PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913349

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913349

Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

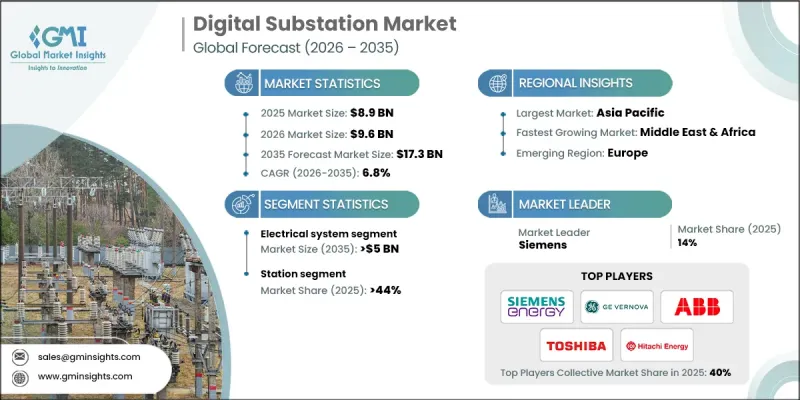

The Global Digital Substation Market was valued at USD 8.9 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 17.3 billion by 2035.

The market is expanding steadily as power utilities and industrial operators prioritize advanced, reliable, and intelligent grid infrastructure. Digital substations are increasingly replacing or modernizing conventional substations by enabling continuous data visibility, automated control, and condition-based maintenance. This shift supports rising electricity consumption while improving grid stability and operational efficiency. Digital substations rely on standardized communication architectures, high-speed data transmission, and connected devices to enhance interoperability and significantly reduce physical cabling requirements. The integration of real-time analytics, digital modeling, and cybersecurity frameworks strengthens system resilience and reduces outage risks. Growing investments in smart grid development continue to accelerate adoption, as digital substations are critical for managing decentralized power generation and complex energy flows. Rapid urban expansion and industrial growth in developing regions are further driving large-scale grid upgrades and transmission network expansion. Collectively, these factors are creating strong long-term demand for digital substations across utilities, renewable integration projects, and energy-intensive industries worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.9 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 6.8% |

The electrical system segment is expected to reach USD 5 billion by 2035. This segment represents the fundamental hardware of substations, including transformers, breakers, and high-voltage assemblies. In digital environments, these assets are equipped with advanced sensing and signal conversion technologies that enable precise measurement, faster protection response, and seamless communication with intelligent control systems, improving overall substation performance.

The station segment accounted for 44.8% share in 2025 and is forecast to grow at a CAGR of 6% through 2035. This segment forms the structural backbone of digital substations, where primary equipment interfaces directly with intelligent electronic devices. By converting physical signals into digital data streams, this layer enables continuous monitoring, faster fault detection, and improved operational transparency.

U.S. Digital Substation Market is expected to reach USD 1.5 billion by 2035. Market growth in the country is supported by sustained investments in grid modernization, rising power demand, and a strong focus on upgrading aging transmission and distribution infrastructure to improve reliability and efficiency.

Key participants operating in the Global Digital Substation Market include Siemens Energy, ABB, Schneider Electric, GE Vernova, Eaton Corporation, Toshiba Energy Systems & Solutions, Cisco Systems, WEG, Belden Inc, NovaTech, OMICRON, Ponovo Power, Bharat Heavy Electricals Limited, and Redeia. Companies active in the Global Digital Substation Market are strengthening their market presence through continuous technology innovation, strategic partnerships, and expanded service portfolios. Key strategies include investing in interoperable solutions that align with global communication standards and enhance compatibility across grid assets. Market players are focusing on integrated hardware and software offerings that combine protection, control, and monitoring capabilities within unified platforms. Expansion into emerging markets through localized manufacturing and engineering support is also a priority. Additionally, firms are emphasizing cybersecurity, lifecycle services, and predictive maintenance solutions to deliver long-term value to utilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Digital substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.4.1 Transformer

- 5.4.2 Busbar

- 5.4.3 Protection devices

- 5.4.3.1 Circuit breaker

- 5.4.3.2 Protective relay

- 5.4.3.3 Switchgear

- 5.5 Monitoring & control system

- 5.5.1 Human machine interface

- 5.5.2 Programmable logic controller

- 5.5.3 Others

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Transmission

- 7.3 Distribution

Chapter 8 Market Size and Forecast, By Connectivity, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 ≤ 33 kV

- 8.3 > 33 kV to ≤ 110 kV

- 8.4 > 110 kV to ≤ 220 kV

- 8.5 > 220 kV to ≤ 550 kV

- 8.6 > 550 kV

Chapter 9 Market Size and Forecast, By Voltage Level, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Utility

- 10.3 Industrial

Chapter 11 Market Size and Forecast, By Installation, 2022 - 2035 (USD Million, Units)

- 11.1 Key trends

- 11.2 New

- 11.3 Refurbished

Chapter 12 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 France

- 12.3.3 Germany

- 12.3.4 Italy

- 12.3.5 Russia

- 12.3.6 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Australia

- 12.4.3 India

- 12.4.4 Japan

- 12.4.5 South Korea

- 12.5 Middle East & Africa

- 12.5.1 Saudi Arabia

- 12.5.2 UAE

- 12.5.3 Turkey

- 12.5.4 South Africa

- 12.5.5 Egypt

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 Belden Inc

- 13.3 Bharat Heavy Electricals Limited

- 13.4 Cisco Systems

- 13.5 Eaton

- 13.6 GE Vernova

- 13.7 NovaTech.

- 13.8 OMICRON

- 13.9 Ponovo Power

- 13.10 Redeia

- 13.11 Schneider Electric

- 13.12 Siemens Energy

- 13.13 Toshiba Energy Systems & Solutions

- 13.14 WEG