PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936577

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936577

Fabric Stain Remover Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

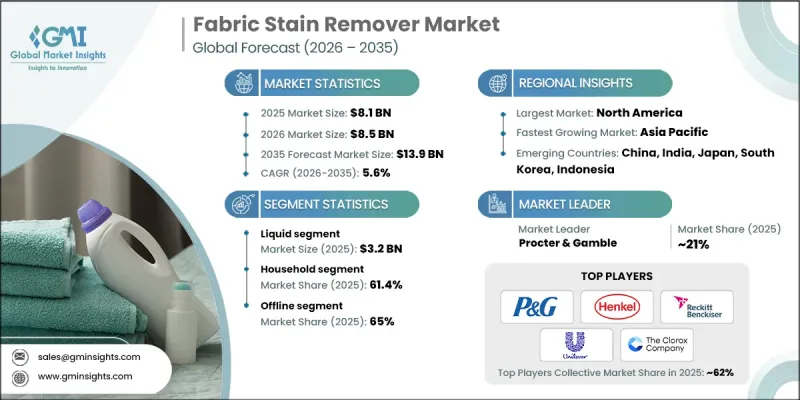

The Global Fabric Stain Remover Market was valued at USD 8.1 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 13.9 billion by 2035.

Market expansion is influenced by the growing working population and increasingly fast-paced lifestyles. As more households operate on limited time availability, consumers actively seek efficient solutions that simplify garment care. The need for quick stain treatment aligns with changing routines, as modern consumers prioritize convenience and effectiveness in household products. Fabric stain removers offer targeted cleaning benefits that allow users to address stains immediately without completing a full laundry process. Urban living patterns and demanding work schedules continue to reinforce reliance on specialized cleaning solutions designed for instant use. Dual-income households increasingly adopt stain removal products to maintain professional and presentable clothing while managing daily responsibilities. Rising expectations for cleanliness and appearance further support sustained market growth. As employment levels rise and daily routines become more structured around efficiency, demand for practical fabric care solutions continues to increase globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.1 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.6% |

The household end users segment accounted for 61.4% share in 2025 and is projected to grow at a CAGR of 6.2% from 2026 to 2035. Residential consumers remain the leading segment due to recurring laundry needs and frequent clothing usage. Greater awareness of garment maintenance and stain prevention has strengthened routine adoption of stain removers in households. Increased use of varied fabric types has heightened reliance on specialized cleaning products that protect fabric quality. Competitive pricing and widespread retail availability encourage regular purchases. A growing focus on neat and well-maintained clothing further supports long-term household demand.

The offline distribution channels segment held 65% share in 2025 and is expected to grow at a CAGR of 3.3% between 2026 and 2035. Physical retail outlets continue to play a vital role, as consumers value immediate product access and in-store selection. Established retail networks contribute to consistent sales volume and brand visibility.

United States Fabric Stain Remover Market reached USD 1.9 billion in 2025 and is forecast to grow at a CAGR of 4.6% through 2035. Strong household penetration and busy lifestyles support steady demand. Consumers demonstrate a clear preference for easy-to-use formats that enable quick application. Growing awareness of fabric-specific care continues to drive product adoption. Expansion of retail and digital sales channels further enhances nationwide accessibility.

Key companies operating in the Global Fabric Stain Remover Market include Procter & Gamble, Reckitt Benckiser, Unilever, Henkel, The Clorox Company, Church & Dwight, Amway, Dr. Beckmann, Biokleen, Bio-Tex, Bissell, Attitude, Buncha Farmers, ACE Gentle, and C. Johnson. To strengthen their position, companies in the fabric stain remover industry focus on product innovation, brand differentiation, and expanded distribution. Manufacturers invest in research to develop effective formulas that work across multiple fabric types while maintaining fabric integrity. Clean-label and environmentally conscious product lines address evolving consumer preferences. Companies also enhance packaging design for ease of use and portability. Strategic partnerships with retailers and expansion into e-commerce platforms improve market reach. Competitive pricing strategies and promotional campaigns help retain customer loyalty. Continuous marketing efforts centered on fabric care education and performance reliability further support long-term brand strength.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Burner design

- 2.2.3 Installation

- 2.2.4 Power Range

- 2.2.5 End Use Industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of working populations and fast-paced lifestyles

- 3.2.1.2 Increasing penetration of washing machines and modern laundry practices

- 3.2.1.3 Growth of hospitality, healthcare, and institutional laundry services

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Concerns over chemical safety and skin irritation

- 3.2.2.2 Intense competition from multipurpose detergents and home remedies

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for plant-based and eco-friendly stain removers

- 3.2.3.2 Growth of convenient formats such as sprays, pens, and wipes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Liquid

- 5.3 Powder

- 5.4 Bar

- 5.5 Spray

- 5.6 Foam

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By End User, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Household

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Offline

- 7.3 Online

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 ACE Gentle

- 9.2 Amway

- 9.3 Attitude

- 9.4 Biokleen

- 9.5 Bio-Tex

- 9.6 Bissell

- 9.7 Buncha Farmers

- 9.8 C. Johnson

- 9.9 Church & Dwight

- 9.10 Dr Beckmann

- 9.11 Henkel

- 9.12 Procter & Gamble

- 9.13 Reckitt Benckiser

- 9.14 The Clorox Company

- 9.15 Unilever