PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936641

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936641

Laser Cutting Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

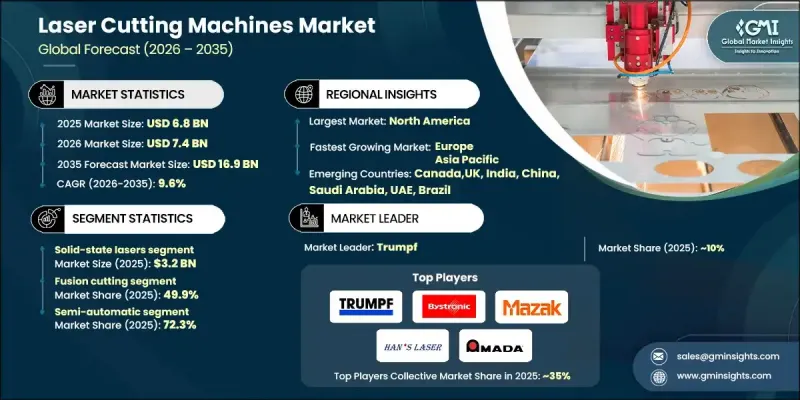

The Global Laser Cutting Machines Market was valued at USD 6.8 billion in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 16.9 billion by 2035.

The market is experiencing rapid expansion as manufacturers across industries increasingly adopt automation technologies and Industry 4.0 practices. Laser cutting machines are becoming central to smart factory operations, enabling connected equipment, real-time monitoring, and advanced analytics to optimize efficiency and reduce downtime through predictive maintenance. These machines allow seamless integration into automated workflows, delivering precise, high-quality cuts with micron-level accuracy and minimal post-processing. Rising demand from automotive, aerospace, electronics, and industrial machinery sectors is driving growth, as these industries require lightweight, complex, and intricately assembled components that conventional cutting methods cannot achieve consistently. The ability of laser systems to produce clean edges and superior geometric accuracy enhances productivity while reducing material waste, making them indispensable for modern manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.8 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 9.6% |

The solid-state lasers segment generated USD 3.2 billion in 2025 and is expected to grow at a CAGR of 10% from 2026 to 2035. The solid-state segment, particularly fiber and disk lasers, is favored due to superior beam quality, faster cutting speeds, lower operating costs, and enhanced energy efficiency compared with traditional gas-based systems. These characteristics make them highly suitable for high-precision industrial operations and fully automated production lines. Solid-state lasers are increasingly adopted across metal fabrication, automotive, aerospace, and electronics manufacturing, supporting digital transformation and industrial efficiency.

The fusion cutting segment held a 49.9% share in 2025 and is anticipated to grow at a CAGR of 9.9% through 2035. Fusion cutting remains the preferred method due to its versatility, high speed, precision, and ability to handle a wide range of metals while producing smooth edges that require minimal post-processing. Its efficiency aligns with industry needs for reduced material waste, tighter tolerances, and streamlined production in automotive, aerospace, electronics, and industrial manufacturing sectors.

U.S. Laser Cutting Machines Market reached USD 1.9 billion in 2025 and is expected to grow at a CAGR of 9.8% between 2026 and 2035. Strong demand from industries requiring precision-cut components and complex designs, such as automotive, aerospace, electronics, and metal fabrication, is driving growth. Continuous technological advancements in laser sources, software integration, and automation capabilities support widespread adoption and encourage manufacturers to upgrade or expand their existing systems.

Key players in the Global Laser Cutting Machines Market include Bystronic, Coherent, Mitsubishi Electric Corporation, IPG Photonics, Trumpf, Amada, Jenoptik, LVD Company, Tanaka, Mazak Optonics, Trotec Laser, Universal Laser Systems, Prima Power, Han's Laser, and Epilog Laser. Companies in the laser cutting machines market are employing multiple strategies to expand their market presence and maintain a competitive advantage. They are investing heavily in R&D to develop faster, more energy-efficient, and higher-precision laser systems that cater to diverse industrial applications. Strategic collaborations with OEMs and industrial integrators are being used to strengthen distribution networks and ensure seamless integration into smart factories. Manufacturers are expanding production capacity, introducing fiber and hybrid laser technologies, and enhancing software and automation compatibility to attract high-end clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Process

- 2.2.4 Function type

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of automation & industry 4.0

- 3.2.1.2 Increasing demand for high-precision fabrication

- 3.2.1.3 Shift toward energy-efficient fiber & solid-state lasers

- 3.2.1.4 Demand for reduced material waste & higher productivity

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High operational & maintenance expenses

- 3.2.2.2 Material limitations & processing challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By technology

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Solid-state lasers

- 5.3 Gas lasers

- 5.4 Semiconductor laser

Chapter 6 Market Estimates & Forecast, By Process, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fusion cutting

- 6.3 Flame cutting

- 6.4 Sublimation cutting

Chapter 7 Market Estimates & Forecast, By Function Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Robotic

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Defense and aerospace

- 8.5 Industrial

- 8.6 Others (medical, energy & power etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amada

- 11.2 Bystronic

- 11.3 Coherent

- 11.4 Epilog Laser

- 11.5 Han's Laser

- 11.6 IPG Photonics

- 11.7 Jenoptik

- 11.8 LVD Company

- 11.9 Mazak Optonics

- 11.10 Mitsubishi Electric Corporation

- 11.11 Prima Power

- 11.12 Tanaka

- 11.13 Trotec Laser

- 11.14 Trumpf

- 11.15 Universal Laser Systems