PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936530

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936530

Canine Arthritis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

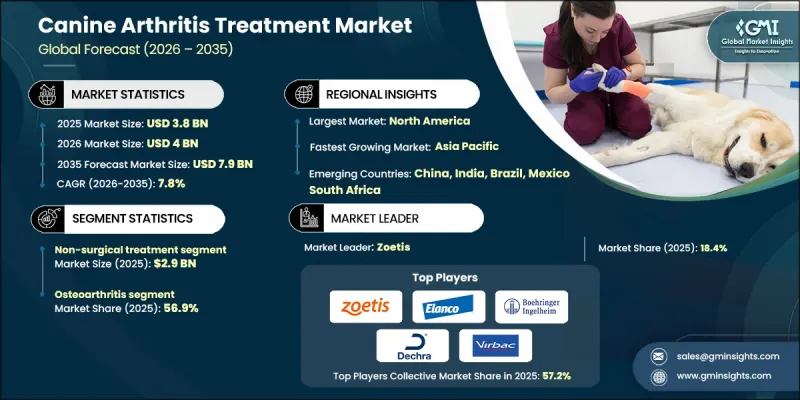

The Global Canine Arthritis Treatment Market was valued at USD 3.8 billion in 2025 and is estimated to grow at a CAGR of 7.8% to reach USD 7.9 billion by 2035.

The market expansion is driven by the rising incidence of osteoarthritis (OA) in dogs. Canine arthritis treatment encompasses a range of therapies designed to manage joint pain, inflammation, and reduced mobility in dogs affected by osteoarthritis or other degenerative joint disorders. These treatments aim to alleviate discomfort, restore joint function, and improve overall well-being through individualized, multimodal approaches that match disease severity and the dog's specific needs. Options include pharmaceutical interventions such as NSAIDs, corticosteroids, and opioid pain relievers, along with newer biologic therapies like monoclonal antibodies, nutritional supplements including glucosamine and omega-3 fatty acids, physical therapy, and, in certain cases, surgical procedures. Adoption of multimodal treatment strategies has strengthened market growth, as combining medications, supplements, and physical therapies provides more comprehensive management for long-term joint health and improved mobility in dogs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.8 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 7.8% |

In 2025, the non-surgical treatments segment held a 77.1% share, generating USD 2.9 billion. This dominance reflects the growing preference among pet owners and veterinarians for non-invasive therapies, such as pharmaceuticals, monoclonal antibodies, supplements, and physical rehabilitation, before considering surgical intervention. Non-surgical approaches are also more cost-effective and accessible for managing chronic conditions over the long term. Increased awareness of disease prevention and the importance of slowing arthritis progression is encouraging broader adoption of these therapies among pet populations worldwide.

The osteoarthritis segment held 56.9% share in 2025. Osteoarthritis is one of the most common degenerative joint disorders in dogs, contributing significantly to the overall burden of canine arthritis. Rising OA prevalence across age groups emphasizes the need for effective, long-term management strategies, positioning osteoarthritis as the dominant segment in the canine arthritis treatment market.

North America Canine Arthritis Treatment Market accounted for 43.3% share in 2025. Market growth in this region is fueled by high pet ownership rates, substantial spending on veterinary care, and advanced veterinary infrastructure. A strong network of clinics, specialty hospitals, and diagnostic centers ensures early diagnosis and continuous management of chronic conditions such as arthritis. North American pet owners' willingness to invest in innovative treatments further drives the adoption of multimodal therapies and high-quality veterinary products.

Key players in the Global Canine Arthritis Treatment Market include Zoetis, VetriScience, Elanco Animal Health, Boehringer Ingelheim Animal Health, K9 Vitality, Dechra Pharmaceuticals, CEVA Sante Animale, Norbrook Laboratories, Nutramax Laboratories Veterinary Sciences, VetStem, Thorne Vet, Auburn Laboratories, Virbac, AdvaCare Pharma, Deley Naturals, American Regent, and JBT Corporation. Leading companies in the canine arthritis treatment market are implementing a range of strategies to strengthen their position and expand their market footprint. They are heavily investing in research and development to introduce innovative pharmaceuticals, biologics, and nutritional supplements tailored for canine joint health. Strategic partnerships with veterinary clinics, specialty hospitals, and distributors are being established to expand market access and provide localized support. Companies are also focusing on acquiring smaller firms with complementary technologies, allowing rapid portfolio expansion and entry into new geographies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research approach

- 1.3 Quality commitments

- 1.3.1 GMI AI policy and data integrity commitment

- 1.3.1.1 Source consistency protocol

- 1.3.1 GMI AI policy and data integrity commitment

- 1.4 Research trail and confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.6.1.1 Sources, by region

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Revenue share analysis

- 1.7.2 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Arthritis type trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and humanization of pets

- 3.2.1.2 Increasing prevalence of osteoarthritis in dogs

- 3.2.1.3 Advancements in veterinary pharmaceuticals and therapies

- 3.2.1.4 Expansion of veterinary infrastructure and telemedicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of long-term treatment

- 3.2.2.2 Competition from alternative therapies

- 3.2.3 Market opportunities

- 3.2.3.1 Growing development and commercialization of next-generation therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Canine population statistics, by country

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Non-surgical treatment

- 5.2.1 By type

- 5.2.1.1 Pharmaceuticals

- 5.2.1.1.1 Non-steroidal anti-inflammatory drugs (NSAIDs)

- 5.2.1.1.2 Corticosteroids

- 5.2.1.1.3 Opioid pain relievers

- 5.2.1.1.4 Other pharmaceuticals

- 5.2.1.2 Supplements

- 5.2.1.2.1 Glucosamine

- 5.2.1.2.2 Chondroitin

- 5.2.1.2.3 Methylsulfonylmethane

- 5.2.1.2.4 Other supplements

- 5.2.1.1 Pharmaceuticals

- 5.2.2 By route of administration

- 5.2.2.1 Oral

- 5.2.2.2 Injectable

- 5.2.2.3 Other routes of administration

- 5.2.3 By distribution channel

- 5.2.3.1 Veterinary hospital pharmacies

- 5.2.3.2 Retail pharmacies

- 5.2.3.3 Online pharmacies

- 5.2.1 By type

- 5.3 Surgical procedures

- 5.4 Other treatment types

Chapter 6 Market Estimates and Forecast, By Arthritis Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Osteoarthritis

- 6.3 Traumatic arthritis

- 6.4 Osteochondrosis

- 6.5 Rheumatoid arthritis

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AdvaCare Pharma

- 8.2 American Regent

- 8.3 Auburn Laboratories

- 8.4 Boehringer Ingelheim Animal Health

- 8.5 CEVA Sante Animale

- 8.6 Dechra Pharmaceuticals

- 8.7 Deley Naturals

- 8.8 Elanco Animal Health

- 8.9 K9 Vitality

- 8.10 Norbrook Laboratories

- 8.11 Nutramax Laboratories Veterinary Sciences

- 8.12 Thorne Vet

- 8.13 Vetoquinol

- 8.14 VetriScience

- 8.15 VetStem

- 8.16 Virbac

- 8.17 Zoetis