PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936527

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936527

Robotics as a Service (RaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

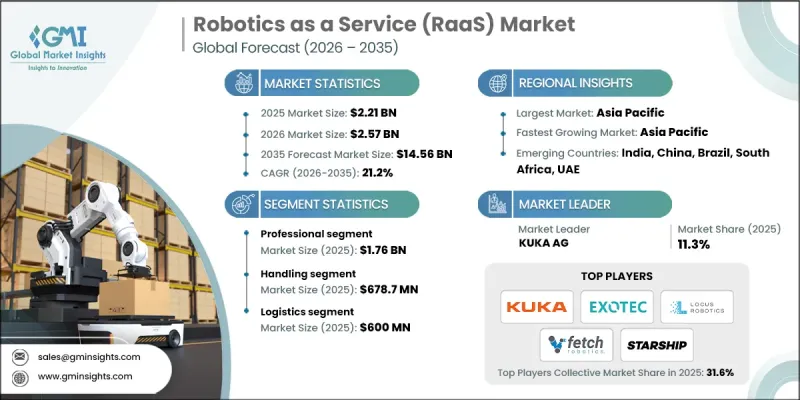

The Global Robotics as a Service Market was valued at USD 2.21 billion in 2025 and is estimated to grow at a CAGR of 21.2% to reach USD 14.56 billion by 2035.

The expansion is driven by multiple factors, including acute labor shortages across logistics, manufacturing, and healthcare sectors, and the increasing preference for shifting from capital-intensive investments to operating expenditure models. Rapid advancements in artificial intelligence, cloud robotics, and autonomous navigation technologies have created viable frameworks for remotely controlled robot fleets, which form the foundation of the RaaS model. Real-time performance tracking, centralized software updates, and adaptive learning not only reduce downtime and service costs but also improve reliability, enabling service providers to manage distributed robots efficiently. The subscription-based, outcome-oriented approach has become commercially attractive, offering businesses scalable, flexible, and on-demand automation solutions. Organizations increasingly rely on RaaS to maintain operational continuity, optimize productivity, and tackle repetitive or high-turnover tasks without the burden of long recruitment cycles. This growing emphasis on automation is reinforced by the convergence of AI, connectivity, and smart software integration, making RaaS a key driver of efficiency in modern industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.21 Billion |

| Forecast Value | $14.56 Billion |

| CAGR | 21.2% |

The professional segment was valued at USD 1.76 billion in 2025. Companies facing skilled labor shortages and productivity pressures are driving the adoption of professional robotics. Industries such as logistics, healthcare, and manufacturing are particularly invested in robotic systems to maintain operational continuity, improve efficiency, and reduce reliance on specialized personnel. Subscription-based robotic services are becoming a practical solution for managing labor-intensive processes and ensuring consistent output without compromising on performance.

The handling segment generated USD 678.7 million in 2025. Logistics automation is a significant driver of this demand, as warehouses and distribution centers increasingly deploy robots on a subscription basis to transport goods, minimize errors, increase throughput, and fill staffing gaps during peak periods. Advanced sensors and software enable autonomous mobile robots to move heavier loads safely and efficiently, offering businesses dependable solutions at a lower total cost.

North America Robotics as a Service Market held a 36.8% share in 2025, making it the most competitive region for RaaS. The U.S. and Canada have established technology ecosystems that facilitate the rapid adoption of autonomous mobile robots to reduce labor costs and enhance operational efficiency. The region benefits from extensive digital infrastructure and innovation networks that support service-oriented robotics and enable scalable subscription-based solutions in commercial applications across logistics, healthcare, and smart factories.

Key players in the Global Robotics as a Service Market include Fetch Robotics, Locus Robotics, Starship Technologies, 6 River Systems, Sarcos Robotics, Glomatriz, Savioke, Bossa Nova Robotics, Liquid Robotics, inVia Robotics, PrecisionHawk, Fellow Robots, Cobalt Robotics, Knightscope, RedZone Robotics, Marble, Hirebotics, Exotec, Sofigate, and Aethon. Companies in the Global Robotics as a Service (RaaS) Market strengthen their presence by focusing on advanced technology integration, service scalability, and strategic partnerships. Providers invest heavily in AI-driven navigation, cloud connectivity, and remote fleet management software to enhance robot efficiency and reduce downtime. They expand their footprint by collaborating with logistics, manufacturing, and healthcare operators to tailor solutions for industry-specific needs. Subscription-based pricing models, flexible deployment options, and outcome-oriented offerings attract cost-conscious clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Application trends

- 2.2.3 End-use industry trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising labor shortages across logistics, manufacturing, and healthcare

- 3.2.1.2 Shift from capital expenditure to operating expenditure models

- 3.2.1.3 Rapid advancements in AI, cloud robotics, and autonomous navigation

- 3.2.1.4 Demand for scalable and flexible automation solutions

- 3.2.1.5 Growing adoption of outcome-based and subscription business models

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High initial service pricing for complex use cases

- 3.2.2.2 Data security, safety, and regulatory compliance concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Initiatives

- 3.11 Supply Chain Resilience

- 3.12 Geopolitical Analysis

- 3.13 Digital Transformation

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Product portfolio comparison

- 4.3.1.1 Product range breadth

- 4.3.1.2 Technology

- 4.3.1.3 Innovation

- 4.3.2 Geographic presence comparison

- 4.3.2.1 Global footprint analysis

- 4.3.2.2 Service network coverage

- 4.3.2.3 Market penetration by region

- 4.3.3 Competitive positioning matrix

- 4.3.3.1 Leaders

- 4.3.3.2 Challengers

- 4.3.3.3 Followers

- 4.3.3.4 Niche players

- 4.3.4 Strategic outlook matrix

- 4.3.1 Product portfolio comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Professional

- 5.3 Personal

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Handling

- 6.3 Assembling

- 6.4 Dispensing

- 6.5 Processing

- 6.6 Welding & Soldering

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End-Use Industry, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Automotive

- 7.4 Food & beverage

- 7.5 Logistics

- 7.6 Healthcare

- 7.7 Retail

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Locus Robotics

- 9.1.2 Fetch Robotics

- 9.1.3 Sarcos Robotics

- 9.1.4 6 River Systems

- 9.1.5 Exotec

- 9.2 Regional Key Players

- 9.2.1 North America

- 9.2.1.1 Aethon

- 9.2.1.2 Savioke

- 9.2.1.3 Cobalt Robotics

- 9.2.1.4 Knightscope

- 9.2.2 Europe

- 9.2.2.1 Starship Technologies

- 9.2.2.2 Sofigate

- 9.2.2.3 Marble

- 9.2.3 Asia Pacific

- 9.2.3.1 Liquid Robotics

- 9.2.3.2 inVia Robotics

- 9.2.1 North America

- 9.3 Niche / Disruptors

- 9.3.1 Bossa Nova Robotics

- 9.3.2 PrecisionHawk

- 9.3.3 RedZone Robotics

- 9.3.4 Hirebotics

- 9.3.5 Fellow Robots

- 9.3.6 Glomatriz