PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936567

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936567

Mechanical Reciprocating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

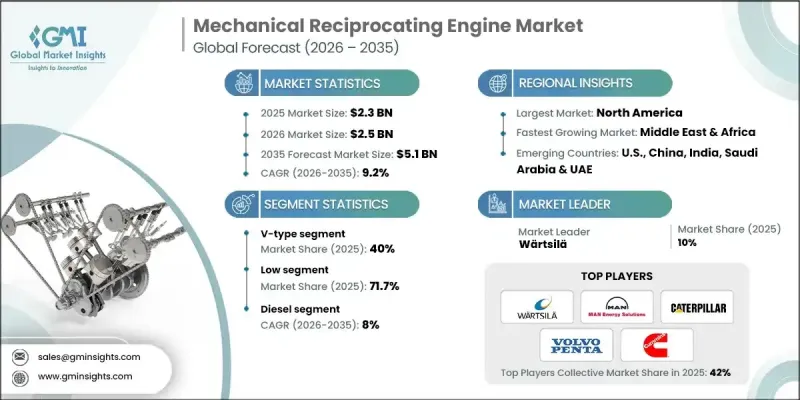

The Global Mechanical Reciprocating Engine Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 9.2% to reach USD 5.1 billion by 2035.

Market expansion is supported by the continued development of industrial infrastructure and rising capital investment from both government bodies and private sector participants. These investments are contributing to capacity expansion, facility modernization, and broader industrial diversification, which together are creating sustained demand across multiple end-use sectors. Mechanical reciprocating engines continue to play a critical role within global power and motion systems due to their proven reliability and adaptability. These engines operate by converting linear piston movement within cylinders into rotational mechanical output through sequential operating cycles, delivering dependable power across a wide range of operating conditions. Increasing focus on rural electrification, supportive regulatory frameworks, and heightened awareness of backup and emergency power requirements are reinforcing market growth. Government-led power access initiatives are further strengthening demand. Despite being a mature technology, the segment continues to evolve through efficiency improvements and emissions optimization, driven by rising requirements for dependable mechanical power in both continuous and intermittent operating environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 9.2% |

The inline engine configuration segment is projected to reach USD 1.4 billion by 2035. Growth in this segment is attributed to its simple structural layout, dependable performance, and ease of servicing. Engines with a linear cylinder arrangement provide stable output, operational efficiency, and long service life, making them well-suited for applications where cost control, durability, and maintenance simplicity are essential. Their broad applicability across multiple industrial and mobility-related uses continues to support steady demand.

The low-speed mechanical reciprocating engines segment accounted for 71.7% share in 2025 and is expected to reach USD 3.5 billion by 2035. This segment is benefiting from increasing reliance on heavy-duty power generation and propulsion systems that require consistent performance over extended operating periods. These engines are favored for their fuel efficiency, mechanical robustness, and ability to operate continuously under demanding load conditions, making them a preferred choice for energy-intensive industrial applications.

United States Mechanical Reciprocating Engine Market held 74% share, generating USD 826.2 million in 2025. Market strength in the country is driven by sustained demand for reliable and efficient engines across power generation, marine operations, and industrial equipment usage. Continued advancements in engine technology, adherence to regulatory requirements, and an increased focus on emissions performance are supporting adoption and reinforcing long-term market stability.

Key companies operating in the Global Mechanical Reciprocating Engine Market include Caterpillar, Cummins, Wartsila, MAN Energy Solutions, Mitsubishi Heavy Industries, Rolls-Royce, Siemens Energy, Kawasaki Heavy Industries, AB Volvo Penta, KUBOTA Corporation, Perkins Engines Company, Deutz AG, Fairbanks Morse Defense, GE Vernova, Doosan Corporation, Motorenfabrik Hatz, Escorts Kubota, JC Bamford Excavators, Lister Petter, and Rehlko. Companies active in the mechanical reciprocating engine market are strengthening their competitive position through technology enhancement, portfolio diversification, and strategic geographic expansion. Leading manufacturers are investing in improved fuel efficiency, emissions reduction technologies, and advanced control systems to meet evolving regulatory and customer requirements. Many players are expanding service networks and aftermarket support to improve lifecycle value and customer retention. Strategic partnerships with industrial operators and infrastructure developers are enabling tailored engine solutions for specific applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Market estimates & forecasts parameters

- 1.8 Forecast model

- 1.8.1 Quantified market impact analysis

- 1.8.1.1 Mathematical impact of growth parameters on forecast

- 1.8.1 Quantified market impact analysis

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Fuel trends

- 2.1.3 Rated power trends

- 2.1.4 Speed trends

- 2.1.5 Cylinder configuration trends

- 2.1.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of marine reciprocating engines

- 3.8 Price trend analysis (USD/MW)

- 3.8.1 By region

- 3.8.2 By rated power

- 3.9 Investment analysis & future prospects

- 3.10 Sustainability initiatives & industry 4.0 integration

Chapter 4 Competitive Landscape, 2026

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2022 - 2035 (USD Million & MW)

- 5.1 Key trends

- 5.2 Gas

- 5.3 Diesel

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2022 - 2035 (USD Million & MW)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

Chapter 7 Market Size and Forecast, By Speed, 2022 - 2035 (USD Million & MW)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Cylinder Configuration, 2022 - 2035 (USD Million & MW)

- 8.1 Key trends

- 8.2 Inline

- 8.3 V-type

- 8.4 Radial

- 8.5 Opposed piston

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Russia

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Denmark

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Thailand

- 9.4.7 Singapore

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 Qatar

- 9.5.4 Oman

- 9.5.5 Kuwait

- 9.5.6 Egypt

- 9.5.7 Turkey

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 AB Volvo Penta

- 10.2 Caterpillar

- 10.3 Cummins

- 10.4 Deutz AG

- 10.5 Doosan Corporation

- 10.6 Escorts Kubota Limited

- 10.7 Fairbanks Morse Defense

- 10.8 GE Vernova

- 10.9 JC Bamford Excavators Ltd.

- 10.10 Kawasaki Heavy Industries, Ltd.

- 10.11 KUBOTA Corporation

- 10.12 Lister Petter

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 Motorenfabrik Hatz GmbH & Co. KG

- 10.16 Perkins Engines Company Limited

- 10.17 Rehlko

- 10.18 Rolls-Royce

- 10.19 Siemens Energy

- 10.20 Wartsila