PUBLISHER: 360iResearch | PRODUCT CODE: 1434763

PUBLISHER: 360iResearch | PRODUCT CODE: 1434763

Laboratory Proficiency Testing Market by Technology (Cell Culture, Chromatography, Immunoassays), Application (Biologics, Cannabis/Opioids, Clinical Diagnostics), End-Use - Global Forecast 2023-2030

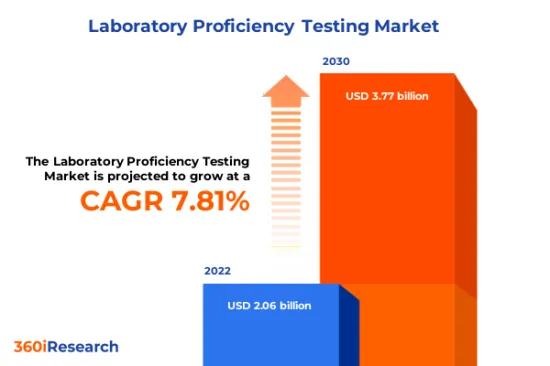

[183 Pages Report] The Laboratory Proficiency Testing Market size was estimated at USD 2.06 billion in 2022 and expected to reach USD 2.22 billion in 2023, at a CAGR 7.81% to reach USD 3.77 billion by 2030.

Global Laboratory Proficiency Testing Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 2.06 billion |

| Estimated Year [2023] | USD 2.22 billion |

| Forecast Year [2030] | USD 3.77 billion |

| CAGR (%) | 7.81% |

Laboratory Proficiency Testing (LPT) is a method used to evaluate and monitor the performance of laboratories by assessing their analytical competence. This process ensures that laboratories adhere to strict quality control measures, maintain high standards of accuracy and reliability in their testing procedures, and generate precise and consistent results. The increasing demand for reliable data from labs, strict regulations governing laboratory operations, and growing consumer awareness of product quality and safety increase the need for laboratory proficiency testing methods. However, high costs associated with internal quality control systems and variations in international regulations on laboratory standards create complexities in harmonizing laboratory proficiency testing methodologies. Moreover, integrating cutting-edge technologies such as big data analytics and artificial intelligence (AI) tools offers potential growth opportunities in laboratory proficiency testing methods.

Regional Insights

In the Americas, the United States and Canada strongly emphasize quality control in industries such as healthcare, food safety, pharmaceuticals, and environmental monitoring with the adoption of advanced analytical techniques. In the United States, laboratory proficiency testing is primarily governed by federal regulations under the Clinical Laboratory Improvement Amendments (CLIA) for laboratories conducting clinical diagnostic tests to ensure validity, reliability, and reproducibility. European Union countries are increasing the uptake of proficiency testing due to regulatory bodies such as EURACHEM and European Co-operation for Accreditation (EA), which ensure compliance with ISO/IEC 17043 standards. The Middle East & Africa region is experiencing steady growth in laboratory proficiency testing as awareness regarding quality assurance measures grows alongside expanding healthcare infrastructure. Initiatives such as Saudi Arabia's Vision 2030 plan and South Africa's National Health Laboratory Service (NHLS) promote quality management systems and proficiency testing schemes. Asia-Pacific is witnessing a rapid expansion of laboratory services led by China's emphasis on proficiency testing. The Chinese Food and Drug Administration (CFDA) regulations require mandatory proficiency testing for medical device manufacturers. The robust pharmaceutical industry in Japan drives demand for accurate analysis through programs offered by the Japan Accreditation Board (JAB). Furthermore, in India, investments from government and private entities are increasing the adoption of proficiency testing in clinical diagnostics facilities.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Laboratory Proficiency Testing Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Laboratory Proficiency Testing Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Laboratory Proficiency Testing Market, highlighting leading vendors and their innovative profiles. These include Absolute Standards Inc., Agilent Technologies, Inc., American Proficiency Institute, AOAC International, Bharat Petroleum Corporation Limited, Bio-Rad Laboratories, Inc., BIPEA, Charles River Laboratories International, Inc, EffecTech Limited, Envira Sostenible S.A., Eurofins Scientific SE, Fera Science Ltd., Fluxana GmbH & Co. KG, Food Safety Net Services, Global Proficiency Ltd., HN Proficiency Testing, Inc., INSTAND e.V., Jalan and Company, Landmark Material Testing & Research Laboratory Pvt. Ltd., LGC Ltd., Merck KGaA, Neogen Corporation, NSI Lab Solutions, Phenova Inc., Quality Assurance And Control Systems Ltd., QuoData GmbH, Randox Laboratories Ltd., RTI Laboratories, SGS S.A., The American Oil Chemists' Society, Trilogy Analytical Laboratory, Waters Corporation, and Worldwide Antimalarial Resistance Network.

Market Segmentation & Coverage

This research report categorizes the Laboratory Proficiency Testing Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Technology

- Cell Culture

- Chromatography

- Immunoassays

- PCR

- Spectrophotometry

- Application

- Biologics

- Cannabis/Opioids

- Clinical Diagnostics

- Commercial Beverages

- Cosmetics

- Dietary Supplements

- Environmental

- Food & Animal Feed

- Microbiology

- Neutraceuticals

- Pharmaceuticals

- Water

- End-Use

- Academic Research

- Contract Research Organizations

- Diagnostic Laboratories

- Independent Laboratories

- Specialty Laboratories

- Pharmaceutical & Biotechnology Companies

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Laboratory Proficiency Testing Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Laboratory Proficiency Testing Market?

3. What are the technology trends and regulatory frameworks in the Laboratory Proficiency Testing Market?

4. What is the market share of the leading vendors in the Laboratory Proficiency Testing Market?

5. Which modes and strategic moves are suitable for entering the Laboratory Proficiency Testing Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Laboratory Proficiency Testing Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing outbreaks of foodborne illness due to the consumption of unsafe foods

- 5.1.1.2. Growing focus on water testing and stringent requirements regarding water quality

- 5.1.1.3. Expansion of personalized medicine and need for enhanced multi-laboratory proficiency testing

- 5.1.2. Restraints

- 5.1.2.1. Complex procedures for conducting proficiency tests and a dearth of trained professionals

- 5.1.3. Opportunities

- 5.1.3.1. Advancements in proficiency testing with automation and digitalization in laboratories

- 5.1.3.2. New investments in lab research activities and the emerging popularity of cannabis testing

- 5.1.4. Challenges

- 5.1.4.1. Intricate standards for proficiency tests for laboratories across industries

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Technology: Use of Chromatography and Immunoassays in laboratory proficiency testing for their high sensitivity and specificity in applications

- 5.2.2. Application: Increasing emphasis on environmental and water proficiency testing in laboratories

- 5.2.3. End-Use: High adoption of laboratory proficiency testing in diagnostic laboratories to ensure accurate diagnoses and minimize potential sample errors

- 5.3. Market Trend Analysis

- 5.3.1. Favorable business environment and improved accreditation encourages research, development, and innovation in PT in Americas

- 5.3.2. Government-backed proficiency testing in the Asia-Pacific to support the establishment of new laboratories focused on accuracy testing

- 5.3.3. Presence of well-established market players offering a diverse range of proficiency testing services to cater to evolving quality standards across industries in the EMEA

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Laboratory Proficiency Testing Market, by Technology

- 6.1. Introduction

- 6.2. Cell Culture

- 6.3. Chromatography

- 6.4. Immunoassays

- 6.5. PCR

- 6.6. Spectrophotometry

7. Laboratory Proficiency Testing Market, by Application

- 7.1. Introduction

- 7.2. Biologics

- 7.3. Cannabis/Opioids

- 7.4. Clinical Diagnostics

- 7.5. Commercial Beverages

- 7.6. Cosmetics

- 7.7. Dietary Supplements

- 7.8. Environmental

- 7.9. Food & Animal Feed

- 7.10. Microbiology

- 7.11. Neutraceuticals

- 7.12. Pharmaceuticals

- 7.13. Water

8. Laboratory Proficiency Testing Market, by End-Use

- 8.1. Introduction

- 8.2. Academic Research

- 8.3. Contract Research Organizations

- 8.4. Diagnostic Laboratories

- 8.5.1. Independent Laboratories

- 8.5.2. Specialty Laboratories

- 8.5. Pharmaceutical & Biotechnology Companies

9. Americas Laboratory Proficiency Testing Market

- 9.1. Introduction

- 9.2. Argentina

- 9.3. Brazil

- 9.4. Canada

- 9.5. Mexico

- 9.6. United States

10. Asia-Pacific Laboratory Proficiency Testing Market

- 10.1. Introduction

- 10.2. Australia

- 10.3. China

- 10.4. India

- 10.5. Indonesia

- 10.6. Japan

- 10.7. Malaysia

- 10.8. Philippines

- 10.9. Singapore

- 10.10. South Korea

- 10.11. Taiwan

- 10.12. Thailand

- 10.13. Vietnam

11. Europe, Middle East & Africa Laboratory Proficiency Testing Market

- 11.1. Introduction

- 11.2. Denmark

- 11.3. Egypt

- 11.4. Finland

- 11.5. France

- 11.6. Germany

- 11.7. Israel

- 11.8. Italy

- 11.9. Netherlands

- 11.10. Nigeria

- 11.11. Norway

- 11.12. Poland

- 11.13. Qatar

- 11.14. Russia

- 11.15. Saudi Arabia

- 11.16. South Africa

- 11.17. Spain

- 11.18. Sweden

- 11.19. Switzerland

- 11.20. Turkey

- 11.21. United Arab Emirates

- 11.22. United Kingdom

12. Competitive Landscape

- 12.1. FPNV Positioning Matrix

- 12.2. Market Share Analysis, By Key Player

- 12.3. Competitive Scenario Analysis, By Key Player

- 12.3.1. Merger & Acquisition

- 12.3.1.1. LGC Acquires Kova International, Inc., including Biochemical Diagnostics, Inc., Strengthening its Portfolio of Quality Measurement Tools

- 12.3.1.2. LGC Acquires the Lipomed Reference Standards Business, Enhancing Global Portfolio of Analytical Reference Materials

- 12.3.2. Agreement, Collaboration, & Partnership

- 12.3.2.1. AOAC INTERNATIONAL Partners with Signature Science for Cannabis Proficiency Testing Program Test Materials

- 12.3.2.2. Spex Announces Partnership Between NSI Lab Solutions and USP for Proficiency Testing

- 12.3.3. New Product Launch & Enhancement

- 12.3.3.1. Introducing PT 114: A New Proficiency Test for the Cosmetic Microbial Challenge

- 12.3.3.2. Microbix Launches QAP to Support "Monkeypox" Testing

- 12.3.3.3. BIPEA Offers New Proficiency Test in the Field of Surface Microbiology

- 12.3.4. Award, Recognition, & Expansion

- 12.3.4.1. Fineotex Chemical Laboratory gets NABL Accreditation

- 12.3.4.2. GOTS, the Organic Cotton Accelerator and Textile Exchange announce new labs for qualitative GMO testing

- 12.3.4.3. At ORNL, 18 Nuclear Analytical Chemistry Methods Get International Stamp of Approval

- 12.3.4.4. SGS Karachi Lab Proved 100% Alignment on Global Proficiency Testing Program for Textile and Leather

- 12.3.4.5. Healthians Becomes the Youngest Lab in India to Get the CAP Accreditation

- 12.3.4.6. ACS Laboratory Receives 82 Emerald Badges for Exemplary Hemp and Cannabis Test Results, More Than Any Laboratory in the USA

- 12.3.1. Merger & Acquisition

13. Competitive Portfolio

- 13.1. Key Company Profiles

- 13.1.1. Absolute Standards Inc.

- 13.1.2. Agilent Technologies, Inc.

- 13.1.3. American Proficiency Institute

- 13.1.4. AOAC International

- 13.1.5. Bharat Petroleum Corporation Limited

- 13.1.6. Bio-Rad Laboratories, Inc.

- 13.1.7. BIPEA

- 13.1.8. Charles River Laboratories International, Inc

- 13.1.9. EffecTech Limited

- 13.1.10. Envira Sostenible S.A.

- 13.1.11. Eurofins Scientific SE

- 13.1.12. Fera Science Ltd.

- 13.1.13. Fluxana GmbH & Co. KG

- 13.1.14. Food Safety Net Services

- 13.1.15. Global Proficiency Ltd.

- 13.1.16. HN Proficiency Testing, Inc.

- 13.1.17. INSTAND e.V.

- 13.1.18. Jalan and Company

- 13.1.19. Landmark Material Testing & Research Laboratory Pvt. Ltd.

- 13.1.20. LGC Ltd.

- 13.1.21. Merck KGaA

- 13.1.22. Neogen Corporation

- 13.1.23. NSI Lab Solutions

- 13.1.24. Phenova Inc.

- 13.1.25. Quality Assurance And Control Systems Ltd.

- 13.1.26. QuoData GmbH

- 13.1.27. Randox Laboratories Ltd.

- 13.1.28. RTI Laboratories

- 13.1.29. SGS S.A.

- 13.1.30. The American Oil Chemists' Society

- 13.1.31. Trilogy Analytical Laboratory

- 13.1.32. Waters Corporation

- 13.1.33. Worldwide Antimalarial Resistance Network

- 13.2. Key Product Portfolio

14. Appendix

- 14.1. Discussion Guide

- 14.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. LABORATORY PROFICIENCY TESTING MARKET RESEARCH PROCESS

- FIGURE 2. LABORATORY PROFICIENCY TESTING MARKET SIZE, 2022 VS 2030

- FIGURE 3. LABORATORY PROFICIENCY TESTING MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. LABORATORY PROFICIENCY TESTING MARKET DYNAMICS

- FIGURE 7. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2022 VS 2030 (%)

- FIGURE 8. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2022 VS 2030 (%)

- FIGURE 10. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2022 VS 2030 (%)

- FIGURE 12. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 14. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 16. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. LABORATORY PROFICIENCY TESTING MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 22. LABORATORY PROFICIENCY TESTING MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. LABORATORY PROFICIENCY TESTING MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. LABORATORY PROFICIENCY TESTING MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 6. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY CELL CULTURE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY CHROMATOGRAPHY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY IMMUNOASSAYS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY PCR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY SPECTROPHOTOMETRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 12. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY BIOLOGICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY CANNABIS/OPIOIDS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY CLINICAL DIAGNOSTICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COMMERCIAL BEVERAGES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COSMETICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIETARY SUPPLEMENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY ENVIRONMENTAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY FOOD & ANIMAL FEED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY MICROBIOLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY NEUTRACEUTICALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY PHARMACEUTICALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY WATER, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 25. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY ACADEMIC RESEARCH, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 29. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY INDEPENDENT LABORATORIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY SPECIALTY LABORATORIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. LABORATORY PROFICIENCY TESTING MARKET SIZE, BY PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 33. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 34. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 35. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 36. AMERICAS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 37. ARGENTINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 38. ARGENTINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 39. ARGENTINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 40. ARGENTINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 41. BRAZIL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 42. BRAZIL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 43. BRAZIL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 44. BRAZIL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 45. CANADA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 46. CANADA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 47. CANADA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 48. CANADA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 49. MEXICO LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 50. MEXICO LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 51. MEXICO LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 52. MEXICO LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 53. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 54. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 55. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 56. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 57. UNITED STATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 58. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 59. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 60. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 61. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 62. ASIA-PACIFIC LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 63. AUSTRALIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 64. AUSTRALIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 65. AUSTRALIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 66. AUSTRALIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 67. CHINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 68. CHINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 69. CHINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 70. CHINA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 71. INDIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 72. INDIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 73. INDIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 74. INDIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 75. INDONESIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 76. INDONESIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 77. INDONESIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 78. INDONESIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 79. JAPAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 80. JAPAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 81. JAPAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 82. JAPAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 83. MALAYSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 84. MALAYSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 85. MALAYSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 86. MALAYSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 87. PHILIPPINES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 88. PHILIPPINES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 89. PHILIPPINES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 90. PHILIPPINES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 91. SINGAPORE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 92. SINGAPORE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 93. SINGAPORE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 94. SINGAPORE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 95. SOUTH KOREA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 96. SOUTH KOREA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 97. SOUTH KOREA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 98. SOUTH KOREA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 99. TAIWAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 100. TAIWAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 101. TAIWAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 102. TAIWAN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 103. THAILAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 104. THAILAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 105. THAILAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 106. THAILAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 107. VIETNAM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 108. VIETNAM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 109. VIETNAM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 110. VIETNAM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 111. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 112. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 113. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 114. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 115. EUROPE, MIDDLE EAST & AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 116. DENMARK LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 117. DENMARK LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 118. DENMARK LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 119. DENMARK LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 120. EGYPT LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 121. EGYPT LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 122. EGYPT LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 123. EGYPT LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 124. FINLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 125. FINLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 126. FINLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 127. FINLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 128. FRANCE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 129. FRANCE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 130. FRANCE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 131. FRANCE LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 132. GERMANY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 133. GERMANY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 134. GERMANY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 135. GERMANY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 136. ISRAEL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 137. ISRAEL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 138. ISRAEL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 139. ISRAEL LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 140. ITALY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 141. ITALY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 142. ITALY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 143. ITALY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 144. NETHERLANDS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 145. NETHERLANDS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 146. NETHERLANDS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 147. NETHERLANDS LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 148. NIGERIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 149. NIGERIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 150. NIGERIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 151. NIGERIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 152. NORWAY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 153. NORWAY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 154. NORWAY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 155. NORWAY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 156. POLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 157. POLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 158. POLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 159. POLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 160. QATAR LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 161. QATAR LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 162. QATAR LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 163. QATAR LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 164. RUSSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 165. RUSSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 166. RUSSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 167. RUSSIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 168. SAUDI ARABIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 169. SAUDI ARABIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 170. SAUDI ARABIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 171. SAUDI ARABIA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 172. SOUTH AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 173. SOUTH AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 174. SOUTH AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 175. SOUTH AFRICA LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 176. SPAIN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 177. SPAIN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 178. SPAIN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 179. SPAIN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 180. SWEDEN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 181. SWEDEN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 182. SWEDEN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 183. SWEDEN LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 184. SWITZERLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 185. SWITZERLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 186. SWITZERLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 187. SWITZERLAND LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 188. TURKEY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 189. TURKEY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 190. TURKEY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 191. TURKEY LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 192. UNITED ARAB EMIRATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 193. UNITED ARAB EMIRATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 194. UNITED ARAB EMIRATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 195. UNITED ARAB EMIRATES LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 196. UNITED KINGDOM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY TECHNOLOGY, 2018-2030 (USD MILLION)

- TABLE 197. UNITED KINGDOM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 198. UNITED KINGDOM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 199. UNITED KINGDOM LABORATORY PROFICIENCY TESTING MARKET SIZE, BY DIAGNOSTIC LABORATORIES, 2018-2030 (USD MILLION)

- TABLE 200. LABORATORY PROFICIENCY TESTING MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 201. LABORATORY PROFICIENCY TESTING MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 202. LABORATORY PROFICIENCY TESTING MARKET LICENSE & PRICING