PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936535

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936535

Pedicle Screw Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

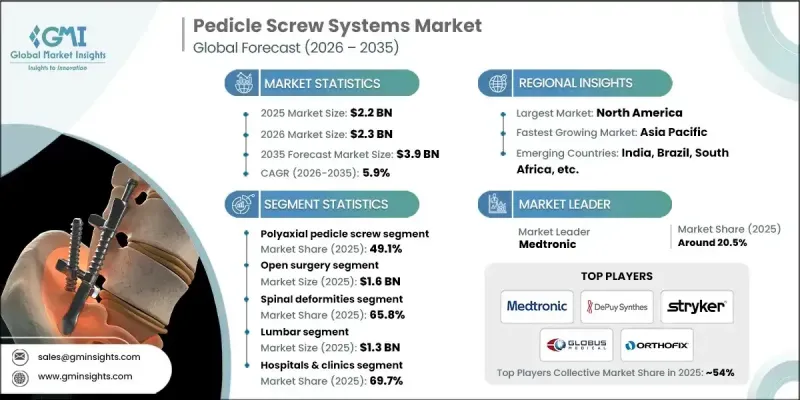

The Global Pedicle Screw Systems Market was valued at USD 2.2 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 3.9 billion by 2035.

The market growth is propelled by rising incidences of spinal injuries, increasing prevalence of degenerative spinal disorders, technological innovations in minimally invasive surgery (MIS), and the aging global population. Sedentary lifestyles, obesity, and longer life expectancy have accelerated the occurrence of conditions such as degenerative disc disease, spinal stenosis, and spondylolisthesis, which drive demand for spinal fusion procedures utilizing pedicle screws. Emerging trends such as integration of AI and navigation systems, medical tourism for spinal surgeries, and the development of bioresorbable and 3D-printed screws are shaping the market landscape. Bioresorbable screws made from polymers, designed to degrade over 18-36 months, eliminate the need for removal post-healing. Titanium alloy 3D-printed screws with porous lattice structures enhance osseointegration, supporting approximately 40% faster bone ingrowth compared to conventional solid screws.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 5.9% |

The polyaxial pedicle screw segment held a 49.1% share in 2025, driven by increasing demand for customizable implants. Polyaxial screws feature a ball-and-socket design that allows multi-directional angulation of 25-40 degrees in all directions. This flexibility enables surgeons to optimally position rods and assemble constructs efficiently, accommodating complex spinal anatomies. Personalized implant options and precision surgical techniques are expanding adoption, particularly in complex fusion procedures.

The open surgery segment reached USD 1.6 billion in 2025. Traditional open surgery involves large incisions ranging from 8 to 15 cm, providing surgeons with full visualization of the spinal anatomy. This approach is preferred for correcting complex deformities, handling revisions requiring extensive instrumentation removal, or performing wide decompression of nerves and the spinal cord. Open surgery allows surgeons greater control during operations, particularly in patients with anatomical variations, scarring, or unforeseen intraoperative challenges.

North America Pedicle Screw Systems Market held 61.9% share in 2025 and is expected to continue significant growth. The region benefits from well-established reimbursement frameworks through Medicare, Medicaid, and private insurance for spinal fusion procedures. North America also has the highest concentration of skilled orthopedic and neurosurgeons, with over 4,000 specialists performing complex spinal surgeries. Comprehensive training programs and professional development opportunities for new surgeons further strengthen the market's expertise base.

Key players in the Global Pedicle Screw Systems Market include Alphatec Spine, Altus Spine, B. Braun, Boneunion Medical, Canwell Medical, CTL AMEDICA, DePuy Synthes, Genesys Spine, GLOBUS MEDICAL, Medacta International, Medtronic, ORTHOFIX, PRECISION SPINE, Stryker, and Z-Medical. Companies in the pedicle screw systems market are focusing on strategic initiatives to strengthen their presence and expand market share. They are investing in R&D to develop advanced, bioresorbable, and 3D-printed screws for enhanced surgical outcomes. Partnerships with hospitals and surgical centers improve product adoption and support surgeon training. Firms are also emphasizing minimally invasive solutions and AI-assisted navigation systems to differentiate offerings. Expanding global footprints through acquisitions, distribution partnerships, and localized manufacturing allows companies to access new markets.

Table of Contents

Chapter 1 Research Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Surgery trends

- 2.2.4 Indication trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in number of accidents and spinal cord injuries

- 3.2.1.2 Technological advancements in minimally invasive surgery (MIS) technique

- 3.2.1.3 Rising prevalence of degenerative disease

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of pedicle screw systems and spinal surgeries

- 3.2.2.2 Risk of post-surgical complications

- 3.2.3 Opportunities

- 3.2.3.1 Development of bioresorbable and 3D-printed pedicle screws

- 3.2.3.2 Integration of AI and navigation systems for precision surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, by product type, 2025

- 3.7 Reimbursement scenario

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Polyaxial pedicle screw

- 5.3 Monoaxial pedicle screw

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Surgery, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Open surgery

- 6.3 Minimally invasive surgery

Chapter 7 Market Estimates and Forecast, By Indication, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Spinal deformities

- 7.3 Spinal degeneration

- 7.4 Spinal trauma

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Lumbar

- 8.3 Thoracolumbar

- 8.4 Cervical fusion

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & clinics

- 9.3 Ambulatory surgical centers

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alphatec Spine

- 11.2 Altus Spine

- 11.3 B. Braun

- 11.4 Boneunion Medical

- 11.5 Canwell Medical

- 11.6 CTL AMEDICA

- 11.7 DePuy Synthes

- 11.8 Genesys Spine

- 11.9 GLOBUS MEDICAL

- 11.10 Medacta International

- 11.11 Medtronic

- 11.12 ORTHOFIX

- 11.13 PRECISION SPINE

- 11.14 Stryker

- 11.15 Z-Medical