PUBLISHER: 360iResearch | PRODUCT CODE: 1380214

PUBLISHER: 360iResearch | PRODUCT CODE: 1380214

Minimal Residual Disease Testing Market by Technology (Flow Cyclometry, Next-Generation Sequencing, Polymerase Chain Reaction), Indication (Leukemia, Lymphoma, Myeloma), End-User - Global Forecast 2023-2030

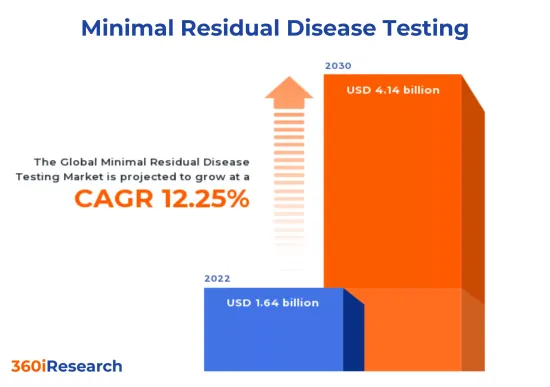

The Minimal Residual Disease Testing Market is projected to reach USD 4.14 billion by 2030 from USD 1.64 billion in 2022, at a CAGR of 12.25% during the forecast period.

Global Minimal Residual Disease Testing Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year Value [2022] | USD 1.64 billion |

| Estimated Year Value [2023] | USD 1.83 billion |

| Forecast Year Value [2030] | USD 4.14 billion |

| CAGR (%) | 12.25% |

Market Segmentation & Coverage:

This research report analyzes various sub-markets, forecasts revenues, and examines emerging trends in each category to provide a comprehensive outlook on the Minimal Residual Disease Testing Market.

Based on Technology, market is studied across Flow Cyclometry, Next-Generation Sequencing, and Polymerase Chain Reaction. The Next-Generation Sequencing is projected to witness significant market share during forecast period.

Based on Indication, market is studied across Leukemia, Lymphoma, and Myeloma. The Myeloma is projected to witness significant market share during forecast period.

Based on End-User, market is studied across Academic & Research Institutes, Diagnostic Laboratories, and Hospitals. The Academic & Research Institutes is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa is projected to witness significant market share during forecast period.

Market Statistics:

The report provides market sizing and forecasts across 7 major currencies - USD, EUR, JPY, GBP, AUD, CAD, and CHF; multiple currency support helps organization leaders to make well-informed decisions. In this report, 2018 to 2021 are considered as historical years, 2022 is base year, 2023 is estimated year, and years from 2024 to 2030 are considered as forecast period.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is an indispensable tool for assessing the Minimal Residual Disease Testing Market. It comprehensively evaluates vendors, analyzing key metrics related to Business Strategy and Product Satisfaction. This enables users to make informed decisions tailored to their specific needs. Through advanced analysis, vendors are categorized into four distinct quadrants, each representing a different level of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V). Be assured that this insightful framework empowers decision-makers to navigate the market with confidence.

Market Share Analysis:

The Market Share Analysis offers invaluable insights into the vendor landscape Minimal Residual Disease Testing Market. By evaluating their impact on overall revenue, customer base, and other key metrics, we provide companies with a comprehensive understanding of their performance and the competitive environment they confront. This analysis also uncovers the level of competition in terms of market share acquisition, fragmentation, dominance, and industry consolidation during the study period.

Key Company Profiles:

The report delves into recent significant developments in the Minimal Residual Disease Testing Market, highlighting leading vendors and their innovative profiles. These include Adaptive Biotechnologies Corporation, Agilus Diagnostics Ltd., Amgen Inc., ARUP Laboratories, AstraZeneca PLC, Asuragen Inc. by Bio-Techne Corporation, Bio-Rad Laboratories, Inc., Bristol-Myers Squibb Company, C2I Genomics Inc., Cergentis B.V., Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., Genetron Holdings Limited, GRAIL, LLC by Illumina, Inc., Guardant Health, Inc., Integrated DNA Technologies, Inc., Invivoscribe, Inc., Kite Pharma, Inc. by Gilead Sciences, Inc., Laboratory Corporation of America Holdings, Mdxhealth BV, MedGenome Inc, Mission Bio, Inc., Myriad Genetics, Inc., Natera Inc., NeoGenomics Laboratories, Inc., OPKO Health, Inc., Quest Diagnostics incorporated, Sysmex Corporation, and Veracyte, Inc..

The report offers valuable insights on the following aspects:

1. Market Penetration: It provides comprehensive information about key players' market dynamics and offerings.

2. Market Development: In-depth analysis of emerging markets and penetration across mature market segments, highlighting lucrative opportunities.

3. Market Diversification: Detailed information about new product launches, untapped geographies, recent developments, and investments.

4. Competitive Assessment & Intelligence: Exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of leading players.

5. Product Development & Innovation: Intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast for the Minimal Residual Disease Testing Market?

2. Which products, segments, applications, and areas hold the highest investment potential in the Minimal Residual Disease Testing Market?

3. What is the competitive strategic window for identifying opportunities in the Minimal Residual Disease Testing Market?

4. What are the latest technology trends and regulatory frameworks in the Minimal Residual Disease Testing Market?

5. What is the market share of the leading vendors in the Minimal Residual Disease Testing Market?

6. Which modes and strategic moves are suitable for entering the Minimal Residual Disease Testing Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Minimal Residual Disease Testing Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Need for refine treatment decisions for a variety of cancers

- 5.1.1.2. Rising prevalence of hematologic malignancies among world population

- 5.1.2. Restraints

- 5.1.2.1. High cost associated with the MRD testing

- 5.1.3. Opportunities

- 5.1.3.1. Evolution of personalized MRD testing techniques

- 5.1.3.2. Ongoing development of new minimal residual disease testing methods

- 5.1.4. Challenges

- 5.1.4.1. Stringent government regulations for the commercialization of MRD

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Minimal Residual Disease Testing Market, by Technology

- 6.1. Introduction

- 6.2. Flow Cyclometry

- 6.3. Next-Generation Sequencing

- 6.4. Polymerase Chain Reaction

7. Minimal Residual Disease Testing Market, by Indication

- 7.1. Introduction

- 7.2. Leukemia

- 7.3. Lymphoma

- 7.4. Myeloma

8. Minimal Residual Disease Testing Market, by End-User

- 8.1. Introduction

- 8.2. Academic & Research Institutes

- 8.3. Diagnostic Laboratories

- 8.4. Hospitals

9. Americas Minimal Residual Disease Testing Market

- 9.1. Introduction

- 9.2. Argentina

- 9.3. Brazil

- 9.4. Canada

- 9.5. Mexico

- 9.6. United States

10. Asia-Pacific Minimal Residual Disease Testing Market

- 10.1. Introduction

- 10.2. Australia

- 10.3. China

- 10.4. India

- 10.5. Indonesia

- 10.6. Japan

- 10.7. Malaysia

- 10.8. Philippines

- 10.9. Singapore

- 10.10. South Korea

- 10.11. Taiwan

- 10.12. Thailand

- 10.13. Vietnam

11. Europe, Middle East & Africa Minimal Residual Disease Testing Market

- 11.1. Introduction

- 11.2. Denmark

- 11.3. Egypt

- 11.4. Finland

- 11.5. France

- 11.6. Germany

- 11.7. Israel

- 11.8. Italy

- 11.9. Netherlands

- 11.10. Nigeria

- 11.11. Norway

- 11.12. Poland

- 11.13. Qatar

- 11.14. Russia

- 11.15. Saudi Arabia

- 11.16. South Africa

- 11.17. Spain

- 11.18. Sweden

- 11.19. Switzerland

- 11.20. Turkey

- 11.21. United Arab Emirates

- 11.22. United Kingdom

12. Competitive Landscape

- 12.1. FPNV Positioning Matrix

- 12.2. Market Share Analysis, By Key Player

- 12.3. Competitive Scenario Analysis, By Key Player

13. Competitive Portfolio

- 13.1. Key Company Profiles

- 13.1.1. Adaptive Biotechnologies Corporation

- 13.1.2. Agilus Diagnostics Ltd.

- 13.1.3. Amgen Inc.

- 13.1.4. ARUP Laboratories

- 13.1.5. AstraZeneca PLC

- 13.1.6. Asuragen Inc. by Bio-Techne Corporation

- 13.1.7. Bio-Rad Laboratories, Inc.

- 13.1.8. Bristol-Myers Squibb Company

- 13.1.9. C2I Genomics Inc.

- 13.1.10. Cergentis B.V.

- 13.1.11. Exact Sciences Corporation

- 13.1.12. F. Hoffmann-La Roche Ltd.

- 13.1.13. Genetron Holdings Limited

- 13.1.14. GRAIL, LLC by Illumina, Inc.

- 13.1.15. Guardant Health, Inc.

- 13.1.16. Integrated DNA Technologies, Inc.

- 13.1.17. Invivoscribe, Inc.

- 13.1.18. Kite Pharma, Inc. by Gilead Sciences, Inc.

- 13.1.19. Laboratory Corporation of America Holdings

- 13.1.20. Mdxhealth BV

- 13.1.21. MedGenome Inc

- 13.1.22. Mission Bio, Inc.

- 13.1.23. Myriad Genetics, Inc.

- 13.1.24. Natera Inc.

- 13.1.25. NeoGenomics Laboratories, Inc.

- 13.1.26. OPKO Health, Inc.

- 13.1.27. Quest Diagnostics incorporated

- 13.1.28. Sysmex Corporation

- 13.1.29. Veracyte, Inc.

- 13.2. Key Product Portfolio

14. Appendix

- 14.1. Discussion Guide

- 14.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. MINIMAL RESIDUAL DISEASE TESTING MARKET RESEARCH PROCESS

- FIGURE 2. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, 2022 VS 2030

- FIGURE 3. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. MINIMAL RESIDUAL DISEASE TESTING MARKET DYNAMICS

- FIGURE 7. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2022 VS 2030 (%)

- FIGURE 8. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2022 VS 2030 (%)

- FIGURE 10. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2022 VS 2030 (%)

- FIGURE 12. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 14. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 16. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. MINIMAL RESIDUAL DISEASE TESTING MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 22. MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. MINIMAL RESIDUAL DISEASE TESTING MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 6. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY FLOW CYCLOMETRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY NEXT-GENERATION SEQUENCING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY POLYMERASE CHAIN REACTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 10. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY LEUKEMIA, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY LYMPHOMA, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY MYELOMA, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 14. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY HOSPITALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 18. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 19. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 20. AMERICAS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 21. ARGENTINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 22. ARGENTINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 23. ARGENTINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 24. BRAZIL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 25. BRAZIL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 26. BRAZIL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 27. CANADA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 28. CANADA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 29. CANADA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 30. MEXICO MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 31. MEXICO MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 32. MEXICO MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 33. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 34. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 35. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 36. UNITED STATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 37. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 38. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 39. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 40. ASIA-PACIFIC MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 41. AUSTRALIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 42. AUSTRALIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 43. AUSTRALIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 44. CHINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 45. CHINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 46. CHINA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 47. INDIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 48. INDIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 49. INDIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 50. INDONESIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 51. INDONESIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 52. INDONESIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 53. JAPAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 54. JAPAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 55. JAPAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 56. MALAYSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 57. MALAYSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 58. MALAYSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 59. PHILIPPINES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 60. PHILIPPINES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 61. PHILIPPINES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 62. SINGAPORE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 63. SINGAPORE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 64. SINGAPORE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 65. SOUTH KOREA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 66. SOUTH KOREA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 67. SOUTH KOREA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 68. TAIWAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 69. TAIWAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 70. TAIWAN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 71. THAILAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 72. THAILAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 73. THAILAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 74. VIETNAM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 75. VIETNAM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 76. VIETNAM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 77. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 78. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 79. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 80. EUROPE, MIDDLE EAST & AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 81. DENMARK MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 82. DENMARK MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 83. DENMARK MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 84. EGYPT MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 85. EGYPT MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 86. EGYPT MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 87. FINLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 88. FINLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 89. FINLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 90. FRANCE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 91. FRANCE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 92. FRANCE MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 93. GERMANY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 94. GERMANY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 95. GERMANY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 96. ISRAEL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 97. ISRAEL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 98. ISRAEL MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 99. ITALY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 100. ITALY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 101. ITALY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 102. NETHERLANDS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 103. NETHERLANDS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 104. NETHERLANDS MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 105. NIGERIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 106. NIGERIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 107. NIGERIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 108. NORWAY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 109. NORWAY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 110. NORWAY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 111. POLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 112. POLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 113. POLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 114. QATAR MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 115. QATAR MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 116. QATAR MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 117. RUSSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 118. RUSSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 119. RUSSIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 120. SAUDI ARABIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 121. SAUDI ARABIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 122. SAUDI ARABIA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 123. SOUTH AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 124. SOUTH AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 125. SOUTH AFRICA MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 126. SPAIN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 127. SPAIN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 128. SPAIN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 129. SWEDEN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 130. SWEDEN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 131. SWEDEN MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 132. SWITZERLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 133. SWITZERLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 134. SWITZERLAND MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 135. TURKEY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 136. TURKEY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 137. TURKEY MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 138. UNITED ARAB EMIRATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 139. UNITED ARAB EMIRATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 140. UNITED ARAB EMIRATES MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 141. UNITED KINGDOM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 142. UNITED KINGDOM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY INDICATION, 2018-2030 (USD MILLION)

- TABLE 143. UNITED KINGDOM MINIMAL RESIDUAL DISEASE TESTING MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 144. MINIMAL RESIDUAL DISEASE TESTING MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 145. MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 146. MINIMAL RESIDUAL DISEASE TESTING MARKET LICENSE & PRICING