PUBLISHER: Industry Experts | PRODUCT CODE: 1421837

PUBLISHER: Industry Experts | PRODUCT CODE: 1421837

Global Hydroponics Market - System Types, Input Types and Crop Types

Report Synopsis

Scarcity of arable land, depleting water resources and migration of people from rural to urban areas in search of adequate livelihood are having a huge adverse impact on agriculture the world over. Coupled with these is the fact that population growth is continuing unabated and forests are being cut down to accommodate this growing mass of people, resulting in climate change. Even with these detrimental factors playing a vital role in decreased agricultural output, the use of open-field agriculture is widely prevalent worldwide, with no consideration given to thousands of acres becoming useless for farming. As a consequence, agriculturists are now being forced to adopt novel techniques to maintain a steady growth and supply of food sources, among which Hydroponics is a major one.

Aggregate Systems account for a Hydroponics market share of about 52% in 2023, globally, while Liquid Systems closely follows with 48% in the same year. Liquid Systems is anticipated to grow by a CAGR of 12.6% during the period 2023-2029 to reach US$12.4 billion almost equal to that of Aggregate Systems. The worldwide market for Hydroponics is expected to surpass US$14 billion in 2024 with Europe accounting for a lion's share of about 39%.

Research Findings & Coverage

- Global market for Hydroponics is analyzed in this report with respect to system types/sub-types, input types and crop types across major geographic regions and key countries

- Global market share analysis for Hydroponics is provided based on the segmentation mentioned above; and current market size estimations and revenue projections given for the analysis period through 2029

- The study discusses major growth trends, R&D, technology updates, statutory regulations and emerging applications of VIPs that influence the market growth, wherever applicable

- Key business trends focusing on product innovations/developments, capacity expansions, M&As, JVs and other recent industry developments by the major players

- The report includes 304 charts/data tables covering market numbers by segment and regions with graphical representation for each table

- Brief business profiles of major companies covered - 25

- The industry guide includes the contact details for 208 companies

Product Outline

The market for system types/sub-types of Hydroponics analyzed in this report includes:

- Aggregate Systems

- Drip Systems

- Ebb & Flow Systems

- Wick Systems

- Liquid (Non-Aggregate) Systems

- Aeroponics Systems

- Deep Water Culture (DWC) Systems

- Nutrient Film Technique (NFT) Systems

Global market for input types of Hydroponics explored in this study includes:

- Growth Media

- Nutrients

The market for crop types of Hydroponics analyzed in this report includes:

- Fruits & Flowers

- Herbs & Microgreens

- Vegetables

Analysis Period, Units and Growth Rates

The report reviews, analyzes and projects the global Hydroponics market for the period 2020-2029 in terms of market value in US$ and the compound annual growth rates (CAGRs) projected from 2023 through 2029.

Geographic Coverage

- North America (The United States, Canada and Mexico)

- Europe (France, Germany, Italy, Netherlands, Spain, United Kingdom and Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea and Rest of Asia-Pacific)

- South America (Argentina, Brazil and Rest of South America)

- Middle East & Africa

TABLE OF CONTENTS

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- 1.1. Product Outline

- 1.1.1. AN ALARMING SITUATION FOREBODED

- 1.1.2. AN INTRODUCTION TO HYDROPONICS

- 1.1.2.1. A Brief History of Hydroponics

- 1.1.2.2. Importance of the Hydroponic Method

- 1.1.2.2.1. Benefits of Hydroponics

- 1.1.2.2.2. Drawbacks of Hydroponics

- 1.1.3. HYDROPONIC SYSTEMS

- 1.1.3.1. Aggregate Systems

- 1.1.3.1.1. Drip System

- 1.1.3.1.2. Ebb & Flow System

- Wick System

- Liquid (Non-Aggregate) Systems

- Aeroponics System

- Deep Water Culture (DWC) System

- Nutrient Film Technique (NFT) System

- 1.1.3.1. Aggregate Systems

- 1.1.4. GROWING MEDIA (SUBSTRATES) USED IN HYDROPONICS

- 1.1.4.1. Rationale Behind Using a Substrate in Hydroponics

- 1.1.4.2. Perlite

- 1.1.4.3. Coconut Coir

- 1.1.4.4. Vermiculite

- 1.1.4.5. Rockwool

- 1.1.4.5.1. Properties, Benefits and Drawbacks of Rockwool as a Hydroponic Substrate

- 1.1.4.6. Expanded Clay Pellets

- 1.1.4.7. Oasis Cubes

- 1.1.4.8. Starter Plugs

- 1.1.4.9. Rice Hulls

- 1.1.4.10. Pumice

- 1.1.4.11. Growstones

- 1.1.4.12. Sawdust

- 1.1.4.13. Wood Chips/Fibers

- 1.1.4.14. Peat Moss

- 1.1.4.15. Sand

- 1.1.4.16. Gravel

- 1.1.4.17. Air

- 1.1.4.18. Expanded Shale

- 1.1.4.19. Lava Rocks

- 1.1.5. HYDROPONIC NUTRIENTS

- 1.1.5.1. Factors Playing Critical Roles in Hydroponic Plant Nutrition

- 1.1.5.1.1. pH

- 1.1.5.1.2. Electrical Conductivity

- 1.1.5.1.3. Temperature

- 1.1.5.1.4. Dissolved Oxygen Levels

- 1.1.5.2. What is Nutrient Antagonism?

- 1.1.5.3. Nutritional Problems in Hydroponic Plants

- 1.1.5.3.1. Soluble Salts Damage

- 1.1.5.3.2. Nitrogen Deficiency

- 1.1.5.3.3. Calcium Deficiency

- 1.1.5.3.4. Iron Deficiency

- 1.1.5.3.5. Magnesium Deficiency

- 1.1.5.3.6. Boron Toxicity

- 1.1.5.4. Managing the Nutrient Solution

- 1.1.5.1. Factors Playing Critical Roles in Hydroponic Plant Nutrition

2. KEY MARKET TRENDS

- 2.1. A Variety of Benefits Propel Demand for Nutrient Film Technique (NFT) in Liquid Hydroponics

- 2.2. Aggregate Hydroponic Systems Led by the Ebb & Flow Technique

- 2.3. IoT Being Widely Used to Monitor and Control Hydroponic Cultivation

- 2.4. Embedded Systems Based Hydroponics Further the Adoption of Hydroponics

3. KEY MARKET PLAYERS

- 3.1. Advanced Nutrients (United States)

- 3.2. AeroFarms (United States)

- 3.3. American Hydroponics, Inc. (AmHydro) (United States)

- 3.4. Controlled Environments Limited (Canada)

- Argus Control Systems Limited (Canada)

- 3.5. Badia Farms (UAE)

- 3.6. Bright Farms (United States)

- 3.7. Emerald Harvest (United States)

- 3.8. Freight Farms, Inc. (United States)

- 3.9. General Hydroponics, Inc. (United States)

- 3.10. Gotham Greens (United States)

- 3.11. GreenTech Agro LLC (United States)

- 3.12. Heliospectra AB (Sweden)

- 3.13. HortiMaX (Ridder) (Netherlands)

- 3.14. HydroGarden Ltd. (United Kingdom)

- 3.15. Hydrodynamics International, Inc. (United States)

- 3.16. Hydrofarm Holdings Group, Inc. (United States)

- 3.17. Hydroponic Systems International (Spain)

- 3.18. Infarm - Indoor Urban Farming GmbH (United Kingdom)

- 3.19. Logiqs BV (Netherlands)

- 3.20. Nature's Miracle (India)

- 3.21. The Scotts Miracle-Gro Company (United States)

- Hawthorne Gardening Company (United States)

- 3.22. Signify N.V. (Philips Lighting) (Netherlands)

- 3.23. Thanet Earth Ltd (United Kingdom)

- 3.24. Triton Foodworks Private Ltd (India)

- 3.25. Village Farms International Inc (United States)

4. KEY BUSINESS & PRODUCT TRENDS

- 4.1. October 2023

- 4.1.1. Advanced Nutrients Launches Novel Base Nutrient in Europe

- 4.1.2. Freight Farms and Agrinam Acquisition Corporation Enter Business Combination Agreement

- 4.1.3. Signify Launches Grow Light Offering Improved Stem Elongation

- 4.1.4. Gotham Greens' Novel Greenhouse in Georgia

- 4.1.5. Relocation of Ridder North America

- 4.2. September 2023

- 4.2.1. BrightFarms Establishes Strategic Alliances with Element Farms

- 4.3. August 2023

- 4.3.1. Gotham Greens' Novel Greenhouse in Colorado

- 4.3.2. Ridder North America to Improve Customer Service through Strategic Reorganization

- 4.4. July 2023

- 4.4.1. Relocation of Infarm Headquarters

- 4.5. June 2023

- 4.5.1. Freight Farms Joins Forces with Local Line

- 4.5.2. Limited Edition Mushroom Chocolate Launched by GrowLife Inc,'s Bridgetown Mushrooms

- 4.5.3. Rebranding of Advanced Nutrients' Bestselling Product

- 4.5.4. Ridder Announces Launch of Harvesting Robot

- 4.5.5. Hydrofarm Forges Strategic Alliance with CEA Advisors to Accelerate Expansion in Controlled Environment Agriculture

- 4.6. May 2023

- 4.6.1. AeroFarms Teams Up with Amazon Fresh

- 4.6.2. GrowGeneration Corp and GrowLife, Inc. Establish Multi-Year Partnership

- 4.7. April 2023

- 4.7.1. AeroFarms Expands Distribution in Texas, Now Available at H-E-B

- 4.7.2. AeroFarms' New Jersey Farm to Serve as Exclusive R&D Facility

- 4.8. February 2023

- 4.8.1. AeroFarms Unveils AeroFarms AgX in UAE

- 4.9. January 2023

- 4.9.1. GrowLife Completes Acquisition of Bridgetown Mushrooms

- 4.9.2. Gotham Greens' West Coast Expansion

- 4.9.3. Village Farms International Secures Exclusive Cannabis Supply Agreement in Israel

- 4.10. November 2022

- 4.10.1. Infarm Pioneers Indoor Wheat Production

- 4.10.2. Freight Farms Announces Series B3 Funding

- 4.11. October 2022

- 4.11.1. Hydroponic Systems to Launch HS Evolution Pot System at Fruit Attraction 2022

- 4.11.2. Signify Introduces Philips GreenPower TLF LED for North America

- 4.12. September 2022

- 4.12.1. CEL Group of Companies Acquired by Madison Industries

- 4.12.2. Freight Farms Joins Forces with Biosphere 2

- 4.12.3. Relocation of Ridder Canada Headquarters

- 4.12.4. Novel AeroFarms Facility in Danville, Virginia

- 4.13. August 2022

- 4.13.1. Hydrofarm and AG Gas Establish Strategic Alliances

- 4.14. July 2022

- 4.14.1. Signify Partners with Greenhouse System USA to Integrate Philips Horticulture LED Lighting

- 4.15. June 2022

- 4.15.1. Infarm Inaugurates Europe's Largest Vertical Farm

- 4.15.2. Infarm Commences Operations at Novel Growing Center in the United States

- 4.15.3. Infarm Joins Forces with Carbmee to Monitor CO2 Emissions

- 4.15.4. Infarm and IKEA Forge Strategic Alliances

- 4.16. May 2022

- 4.16.1. Signify Acquires Fluence from ams OSRAM

- 4.16.2. Village Farms International Collaborates with IUVO Therapeutics GmbH to Introduce Cannabis Products in Germany

- 4.16.3. Village Farms International Integrates Portfolios of Québec Subsidiaries

- 4.17. February 2022

- 4.17.1. Infarm Signs an Expansion Agreement with Coop Danmark

- 4.17.2. AeroFarms' Collaboration with FFAR and University of Florida

- 4.18. January 2022

- 4.18.1. Hydrofarm Joins Forces with AXEON Water Technologies

- 4.18.2. Infarm Announces Retail Partnership with Crisp

- 4.19. December 2021

- 4.19.1. Infarm Concludes Series D Funding Round for Global Expansion of Vertical Farms

- 4.20. November 2021

- 4.20.1. Village Farms International Acquires 70% Stake in ROSE LifeScience

- 4.20.2. Hydrofarm Acquires Innovative Growers Equipment, Inc.

- 4.21. October 2021

- 4.21.1. AeroFarms' Distribution Expansion with Stop & Shop

- 4.21.2. Infarm's Eastern European Expansion

- 4.21.3. AeroFarms Collaborates with Goose Island

5. GLOBAL MARKET OVERVIEW

- 5.1. Global Hydroponic Systems Market Overview by Type

- 5.1.1. Global Hydroponics Aggregate Systems Market Overview by Sub Type

- 5.1.2. Global Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 5.1.3. Aggregate Hydroponic Systems Market Overview by Global Region

- 5.1.3.1. Aggregate Hydroponic Systems Sub-Type Market Overview by Global Region

- 5.1.3.1.1. Hydroponic Drip Systems

- 5.1.3.1.2. Hydroponic Ebb & Flow Systems

- 5.1.3.1.3. Hydroponic Wick Systems

- 5.1.3.1. Aggregate Hydroponic Systems Sub-Type Market Overview by Global Region

- 5.1.4. Liquid (Non-Aggregate) Hydroponic Systems Market Overview by Global Region

- 5.1.4.1. Liquid (Non-Aggregate) Hydroponic Systems Sub-Type Market Overview by Global Region

- 5.1.4.1.1. Hydroponic Aeroponic Systems

- 5.1.4.1.2. Hydroponic Deep Water Culture (DWC) Systems

- 5.1.4.1.3. Hydroponic Nutrient Film Technique (NFT) Systems

- 5.1.4.1. Liquid (Non-Aggregate) Hydroponic Systems Sub-Type Market Overview by Global Region

- 5.2. Global Hydroponics Market Overview by Input Type

- 5.2.1. Hydroponics Input Type Market Overview by Global Region

- 5.2.1.1. Growth Media

- 5.2.1.2. Nutrients

- 5.2.1. Hydroponics Input Type Market Overview by Global Region

- 5.3. Global Hydroponics Market Overview by Crop Type

- 5.3.1. Global Hydroponics Crop Type Market Overview by Global Region

- 5.3.1.1. Fruits & Flowers

- 5.3.1.2. Herbs & Microgreens

- 5.3.1.3. Vegetables

- 5.3.1. Global Hydroponics Crop Type Market Overview by Global Region

PART B: REGIONAL MARKET PERSPECTIVE

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- 6.1. North American Hydroponics Market Overview by Geographic Region

- 6.2. North American Hydroponics Market Overview by System Type

- 6.2.1. North American Hydroponics Aggregate Systems Market Overview by Sub Type

- 6.2.2. North American Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 6.3. North American Hydroponics Market Overview by Input Type

- 6.4. North American Hydroponics Market Overview by Crop Type

- 6.5. Country-wise Analysis of North American Hydroponics Market

- 6.5.1. THE UNITED STATES

- 6.5.1.1. The US Market for Hydroponics Still to Deliver to its Potential

- 6.5.1.2. United States' Hydroponics Market Overview by System Type

- 6.5.1.2.1. United States' Hydroponics Aggregate Systems Market Overview by Sub Type

- 6.5.1.2.2. United States' Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 6.5.1.3. United States' Hydroponics Market Overview by Input Type

- 6.5.1.4. United States' Hydroponics Market Overview by Crop Type

- 6.5.2. CANADA

- 6.5.2.1. Government Incentives and Automated Techniques Propel Growth for Hydroponics in Canada

- 6.5.2.2. Canadian Hydroponics Market Overview by System Type

- 6.5.2.2.1. Canadian Hydroponics Aggregate Systems Market Overview by Sub Type

- 6.5.2.2.2. Canadian Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 6.5.2.3. Canadian Hydroponics Market Overview by Input Type

- 6.5.2.4. Canadian Hydroponics Market Overview by Crop Type

- 6.5.3. MEXICO

- 6.5.3.1. Local Mexican Produce a Favorite Among Hydroponic Growers

- 6.5.3.2. Mexican Hydroponics Market Overview by System Type

- 6.5.3.2.1. Mexican Hydroponics Aggregate Systems Market Overview by Sub Type

- 6.5.3.2.2. Mexican Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 6.5.3.3. Mexican Hydroponics Market Overview by Input Type

- 6.5.3.4. Mexican Hydroponics Market Overview by Crop Type

- 6.5.1. THE UNITED STATES

7. EUROPE

- 7.1. European Hydroponics Market Overview by Geographic Region

- 7.2. European Hydroponics Market Overview by System Type

- 7.3.1. European Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.3.2. European Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.3. European Hydroponics Market Overview by Input Type

- 7.4. European Hydroponics Market Overview by Crop Type

- 7.5. Country-wise Analysis of European Hydroponics Market

- 7.5.1. FRANCE

- 7.5.1.1. Urban Agriculture Focus of Hydroponics in France

- 7.5.1.2. French Hydroponics Market Overview by System Type

- 7.5.1.2.1. French Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.1.2.2. French Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.1.3. French Hydroponics Market Overview by Input Type

- 7.5.1.4. French Hydroponics Market Overview by Crop Type

- 7.5.2. GERMANY

- 7.5.2.1. German Market for Aeroponics Quite Robust

- 7.5.2.2. German Hydroponics Market Overview by System Type

- 7.5.2.2.1. German Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.2.2.2. German Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.2.3. German Hydroponics Market Overview by Input Type

- 7.5.2.4. German Hydroponics Market Overview by Crop Type

- 7.5.3. ITALY

- 7.5.3.1. Vertical Farming Much in Demand in Italy

- 7.5.3.2. Italian Hydroponics Market Overview by System Type

- 7.5.3.2.1. Italian Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.3.2.2. Italian Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.3.3. Italian Hydroponics Market Overview by Input Type

- 7.5.3.4. Italian Hydroponics Market Overview by Crop Type

- 7.5.4. THE NETHERLANDS

- 7.5.4.1. Hydroponics a Much Sought After Means to Grow Crops in the Netherlands

- 7.5.4.2. Dutch Hydroponics Market Overview by System Type

- 7.5.4.2.1. Dutch Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.4.2.2. Dutch Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.4.3. Dutch Hydroponics Market Overview by Input Type

- 7.5.4.4. Dutch Hydroponics Market Overview by Crop Type

- 7.5.5. SPAIN

- 7.5.5.1. Shift from Soil to Soilless Farming Still a Work-In-Progress in Spain

- 7.5.5.2. Spanish Hydroponics Market Overview by System Type

- 7.5.5.2.1. Spanish Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.5.2.2. Spanish Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.5.3. Spanish Hydroponics Market Overview by Input Type

- 7.5.5.4. Spanish Hydroponics Market Overview by Crop Type

- 7.5.6. THE UNITED KINGDOM

- 7.5.6.1. Steady Demand for Hydroponics Predicted in the United Kingdom

- 7.5.6.2. United Kingdom Hydroponics Market Overview by System Type

- 7.5.6.2.1. United Kingdom Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.6.2.2. United Kingdom Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.6.3. United Kingdom Hydroponics Market Overview by Input Type

- 7.5.6.4. United Kingdom Hydroponics Market Overview by Crop Type

- 7.5.7. REST OF EUROPE

- 7.5.7.1. Rest of Europe Hydroponics Market Overview by System Type

- 7.5.7.1.1. Rest of Europe Hydroponics Aggregate Systems Market Overview by Sub Type

- 7.5.7.1.2. Rest of Europe Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 7.5.7.2. Rest of Europe Hydroponics Market Overview by Input Type

- 7.5.7.3. Rest of Europe Hydroponics Market Overview by Crop Type

- 7.5.7.1. Rest of Europe Hydroponics Market Overview by System Type

- 7.5.1. FRANCE

8. ASIA-PACIFIC

- 8.1. Asia-Pacific Hydroponics Market Overview by Geographic Region

- 8.2. Asia-Pacific Hydroponics Market Overview by System Type

- 8.2.1. Asia-Pacific Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.2.2. Asia-Pacific Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.3. Asia-Pacific Hydroponics Market Overview by Input Type

- 8.4. Asia-Pacific Hydroponics Market Overview by Crop Type

- 8.5. Country-wise Analysis of Asia-Pacific Hydroponics Market

- 8.5.1. CHINA

- 8.5.1.1. Reasons Galore for China to Adopt Hydroponics

- 8.5.1.2. Chinese Hydroponics Market Overview by System Type

- 8.5.1.2.1. Chinese Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.5.1.2.2. Chinese Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.5.1.3. Chinese Hydroponics Market Overview by Input Type

- 8.5.1.4. Chinese Hydroponics Market Overview by Crop Type

- 8.5.2. INDIA

- 8.5.2.1. Hydroponic Farming in India Highly Timely and Advantageous

- 8.5.2.2. Indian Hydroponics Market Overview by System Type

- 8.5.2.2.1. Indian Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.5.2.2.2. Indian Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.5.2.3. Indian Hydroponics Market Overview by Input Type

- 8.5.2.4. Indian Hydroponics Market Overview by Crop Type

- 8.5.3. JAPAN

- 8.5.3.1. Japan's Adoption of Hydroponics Beset by Several Issues

- 8.5.3.2. Japanese Hydroponics Market Overview by System Type

- 8.5.3.2.1. Japanese Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.5.3.2.2. Japanese Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.5.3.3. Japanese Hydroponics Market Overview by Input Type

- 8.5.3.4. Japanese Hydroponics Market Overview by Crop Type

- 8.5.4. SOUTH KOREA

- 8.5.4.1. Vegetable Production Dominates South Korea's Hydroponics Sector

- 8.5.4.2. South Korean Hydroponics Market Overview by System Type

- 8.5.4.2.1. South Korean Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.5.4.2.2. South Korean Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.5.4.3. South Korean Hydroponics Market Overview by Input Type

- 8.5.4.4. South Korean Hydroponics Market Overview by Crop Type

- 8.5.5. REST OF ASIA-PACIFIC

- 8.5.5.1. Rest of Asia-Pacific Hydroponics Market Overview by System Type

- 8.5.5.1.1. Rest of Asia-Pacific Hydroponics Aggregate Systems Market Overview by Sub Type

- 8.5.5.1.2. Rest of Asia-Pacific Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 8.5.5.2. Rest of Asia-Pacific Hydroponics Market Overview by Input Type

- 8.5.5.3. Rest of Asia-Pacific Hydroponics Market Overview by Crop Type

- 8.5.5.1. Rest of Asia-Pacific Hydroponics Market Overview by System Type

- 8.5.1. CHINA

9. SOUTH AMERICA

- 9.1. South American Hydroponics Market Overview by Geographic Region

- 9.2. South American Hydroponics Market Overview by System Type

- 9.2.1. South American Hydroponics Aggregate Systems Market Overview by Sub Type

- 9.2.2. South American Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 9.3. South American Hydroponics Market Overview by Input Type

- 9.4. South American Hydroponics Market Overview by Crop Type

- 9.5. Country-wise Analysis of South American Hydroponics Market

- 9.5.1. ARGENTINA

- 9.5.1.1. Hydroponics Technology on a Growth Trajectory in Argentina

- 9.5.1.2. Argentine Hydroponics Market Overview by System Type

- 9.5.1.2.1. Argentine Hydroponics Aggregate Systems Market Overview by Sub Type

- 9.5.1.2.2. Argentine Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 9.5.1.3. Argentine Hydroponics Market Overview by Input Type

- 9.5.1.4. Argentine Hydroponics Market Overview by Crop Type

- 9.5.2. BRAZIL

- 9.5.2.1. NFT Leads Hydroponic Farming in Brazil

- 9.5.2.2. Brazilian Hydroponics Market Overview by System Type

- 9.5.2.2.1. Brazilian Hydroponics Aggregate Systems Market Overview by Sub Type

- 9.5.2.2.2. Brazilian Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 9.5.2.3. Brazilian Hydroponics Market Overview by Input Type

- 9.5.2.4. Brazilian Hydroponics Market Overview by Crop Type

- 9.5.3. REST OF SOUTH AMERICA

- 9.5.3.1. Rest of South American Hydroponics Market Overview by System Type

- 9.5.3.1.1. Rest of South American Hydroponics Aggregate Systems Market Overview by Sub Type

- 9.5.3.1.2. Rest of South American Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 9.5.3.2. Rest of South American Hydroponics Market Overview by Input Type

- 9.5.3.3. Rest of South American Hydroponics Market Overview by Crop Type

- 9.5.3.1. Rest of South American Hydroponics Market Overview by System Type

- 9.5.1. ARGENTINA

10. MIDDLE EAST & AFRICA

- 10.1. Hydroponics a Feasible Alternative to Grow Crops in the Middle East

- 10.2. Hydroponics Offers a Means of Reviving Africa's Agricultural Sector

- 10.3. Middle East & Africa Hydroponics Market Overview by System Type

- 10.3.1. Middle East & Africa Hydroponics Aggregate Systems Market Overview by Sub Type

- 10.3.2. Middle East & Africa Hydroponics Liquid (Non-Aggregate) Systems Market Overview by Sub Type

- 10.4. Middle East & Africa Hydroponics Market Overview by Input Type

- 10.5. Middle East & Africa Hydroponics Market Overview by Crop Type

PART C: GUIDE TO THE INDUSTRY

- 1. NORTH AMERICA

- 2. EUROPE

- 3. ASIA-PACIFIC

- 4. REST OF WORLD

PART D: ANNEXURE

- 1. RESEARCH METHODOLOGY

- 2. FEEDBACK

Charts & Graphs

- Chart 1: Global Hydroponics Market (2023 & 2029) by System Type

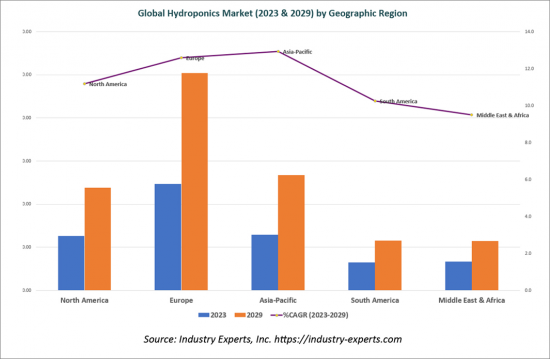

- Chart 2: Global Hydroponics Market (2023 & 2029) by Geographic Region

- Chart 3: Global Hydroponics Market (2023 & 2029) by Input Type

- Chart 4: Global Hydroponics Market (2023 & 2029) by Crop Type

- Chart 5: Global Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 6: Global Hydroponic Systems Market Analysis (2020-2029) by Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 7: Glance at 2020, 2023 and 2029 Global Hydroponic Systems Market Share (%) by Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 8: Global Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 9: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 10: Global Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 11: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 12: Global Aggregate Hydroponic Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 13: Glance at 2020, 2023 and 2029 Global Aggregate Hydroponic Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 14: Global Hydroponic Drip Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 15: Glance at 2020, 2023 and 2029 Global Hydroponic Drip Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 16: Global Hydroponic Ebb & Flow Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 17: Glance at 2020, 2023 and 2029 Global Hydroponic Ebb & Flow Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 18: Global Hydroponic Wick Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 19: Glance at 2020, 2023 and 2029 Global Hydroponic Wick Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 20: Global Liquid (Non-Aggregate) Hydroponic Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 21: Glance at 2020, 2023 and 2029 Global Liquid (Non-Aggregate) Hydroponic Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 22: Global Hydroponic Aeroponic Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 23: Glance at 2020, 2023 and 2029 Global Hydroponic Aeroponic Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 24: Global Hydroponic Deep Water Culture (DWC) Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 25: Glance at 2020, 2023 and 2029 Global Hydroponic Deep Water Culture (DWC) Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 26: Global Hydroponic Nutrient Film Technique (NFT) Systems Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 27: Glance at 2020, 2023 and 2029 Global Hydroponic Nutrient Film Technique (NFT) Systems Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 28: Global Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 29: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 30: Global Hydroponics Market Analysis (2020-2029) of Growth Media by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 31: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) of Growth Media by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 32: Global Hydroponics Market Analysis (2020-2029) of Nutrients by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 33: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) of Nutrients by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 34: Global Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 35: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

- Chart 36: Global Hydroponics Market Analysis (2020-2029) in Cultivation of Fruits & Flowers by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 37: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) in Cultivation of Fruits & Flowers Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 38: Global Hydroponics Market Analysis (2020-2029) in Cultivation of Herbs & Microgreens by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 39: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) in Cultivation of Herbs & Microgreens Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 40: Global Hydroponics Market Analysis (2020-2029) in Cultivation of Vegetables by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 41: Glance at 2020, 2023 and 2029 Global Indoor Air Quality (IAQ) Equipment Market Share (%) in Residential Buildings by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 42: Global Hydroponics Market Analysis (2020-2029) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in USD Million

- Chart 43: Glance at 2020, 2023 and 2029 Global Hydroponics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

REGIONAL MARKET OVERVIEW

NORTH AMERICA

- Chart 44: North American Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 45: North American Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) by Geographic Region - United States, Canada and Mexico in USD Million

- Chart 46: Glance at 2020, 2023 and 2029 North American Hydroponic Systems, Growth Media & Nutrients Market Share (%) by Geographic Region - United States, Canada and Mexico

- Chart 47: North American Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 48: Glance at 2020, 2023 and 2029 North American Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 49: North American Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 50: Glance at 2020, 2023 and 2029 North American Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 51: North American Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 52: Glance at 2020, 2023 and 2029 North American Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 53: North American Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 54: Glance at 2020, 2023 and 2029 North American Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 55: North American Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 56: Glance at 2020, 2023 and 2029 North American Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

THE UNITED STATES

- Chart 57: United States' Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 58: United States' Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 59: Glance at 2020, 2023 and 2029 United States' Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 60: United States' Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 61: Glance at 2020, 2023 and 2029 United States' Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 62: United States' Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 63: Glance at 2020, 2023 and 2029 United States' Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 64: United States' Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 65: Glance at 2020, 2023 and 2029 United States' Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 66: United States' Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 67: Glance at 2020, 2023 and 2029 United States' Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

CANADA

- Chart 68: Canadian Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 69: Canadian Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 70: Glance at 2020, 2023 and 2029 Canadian Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 71: Canadian Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 72: Glance at 2020, 2023 and 2029 Canadian Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 73: Canadian Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 74: Glance at 2020, 2023 and 2029 Canadian Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 75: Canadian Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 76: Glance at 2020, 2023 and 2029 Canadian Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 77: Canadian Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 78: Glance at 2020, 2023 and 2029 Canadian Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

MEXICO

- Chart 79: Mexican Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 80: Mexican Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 81: Glance at 2020, 2023 and 2029 Mexican Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 82: Mexican Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 83: Glance at 2020, 2023 and 2029 Mexican Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 84: Mexican Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 85: Glance at 2020, 2023 and 2029 Mexican Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 86: Mexican Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 87: Glance at 2020, 2023 and 2029 Mexican Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 88: Mexican Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 89: Glance at 2020, 2023 and 2029 Mexican Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

EUROPE

- Chart 90: European Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 91: European Hydroponics Market Analysis (2020-2029) by Geographic Region - France, Germany, Italy, Netherlands, Spain, United Kingdom and Rest of Europe in USD Million

- Chart 92: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by Geographic Region - France, Germany, Italy, Netherlands, Spain, United Kingdom and Rest of Europe

- Chart 93: European Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 94: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 95: European Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 96: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 97: European Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 98: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 99: European Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 100: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 101: European Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 102: Glance at 2020, 2023 and 2029 European Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

FRANCE

- Chart 103: French Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 104: French Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 105: Glance at 2020, 2023 and 2029 French Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 106: French Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 107: Glance at 2020, 2023 and 2029 French Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 108: French Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 109: Glance at 2020, 2023 and 2029 French Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 110: French Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 111: Glance at 2020, 2023 and 2029 French Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 112: French Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 113: Glance at 2020, 2023 and 2029 French Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

GERMANY

- Chart 114: German Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 115: German Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 116: Glance at 2020, 2023 and 2029 German Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 117: German Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 118: Glance at 2020, 2023 and 2029 German Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 119: German Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 120: Glance at 2020, 2023 and 2029 German Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 121: German Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 122: Glance at 2020, 2023 and 2029 German Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 123: German Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 124: Glance at 2020, 2023 and 2029 German Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

ITALY

- Chart 125: Italian Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 126: Italian Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 127: Glance at 2020, 2023 and 2029 Italian Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 128: Italian Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 129: Glance at 2020, 2023 and 2029 Italian Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 130: Italian Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 131: Glance at 2020, 2023 and 2029 Italian Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 132: Italian Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 133: Glance at 2020, 2023 and 2029 Italian Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 134: Italian Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 135: Glance at 2020, 2023 and 2029 Italian Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

THE NETHERLANDS

- Chart 136: Dutch Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 137: Dutch Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 138: Glance at 2020, 2023 and 2029 Dutch Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 139: Dutch Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 140: Glance at 2020, 2023 and 2029 Dutch Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 141: Dutch Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 142: Glance at 2020, 2023 and 2029 Dutch Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 143: Dutch Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 144: Glance at 2020, 2023 and 2029 Dutch Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 145: Dutch Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 146: Glance at 2020, 2023 and 2029 Dutch Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

SPAIN

- Chart 147: Spanish Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 148: Spanish Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 149: Glance at 2020, 2023 and 2029 Spanish Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 150: Spanish Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 151: Glance at 2020, 2023 and 2029 Spanish Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 152: Spanish Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 153: Glance at 2020, 2023 and 2029 Spanish Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 154: Spanish Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 155: Glance at 2020, 2023 and 2029 Spanish Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 156: Spanish Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 157: Glance at 2020, 2023 and 2029 Spanish Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

THE UNITED KINGDOM

- Chart 158: United Kingdom Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 159: United Kingdom Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 160: Glance at 2020, 2023 and 2029 United Kingdom Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 161: United Kingdom Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 162: Glance at 2020, 2023 and 2029 United Kingdom Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 163: United Kingdom Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 164: Glance at 2020, 2023 and 2029 United Kingdom Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 165: United Kingdom Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 166: Glance at 2020, 2023 and 2029 United Kingdom Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 167: United Kingdom Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 168: Glance at 2020, 2023 and 2029 United Kingdom Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

REST OF EUROPE

- Chart 169: Rest of Europe Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 170: Rest of Europe Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 171: Glance at 2020, 2023 and 2029 Rest of Europe Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 172: Rest of Europe Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 173: Glance at 2020, 2023 and 2029 Rest of Europe Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 174: Rest of Europe Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 175: Glance at 2020, 2023 and 2029 Rest of Europe Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 176: Rest of Europe Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 177: Glance at 2020, 2023 and 2029 Rest of Europe Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 178: Rest of Europe Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 179: Glance at 2020, 2023 and 2029 Rest of Europe Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

ASIA-PACIFIC

- Chart 180: Asia-Pacific Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 181: Asia-Pacific Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) by Geographic Region - China, India, Japan, South Korea and Rest of Asia-Pacific in USD Million

- Chart 182: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponic Systems, Growth Media & Nutrients Equipment Market Share (%) by Geographic Region - China, India, Japan, South Korea and Rest of Asia-Pacific

- Chart 183: Asia-Pacific Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 184: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 185: Asia-Pacific Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 186: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 187: Asia-Pacific Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 188: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 189: Asia-Pacific Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 190: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 191: Asia-Pacific Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 192: Glance at 2020, 2023 and 2029 Asia-Pacific Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

CHINA

- Chart 193: Chinese Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 194: Chinese Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 195: Glance at 2020, 2023 and 2029 Chinese Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 196: Chinese Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 197: Glance at 2020, 2023 and 2029 Chinese Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 198: Chinese Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 199: Glance at 2020, 2023 and 2029 Chinese Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 200: Chinese Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 201: Glance at 2020, 2023 and 2029 Chinese Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 202: Chinese Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 203: Glance at 2020, 2023 and 2029 Chinese Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

INDIA

- Chart 204: Indian Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 205: Indian Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 206: Glance at 2020, 2023 and 2029 Indian Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 207: Indian Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 208: Glance at 2020, 2023 and 2029 Indian Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 209: Indian Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 210: Glance at 2020, 2023 and 2029 Indian Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 211: Indian Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 212: Glance at 2020, 2023 and 2029 Indian Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 213: Indian Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 214: Glance at 2020, 2023 and 2029 Indian Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

JAPAN

- Chart 215: Japanese Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 216: Japanese Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 217: Glance at 2020, 2023 and 2029 Japanese Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 218: Japanese Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 219: Glance at 2020, 2023 and 2029 Japanese Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 220: Japanese Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 221: Glance at 2020, 2023 and 2029 Japanese Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 222: Japanese Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 223: Glance at 2020, 2023 and 2029 Japanese Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 224: Japanese Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 225: Glance at 2020, 2023 and 2029 Japanese Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

SOUTH KOREA

- Chart 226: South Korean Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 227: South Korean Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 228: Glance at 2020, 2023 and 2029 South Korean Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 229: South Korean Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 230: Glance at 2020, 2023 and 2029 South Korean Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 231: South Korean Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 232: Glance at 2020, 2023 and 2029 South Korean Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 233: South Korean Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 234: Glance at 2020, 2023 and 2029 South Korean Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 235: South Korean Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 236: Glance at 2020, 2023 and 2029 South Korean Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

REST OF ASIA-PACIFIC

- Chart 237: Rest of Asia-Pacific Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 238: Rest of Asia-Pacific Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 239: Glance at 2020, 2023 and 2029 Rest of Asia-Pacific Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 240: Rest of Asia-Pacific Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 241: Glance at 2020, 2023 and 2029 Rest of Asia-Pacific Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 242: Rest of Asia-Pacific Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 243: Glance at 2020, 2023 and 2029 Rest of Asia-Pacific Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 244: Rest of Asia-Pacific Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 245: Glance at 2020, 2023 and 2029 Rest of Asia-Pacific Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 246: Rest of Asia-Pacific Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 247: Glance at 2020, 2023 and 2029 Rest of Asia-Pacific Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

SOUTH AMERICA

- Chart 248: South American Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 249: South American Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) by Geographic Region - Argentina, Brazil and Rest of South America in USD Million

- Chart 250: Glance at 2020, 2023 and 2029 South American Hydroponic Systems, Growth Media & Nutrients Market Share (%) by Geographic Region - Argentina, Brazil and Rest of South America

- Chart 251: South American Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 252: Glance at 2020, 2023 and 2029 South American Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 253: South American Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 254: Glance at 2020, 2023 and 2029 South American Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 255: South American Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 256: Glance at 2020, 2023 and 2029 South American Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 257: South American Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 258: Glance at 2020, 2023 and 2029 South American Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 259: South American Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 260: Glance at 2020, 2023 and 2029 South American Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

ARGENTINA

- Chart 261: Argentine Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 262: Argentine Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 263: Glance at 2020, 2023 and 2029 Argentine Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 264: Argentine Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 265: Glance at 2020, 2023 and 2029 Argentine Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 266: Argentine Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 267: Glance at 2020, 2023 and 2029 Argentine Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 268: Argentine Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 269: Glance at 2020, 2023 and 2029 Argentine Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 270: Argentine Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 271: Glance at 2020, 2023 and 2029 Argentine Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

BRAZIL

- Chart 272: Brazilian Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 273: Brazilian Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 274: Glance at 2020, 2023 and 2029 Brazilian Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 275: Brazilian Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 276: Glance at 2020, 2023 and 2029 Brazilian Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 277: Brazilian Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 278: Glance at 2020, 2023 and 2029 Brazilian Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 279: Brazilian Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 280: Glance at 2020, 2023 and 2029 Brazilian Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 281: Brazilian Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 282: Glance at 2020, 2023 and 2029 Brazilian Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

REST OF SOUTH AMERICA

- Chart 283: Rest of South American Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 284: Rest of South American Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 285: Glance at 2020, 2023 and 2029 Rest of South American Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 286: Rest of South American Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 287: Glance at 2020, 2023 and 2029 Rest of South American Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 288: Rest of South American Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 289: Glance at 2020, 2023 and 2029 Rest of South American Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 290: Rest of South American Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 291: Glance at 2020, 2023 and 2029 Rest of South American Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 292: Rest of South American Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 293: Glance at 2020, 2023 and 2029 Rest of South American Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

MIDDLE EAST & AFRICA

- Chart 294: Middle East & Africa Hydroponic Systems, Growth Media & Nutrients Market Analysis (2020-2029) in USD Million

- Chart 295: Middle East & Africa Hydroponics Market Analysis (2020-2029) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems in USD Million

- Chart 296: Glance at 2020, 2023 and 2029 Middle East & Africa Hydroponics Market Share (%) by System Type - Aggregate Systems and Liquid (Non-Aggregate) Systems

- Chart 297: Middle East & Africa Hydroponics Market Analysis (2020-2029) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems in USD Million

- Chart 298: Glance at 2020, 2023 and 2029 Middle East & Africa Hydroponics Market Share (%) by Aggregate Sub-System Type - Drip Systems, Ebb & Flow Systems and Wick Systems

- Chart 299: Middle East & Africa Hydroponics Market Analysis (2020-2029) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems in USD Million

- Chart 300: Glance at 2020, 2023 and 2029 Middle East & Africa Hydroponics Market Share (%) by Liquid (Non-Aggregate) Sub-System Type - Aeroponics Systems, Deep Water Culture (DWC) Systems and Nutrient Film Technique (NFT) Systems

- Chart 301: Middle East & Africa Hydroponics Market Analysis (2020-2029) by Input Type - Growth Media and Nutrients in USD Million

- Chart 302: Glance at 2020, 2023 and 2029 Middle East & Africa Hydroponics Market Share (%) by Input Type - Growth Media and Nutrients

- Chart 303: Middle East & Africa Hydroponics Market Analysis (2020-2029) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables in USD Million

- Chart 304: Glance at 2020, 2023 and 2029 Middle East & Africa Hydroponics Market Share (%) by Crop Type - Fruits & Flowers, Herbs & Microgreens and Vegetables

Figures:

- Figure 1: Drip System in Hydroponics

- Figure 2: Ebb & Flow System in Hydroponics

- Figure 3: Ebb & Flow Flooding Tray Design

- Figure 4: Ebb & Flow Overflow Tube Height System

- Figure 5: Surge Tank Ebb & Flow System

- Figure 6: Ebb & Flow Dutch Bucket System

- Figure 7: Wick System in Hydroponics

- Figure 8: Aeroponic System in Hydroponics

- Figure 9: Deep Water Culture (DWC) System in Hydroponics

- Figure 10: Bubbleponics System

- Figure 11: Kratky System

- Figure 12: Recirculating Deep Water Culture (RDWC) System

- Figure 13: Nutrient Film Technique (NFT) System in Hydroponics

- Figure 14: Classification of Various Substrate Types Used in Hydroponics

Tables:

- Table 1: Critical Historical Occurrences in Hydroponics from Ancient Times to Present

- Table 2: Plants Most Suited for Hydroponic Cultivation Techniques

- Table 3: Approximate Content of Essential Nutrients in Plants, their Roles and Available Sources

- Table 4: Optimum pH Ranges for Hydroponically Grown Crops

- Table 5: Optimum Electrical Conductivity Levels for Hydroponically Grown Crops

- Table 6: Solubility of Oxygen in Pure Water at Various Temperatures