PUBLISHER: Industry Experts | PRODUCT CODE: 1820665

PUBLISHER: Industry Experts | PRODUCT CODE: 1820665

Global AI Consulting and Support Services Market - Service Types, Company Types and Industry Sectors

AI Consulting and Support Services Market Trends and Outlook

AI Consulting and Support Services cover a specialized set of advisory and technical services, allowing organizations to strategically adopt, implement and maintain artificial intelligence (AI) technologies for enhancing their operations, decision-making and overall business objectives. AI Consulting Services offer expert guidance to businesses at different stages of their AI journey, ranging from initial strategy to deployment and integration. Major aspects include assessment & analytics, development of AI strategy, designing & implementing solutions, preparing & managing data, selecting & developing AI models, AI governance & ethics and training & education. The focus of AI Support Services, parallelly, is on monitoring & optimization, troubleshooting & resolution of issues, maintenance & updates, scalability & reliability, enhancement of performance and knowledge transfer. Essentially, whereas AI Consulting is concerned with providing a working AI solution, AI Support's task is to make sure that that solution continues to perform optimally and evolve with specific organizational requirements.

INFOGRAPHICS

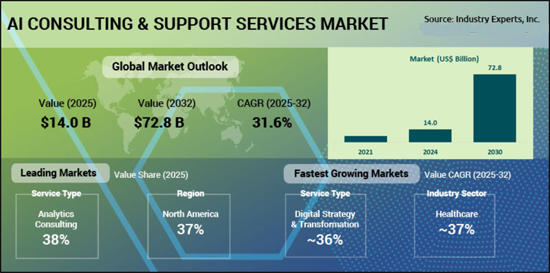

The global AI Consulting and Support Services market, valued at US$14 billion in 2024, is forecast to expand at a CAGR of 31.6% during 2024-2030 to reach US$72.8 billion by 2030. AI adoption is accelerating across sectors such as healthcare, finance, retail, and manufacturing, driven by automation, competitive differentiation, and enhanced customer experience. Nearly 70% of global businesses are already implementing or planning AI integration as part of digital transformation, creating strong demand for consulting and support expertise. Rising volumes of structured and unstructured data are amplifying the need for advisory services to generate actionable insights and manage silos. Large-scale investments, including the EU's US$1 billion AI Innovation Fund and India's US$7 billion India AI Mission, are further boosting demand. Increasing focus on ethical deployment and compliance with data privacy regulations is prompting companies to engage consultants, especially since around 37% cite lack of in-house expertise as a key barrier.

AI Consulting and Support Services Regional Market Analysis

North America leads the global market with a 36.8% share in 2024. The United States, home to major AI innovators such as Google, Microsoft, and IBM, benefits from advanced infrastructure, cloud penetration, and strict privacy laws like the CCPA that reinforce demand for consulting services. High adoption levels across BFSI, healthcare, and retail further underpin the region's leadership. Asia-Pacific is poised to record the fastest CAGR of 36.9% between 2024 and 2030, fueled by rapid digital transformation in China, India, Singapore, and beyond. Government funding, vibrant tech hubs, and strong AI talent pools are supporting aggressive adoption in manufacturing, finance, and e-commerce. Consulting firms are increasingly sought to deliver scalable, localized solutions, ensure compliance with emerging AI regulations, and enable SMEs and startups to implement AI affordably.

AI Consulting and Support Services Market Analysis by Service Type

Analytics Consulting is the largest service type, representing 38.1% of the global market in 2024. Its strength lies in enabling businesses to derive actionable insights through predictive analytics, ML, and big data, while optimizing processes and customer engagement. Digital Strategy & Transformation is forecast to be the fastest-growing service, registering a CAGR of 36.2% between 2024 and 2030. Demand is fueled by the need for end-to-end integration of AI into business functions, helping organizations realign models, processes, and customer experiences around AI.

AI Consulting and Support Services Market Analysis by Company Type

Large Enterprises dominate with a 63.1% share in 2024, supported by greater budgets, complex global operations, and strong partnerships with leading consultancies like Accenture, Deloitte, and IBM. Their need for scalable, compliant AI strategies sustains leadership. SMEs, however, are expected to post a rapid CAGR of 35.9% through 2030, driven by accessible cloud-based AI tools, agility in adoption, and tailored consulting packages. Government support programs and AIaaS models are further enabling SMEs to leverage AI without heavy upfront investment.

AI Consulting and Support Services Market Analysis by Industry Sector

BFSI is the largest sector, with a 22.1% share in 2024. The industry leverages AI for fraud detection, risk management, automation, and hyper-personalized financial services. Healthcare is forecast to expand the fastest, with a CAGR of 36.6% during 2024-2030, as consulting services become critical for managing massive healthcare datasets, deploying predictive models, integrating AI decision support systems, and ensuring regulatory compliance. Telemedicine and remote monitoring adoption post-COVID-19 is also boosting consulting demand.

AI Consulting and Support Services Market Report Scope

This global report on AI Consulting and Support Services analyzes the global and regional markets based on Service Type, Company Type and Industry Sector for the period 2021-2030 with projections from 2024-2030 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

| Key Metrics | |

|---|---|

| Analysis Period: | 2021-2030 |

| Base Year: | 2024 |

| Forecast Period: | 2024-2030 |

| Units: | Value market in US$ |

| Companies Mentioned: | 25+ |

AI Consulting and Support Services Market by Geographic Region:

- North America (United States, Canada and Mexico)

- Europe (Germany, United Kingdom, France, Italy, Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

AI Consulting and Support Services Market by Service Type:

- Analytics Consulting

- Automation Consulting

- Digital Strategy & Transformation

- Application Development

- Cognitive Integration

AI Consulting and Support Services Market by Company Type

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

AI Consulting and Support Services Market by Industry Sector

- BFSI (Banking, Financial Services, Insurance)

- IT & Telecom

- Manufacturing

- Government

- Healthcare

- Retail & Ecommerce

- Energy & Utilities

- Transportation

- Education

- Others

Major Companies:

|

|

TABLE OF CONTENTS

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- 1.1. A Roundup on AI Consulting and Support Services

- 1.1.1. Market Segmentation for AI Consulting and Support Services

- 1.1.1.1. Service Types

- 1.1.1.2. Company Types

- 1.1.1.3. Industry Sectors

- 1.1.1. Market Segmentation for AI Consulting and Support Services

2. INDUSTRY LANDSCAPE

- 2.1. Industry Structure and Evolution

- 2.1.1. Market Evolution Phases at a Glance

- 2.2. AI Consulting and Support Services Market Outlook

- 2.2.1. Key Outlook Highlights Through 2030

- 2.3. Comprehensive Industry Analysis: Growth Drivers and Inhibitors

- 2.3.1. Market Growth Drivers

- 2.3.1.1. Generative AI Surge

- 2.3.1.2. Enterprise-Scale Adoption

- 2.3.1.3. Cloud AI Platform Maturity

- 2.3.1.4. Advancements in MLOps and Lifecycle Tools

- 2.3.1.5. Regulatory and Responsible AI Pressure

- 2.3.1.6. ROI and Productivity Focus

- 2.3.1.7. Democratization for SMEs

- 2.3.1.8. Talent Gaps and Outsourcing

- 2.3.1.9. Competitive Dynamics and Specialization

- 2.3.2. Market Growth Inhibitors

- 2.3.2.1. ROI Uncertainty and Pilot Fatigue

- 2.3.2.2. High Infrastructure and Compute Costs

- 2.3.2.3. Tooling Fragmentation

- 2.3.2.4. Data Quality and Readiness Issues

- 2.3.2.5. Regulatory Complexity and Ambiguity

- 2.3.2.6. Talent Retention Challenges

- 2.3.2.7. Resistance to Change and Workforce Pushback

- 2.3.2.8. Vendor Lock-In Risk

- 2.3.2.9. Security and Intellectual Property Risks

- 2.3.2.10. Market Saturation and Commoditization

- 2.3.1. Market Growth Drivers

- 2.4. Market Entry Strategies for AI Consulting Industry

- 2.4.1. Building Local Collaborations

- 2.4.2. Establishing New Operations

- 2.4.3. Acquiring Local Businesses

- 2.4.4. Leveraging Licensing & Brand Agreements

- 2.5. Barriers to Market Entry

- 2.5.1. Technology-Driven Vulnerabilities

- 2.5.2. Human Capital Pressures

- 2.5.3. Competitive Strain

- 2.5.4. Policy and Compliance Hurdles

- 2.5.5. Financial and Operational Strains

- 2.5.6. Infrastructure and Ecosystem Risks

- 2.6. Startup Standpoint: AI Consulting and Support Services Market

- 2.6.1. Emerging Startup Profiles

- 2.6.2. Capital and Funding Momentum

- 2.6.3. Startup Revenue Approaches

- 2.6.4. Regional Startup Hotspots

- 2.6.5. Untapped Growth Niches

- 2.6.6. Roadblocks to Scaling

- 2.7. Strategic Industry Analysis: AI Consulting and Support Services

- 2.7.1. SWOT Analysis

- 2.7.1.1. Strengths

- 2.7.1.2. Weaknesses

- 2.7.1.3. Opportunities

- 2.7.1.4. Threats

- 2.7.2. Porter's Five Forces Analysis

- 2.7.2.1. Competitive Rivalry

- 2.7.2.2. Threat of New Entrants

- 2.7.2.3. Bargaining Power of Buyers

- 2.7.2.4. Bargaining Power of Suppliers

- 2.7.2.5. Threat of Substitutes

- 2.7.3. PESTLE Analysis

- 2.7.3.1. Political Factors

- 2.7.3.2. Economic Factors

- 2.7.3.3. Social Factors

- 2.7.3.4. Technological Factors

- 2.7.3.5. Legal Factors

- 2.7.3.6. Environmental Factors

- 2.7.1. SWOT Analysis

3. COMPETITIVE LANDSCAPE

- 3.1. Market Positioning of Key Companies

- 3.1.1. Accenture

- 3.1.2. IBM Consulting

- 3.1.3. Deloitte Touche Tohmatsu Ltd

- 3.1.4. PricewaterhouseCoopers (PwC)

- 3.1.5. Ernst & Young (EY)

- 3.1.6. McKinsey & Company

- 3.1.7. Boston Consulting Group (BCG)

- 3.1.8. Tata Consultancy Services (TCS)

- 3.2. Market Share Analysis: AI Consulting and Support Services

- 3.3. Beyond the Mainstream: Hidden Opportunities in AI Consulting & Support Services

- 3.3.1. Emerging Opportunity Areas

- 3.4. Key Market Players

- 3.4.1. Accenture PLC

- 3.4.2. Adastra

- 3.4.3. Addepto sp. z o.o.

- 3.4.4. ADDO AI

- 3.4.5. Bain & Company

- 3.4.6. Boston Consulting Group (BCG)

- 3.4.7. Capgemini Services SAS

- 3.4.8. Centric Consulting

- 3.4.9. Coupa

- 3.4.10. Deloitte Touche Tohmatsu Ltd

- 3.4.11. Eigen Innovations

- 3.4.12. Elucidate

- 3.4.13. EvaCodes LLC

- 3.4.14. Ernst & Young (EY)

- 3.4.15. Google LLC

- 3.4.16. International Business Machines Corp. (IBM)

- 3.4.17. Itrex Group

- 3.4.18. KYNDRYL INC

- 3.4.19. McKinsey & Company

- 3.4.20. Neurond AI

- 3.4.21. Nexocode

- 3.4.22. PricewaterhouseCoopers (PwC)

- 3.4.23. Rysun Labs Inc.

- 3.4.24. Salesforce, Inc.

- 3.4.25. Softweb Solutions Inc.

- 3.4.26. TATA Consultancy Services Ltd.

4. KEY BUSINESS & PRODUCT TRENDS

- 4.1. July 2025

- 4.1.1. Deloitte Unveils Advanced Features of Omnia Platform

- 4.1.2. Rysun Partners with Andersen Consulting to Drive Scalable AI and Industry Innovation Globally

- 4.1.3. Carlyle Announces Acquisition of Adastra

- 4.1.4. Bain & Company Announces Collaboration with Dr. Andrew Ng

- 4.1.5. Capgemini Acquires WNS

- 4.1.6. Capgemini unveils new Offering Resonance AI Framework

- 4.2. June 2025

- 4.2.1. Kyndryl announces new AI Innovation Lab in Singapore

- 4.2.2. TCS and Microsoft extend Partnership to Drive Business Transformation

- 4.2.3. Accenture Announces release of Distiller Agentic AI Framework

- 4.2.4. Centric receives Microsoft Copilot Ready Tier Designation

- 4.3. May 2025

- 4.3.1. Bain & Company Announces Collaboration with Palantir

- 4.3.2. Centric receives Microsoft Dynamics 365 Sales Specialization

- 4.3.3. Microsoft and BCG Partner to Launch Executive Workshops to Drive AI Innovation in Manufacturing

- 4.4. April 2025

- 4.4.1. Kyndryl Introduces AI Private Cloud services

- 4.4.2. TCS Collaborates with Google Cloud to Advance AI and Gen AI Solutions for the Retail Industry

- 4.4.3. Sutherland and Google Cloud Announce Extended Partnership

- 4.4.4. IBM Announces Acquisition of Hakkoda

- 4.4.5. EY Unveils new Capabilities for Audit Transformation

- 4.5. March 2025

- 4.5.1. PwC Announces Launch of new Agent OS

- 4.5.2. Deloitte Expands Global AI Simulation Center of Excellence, driving Innovation and Impact

- 4.5.3. C3 AI and PwC Forge a Strategic Alliance

- 4.5.4. EY Announces Launch of EY.ai Agentic Platform

- 4.6. February 2025

- 4.6.1. IBM Unveils new AI Integration Services

- 4.7. January 2025

- 4.7.1. McKinsey & Company Forms a Strategic Alliance with C3 AI

- 4.8. December 2024

- 4.8.1. Infosys Announces Launch of Google Cloud Center of Excellence

- 4.9. November 2024

- 4.9.1. IBM Announces new AI Capabilities of IBM Consulting Advantage

- 4.10. October 2024

- 4.10.1. Eigen Innovations Raises $2.6M to Advance AI-Powered Thermal Inspection Solutions

- 4.10.2. PwC India Announces Collaboration with Meta for AI Innovation

- 4.11. September 2024

- 4.11.1. Softweb Solutions Announces Collaboration with Salesforce and DataRobot

- 4.12. August 2024

- 4.12.1. Addepto Announces its Partnership with Databricks

- 4.13. June 2024

- 4.13.1. Kyndryl Announces Launch of New Service that uses Third-party AI

- 4.14. May 2024

- 4.14.1. Kyndryl Unveils New AI Consulting and Managed services

- 4.15. March 2024

- 4.15.1. Bain & Company Acquires PiperLab

- 4.16. January 2024

- 4.16.1. IBM Unveils New Service AI Platform IBM Consulting Advantage

- 4.17. November 2023

- 4.17.1. Accenture and Salesforce Partner for Salesforce Life Sciences Cloud

- 4.18. October 2023

- 4.18.1. Bain & Company Partners with Microsoft to Accelerate Enterprise Adoption of Generative AI

- 4.18.2. EY and IBM Announce Launch of EY.ai Workforce

- 4.19. September 2023

- 4.19.1. KCS Announces Rebranding to Rysun Labs

- 4.19.2. McKinsey and Salesforce Announce Collaboration

- 4.20. August 2023

- 4.20.1. Deloitte Announces Launch of ConvergeCONSUMER

- 4.21. June 2023

- 4.21.1. Deloitte Forges Multi-year Partnership with AWS to Scale Gen AI

5. GLOBAL MARKET OVERVIEW

- 5.1. Global AI Consulting and Support Services Market Overview by Service Type

- 5.1.1. AI Consulting and Support Services Type Market Overview Global Region

- 5.1.1.1. Analytics Consulting

- 5.1.1.2. Automation Consulting

- 5.1.1.3. Digital Strategy & Transformation

- 5.1.1.4. Application Development

- 5.1.1.5. Cognitive Integration

- 5.1.1. AI Consulting and Support Services Type Market Overview Global Region

- 5.2. Global AI Consulting and Support Services Market Overview by Company Type

- 5.2.1. AI Consulting and Support Services Company Type Market Overview by Global Region

- 5.2.1.1. Large Enterprises

- 5.2.1.2. Small & Medium-sized Enterprises (SMEs)

- 5.2.1. AI Consulting and Support Services Company Type Market Overview by Global Region

- 5.3. Global AI Consulting and Support Services Market Overview by Industry Sector

- 5.3.1. AI Consulting and Support Services Industry Sector Market Overview by Global Region

- 5.3.1.1. BFSI (Banking, Financial Services, Insurance)

- 5.3.1.2. IT & Telecom

- 5.3.1.3. Manufacturing

- 5.3.1.4. Government

- 5.3.1.5. Healthcare

- 5.3.1.6. Retail & Ecommerce

- 5.3.1.7. Energy & Utilities

- 5.3.1.8. Transportation

- 5.3.1.9. Education

- 5.3.1.10. Other Sectors

- 5.3.1. AI Consulting and Support Services Industry Sector Market Overview by Global Region

PART B: REGIONAL MARKET PERSPECTIVE

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- 6.1. North American AI Consulting and Support Services Market Overview by Geographic Region

- 6.2. North American AI Consulting and Support Services Market Overview by Service Type

- 6.3. North American AI Consulting and Support Services Market Overview by Company Type

- 6.4. North American AI Consulting and Support Services Market Overview by Industry Sector

- 6.5. Country-wise Analysis of North American AI Consulting and Support Services Market

- 6.5.1. THE UNITED STATES

- 6.5.1.1. United States AI Consulting and Support Services Market Overview by Service Type

- 6.5.1.2. United States AI Consulting and Support Services Market Overview by Company Type

- 6.5.1.3. United States AI Consulting and Support Services Market Overview by Industry Sector

- 6.5.2. CANADA

- 6.5.2.1. Canadian AI Consulting and Support Services Market Overview by Service Type

- 6.5.2.2. Canadian AI Consulting and Support Services Market Overview by Company Type

- 6.5.2.3. Canadian AI Consulting and Support Services Market Overview by Industry Sector

- 6.5.3. MEXICO

- 6.5.3.1. Mexican AI Consulting and Support Services Market Overview by Service Type

- 6.5.3.2. Mexican AI Consulting and Support Services Market Overview by Company Type

- 6.5.3.3. Mexican AI Consulting and Support Services Market Overview by Industry Sector

- 6.5.1. THE UNITED STATES

7. EUROPE

- 7.1. European AI Consulting and Support Services Market Overview by Geographic Region

- 7.2. European AI Consulting and Support Services Market Overview by Service Type

- 7.3. European AI Consulting and Support Services Market Overview by Company Type

- 7.4. European AI Consulting and Support Services Market Overview by Industry Sector

- 7.5. Country-wise Analysis of European AI Consulting and Support Services Market

- 7.5.1. GERMANY

- 7.5.1.1. German AI Consulting and Support Services Market Overview by Service Type

- 7.5.1.2. German AI Consulting and Support Services Market Overview by Company Type

- 7.5.1.3. German AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.2. THE UNITED KINGDOM

- 7.5.2.1. United Kingdom AI Consulting and Support Services Market Overview by Service Type

- 7.5.2.2. United Kingdom AI Consulting and Support Services Market Overview by Company Type

- 7.5.2.3. United Kingdom AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.3. FRANCE

- 7.5.3.1. French AI Consulting and Support Services Market Overview by Service Type

- 7.5.3.2. French AI Consulting and Support Services Market Overview by Company Type

- 7.5.3.3. French AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.4. ITALY

- 7.5.4.1. Italian AI Consulting and Support Services Market Overview by Service Type

- 7.5.4.2. Italian AI Consulting and Support Services Market Overview by Company Type

- 7.5.4.3. Italian AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.5. THE NETHERLANDS

- 7.5.5.1. Dutch AI Consulting and Support Services Market Overview by Service Type

- 7.5.5.2. Dutch AI Consulting and Support Services Market Overview by Company Type

- 7.5.5.3. Dutch AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.6. SPAIN

- 7.5.6.1. Spanish AI Consulting and Support Services Market Overview by Service Type

- 7.5.6.2. Spanish AI Consulting and Support Services Market Overview by Company Type

- 7.5.6.3. Spanish AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.7. RUSSIA

- 7.5.7.1. Russian AI Consulting and Support Services Market Overview by Service Type

- 7.5.7.2. Russian AI Consulting and Support Services Market Overview by Company Type

- 7.5.7.3. Russian AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.8. SWITZERLAND

- 7.5.8.1. Swiss AI Consulting and Support Services Market Overview by Service Type

- 7.5.8.2. Swiss AI Consulting and Support Services Market Overview by Company Type

- 7.5.8.3. Swiss AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.9. REST OF EUROPE

- 7.5.9.1. Rest of Europe AI Consulting and Support Services Market Overview by Service Type

- 7.5.9.2. Rest of Europe AI Consulting and Support Services Market Overview by Company Type

- 7.5.9.3. Rest of Europe AI Consulting and Support Services Market Overview by Industry Sector

- 7.5.1. GERMANY

8. ASIA-PACIFIC

- 8.1. Asia-Pacific AI Consulting and Support Services Market Overview by Geographic Region

- 8.2. Asia-Pacific AI Consulting and Support Services Market Overview by Service Type

- 8.3. Asia-Pacific AI Consulting and Support Services Market Overview by Company Type

- 8.4. Asia-Pacific AI Consulting and Support Services Market Overview by Industry Sector

- 8.5. Country-wise Analysis of Asia-Pacific AI Consulting and Support Services Market

- 8.5.1. CHINA

- 8.5.1.1. Chinese AI Consulting and Support Services Market Overview by Service Type

- 8.5.1.2. Chinese AI Consulting and Support Services Market Overview by Company Type

- 8.5.1.3. Chinese AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.2. JAPAN

- 8.5.2.1. Japanese AI Consulting and Support Services Market Overview by Service Type

- 8.5.2.2. Japanese AI Consulting and Support Services Market Overview by Company Type

- 8.5.2.3. Japanese AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.3. INDIA

- 8.5.3.1. Indian AI Consulting and Support Services Market Overview by Service Type

- 8.5.3.2. Indian AI Consulting and Support Services Market Overview by Company Type

- 8.5.3.3. Indian AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.4. AUSTRALIA

- 8.5.4.1. Australia AI Consulting and Support Services Market Overview by Service Type

- 8.5.4.2. Australia AI Consulting and Support Services Market Overview by Company Type

- 8.5.4.3. Australia AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.5. SINGAPORE

- 8.5.5.1. Singaporean AI Consulting and Support Services Market Overview by Service Type

- 8.5.5.2. Singaporean AI Consulting and Support Services Market Overview by Company Type

- 8.5.5.3. Singaporean AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.6. SOUTH KOREA

- 8.5.6.1. South Korean AI Consulting and Support Services Market Overview by Service Type

- 8.5.6.2. South Korean AI Consulting and Support Services Market Overview by Company Type

- 8.5.6.3. South Korean AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.7. REST OF ASIA-PACIFIC

- 8.5.7.1. Rest of Asia-Pacific AI Consulting and Support Services Market Overview by Service Type

- 8.5.7.2. Rest of Asia-Pacific AI Consulting and Support Services Market Overview by Company Type

- 8.5.7.3. Rest of Asia-Pacific AI Consulting and Support Services Market Overview by Industry Sector

- 8.5.1. CHINA

9. SOUTH AMERICA

- 9.1. South American AI Consulting and Support Services Market Overview by Geographic Region

- 9.2. South American AI Consulting and Support Services Market Overview by Service Type

- 9.3. South American AI Consulting and Support Services Market Overview by Company Type

- 9.4. South American AI Consulting and Support Services Market Overview by Industry Sector

- 9.5. Country-wise Analysis of South American AI Consulting and Support Services Market

- 9.5.1. BRAZIL

- 9.5.1.1. Brazilian AI Consulting and Support Services Market Overview by Service Type

- 9.5.1.2. Brazilian AI Consulting and Support Services Market Overview by Company Type

- 9.5.1.3. Brazilian AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.2. ARGENTINA

- 9.5.2.1. Argentine AI Consulting and Support Services Market Overview by Service Type

- 9.5.2.2. Argentine AI Consulting and Support Services Market Overview by Company Type

- 9.5.2.3. Argentine AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.3. COLOMBIA

- 9.5.3.1. Colombian AI Consulting and Support Services Market Overview by Service Type

- 9.5.3.2. Colombian AI Consulting and Support Services Market Overview by Company Type

- 9.5.3.3. Colombian AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.4. CHILE

- 9.5.4.1. Chilean AI Consulting and Support Services Market Overview by Service Type

- 9.5.4.2. Chilean AI Consulting and Support Services Market Overview by Company Type

- 9.5.4.3. Chilean AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.5. PERU

- 9.5.5.1. Peruvian AI Consulting and Support Services Market Overview by Service Type

- 9.5.5.2. Peruvian AI Consulting and Support Services Market Overview by Company Type

- 9.5.5.3. Peruvian AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.6. REST OF SOUTH AMERICA

- 9.5.6.1. Rest of South America AI Consulting and Support Services Market Overview by Service Type

- 9.5.6.2. Rest of South America AI Consulting and Support Services Market Overview by Company Type

- 9.5.6.3. Rest of South America AI Consulting and Support Services Market Overview by Industry Sector

- 9.5.1. BRAZIL

10. MIDDLE EAST & AFRICA

- 10.1. Middle East & Africa AI Consulting and Support Services Market Overview by Geographic Region

- 10.2. Middle East & Africa AI Consulting and Support Services Market Overview by Service Type

- 10.3. Middle East & Africa AI Consulting and Support Services Market Overview by Company Type

- 10.4. Middle East & Africa AI Consulting and Support Services Market Overview by Industry Sector

- 10.5. Country-wise Analysis of Middle East & Africa AI Consulting and Support Services Market

- 10.5.1. THE UNITED ARAB EMIRATES

- 10.5.1.1. United Arab Emirates AI Consulting and Support Services Market Overview by Service Type

- 10.5.1.2. United Arab Emirates AI Consulting and Support Services Market Overview by Company Type

- 10.5.1.3. United Arab Emirates AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.2. SOUTH AFRICA

- 10.5.2.1. South African AI Consulting and Support Services Market Overview by Service Type

- 10.5.2.2. South African AI Consulting and Support Services Market Overview by Company Type

- 10.5.2.3. South African AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.3. EGYPT

- 10.5.3.1. Egyptian AI Consulting and Support Services Market Overview by Service Type

- 10.5.3.2. Egyptian AI Consulting and Support Services Market Overview by Company Type

- 10.5.3.3. Egyptian AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.4. SAUDI ARABIA

- 10.5.4.1. Saudi Arabian AI Consulting and Support Services Market Overview by Service Type

- 10.5.4.2. Saudi Arabian AI Consulting and Support Services Market Overview by Company Type

- 10.5.4.3. Saudi Arabian AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.5. MOROCCO

- 10.5.5.1. Moroccan AI Consulting and Support Services Market Overview by Service Type

- 10.5.5.2. Moroccan AI Consulting and Support Services Market Overview by Company Type

- 10.5.5.3. Moroccan AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.6. KUWAIT

- 10.5.6.1. Kuwait AI Consulting and Support Services Market Overview by Service Type

- 10.5.6.2. Kuwait AI Consulting and Support Services Market Overview by Company Type

- 10.5.6.3. Kuwait AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.7. QATAR

- 10.5.7.1. Qatar AI Consulting and Support Services Market Overview by Service Type

- 10.5.7.2. Qatar AI Consulting and Support Services Market Overview by Company Type

- 10.5.7.3. Qatar AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.8. REST OF MIDDLE EAST & AFRICA

- 10.5.8.1. Rest of Middle East & Africa AI Consulting and Support Services Market Overview by Service Type

- 10.5.8.2. Rest of Middle East & Africa AI Consulting and Support Services Market Overview by Company Type

- 10.5.8.3. Rest of Middle East & Africa AI Consulting and Support Services Market Overview by Industry Sector

- 10.5.1. THE UNITED ARAB EMIRATES

PART C: GUIDE TO THE INDUSTRY

- 1. NORTH AMERICA

- 2. EUROPE

- 3. ASIA-PACIFIC

- 4. REST OF WORLD

PART D: ANNEXURE

- 1. RESEARCH METHODOLOGY

- 2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

- Chart 1: Global AI Consulting and Support Services Market (2024 & 2030) by Geographic Region

- Chart 2: Global AI Consulting and Support Services Market (2024 & 2030) by Service Type

- Chart 3: Global AI Consulting and Support Services Market (2024 & 2030) by Company Type

- Chart 4: Global AI Consulting and Support Services Market (2024 & 2030) by Industry Sector

- Chart 5: Global AI Consulting and Support Services Market Share (2024) by Company

GLOBAL MARKET OVERVIEW

- Chart 6: Global AI Consulting and Support Services Market Analysis (2021-2030) in US$ Million

- Chart 7: Global AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 8: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 9: Global AI Analytics Consulting Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 10: Glance at 2021, 2024 and 2030 Global AI Analytics Consulting Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 11: Global AI Automation Consulting Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 12: Glance at 2021, 2024 and 2030 Global AI Automation Consulting Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 13: Global AI Digital Strategy & Transformation Consulting Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 14: Glance at 2021, 2024 and 2030 Global Digital Strategy & Transformation Consulting Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 15: Global AI Application Development Consulting Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 16: Glance at 2021, 2024 and 2030 Global AI Application Development Consulting Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 17: Global AI Cognitive Integration Consulting Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 18: Glance at 2021, 2024 and 2030 Global AI Cognitive Integration Consulting Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 19: Global AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 20: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 21: Global AI Consulting and Support Services Market Analysis (2021-2030) in Large Enterprises by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 22: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Large Enterprises by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 23: Global AI Consulting and Support Services Market Analysis (2021-2030) in Small & Medium-sized Enterprises (SMEs) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 24: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Small & Medium-sized Enterprises (SMEs) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 25: Global AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 26: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

- Chart 27: Global AI Consulting and Support Services Market Analysis (2021-2030) in BFSI (Banking, Financial Services, Insurance) Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 28: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in BFSI (Banking, Financial Services, Insurance) Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 29: Global AI Consulting and Support Services Market Analysis (2021-2030) in IT & Telecom Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 30: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in IT & Telecom Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 31: Global AI Consulting and Support Services Market Analysis (2021-2030) in Manufacturing Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 32: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Manufacturing Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 33: Global AI Consulting and Support Services Market Analysis (2021-2030) in Government Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 34: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Government Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 35: Global AI Consulting and Support Services Market Analysis (2021-2030) in Healthcare Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 36: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Healthcare Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 37: Global AI Consulting and Support Services Market Analysis (2021-2030) in Retail & Ecommerce Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 38: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Retail & Ecommerce Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 39: Global AI Consulting and Support Services Market Analysis (2021-2030) in Energy & Utilities Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 40: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Energy & Utilities Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 41: Global AI Consulting and Support Services Market Analysis (2021-2030) in Transportation Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 42: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Transportation Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 43: Global AI Consulting and Support Services Market Analysis (2021-2030) in Education Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 44: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Education Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 45: Global AI Consulting and Support Services Market Analysis (2021-2030) in Other Sectors by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 46: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) in Other Sectors by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

PART B: REGIONAL MARKET PERSPECTIVE

- Chart 47: Global AI Consulting and Support Services Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 48: Glance at 2021, 2024 and 2030 Global AI Consulting and Support Services Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

REGIONAL MARKET OVERVIEW

NORTH AMERICA

- Chart 49: North American AI Consulting and Support Services Market Analysis (2021-2030) in US$ Million

- Chart 50: North American AI Consulting and Support Services Market Analysis (2021-2030) by Geographic Region - United States, Canada and Mexico in US$ Million

- Chart 51: Glance at 2021, 2024 and 2030 North American AI Consulting and Support Services Market Share (%) by Geographic Region - United States, Canada and Mexico

- Chart 52: North American AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 53: Glance at 2021, 2024 and 2030 North American AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 54: North American AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 55: Glance at 2021, 2024 and 2030 North American AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 56: North American AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 57: Glance at 2021, 2024 and 2030 North American AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE UNITED STATES

- Chart 58: United States AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 59: Glance at 2021, 2024 and 2030 United States AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 60: United States AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 61: Glance at 2021, 2024 and 2030 United States AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 62: United States AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 63: Glance at 2021, 2024 and 2030 United States AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

CANADA

- Chart 64: Canadian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 65: Glance at 2021, 2024 and 2030 Canadian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 66: Canadian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 67: Glance at 2021, 2024 and 2030 Canadian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 68: Canadian AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 69: Glance at 2021, 2024 and 2030 Canadian AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

MEXICO

- Chart 70: Mexican AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 71: Glance at 2021, 2024 and 2030 Mexican AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 72: Mexican AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 73: Glance at 2021, 2024 and 2030 Mexican AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 74: Mexican AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 75: Glance at 2021, 2024 and 2030 Mexican AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

EUROPE

- Chart 76: European AI Consulting and Support Services Market Analysis (2021-2030) in US$ Million

- Chart 77: European AI Consulting and Support Services Market Analysis (2021-2030) by Geographic Region - Germany, United Kingdom, France, Italy, Netherlands, Spain, Russia, Switzerland and Rest of Europe in US$ Million

- Chart 78: Glance at 2021, 2024 and 2030 European AI Consulting and Support Services Market Share (%) by Geographic Region - Germany, United Kingdom, France, Italy, Netherlands, Spain, Russia, Switzerland and Rest of Europe

- Chart 79: European AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 80: Glance at 2021, 2024 and 2030 European AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 81: European AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 82: Glance at 2021, 2024 and 2030 European AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 83: European AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 84: Glance at 2021, 2024 and 2030 European AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

GERMANY

- Chart 85: German AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 86: Glance at 2021, 2024 and 2030 German AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 87: German AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 88: Glance at 2021, 2024 and 2030 German AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 89: German AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 90: Glance at 2021, 2024 and 2030 German AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE UNITED KINGDOM

- Chart 91: United Kingdom AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 92: Glance at 2021, 2024 and 2030 United Kingdom AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 93: United Kingdom AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 94: Glance at 2021, 2024 and 2030 United Kingdom AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 95: United Kingdom AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 96: Glance at 2021, 2024 and 2030 United Kingdom AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

FRANCE

- Chart 97: French AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 98: Glance at 2021, 2024 and 2030 French AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 99: French AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 100: Glance at 2021, 2024 and 2030 French AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 101: French AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 102: Glance at 2021, 2024 and 2030 French AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

ITALY

- Chart 103: Italian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 104: Glance at 2021, 2024 and 2030 Italian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 105: Italian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 106: Glance at 2021, 2024 and 2030 Italian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 107: Italian AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 108: Glance at 2021, 2024 and 2030 Italian AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE NETHERLANDS

- Chart 109: Dutch AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 110: Glance at 2021, 2024 and 2030 Dutch AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 111: Dutch AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 112: Glance at 2021, 2024 and 2030 Dutch AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 113: Dutch AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 114: Glance at 2021, 2024 and 2030 Dutch AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SPAIN

- Chart 115: Spanish AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 116: Glance at 2021, 2024 and 2030 Spanish AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 117: Spanish AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 118: Glance at 2021, 2024 and 2030 Spanish AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 119: Spanish AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 120: Glance at 2021, 2024 and 2030 Spanish AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

RUSSIA

- Chart 121: Russian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 122: Glance at 2021, 2024 and 2030 Russian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 123: Russian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 124: Glance at 2021, 2024 and 2030 Russian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 125: Russian AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 126: Glance at 2021, 2024 and 2030 Russian AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SWITZERLAND

- Chart 127: Swiss AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 128: Glance at 2021, 2024 and 2030 Swiss AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 129: Swiss AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 130: Glance at 2021, 2024 and 2030 Swiss AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 131: Swiss AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 132: Glance at 2021, 2024 and 2030 Swiss AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

REST OF EUROPE

- Chart 133: Rest of Europe AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 134: Glance at 2021, 2024 and 2030 Rest of Europe AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 135: Rest of Europe AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 136: Glance at 2021, 2024 and 2030 Rest of Europe AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 137: Rest of Europe AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 138: Glance at 2021, 2024 and 2030 Rest of Europe AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

ASIA-PACIFIC

- Chart 139: Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) in US$ Million

- Chart 140: Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Geographic Region - China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific in US$ Million

- Chart 141: Glance at 2021, 2024 and 2030 Asia-Pacific AI Consulting and Support Services Market Share (%) by Geographic Region - China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific

- Chart 142: Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 143: Glance at 2021, 2024 and 2030 Asia-Pacific AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 144: Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 145: Glance at 2021, 2024 and 2030 Asia-Pacific AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 146: Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 147: Glance at 2021, 2024 and 2030 Asia-Pacific AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

CHINA

- Chart 148: Chinese AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 149: Glance at 2021, 2024 and 2030 Chinese AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 150: Chinese AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 151: Glance at 2021, 2024 and 2030 Chinese AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 152: Chinese AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 153: Glance at 2021, 2024 and 2030 Chinese AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

JAPAN

- Chart 154: Japanese AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 155: Glance at 2021, 2024 and 2030 Japanese AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 156: Japanese AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 157: Glance at 2021, 2024 and 2030 Japanese AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 158: Japanese AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 159: Glance at 2021, 2024 and 2030 Japanese AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

INDIA

- Chart 160: Indian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 161: Glance at 2021, 2024 and 2030 Indian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 162: Indian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 163: Glance at 2021, 2024 and 2030 Indian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 164: Indian AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 165: Glance at 2021, 2024 and 2030 Indian AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

AUSTRALIA

- Chart 166: Australia AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 167: Glance at 2021, 2024 and 2030 Australia AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 168: Australia AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 169: Glance at 2021, 2024 and 2030 Australia AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 170: Australia AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 171: Glance at 2021, 2024 and 2030 Australia AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SINGAPORE

- Chart 172: Singaporean AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 173: Glance at 2021, 2024 and 2030 Singaporean AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 174: Singaporean AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 175: Glance at 2021, 2024 and 2030 Singaporean AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 176: Singaporean AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 177: Glance at 2021, 2024 and 2030 Singaporean AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SOUTH KOREA

- Chart 178: South Korean AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 179: Glance at 2021, 2024 and 2030 South Korean AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 180: South Korean AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 181: Glance at 2021, 2024 and 2030 South Korean AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 182: South Korean AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 183: Glance at 2021, 2024 and 2030 South Korean AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

REST OF ASIA-PACIFIC

- Chart 184: Rest of Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 185: Glance at 2021, 2024 and 2030 Rest of Asia-Pacific AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 186: Rest of Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 187: Glance at 2021, 2024 and 2030 Rest of Asia-Pacific AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 188: Rest of Asia-Pacific AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 189: Glance at 2021, 2024 and 2030 Rest of Asia-Pacific AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SOUTH AMERICA

- Chart 190: South American AI Consulting and Support Services Market Analysis (2021-2030) in US$ Million

- Chart 191: South American AI Consulting and Support Services Market Analysis (2021-2030) by Geographic Region - Brazil, Argentina, Colombia, Chile, Peru and Rest of South America in US$ Million

- Chart 192: Glance at 2021, 2024 and 2030 South American AI Consulting and Support Services Market Share (%) by Geographic Region - Brazil, Argentina, Colombia, Chile, Peru and Rest of South America

- Chart 193: South American AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 194: Glance at 2021, 2024 and 2030 South American AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 195: South American AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 196: Glance at 2021, 2024 and 2030 South American AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 197: South American AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 198: Glance at 2021, 2024 and 2030 South American AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

BRAZIL

- Chart 199: Brazilian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 200: Glance at 2021, 2024 and 2030 Brazilian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 201: Brazilian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 202: Glance at 2021, 2024 and 2030 Brazilian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 203: Brazilian AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 204: Glance at 2021, 2024 and 2030 Brazilian AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

ARGENTINA

- Chart 205: Argentine AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 206: Glance at 2021, 2024 and 2030 Argentine AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 207: Argentine AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 208: Glance at 2021, 2024 and 2030 Argentine AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 209: Argentine AI Consulting and Support Services Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 210: Glance at 2021, 2024 and 2030 Argentine AI Consulting and Support Services Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

COLOMBIA

- Chart 211: Colombian AI Consulting and Support Services Market Analysis (2021-2030) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration in US$ Million

- Chart 212: Glance at 2021, 2024 and 2030 Colombian AI Consulting and Support Services Market Share (%) by Service Type - Analytics Consulting, Automation Consulting, Digital Strategy & Transformation, Application Development and Cognitive Integration

- Chart 213: Colombian AI Consulting and Support Services Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 214: Glance at 2021, 2024 and 2030 Colombian AI Consulting and Support Services Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)