PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936632

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936632

Sepsis Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

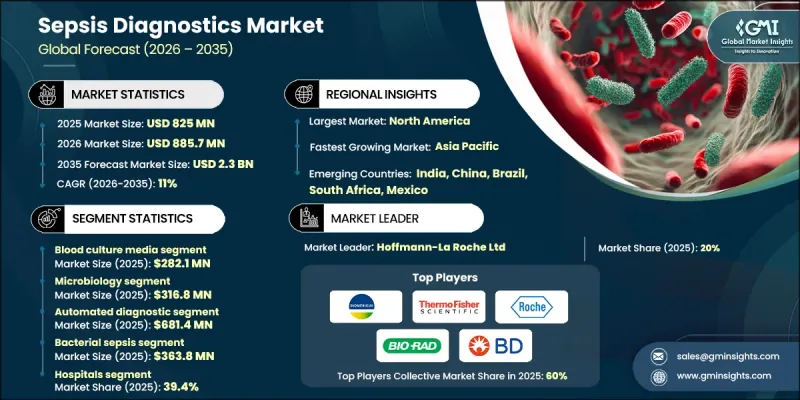

The Global Sepsis Diagnostics Market was valued at USD 825 million in 2025 and is estimated to grow at a CAGR of 11% to reach USD 2.3 billion by 2035.

Growth is supported by the rising incidence of infectious diseases, increasing public-sector focus on infection control, and continuous progress in diagnostic technologies. Greater awareness among clinicians and patients regarding the importance of timely diagnosis is further strengthening market demand. Factors such as antimicrobial resistance, hospital-acquired infections, and the expanding prevalence of chronic health conditions continue to elevate sepsis risk, especially among elderly and immunocompromised individuals. Healthcare providers are increasingly prioritizing rapid and accurate diagnostic solutions to improve survival rates and manage treatment costs more effectively. The growing need for point-of-care and faster diagnostic tools is creating favorable conditions for innovation and global market expansion, as early detection remains critical for improving clinical outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $825 Million |

| Forecast Value | $2.3 Billion |

| CAGR | 11% |

Government-driven investments in public health infrastructure continue to accelerate market growth. Sepsis is closely linked to infectious disease progression, making early identification a public health priority. National healthcare programs increasingly emphasize improved diagnostic readiness, enhanced laboratory capacity, and faster clinical decision-making. These initiatives support wider adoption of advanced diagnostic platforms and strengthen demand across hospital and laboratory settings.

The blood culture media segment generated USD 282.1 million in 2025. These products are formulated to promote the growth of microorganisms from blood samples, enabling the detection of bloodstream infections. Their compatibility with automated diagnostic systems and consistent usage across clinical laboratories ensures stable demand. Blood culture media remain a core component of sepsis diagnostics due to their essential role in confirming infections.

The microbiology-based diagnostics segment accounted for USD 316.8 million in 2025. This approach focuses on cultivating and identifying pathogens from patient samples and remains widely accepted in clinical practice. It supports detailed organism identification and antimicrobial sensitivity analysis, which are essential for guiding effective treatment decisions and improving patient management.

U.S. Sepsis Diagnostics Market was valued at USD 283.7 million in 2025. Rising infection rates and increased vulnerability among aging and immunocompromised populations continue to drive demand for rapid diagnostic solutions. Strong healthcare infrastructure and high adoption of advanced diagnostic technologies support sustained market growth across the country.

Key companies active in the Global Sepsis Diagnostics Market include Abbott Laboratories, Thermo Fisher Scientific, Inc., bioMerieux SA, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Becton, Dickinson and Company, Beckman Coulter Inc (Danaher Corporation), Bio-Rad Laboratories, Bruker Corporation, and T2 Biosystems, Inc. Companies operating in the sepsis diagnostics market focus on multiple strategies to strengthen market position and expand global reach. Continuous investment in research and development enables faster, more sensitive, and more accurate diagnostic solutions. Strategic collaborations with hospitals and research institutions support clinical validation and adoption. Many players expand product portfolios to include rapid and point-of-care testing platforms. Geographic expansion into emerging healthcare markets enhances revenue opportunities. Automation, digital integration, and workflow optimization are prioritized to improve laboratory efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Product trends

- 2.2.4 Method trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in prevalence of infectious diseases

- 3.2.1.2 Increasing government initiatives towards infectious diseases

- 3.2.1.3 Technological advancements in infectious diseases diagnosis

- 3.2.1.4 Rising awareness regarding infectious diseases and its diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of sepsis diagnostics devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI & digital health

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Blood culture media

- 5.3 Instruments

- 5.4 Assay kits & reagents

- 5.5 Software

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Microbiology

- 6.3 Molecular diagnostics

- 6.4 Immunoassays

- 6.5 Flow cytometry

Chapter 7 Market Estimates and Forecast, By Method type, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Conventional diagnostics

- 7.3 Automated diagnostics

Chapter 8 Market Estimates and Forecast, By Pathogen type, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Bacterial sepsis

- 8.3 Fungal sepsis

- 8.4 Other pathogen types

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Clinics

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 F. Hoffmann-La Roche Ltd

- 11.2 Thermo Fisher Scientific

- 11.3 Abbott Laboratories

- 11.4 Beckman Coulter Inc

- 11.5 Siemens Healthineers

- 11.6 Becton, Dickinson and Company

- 11.7 bioMerieux SA

- 11.8 Bio-Rad Laboratories

- 11.9 Bruker Corporation

- 11.10 T2 Biosystems, Inc