PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936615

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936615

Cleanroom Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

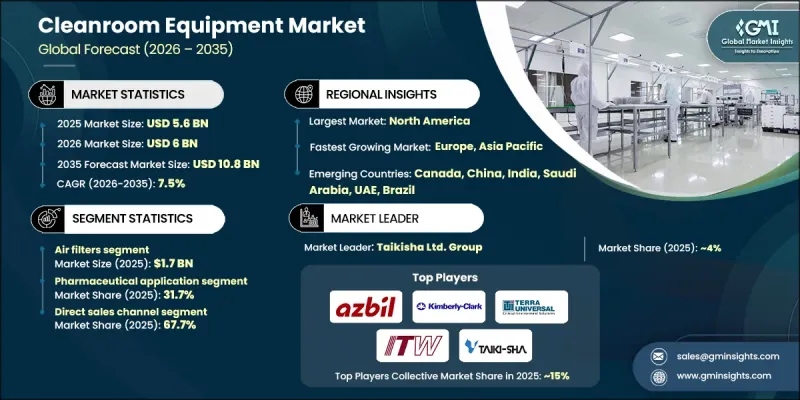

The Global Cleanroom Equipment Market was valued at USD 5.6 billion in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 10.8 billion by 2035.

The market is witnessing rapid growth due to the worldwide expansion of pharmaceutical, biotechnology, and advanced therapy manufacturing. The increasing production of sterile injectables, biologics, vaccines, personalized medicines, and cell and gene therapies has created significant demand for controlled manufacturing environments. These production spaces require state-of-the-art HVAC systems, HEPA and ULPA filtration, advanced air handling units, and continuous environmental monitoring. Another key factor fueling growth is the rising adoption of modular and flexible cleanroom solutions. Manufacturers prefer modular cleanrooms for their lower installation costs, rapid deployment, and ability to scale production spaces according to evolving regulatory or production demands. The flexibility to quickly expand or reconfigure cleanroom layouts to meet increasing output requirements or regulatory compliance is driving strong adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.6 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 7.5% |

The air filters segment generated USD 1.7 billion in 2025 and is anticipated to grow at a CAGR of 7.7% from 2026 to 2035. Stringent contamination control regulations in pharmaceuticals, biotechnology, semiconductor manufacturing, and healthcare industries are driving demand for high-efficiency HEPA and ULPA filtration. Industries producing sensitive electronics, nanotechnology components, and medical devices require ultra-clean air environments, fueling the need for advanced filtration solutions in both new cleanroom installations and retrofitted facilities.

The direct sales segment held a 67.7% share in 2025 and is expected to grow at a CAGR of 7.2% through 2035. Direct sales allow companies to provide customized solutions such as specialized air handling units, integrated laminar flow systems, and automation with real-time monitoring. This approach ensures compliance with GMP, FDA, EMA, ISO, and industry-specific standards while providing complete documentation, validation, and qualification from a single source. OEMs support customers throughout design, installation, commissioning, and lifecycle maintenance, minimizing contamination risks and downtime in mission-critical cleanroom operations.

U.S. Cleanroom Equipment Market reached USD 1.5 billion in 2025 and is expected to grow at a CAGR of 7.2% from 2026 to 2035. The country's robust pharmaceutical and biotechnology sectors, including biologics, vaccines, sterile injectables, and advanced therapies, drive consistent demand for cleanroom equipment. Increasing reliance on contract development and manufacturing organizations (CDMOs) has accelerated the establishment of multi-product, flexible cleanroom facilities, further supporting market expansion. Investments in advanced HVAC, HEPA/ULPA filtration, laminar airflow systems, and real-time environmental monitoring are key growth drivers in the U.S.

Key players shaping the Global Cleanroom Equipment Market include Abtech, Airomax Airborne LLP, Alpiq Holding AG, Angstrom Technology, Ardmac Ltd., Azbil Corporation, Camfil AB Source, Clean Air Products, HVAX, Illinois Tool Works Inc., Integrated Cleanroom Technologies Pvt. Ltd., Kimberly-Clark Corporation, Labconco, M + W Group, Taikisha Ltd., and Terra Universal Inc. Companies in the cleanroom equipment market strengthen their presence by focusing on product innovation, regulatory compliance, and turnkey solutions. Providers develop modular, scalable, and energy-efficient cleanroom systems to meet evolving industry needs. Strategic collaborations with pharmaceutical, biotech, and semiconductor manufacturers allow co-development of customized solutions. Expanding distribution networks across emerging and established markets improves accessibility, while strong after-sales and maintenance services reinforce customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Type of cleanroom

- 2.2.4 Cleanroom classification

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding pharmaceutical & biotechnology manufacturing

- 3.2.1.2 Adoption of modular & flexible cleanroom solutions

- 3.2.1.3 Stringent regulatory & quality compliance requirements

- 3.2.1.4 Increasing focus on infection control in healthcare facilities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital expenditure & operating costs

- 3.2.2.2 Energy consumption & sustainability constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Air showers

- 5.3 Air filters

- 5.3.1 HEPA filter

- 5.3.2 ULPA filter

- 5.3.3 Fan filter unit

- 5.3.4 Ceiling HEPA filter AC unit

- 5.4 Laminar flow hood

- 5.4.1 Horizontal laminar flow hood

- 5.4.2 Vertical laminar flow hood

- 5.5 Desiccator cabinet

- 5.5.1 Stainless steel desiccator cabinet

- 5.5.2 Acrylic desiccator cabinet

- 5.6 Pass through

- 5.7 Chemical fume hood

- 5.8 Cleanroom doors

- 5.8.1 Roll up doors

- 5.8.2 Automatic sliding doors

- 5.9 Others (sink, bench, door interlock system, etc.)

Chapter 6 Market Estimates & Forecast, By Type of Cleanroom, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Traditional cleanroom

- 6.3 Modular cleanroom

- 6.4 Modular softwall cleanrooms

- 6.5 Mobile cleanrooms

- 6.6 Hybrid cleanrooms

Chapter 7 Market Estimates & Forecast, By Cleanroom Classification, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 ISO Class 1-3

- 7.3 ISO Class 4-5

- 7.4 ISO Class 6-7

- 7.5 ISO Class 8-9

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Semiconductors

- 8.4 Biotechnology

- 8.5 Hospital

- 8.6 Aerospace

- 8.7 Automotive

- 8.8 Others (Life sciences, Military facilities, Research laboratories, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Abtech

- 11.2 Airomax Airborne LLP

- 11.3 Alpiq holding AG

- 11.4 Angstrom Technology

- 11.5 Ardmac Ltd.

- 11.6 Azbil Corporation

- 11.7 Camfil AB Source

- 11.8 Clean Air Products

- 11.9 HVAX

- 11.10 Illinois Tool Works Inc.

- 11.11 Integrated Cleanroom Technologies Pvt. Ltd.

- 11.12 Kimberly-Clark Corporation

- 11.13 Labconco

- 11.14 M + W Group

- 11.15 Taikisha Ltd.

- 11.16 Terra Universal Inc.