PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936580

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936580

Natural Cosmetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

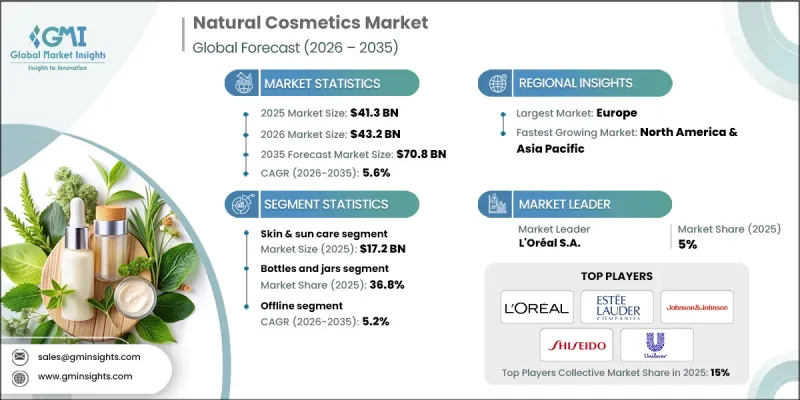

The Global Natural Cosmetics Market was valued at USD 41.3 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 70.8 billion by 2035.

The rapid expansion is fueled by growing consumer awareness about health and wellness, which is driving the preference for natural products over formulations containing synthetic chemicals. Increasing concerns over the safety of synthetic ingredients on skin are pushing consumers to seek clean, plant-based, and organic alternatives. Sustainability and environmentally responsible consumption are also influencing purchasing decisions, creating significant opportunities for brands that focus on ethical practices. Modern buyers are looking for products that align with their environmental values, preferring biodegradable packaging, cruelty-free testing, and ethically sourced raw materials. Advances in green chemistry, biomanufacturing, and innovative formulations have allowed companies to develop high-performance natural and organic cosmetics that deliver tangible benefits while meeting consumer expectations for safety, quality, and ethical responsibility, enabling the market to continuously evolve and expand.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $41.3 Billion |

| Forecast Value | $70.8 Billion |

| CAGR | 5.6% |

In 2025, the skin and sun care products segment generated USD 17.2 billion and is projected to grow at a CAGR of 6.9% between 2026 and 2035. Rising concerns about premature aging, hyperpigmentation, and UV-induced skin damage are driving the demand for gentle, plant-based formulations. Consumers are increasingly adopting preventive wellness routines, creating strong interest in natural sunscreens and moisturizers enriched with antioxidants, botanical extracts, and mineral-based UV filters that offer effective protection without harsh chemicals.

The bottles and jars segment held 36.8% share and is expected to grow at a CAGR of 7.5% from 2026 to 2035. Beyond functionality, the aesthetic appeal of jars and bottles reinforces brand perception in the premium segment, attracting consumers who associate this type of packaging with luxury and authenticity. Rising demand for eco-friendly packaging solutions, including airless jars and biodegradable materials, continues to drive innovation and solidify this segment's leadership in the market.

United States Natural Cosmetics Market generated USD 9.1 billion in 2025 and is anticipated to grow at a CAGR of 6% from 2026 to 2035. U.S. consumers are increasingly prioritizing health-conscious and chemical-free products, with clean-label certifications and transparency initiatives influencing purchase decisions. The growth is further supported by a strong e-commerce ecosystem and the adoption of direct-to-consumer sales models, enabling niche and premium natural brands to reach wider audiences effectively and efficiently.

Key players in the Global Natural Cosmetics Market include Beiersdorf AG, L'Oreal SA, Unilever PLC, Procter & Gamble Co., Johnson & Johnson, Estee Lauder Companies Inc., Shiseido Co., Ltd., Aveda Corporation, Burt's Bees, 100% Pure, Coty Inc., Amway Corporation, Arbonne International LLC, Avon Products, Inc., and Bare Escentuals Beauty Inc. Companies in the natural cosmetics market are employing multiple strategies to strengthen their market position and expand their presence. They are investing heavily in research and development to create innovative, high-performance natural formulations that meet evolving consumer expectations. Sustainability initiatives, including biodegradable and recyclable packaging, are being prioritized to appeal to environmentally conscious buyers. Strategic partnerships and collaborations with suppliers, distributors, and e-commerce platforms are helping brands reach wider markets efficiently.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Packaging type

- 2.2.4 Price range

- 2.2.5 Consumer group

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Heightened awareness of health & wellness

- 3.2.1.2 Eco-conscious purchasing & sustainability

- 3.2.1.3 Technological & product innovations

- 3.2.1.4 Ethical standards & premiumization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Premium pricing & elevated production costs

- 3.2.2.2 Preservation issues & limited shelf life

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Skin care and sun care

- 5.2.1 Lotions

- 5.2.2 Creams

- 5.2.3 Balms

- 5.2.4 Face oils

- 5.2.5 Serums

- 5.2.6 Masks

- 5.2.7 Others (toners, exfoliators, etc.)

- 5.3 Hair care

- 5.3.1 Shampoo

- 5.3.2 Conditioner

- 5.3.3 Mask

- 5.3.4 Oil

- 5.3.5 Others (scrubs, serums, etc.)

- 5.4 Body care

- 5.4.1 Lotion

- 5.4.2 Creams

- 5.4.3 Body butter

- 5.4.4 Oil

- 5.4.5 Scrub

- 5.4.6 Others (body wash, soaps, bath bombs, etc.)

- 5.5 Men’s grooming

- 5.5.1 Beard oils

- 5.5.2 After shave

- 5.5.3 Shaving cream

- 5.5.4 Others (serums, etc.)

- 5.6 Makeup

- 5.6.1 Facial products

- 5.6.2 Foundation

- 5.6.3 Concealer

- 5.6.4 Primer

- 5.6.5 Face powders

- 5.6.6 Others (blush, highlighter, contour, etc.)

- 5.7 Eye products

- 5.7.1 Eye shadow

- 5.7.2 Eye liner

- 5.7.3 Kohl

- 5.7.4 Mascara

- 5.7.5 Others (eye lashes, eye primer, etc.)

- 5.8 Lip products

- 5.8.1 Lipstick

- 5.8.2 Lip liner

- 5.8.3 Lip balm

- 5.8.4 Lip gloss

- 5.8.5 Others (lip tints, primer, etc.)

- 5.9 Fragrance

- 5.9.1 Body mists

- 5.9.2 Intense perfumes

- 5.9.3 Natural deodorants

- 5.9.4 Others (solid perfumes, etc.)

- 5.10 Others (body shimmers, brushes, etc.)

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Bottles and jars

- 6.3 Tubes

- 6.4 Pencils and sticks

- 6.5 Pouches and sachets

- 6.6 Others (roll-ons, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Premium range

- 7.3 Economical range

Chapter 8 Market Estimates & Forecast, By Consumer Group, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Male

- 8.3 Female

- 8.4 Kids

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online channels

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline channels

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (departmental stores, pharmacies, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 100% Pure

- 11.2 Amway Corporation

- 11.3 Arbonne International LLC

- 11.4 Aveda Corporation

- 11.5 Avon Products, Inc.

- 11.6 Bare Escentuals Beauty Inc.

- 11.7 Beiersdorf AG

- 11.8 Burt’s Bees

- 11.9 Coty Inc.

- 11.10 Estee Lauder Companies Inc.

- 11.11 Johnson & Johnson

- 11.12 L'Oreal SA

- 11.13 Procter & Gamble Co.

- 11.14 Shiseido Co., Ltd.

- 11.15 Unilever PLC