainability messaging, third-party certifications, and clean-label positioning are widely used to build consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Functional category

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Agro-food & fruit byproducts

- 5.3 Seed & nut byproducts

- 5.4 Wood & forestry byproducts

- 5.5 Botanical & floral byproducts

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Functional Category, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Emollients & moisturizers

- 6.3 Antioxidants & anti-aging actives

- 6.4 Exfoliants & scrubs

- 6.5 Preservatives & antimicrobials

- 6.6 Surfactants & emulsifiers

- 6.7 UV filters & photoprotection agents

- 6.8 Colorants & pigments

- 6.9 Thickeners & rheology modifiers

- 6.10 Fragrances & essential oils components

- 6.11 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Skin care products

- 7.2.1 Moisturizers & creams

- 7.2.2 Serums & anti-aging products

- 7.2.3 Sunscreens

- 7.2.4 Facial cleansers & toners

- 7.2.5 Others (masks & exfoliators, etc.)

- 7.3 Hair care products

- 7.3.1 Shampoos & conditioners

- 7.3.2 Hair treatments & masks

- 7.3.3 Styling products

- 7.3.4 Others

- 7.4 Makeup & color cosmetics

- 7.4.1 Foundations & BB/CC creams

- 7.4.2 Lipsticks & lip care

- 7.4.3 Eye makeup products

- 7.4.4 Blush & bronzers

- 7.4.5 Others

- 7.5 Body care products

- 7.5.1 Body lotions & butters

- 7.5.2 Body washes & scrubs

- 7.5.3 Others

- 7.6 Oral care products

- 7.7 Personal hygiene products

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill

- 9.2 Givaudan

- 9.3 Innomost Oy

- 9.4 Lignopure

- 9.5 Mibelle Ltd.

- 9.6 OLVEA Group

- 9.7 P2 Science, Inc

- 9.8 SOPHIM IBERIA S.L.

- 9.9 Symrise

- 9.10 Upcycled Beauty Ltd