PUBLISHER: Information Network | PRODUCT CODE: 1473282

PUBLISHER: Information Network | PRODUCT CODE: 1473282

Applied Materials: Competitive Analysis of Served Markets

Introduction

In the competitive realm of semiconductor manufacturing equipment, Applied Materials stands out for its technological leadership, strategic market positioning, and comprehensive approach to addressing the challenges of modern semiconductor fabrication. As the industry moves towards smaller nodes and more complex device architectures, Applied Materials' innovations in etch, deposition, CMP, metrology, and ion implant equipment will continue to play a critical role in enabling the next generation of electronic devices. Through continuous innovation and strategic foresight, Applied Materials is not just competing but leading in the markets it serves, shaping the future of semiconductor technology and manufacturing.

Applied Materials' market leadership is supported by continuous innovation and a strategic approach to addressing semiconductor manufacturing challenges. The company's investment in research and development ensures its technologies meet current demands and anticipate future industry shifts.

As semiconductor fabrication evolves towards more advanced nodes and explores novel materials and architectures, Applied Materials is poised to play a central role. Its comprehensive technology portfolio, covering etch, deposition, CMP, metrology/inspection, and ion implant, positions the company as a key enabler of next-generation semiconductor devices.

Etch and Deposition Technologies

Applied Materials excels in etch and deposition processes, foundational to semiconductor device fabrication. The company's etch systems offer precise control over plasma processes, crucial for defining nanoscale features on silicon substrates. These systems enable the creation of intricate device structures required for current computing and memory applications.

In deposition, Applied Materials provides solutions across Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), and Atomic Layer Deposition (ALD). These technologies are critical for forming the various thin-film layers in semiconductor devices, with a focus on precision, process efficiency, and adaptability to evolving industry requirements.

CMP Systems

CMP equipment is another area of focus for Applied Materials, ensuring the planarity of wafer surfaces between fabrication steps. The company's CMP systems integrate with fabrication workflows, optimizing throughput and reducing defectivity. This contributes to improved manufacturing yields and cost efficiencies, aligning with the semiconductor industry's goals.

Metrology/Inspection Equipment

Metrology and inspection equipment from Applied Materials provides critical data on wafer properties, facilitating process adjustments and early defect identification. This category of equipment is vital for quality control, enabling manufacturers to uphold high standards of product yield and operational efficiency amid increasing device complexity.Ion Implant Equipment

Applied Materials also specializes in ion implantation technology, essential for doping semiconductor materials. The company's implanters deliver high precision in dopant species, energy, and dose control, critical for achieving desired electrical characteristics in semiconductor devices.

About This Report

This report addressed the Served Available Markets that Applied Materials competes. Namely:

- Chemical Vapor Deposition

- Physical Vapor Deposition

- Dry Etch

- Rapid Thermal Processing/Oxidation/Diffusion

- Silicon Epitaxy

- Chemical Mechanical Planarization

- Metrology and Inspection

- Ion Implantation

It presents forecasts for each sector and market shares for each equipment type between 2012 and 2023.

Table of Contents

Chapter 1. Introduction

Chapter 2. Applied's Strategies

- 2.1. Market Strategies

- 2.1.1. Driving Demand for Processing Equipment

- 2.1.2. A Global Presence

- 2.1.3. Meeting Customer Needs

- 2.1.4. New CEO's Strategy

- 2.2. Business Strategies 2.

- 2.2.1. Silicon Systems Group

- 2.2.2. Applied Global Services

- 2.2.3. Display

- 2.2.4. Energy and Environmental Solutions

- 2.3. Technology Strategies

- 2.4. Product Strategies

- 2.5. Acquisition Strategies

- 2.6. Legal Strategies

- 2.7. Financial Analysis

Chapter 3. Market Forecast

- 3.1. Market Drivers

- 3.1.1. Semiconductor Market

- 3.1.2. Technical Trends

- 3.1.3. Economic Trends

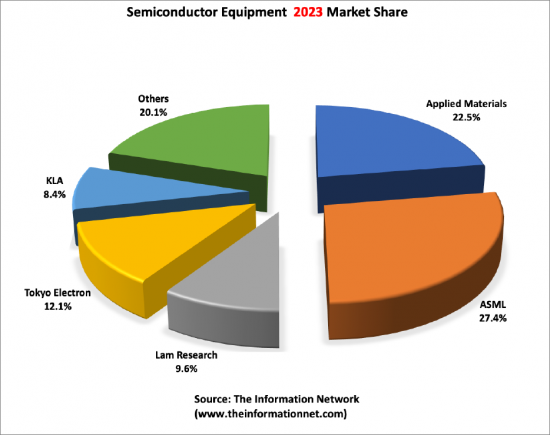

- 3.2. Applied Materials - Global Market Leader Until 2019

- 3.3. Market Size and Market Shares

- 3.3.1. Chemical Vapor Deposition

- 3.3.2. Physical Vapor Deposition

- 3.3.3. Dry Etch

- 3.3.4. Rapid Thermal Processing/Oxidation/Diffusion

- 3.3.5. Silicon Epitaxy

- 3.3.6. Chemical Mechanical Planarization

- 3.3.7. Metrology and Inspection

- 3.3.8. Ion Implantation

Chapter 4. Competitive Environment

- 4.1. Introduction

- 4.2. Lam Research

- 4.2.1. Strategies

- 4.2.2. Products

- 4.2.3. Financial Analysis

- 4.3. Tokyo Electron Limited

- 4.3.1. Strategies

- 4.3.2. Products

- 4.3.3. Financial Analysis

- 4.4. KLA

- 4.4.1. Strategies

- 4.4.2. Products

- 4.4.3. Financial Analysis

- 4.5. ASM International

- 4.5.1. Strategies

- 4.5.2. Products

- 4.5.3. Financial Analysis

- 4.6. Axcelis

- 4.6.1. Strategies

- 4.6.2. Products

- 4.6.3. Financial Analysis

- 4.7. Canon Anelva

- 4.7.1. Business Sectors Covered In The Market Analysis Chapter

- 4.7.2. Company Profile

- 4.7.3. Company Financials

- 4.8. Ebara

- 4.8.1. Business Sectors Covered In The Market Analysis Chapter

- 4.8.2. Company Profile

- 4.8.3. Company Financials

- 4.9. Eugene Technology

- 4.9.1. Business Sectors Covered In The Market Analysis Chapter

- 4.9.2. Company Profile

- 4.9.3. Company Financials

- 4.10. Hitachi High-Technologies

- 4.10.1. Business Sectors Covered In The Market Analysis Chapter

- 4.10.2. Company Profile

- 4.10.3. Company Financials

- 4.11. Hitachi Kokusai Electric

- 4.11.1. Business Sectors Covered In The Market Analysis Chapter

- 4.11.2. Company Profile

- 4.11.3. Company Financials

- 4.12. Jusung Engineering

- 4.12.1. Business Sectors Covered In The Market Analysis Chapter

- 4.12.2. Company Profile

- 4.12.3. Company Financials

- 4.13. KC Tech

- 4.13.1. Business Sectors Covered In The Market Analysis Chapter

- 4.13.2. Company Profile

- 4.13.3. Company Financials

- 4.14. Lasertec

- 4.14.1. Business Sectors Covered In The Market Analysis Chapter

- 4.14.2. Company Profile

- 4.14.3. Company Financials

- 4.15. Nissin Ion Equipment

- 4.15.1. Business Sectors Covered In The Market Analysis Chapter

- 4.15.2. Company Profile

- 4.15.3. Company Financials

- 4.16. NuFlare Technology

- 4.16.1. Business Sectors Covered In The Market Analysis Chapter

- 4.16.2. Company Profile

- 4.16.3. Company Financials

- 4.17. Screen Semiconductor Solutions

- 4.17.1. Business Sectors Covered In The Market Analysis Chapter

- 4.17.2. Company Profile

- 4.17.3. Company Financials

- 4.18. SEMES

- 4.18.1. Business Sectors Covered In The Market Analysis Chapter

- 4.18.2. Company Profile

- 4.18.3. Company Financials

- 4.19. SEN

- 4.19.1. Business Sectors Covered In The Market Analysis Chapter

- 4.19.2. Company Profile

- 4.19.3. Company Financials

- 4.20. TES

- 4.20.1. Business Sectors Covered In The Market Analysis Chapter

- 4.20.2. Company Profile

- 4.20.3. Company Financials

- 4.21. Ulvac

- 4.21.1. Business Sectors Covered In The Market Analysis Chapter

- 4.21.2. Company Profile

- 4.21.3. Company Financials

- 4.22. Wonik IPS

- 4.22.1. Business Sectors Covered In The Market Analysis Chapter

- 4.22.2. Company Profile

- 4.22.3. Company Financials

List of Tables

- 3.1. Worldwide Capital Spending

- 3.2. Wafer Front End (WFE) Market By Device Type

- 3.3. Top Semiconductor Equipment Revenues

- 3.4. Worldwide CVD Market Forecast

- 3.5. Worldwide CVD Market Shares

- 3.6. Worldwide PVD Market Forecast

- 3.7. Worldwide PVD Market Shares

- 3.8. Worldwide Dry Etch Market Forecast

- 3.9. Worldwide Dry Etch Market Shares

- 3.10. Worldwide RTP/Oxidation/Diffusion Market Forecast

- 3.11. Worldwide RTP/Oxidation/Diffusion Market Shares

- 3.12. Worldwide Silicon Epitaxy Market Forecast

- 3.13. Worldwide Silicon Epitaxy Market Shares

- 3.14. Worldwide CMP Market Forecast

- 3.15. Worldwide CMP Market Shares

- 3.16. Worldwide M&I Market Forecast

- 3.17. Worldwide M&I Market Shares

- 3.18. Worldwide Ion Implantation Market Forecast

- 3.19. Worldwide Ion Implantation Market Shares

List of Figures

- 3.1. Semiconductor vs Equipment vs GDP

- 3.2. Recession Cycle

- 3.3. Semiconductor Equipment Share

- 3.4. Worldwide CVD Market Shares

- 3.5. Worldwide PVD Market Shares

- 3.6. Worldwide Dry Etch Market Shares

- 3.7. Worldwide RTP/Oxidation/Diffusion Market Shares

- 3.8. Worldwide Silicon Epitaxy Market Shares

- 3.9. Worldwide CMP Market Shares

- 3.10. Worldwide M&I Market Shares

- 3.11. Worldwide Ion Implantation Market Shares