PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844362

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844362

Milk Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

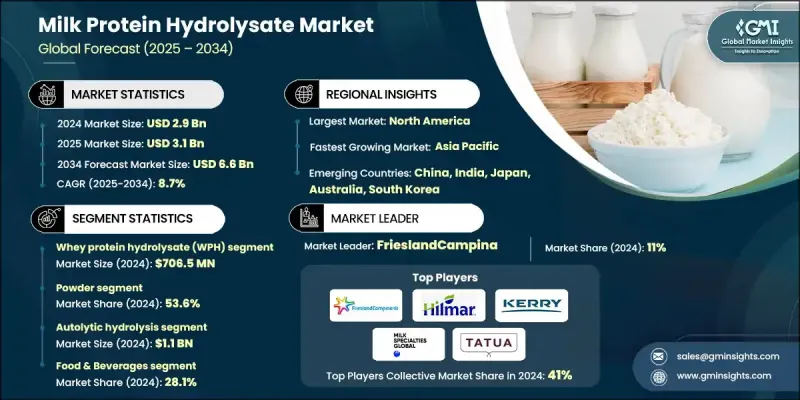

The Global Milk Protein Hydrolysate Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 6.6 billion by 2034.

This growth reflects rising consumer demand for highly digestible and low-allergen protein solutions. Milk protein hydrolysate is created through the enzymatic breakdown of milk proteins into smaller peptides and amino acids, improving digestibility and reducing allergenic effects. Growing health awareness, especially around food intolerances and digestion-friendly nutrition, is fueling market momentum. The product's primary applications include infant formulas tailored for children with milk allergies, sports supplements requiring fast protein absorption, and medical nutrition designed for patients needing easily digestible protein intake. Technological innovations in enzymatic hydrolysis and filtration methods have improved consistency, taste, and nutrient delivery. These advancements allow producers to finely control the degree of hydrolysis and tailor products to different needs-from early life to clinical recovery support. With nutrition science and consumer demand evolving, manufacturers are scaling production and introducing multi-functional variants. Clinical research supporting benefits like muscle recovery, immune support, and ease of digestion continues to build confidence in the product's use across consumer health categories.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 8.7% |

The whey protein hydrolysate segment held a 24.5% share in 2024. Its fast absorption rate, minimal allergenic potential, and superior bioavailability have made it an essential ingredient in specialized nutritional products. Athletes, health-conscious individuals, and patients on therapeutic diets rely on whey protein hydrolysate for its quick delivery of amino acids and its role in muscle repair and wellness. This segment's rise reflects the growing shift toward performance-focused and dietary-specific products with measurable health outcomes.

The powder-based formats segment held 53.6% share in 2024. Their long shelf life, cost-effective storage and transport, and compatibility with diverse applications from sports nutrition and infant formulas to clinical foods have made powdered hydrolysates the preferred form for both manufacturers and end-users. Their stability and versatility further enable widespread adoption across global markets.

United States Milk Protein Hydrolysate Market generated USD 870.3 million in 2024, reinforcing its leadership position in North America's milk protein hydrolysate sector. A well-established dairy infrastructure, growing focus on digestive wellness, and heightened public awareness around food sensitivities are key market drivers. High healthcare spending and strong interest in functional nutrition among aging and infant populations also contribute to the country's increasing demand for hydrolyzed milk protein products.

Key players driving the Global Milk Protein Hydrolysate Market include Hilmar Ingredients, Arla Foods Ingredients Group, FrieslandCampina, Kerry Ingredients, AMCO Proteins, Glanbia Nutritionals, Havero Hoogwegt, Milk Specialties Global, A. Costantino & C., Agropur Cooperative, Lactalis Group, Armor Proteines, and Tatua Co-operative Dairy Company. Companies in this space are strengthening their positions by expanding production capacities and investing in R&D to create highly specific and functional hydrolysate variants. Strategic collaborations with clinical nutrition brands and sports supplement companies are becoming common, enabling targeted product placement. Manufacturers like FrieslandCampina and Glanbia Nutritionals focus on clean-label claims and improving flavor profiles to increase consumer acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Form trends

- 2.2.3 Technology trends

- 2.2.4 End Use trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift to hypoallergenic nutrition

- 3.2.1.2 Demand for clean-label products

- 3.2.1.3 Integration into functional foods

- 3.2.1.4 Expansion of infant and clinical nutrition needs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Flavor and palatability issues

- 3.2.2.2 Intense market competition

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in sports nutrition

- 3.2.3.2 Growth in personalized nutrition

- 3.2.3.3 Rising interest in gut health and immunity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Whey protein hydrolysate (WPH)

- 5.3 Casein hydrolysate (CPH)

- 5.4 Total milk protein hydrolysate

- 5.5 Lactoferrin hydrolysate

- 5.6 Immunoglobulin hydrolysate

- 5.7 Alpha-lactalbumin hydrolysate

- 5.8 Beta-lactoglobulin hydrolysate

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Paste

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Acid hydrolysis

- 7.3 Enzymatic hydrolysis

- 7.4 Microbial fermentation

- 7.5 Autolytic hydrolysis

- 7.6 Ultrasonic hydrolysis

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Protein supplement

- 8.2.2 Infant nutrition

- 8.2.3 Sports nutrition

- 8.2.4 Bakery & food ingredients

- 8.2.5 Beverages

- 8.2.6 Others

- 8.3 Animal feed

- 8.3.1 Poultry

- 8.3.1.1 Broilers

- 8.3.1.2 Layers

- 8.3.2 Swine

- 8.3.3 Cattle

- 8.3.4 Aquaculture

- 8.3.4.1 Salmon

- 8.3.4.2 Trouts

- 8.3.4.3 Shrimps

- 8.3.4.4 Others

- 8.3.5 Equine

- 8.3.6 Pet

- 8.3.1 Poultry

- 8.4 Pharmaceutical

- 8.4.1 Pharmaceutical formulations

- 8.4.2 Clinical nutrition

- 8.4.3 Others

- 8.5 Cosmetics & Personal Care

- 8.5.1 Skincare

- 8.5.2 Haircare

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arla Foods Ingredients Group

- 10.2 AMCO Proteins

- 10.3 A. Costantino & C.

- 10.4 Armor Proteines

- 10.5 Agropur Cooperative

- 10.6 FrieslandCampina

- 10.7 Glanbia Nutritionals

- 10.8 Hilmar Ingredients

- 10.9 Havero Hoogwegt

- 10.10 Kerry Ingredients

- 10.11 Lactalis Group

- 10.12 Milk Specialties Global

- 10.13 Tatua Co-operative Dairy Company

- 10.14 Others