PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936520

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936520

Luxury Leather Goods Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

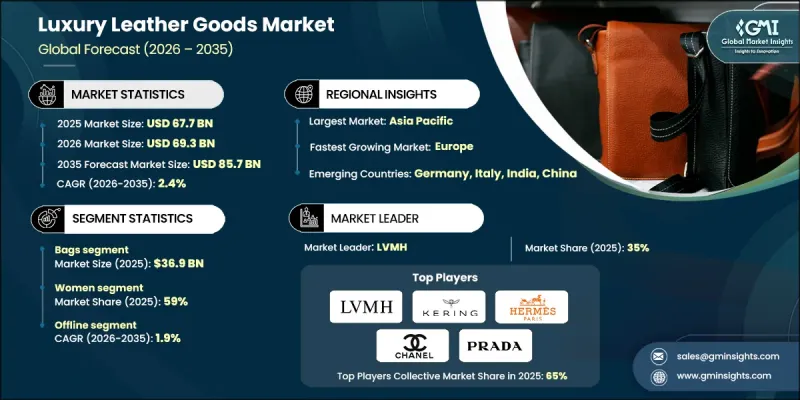

The Global Luxury Leather Goods Market was valued at USD 67.7 billion in 2025 and is estimated to grow at a CAGR of 2.4% to reach USD 85.7 billion by 2035.

Market growth is supported by rising demand for premium lifestyle products and higher consumer spending across developing economies. Shifting preferences toward environmentally responsible lifestyles are also influencing purchasing decisions, encouraging demand for sustainably sourced and responsibly manufactured leather goods. Industry participants are actively investing in product innovation and brand differentiation to align with evolving consumer expectations. Advances in leather processing and production technologies have improved product durability, aesthetics, and overall quality, further supporting market expansion. Digital commerce platforms continue to play a critical role by expanding brand reach and enabling access to previously underserved markets. Improved convenience and visibility through online channels are strengthening global demand. On the supply side, global trade performance remains strong, with India holding a significant position as one of the world's leading exporters of leather garments, saddlery, harnesses, and finished leather goods, with garments contributing 6.84% of the country's total leather exports. These combined factors reinforce steady long-term growth across the luxury leather goods industry.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $67.7 Billion |

| Forecast Value | $85.7 Billion |

| CAGR | 2.4% |

The bags segment generated USD 36.9 billion in 2025 and is expected to grow at a CAGR of 2.7% through 2035. Growth in this category is supported by sustained interest in premium bag designs and strong demand among younger consumer groups. Brand visibility across digital platforms continues to influence purchasing behavior in this segment.

The women segment accounted for 59% share in 2025, with the segment projected to grow at a CAGR of 2.6% from 2026 to 2035. Rising income levels, growing interest in luxury fashion, increased personalization options, and wider access through e-commerce platforms are key contributors to sustained demand among female consumers, particularly in emerging markets.

United States Luxury Leather Goods Market held 77% share and generated USD 12.1 billion in 2025. Market strength is supported by high disposable income levels, strong demand for premium materials, and effective digital brand engagement strategies. Sustainability-focused product development and innovative design approaches continue to attract environmentally aware consumers.

Major companies operating in the Global Luxury Leather Goods Market include LVMH, Chanel, Hermes, Prada, Kering, Burberry, Tapestry, Capri, Hugo Boss, Bottega Veneta, Mulberry, Aspinal of London, Shinola, Nappa Dori, and Moshi Leather Bag. Companies in the luxury leather goods market strengthen their competitive position through brand heritage, product innovation, and sustainability-led strategies. Many players invest in responsible sourcing, eco-friendly materials, and transparent supply chains to appeal to conscious consumers. Limited-edition collections and personalization options help create exclusivity and brand loyalty. Strong digital marketing, social media engagement, and direct-to-consumer channels enhance visibility and global reach. Firms also focus on expanding e-commerce capabilities while maintaining premium in-store experiences.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Leather Type

- 2.2.4 End User

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Luggage

- 5.2.1 Suitcases & trolleys

- 5.2.2 Backpacks

- 5.2.3 Duffel bags

- 5.2.4 Briefcases

- 5.2.5 Others (weekenders etc.)

- 5.3 Bags

- 5.3.1 Handbags

- 5.3.2 Tote bags

- 5.3.3 Clutches

- 5.3.4 Messenger bags

- 5.3.5 Others (hobo bags etc.)

- 5.4 Small leather goods

- 5.4.1 Wallets

- 5.4.2 Cardholders & card cases

- 5.4.3 Coin purses

- 5.4.4 Others (key cases etc.)

- 5.5 Others (apparel etc.)

Chapter 6 Market Estimates & Forecast, By Leather Type, 2022 - 2035 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Genuine leather

- 6.3 Exotic skins

- 6.4 Synthetic leather

- 6.5 Hybrid materials

Chapter 7 Market Estimates & Forecast, By End User, 2022 - 2035 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Women

- 7.3 Men

- 7.4 Unisex

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarket

- 8.3.2 Specialty retail stores

- 8.3.3 Others (independent retailer etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aspinal of London

- 10.2 Bottega Veneta

- 10.3 Burberry

- 10.4 Capri

- 10.5 Chanel

- 10.6 Hermes

- 10.7 Hugo Boss

- 10.8 Kering

- 10.9 LVMH

- 10.10 Moshi Leather Bag

- 10.11 Mulberry

- 10.12 Nappa Dori

- 10.13 Prada

- 10.14 Shinola

- 10.15 Tapestry