PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936573

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936573

Traffic Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

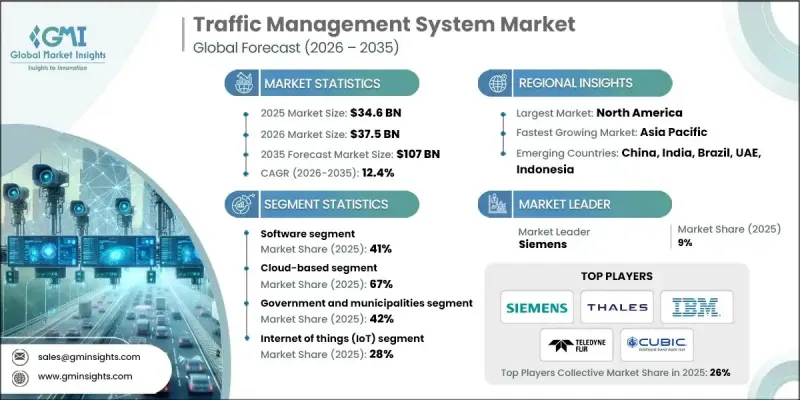

The Global Traffic Management System Market was valued at USD 34.6 billion in 2025 and is estimated to grow at a CAGR of 12.4% to reach USD 107 billion by 2035.

Modern urban centers rely heavily on traffic management systems to improve mobility, reduce congestion, and enhance road safety by integrating hardware, software, and services. The market is driven by rapid urbanization, infrastructure modernization, and rising economic costs of traffic congestion, which the International Energy Agency estimates to be 2-4% of GDP in developed economies annually. Traffic management systems increasingly leverage AI, IoT, cloud computing, and big data to enable real-time monitoring, predictive analytics, and intelligent transport solutions. Cloud-based deployments allow centralized control, scalable citywide implementation, and integration with connected vehicle technologies such as vehicle-to-everything (V2X) communication. Phased implementations typically begin with signal optimization and real-time monitoring and evolve to predictive analytics, autonomous vehicle coordination, and multi-modal transport management.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $34.6 Billion |

| Forecast Value | $107 Billion |

| CAGR | 12.4% |

The cloud deployment model accounted for 67% share in 2025 and is growing at a CAGR of 12.7% through 2035. Cloud solutions provide elastic scalability, real-time processing of massive sensor data streams, and seamless third-party integration while reducing reliance on costly on-premises infrastructure by 40-60%.

The software solutions segment held 41% share in 2025, with growth at a CAGR of 11.5% through 2035, driven by AI-powered analytics, adaptive signal control, and automated incident detection technologies. These platforms use machine learning algorithms for traffic prediction, computer vision for real-time monitoring, and optimization engines to improve urban traffic flow.

U.S. Traffic Management System Market will grow at a CAGR of 11.9% from 2026 to 2035. Federal initiatives such as the Infrastructure Investment and Jobs Act, which allocates USD 110 billion for modernizing transportation infrastructure, and guidance from the U.S. Department of Transportation's Intelligent Transportation Systems Joint Program Office, are accelerating TMS adoption across the country.

Key players in the Global Traffic Management System Market include Siemens, Iteris, Teledyne FLIR, Intel, Thales, Cubic, IBM, Jenoptik, Swarco, and Transcore. Companies in the traffic management system market strengthen their position by investing in AI-driven traffic analytics, expanding cloud-based service offerings, and developing modular, scalable solutions for urban deployments. Strategic collaborations with smart city projects, integration with connected vehicle and V2X technologies, and continuous R&D into predictive traffic optimization and real-time monitoring tools help firms expand their market footprint. Additionally, partnerships with government agencies and transportation authorities enable these companies to secure long-term contracts and maintain competitive advantage, while global expansion strategies and regional deployment customization support growth across emerging and mature markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 Research trail and confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Best estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Components

- 2.2.4 Application

- 2.2.5 Deployment Mode

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Increasing global urbanization

- 3.2.1.3 Government investments and regulatory support

- 3.2.1.4 Technological advancements in traffic management systems

- 3.2.1.5 Increased demand for efficient transportation

- 3.2.1.6 Rising adoption of advanced analytics and big data

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and operational costs

- 3.2.2.2 Privacy and data security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Smart city projects drive TMS adoption

- 3.2.3.2 Rising urban vehicle populations increase demand

- 3.2.3.3 Integration with connected and autonomous vehicles

- 3.2.3.4 Support for emergency services and public safety

- 3.2.3.5 Reduce emissions and fuel consumption through smart traffic flow

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US- Federal ITS standards and Connected Vehicle Guidelines

- 3.4.1.2 Canada - National ITS strategy and provincial traffic regulations

- 3.4.2 Europe

- 3.4.2.1 Germany- Road Traffic Act and EU ITS directives

- 3.4.2.2 UK- Traffic Management Act and urban mobility frameworks

- 3.4.2.3 France- National ITS strategy for traffic optimization

- 3.4.2.4 Italy- ITS action plans and road safety mandates

- 3.4.3 Asia Pacific

- 3.4.3.1 China- National ITS standards and smart city traffic guidelines

- 3.4.3.2 India- Motor vehicles act and smart city mission initiatives

- 3.4.3.3 Japan- i-Transportation policies and road traffic act

- 3.4.3.4 Australia- ADR and ITS guidelines for traffic control

- 3.4.4 LATAM

- 3.4.4.1 Mexico- NOM standards for traffic monitoring and ITS solutions

- 3.4.4.2 Argentina- National Traffic Law and ITS frameworks

- 3.4.5 MEA

- 3.4.5.1 South Africa- Road Traffic Act and smart mobility initiatives

- 3.4.5.2 Saudi Arabia- Traffic regulations and Vision 2030 ITS initiatives

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Use cases & success stories

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Future outlook and opportunities

- 3.12 Business Model & Pricing Framework

- 3.12.1 One-time hardware CAPEX vs recurring software OPEX

- 3.12.2 License-based vs subscription-based software pricing

- 3.12.3 Managed services & annuity revenue models

- 3.12.4 Performance-based contracts (KPIs, congestion reduction SLAs)

- 3.12.5 PPP and outcome-based payment structures

- 3.13 Cost Economics: Upfront vs Recurring Spend

- 3.14 Interoperability & Standards Compliance

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 AI & ML

- 5.3 Internet of things (IoT)

- 5.4 Cloud-based

- 5.5 Big data analytics

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Traffic signals and controllers

- 6.2.2 Sensors

- 6.2.3 Camera and surveillance systems

- 6.2.4 Variable message signs

- 6.3 Software

- 6.3.1 Traffic analytics

- 6.3.2 Smart signaling

- 6.3.3 Route guidance

- 6.3.4 Traffic monitoring

- 6.4 Services

- 6.4.1 Consulting

- 6.4.2 Deployment and integration

- 6.4.3 Support and maintenance

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Urban traffic management

- 7.3 Highway traffic management

- 7.4 Public transportation management

- 7.5 Parking management

- 7.6 Incident management

- 7.7 Integrated corridor management (ICM)

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Government and municipalities

- 9.3 Transportation agencies

- 9.4 Private organizations

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Cisco

- 11.1.2 Huawei Technologies

- 11.1.3 IBM

- 11.1.4 Intel

- 11.1.5 Siemens

- 11.1.6 Swarco

- 11.1.7 Teledyne FLIR

- 11.1.8 Thales

- 11.1.9 TomTom International

- 11.2 Regional Players

- 11.2.1 Cubic

- 11.2.2 Iteris

- 11.2.3 Jenoptik

- 11.2.4 Kapsch

- 11.2.5 Metro Infrasys

- 11.2.6 Omnitec Systems

- 11.2.7 Q-Free

- 11.2.8 TransCore

- 11.3 Emerging Technology Innovators

- 11.3.1 Acyclica

- 11.3.2 Cohda Wireless

- 11.3.3 Miovision

- 11.3.4 Radwin

- 11.3.5 Sensys Networks

- 11.3.6 Sick

- 11.3.7 Sumitomo

- 11.3.8 Vayyar Imaging