PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936630

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936630

Floriculture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

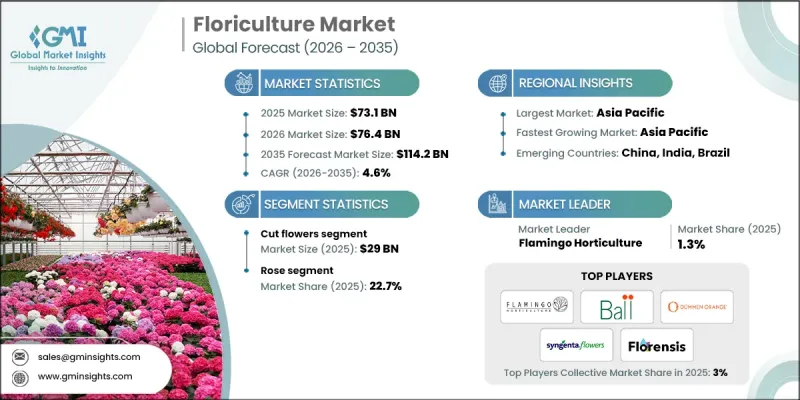

The Global Floriculture Market was valued at USD 73.1 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 114.2 billion by 2035.

Market growth is driven by rising demand for ornamental plants, increasing disposable incomes, and the growing popularity of flowers for gifting, events, landscaping, and interior decoration. Floriculture, which includes the cultivation of cut flowers, potted plants, bedding plants, and ornamental foliage, has evolved into a highly commercialized and export-oriented industry. Urbanization, lifestyle changes, and the expansion of organized retail and e-commerce platforms have significantly increased flower consumption across both developed and emerging economies. Additionally, technological advancements in greenhouse cultivation, precision irrigation, and post-harvest handling have improved yield quality, shelf life, and year-round availability, supporting sustained market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $73.1 Billion |

| Forecast Value | $114.2 Billion |

| CAGR | 4.6% |

The market is further supported by the rising use of flowers in weddings, festivals, corporate events, and hospitality settings, where aesthetic appeal plays a crucial role. Increasing awareness of the emotional and psychological benefits of flowers, along with their growing use in home decor and wellness spaces, is positively influencing consumer demand. Export-oriented production hubs are also benefiting from improved cold chain infrastructure and international trade agreements, enabling growers to access high-value global markets. Sustainability initiatives, including eco-friendly cultivation practices and reduced chemical usage, are becoming increasingly important, especially in regions supplying premium floriculture products to environmentally conscious consumers.

Based on product type, the cut flowers segment generated USD 29 billion in 2025, accounting for the largest share of total revenue. Cut flowers such as roses, chrysanthemums, carnations, lilies, and gerberas are widely used for gifting, decoration, and ceremonial purposes, driving consistent demand throughout the year. Their strong export potential, higher margins, and widespread acceptance across cultures cut flowers the most commercially valuable segment. Advancements in breeding techniques, controlled environment agriculture, and logistics have significantly enhanced flower quality and vase life, further strengthening the dominance of this segment in both domestic and international markets.

The B2B segment held the largest share in 2025, driven by strong demand from wholesalers, exporters, event management companies, hotels, corporate offices, supermarkets, and landscaping contractors. These buyers procure flowers and ornamental plants in large volumes to support continuous commercial usage, making B2B transactions the backbone of the floriculture supply chain. The segment benefits from long-term supply contracts, centralized auctions, and organized wholesale markets that ensure consistent quality, pricing stability, and timely delivery. Increasing reliance on cold chain logistics and contract farming arrangements has further strengthened B2B operations, enabling year-round availability and reduced post-harvest losses.

United States Floriculture Market held 80% share, generating USD 11.1 billion in 2025. The North American floriculture market benefits from robust consumer demand in both the U.S. and Canada for ornamental plants and cut flowers, particularly during seasonal occasions like Valentine's Day and Mother's Day. These celebrations remain key drivers of floral sales, as flowers continue to be highly favored for gifting and home decoration. The adoption of advanced greenhouse technologies enables growers in North America to cultivate high-quality flowers and plants year-round. This capability not only ensures a consistent supply but also allows retailers and online florists to command significantly higher margins compared to international markets, reflecting the premium quality and sustained consumer demand.

Key players operating in the Global Floriculture Market include Dummen Orange, Syngenta Flowers, Ball Horticultural Company, Selecta One, Karuturi Global, Oserian Development Company, Finlays, Beekenkamp Group, and Washington Bulb Co. These companies focus on high-quality planting material, innovative flower varieties, and advanced cultivation techniques to maintain competitiveness in global markets. Companies in the floriculture market are strengthening their market position through investment in advanced cultivation technologies, product innovation, and global distribution expansion. Leading players are focusing on developing new flower varieties with longer vase life, improved color, and higher resistance to pests and diseases to meet evolving consumer preferences. Expansion into high-growth regions through contract farming and strategic partnerships with local growers is a key strategy. Companies are also leveraging cold chain logistics, digital sales platforms, and direct-to-consumer models to improve market reach and reduce post-harvest losses.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By product type

- 2.2.3 By flower type

- 2.2.4 By distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for ornamental plant

- 3.2.1.2 Increasing popularity of gifting culture

- 3.2.1.3 Growing wellness and health awareness

- 3.2.1.4 Expansion of e-commerce and digital platforms

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Perishability of products

- 3.2.2.2 Increasing competition from artificial flowers

- 3.2.3 Opportunities

- 3.2.3.1 Commercialization of sustainability and eco-innovation

- 3.2.3.2 Adoption of precision agriculture and AI-driven logistics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruption

- 3.5 Future market trends

- 3.6 Risk and mitigation Analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.9 Regulatory landscape

- 3.9.1 Standards and compliance requirement

- 3.9.2 Certification standards

- 3.10 Consumer buying behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022-2035 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Cut flowers

- 5.3 Potted plants

- 5.4 Bedding plants

- 5.5 Foliage plants

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Flower Type, 2022-2035 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Rose

- 6.3 Chrysanthemum

- 6.4 Tulip

- 6.5 Lily

- 6.6 Gerbera

- 6.7 Carnations

- 6.8 Texas bluebell

- 6.9 Freesia

- 6.10 Hydrangea

- 6.11 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 B to B

- 7.3 B to C

- 7.3.1 Online

- 7.3.2 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Malaysia

- 8.4.7 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Beekenkamp Group

- 9.2 Danziger

- 9.3 Dummen Orange

- 9.4 Esmeralda Farms

- 9.5 Flamingo Horticulture

- 9.6 Florance Flora

- 9.7 Florensis Flower Seeds

- 9.8 Forest Produce

- 9.9 Marginpar

- 9.10 Native Floral Group

- 9.11 Bohemian Flowers

- 9.12 Proven Winners

- 9.13 Selecta Cut Flowers

- 9.14 Syngenta

- 9.15 Ball Horticultural Company

- 9.16 Anthura

- 9.17 Deliflor Chrysanten B.V.

- 9.18 Schreurs

- 9.19 Konst Alstroemeria B.V