PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936519

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936519

Soil Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

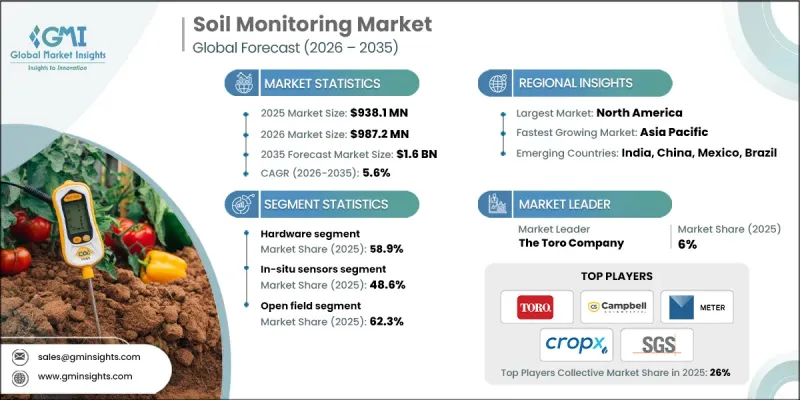

The Global Soil Monitoring Market was valued at USD 938.1 million in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 1.6 billion by 2035.

Market expansion is driven by rising awareness of environmental protection, sustainable land management, and the need to optimize agricultural productivity under increasing climate pressure. The industry is shifting away from conventional soil testing approaches that rely on infrequent, manual, and laboratory-dependent analysis. In their place, digitally enabled monitoring solutions are gaining momentum by delivering continuous and location-specific insights. Strategic consolidation across industry is accelerating innovation, expanding technology portfolios, and improving global market reach. Soil monitoring solutions now play a central role in modern agriculture by supporting data-driven decisions that improve yields while reducing environmental stress. These systems align well with food security objectives, regulatory sustainability goals, and increasing public and private investment in smart agriculture initiatives. As farmers and agribusinesses seek scalable and efficient crop management tools, soil monitoring continues to gain relevance as a core component of precision agriculture worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $938.1 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 5.6% |

Modern soil monitoring systems provide accurate, real-time measurements of moisture levels, nutrient content, and soil chemistry, enabling precise application of water and fertilizers. This approach improves resource efficiency, lowers input costs, and reduces runoff that can harm surrounding ecosystems. The growing demand for higher agricultural output in North America, combined with expanding policy support for advanced farming practices in Europe and the Asia-Pacific region, reinforces the commercial value of these technologies. Farmers and agronomists increasingly favor automated systems that replace labor-intensive sampling methods, supporting faster decision-making and improved crop outcomes.

In 2025, the in-situ sensors segment accounted for a 48.6% share and generated USD 456.3 million. This segment also recorded the highest growth rate with a CAGR of 6.1%. In-situ sensors are widely adopted because they deliver continuous, high-resolution data directly from the soil profile, supporting autonomous farm operations and minimizing human intervention. Their widespread use reflects the broader industry shift toward intelligent, connected agricultural technologies.

The open-field applications segment held a 62.3% share, generating USD 584.7 million in 2025. This segment is expected to grow at a CAGR of 5.8% from 2026 to 2035. The dominance of open-field monitoring is linked to the vast scale of global crop cultivation and the increasing adoption of precision farming practices in large agricultural operations, where real-time soil insights significantly enhance productivity and efficiency.

North America Soil Monitoring Market reached USD 308.5 million in 2025 and is projected to grow at a CAGR of 5.6% through 2035. The region benefits from advanced sensing technologies and integrated data platforms that support sustainable land use and high-yield farming. Regulatory focus on environmental protection and climate accountability further drives demand for solutions that monitor soil health, carbon content, and chemical impact, ensuring steady regional growth.

Key companies active in the Global Soil Monitoring Market include METER Group, Inc., CropX Technologies, Acclima, Inc., SGS SA, Spectrum Technologies, Inc., Campbell Scientific, Inc., Sentek Technologies, Soil Scout Oy, Irrometer Company, Inc., Arable Labs, Inc., EarthOptics, Delta-T Devices Ltd, HydroPoint Data Systems, Inc., Element Materials Technology, and The Toro Company. Companies operating in the soil monitoring market strengthen their market position through technology innovation, data integration, and strategic expansion. Many players focus on developing sensor systems with higher accuracy, longer lifespan, and seamless connectivity with farm management platforms. Investments in analytics software and cloud-based dashboards enhance value by translating raw data into actionable insights. Firms also expand geographically to serve emerging agricultural markets while forming partnerships with agribusinesses and research institutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Product Type

- 2.2.4 Application Type

- 2.2.5 End-User

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Urbanization & Infrastructure Development

- 3.2.1.2 Growth in Landscaping & Professional Tree Care

- 3.2.1.3 Emphasis on Environmental Sustainability & Regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment and Maintenance Costs

- 3.2.2.2 Safety Risks and Need for Specialized Training

- 3.2.3 Opportunities

- 3.2.3.1 Electrification and Smart Technology Integration

- 3.2.3.2 Expansion of the Equipment Rental Market

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 In-situ Sensors

- 6.3 Remote Sensing Platforms

- 6.4 Portable Probes & Test Kits

Chapter 7 Market Estimates and Forecast, By Application Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Open Field

- 7.3 Protected Cultivation

- 7.4 Forestry

Chapter 8 Market Estimates and Forecast, By End User, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Large Commercial Farms

- 8.3 Smallholder & Cooperative Farms

- 8.4 Research Institutes & Universities

- 8.5 Government & NGOs

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Acclima, Inc.

- 10.2 Arable Labs, Inc.

- 10.3 Campbell Scientific, Inc.

- 10.4 CropX Technologies

- 10.5 Delta-T Devices Ltd

- 10.6 EarthOptics

- 10.7 Element Materials Technology

- 10.8 HydroPoint Data Systems, Inc.

- 10.9 Irrometer Company, Inc.

- 10.10 METER Group, Inc.

- 10.11 SGS SA

- 10.12 Sentek Technologies

- 10.13 Soil Scout Oy

- 10.14 Spectrum Technologies, Inc.

- 10.15 The Toro Company