PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1868994

PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1868994

IoT Semiconductor Design and Manufacturing Ecosystem Market Report 2025-2030

A 148-page report detailing the IoT semiconductor design and manufacturing ecosystem, covering EDA and IP markets as well as foundries, with market sizing, key trends, and market shares.

Sample preview

The global installed base of connected IoT devices continues to expand, driving a corresponding increase in semiconductor density within each device. This growing demand is supported by a complex IoT semiconductor value chain responsible for designing and manufacturing the underlying chips.

This report provides a structured IoT semiconductor value chain analysis, focusing on the design and manufacturing ecosystem. Its primary objective is to help readers understand this landscape by defining, sizing, and analyzing the three foundational pillars of the value chain: Electronic Design Automation (EDA), Semiconductor Intellectual Property (IP), and Foundries.

The findings are based on extensive primary research, including interviews with semiconductor experts from leading vendors and end-user organizations across the IoT semiconductor value chain, complemented by secondary research and insights gathered from major industry trade fairs.

Sample preview

Report at a glance

- 148-page report: A comprehensive analysis of the IoT semiconductor value chain, focusing on the design, IP, and manufacturing ecosystem.

- 3 technology deep dives: In-depth analyses of Electronic Design Automation (EDA), Semiconductor Intellectual Property (IP), and Foundries for IoT.

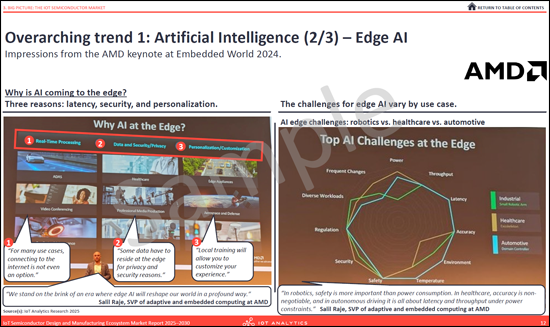

- 5 overarching semiconductor trends: Examination of macro trends (e.g., AI, security, geopolitics) impacting the IoT semiconductor value chain.

- Vendor market share analysis: A breakdown of the competitive landscape for each of the three ecosystem segments (EDA, IP, and Foundries).

- Market sizing and forecast: Market analysis for the EDA, IP, and Foundry for IoT markets, with forecasts to 2030.

Key areas of analysis

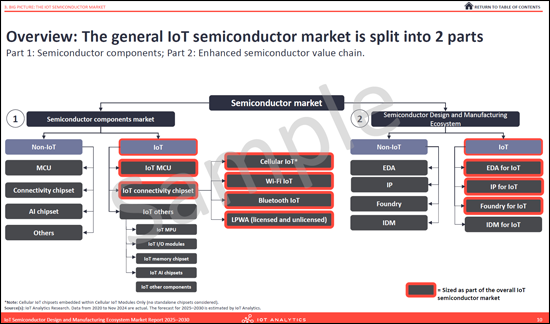

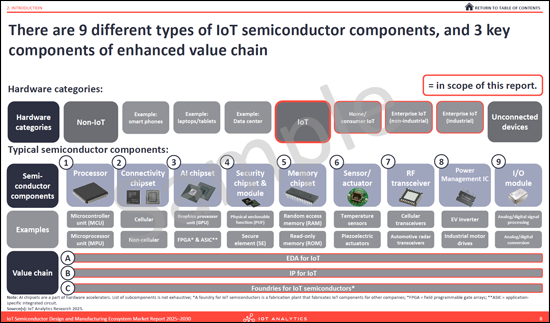

- Introduction to IoT semiconductors: Defines nine categories of semiconductor components and explains the three key segments of the IoT semiconductor value chain analyzed in this report.

- Big picture-The IoT semiconductor market: Provides market spending analysis for both IoT semiconductor components and the design/manufacturing segments of the IoT semiconductor value chain. Also outlines five cross-industry trends influencing market dynamics.

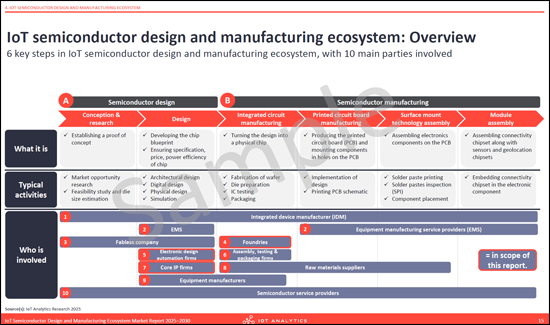

- Overview of the IoT semiconductor value chain: Maps the six critical steps and ten primary stakeholder groups within the design and manufacturing ecosystem. Includes market spending by segment and region and explores four major technical trends.

- EDA for IoT deep dive: Examines the chip design and verification process from system specification to fabrication and testing. Provides regional spending analysis, market share insights, key vendor profiles, and four emerging trends.

- IP for IoT deep dive: Covers the four main types of semiconductor IP (Processor, Interface, Memory, and Security) and their sub-segments. Includes regional market sizing, competitive landscape assessment, and a leading vendor profile.

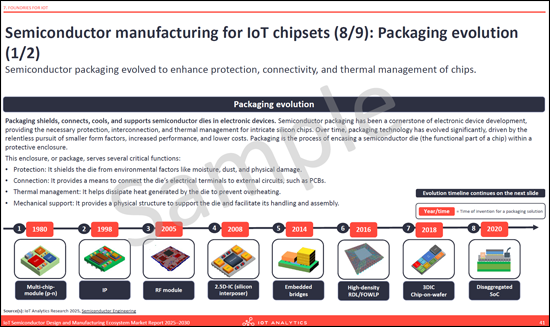

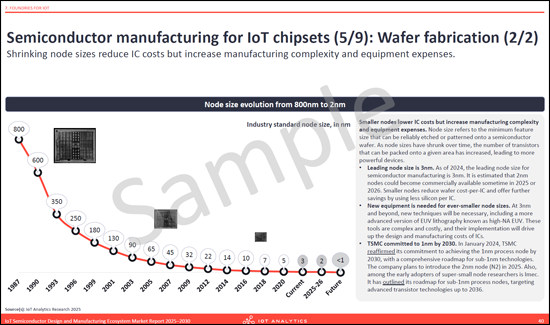

- Foundries for IoT deep dive: Outlines the semiconductor manufacturing process, including wafer preparation, fabrication, assembly, testing, and packaging evolution. Analyzes regional spending, market shares, and includes a leading foundry profile.

A data-driven foundation for key business functions

- Strategy and corporate development: Inform strategic planning with market sizing, 2030 forecasts, and analysis of macro trends impacting the IoT semiconductor value chain, such as geopolitical shifts and supply chain diversification.

- Product management and marketing: Guide product and technology roadmaps using detailed analyses of emerging technology trends and competitive dynamics across the EDA, IP, and foundry segments of the IoT semiconductor value chain.

- R&D and engineering leadership: Direct technical priorities with insights into EDA workflows, IP block architectures, and advanced packaging innovations, along with trends such as security-by-design and cloud-based design platforms.

- Market intelligence and competitive analysis: Benchmark market position within the IoT semiconductor value chain using granular market share data and vendor profiles for the EDA, IP, and foundry segments.

Key concepts defined

- IoT semiconductor value chain: The ecosystem of companies and processes involved in chip creation, defined in this report by six key stages: conception & research, design, integrated circuit manufacturing, printed circuit board manufacturing, surface mount technology assembly, and module assembly.

- Electronic design automation (EDA) for IoT: A key segment of the IoT semiconductor value chain providing software and tools used to design silicon or modules for IoT endpoints or gateways. Includes RTL design, simulation, verification, synthesis, analog/mixed-signal, DFT, advanced packaging, and PCB tools.

- Semiconductor intellectual property (IP) for IoT: A foundational segment of the IoT semiconductor value chain comprising licenses and royalties derived from integrating reusable IP blocks (IP cores) into silicon for IoT devices.

- Foundries for IoT: The manufacturing segment of the IoT semiconductor value chain that provides wafer fabrication and advanced packaging services for chips designed by fabless semiconductor companies.

- Chiplet: A small, specialized IC designed to interconnect with other chiplets or larger ICs. This modular structure enables integration of multiple chips using different process nodes within a single package.

- Heterogeneous integration: A manufacturing approach that combines multiple, separately manufactured components (chips, chiplets, etc.) into a single package, often using different materials and processes.

Questions answered:

- Which stakeholders are involved across EDA, IP, and foundry stages of the value chain?

- Which technologies are critical across EDA, IP, and foundries in enabling IoT semiconductor development?

- What is the current and projected market size of EDA, IP, and foundry for IoT markets?

- What is the market share of leading vendors across these three segments?

- What trends are shaping the future of the IoT semiconductor design and manufacturing ecosystem?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary

2. Introduction

- Chapter overview: Introduction

- Starting point: The number of loT connected devices continues to grow - Expected to reach 39 billion by 2030

- The semiconductor density within each device also continues to increase

- There are 9 different types of IoT semiconductor components, and 3 key components of enhanced value chain.

- Definitions (1/6): Semiconductors & IoT semiconductors

- Definitions (2/6): Processors

- Definitions (3/6): Connectivity chipsets

- Definitions (4/6): AI chipsets

- Definitions (5/6): Security chipsets

- Definitions (6/6): Other key components

3. Big picture: The IoT semiconductor market

- Chapter overview: Big picture: The IoT semiconductor market

- Overview: The general IoT semiconductor market is split into 2 parts

- Part 1: IoT semiconductor components - Spending by type

- Part 2: IoT semiconductor design and manufacturing ecosystem - Spending by segment

- Overall IoT semiconductor competitive landscape

- Importance of IoT as a segment within several chip companies

- 5 overarching trends impacting IoT semiconductors

- Overarching trend 1

- Overarching trend 2

- Overarching trend 3

- Overarching trend 4

- Overarching trend 5

- Recent announcements for new semiconductor plants

- Methodology: Mapping IoT-related business - TSMC

IoT semiconductor design and manufacturing ecosystem: Overview

- Chapter overview: IoT semiconductor design and manufacturing ecosystem: Overview

- IoT semiconductor design and manufacturing ecosystem: Overview

- IoT semiconductor design and manufacturing ecosystem: Definitions

- IoT semiconductor design and manufacturing market spending - Overview

- Analyst commentary on the IoT semiconductor design and manufacturing

- IoT semiconductor design and manufacturing market spending - By segment

- IoT semiconductor design and manufacturing market spending - By region

- Competitive landscape: Key vendors in IoT semiconductor design and manufacturing ecosystem

- Trend 1

- Trend 2

- Trend 3

- Trend 4

5. EDA for IoT

- Chapter overview: EDA for IoT

- IoT semiconductor design: Overview

- Chip design and verification

- Printed circuit board design: Process overview

- Heterogeneous integration: Overview

- Global EDA for IoT spending 2020-2030 - Overview

- Analyst commentary on the EDA for IoT

- Global EDA for IoT spending 2020-2030 - By region

- Competitive landscape: Key vendors in EDA for IoT market

- EDA for IoT competitive landscape

- Key company profile: Cadence

- Key company profile: Synopsys

- Trend 1

- Trend 2

- Trend 3

- Trend 4

6. IP for IoT

- Chapter overview: IP for IoT

- IP for IoT

- Global IP for IoT spending 2020-2030 - Overview

- Analyst commentary on the IP for IoT

- Global IP for IoT spending 2020-2030 - By region

- Competitive landscape: Key vendors in IP for IoT market

- IP for IoT competitive landscape

- Key company profile: Arm

7. Foundries for IoT

- Chapter overview: Foundries for IoT

- Semiconductor manufacturing for IoT chipsets

- Global Foundry for IoT spending 2020-2030 - Overview

- Analyst commentary on the Foundries for IoT

- Global Foundry for IoT spending 2020-2030 - By region

- Competitive landscape: Key foundries for IoT

- Foundries for IoT competitive landscape

- Key company profile: TSMC

8. Methodology & market definitions

- Key market definitions

- Country mappings to regions

- Research Methodology

9. About IoT Analytics