PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1678837

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1678837

Global Private Cellular Networks: 2025-2030

'Private Cellular Network Market to Grow 114% by 2028, But 5G Uptake Continues to Disappoint'

| KEY STATISTICS | |

|---|---|

| Total revenue in 2025: | $5.5bn |

| Total revenue in 2030: | $21.4bn |

| 2025 to 2030 market growth: | 283% |

| Forecast period: | 2025-2029 |

Overview

Our "Private Cellular Networks" Market research suite provides a comprehensive and insightful analysis of this progressing market; enabling stakeholders, from private network service providers and regulators to network equipment companies, to understand future growth, key trends and the competitive environment. It includes a monetisation model analysis which studies the key monetisation models in the market, providing strategic recommendations for private network vendors and operators. Additionally, it features Juniper Research's Country Readiness Index which compares the position of 60+ countries in the market and provides a country-level analysis of current trends and future growth. The coverage can also be purchased as a full research suite, containing all these elements, and including a substantial discount.

The research suite includes several different options that can be purchased separately, including access to data mapping the adoption and future growth of the private networks market over the next five years, split by two key technologies (5G/4G LTE) and seven key industries:

|

|

It provides an insightful study uncovering the latest trends and opportunities within the private networks market, including the use of AI and automation in network management tools and the rising adoption of neutral host network deployments. It also features a document containing an extensive analysis of the 17 market leaders in the private cellular networks space.

Collectively, these documents provide a critical tool for understanding this fast-evolving market; enabling private network vendors and operators to shape their future strategy and capitalise on future growth opportunities in digitally transforming regions. Its extensive coverage makes this research suite a valuable tool for navigating this rapidly growing market.

Key Features

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and key findings, accompanied by key strategic recommendations for private network vendors, equipment vendors, and regulators.

- Market Outlook: Insights into key drivers and market challenges within the private networks market; addressing challenges posed by integration complexity of private network solutions and outlining how these can be overcome. It also provides analysis into the current and future trends in 5G and 4G LTE technology; providing strategic recommendations for private network vendors, network equipment companies, and regulators to overcome the current market challenges, highlighting key monetisation opportunities for private 5G networks.

- Benchmark Industry Forecasts: The market size and forecast for private networks market including total revenue, total businesses deploying private networks, and total number of private networks in operation per annum. The forecast further breaks down total revenue and business adoption into the aforementioned technology and industry segments.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 17 private network vendors, via the Juniper Research Competitor Leaderboard, featuring private networks market size for major players in the private networks industry.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the private networks market includes access to the full set of forecast data of 176 tables and over 82,000 datapoints. Metrics in the research suite include:

- Total Number of Businesses Deploying Private Networks

- Total Number of Private Networks in Operation per annum

- Total Private Networks Revenue

These metrics are provided for the following key cellular technology:

- 5G

- 4G LTE

They are also provided for the following market verticals:

- Energy

- Government

- Healthcare

- Logistics

- Manufacturing

- Mining

- Other Sectors

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This report examines the future market outlook in detail; assessing market trends and the factors shaping the evolution of this growing market. The cost of deploying private networks, as well as the complexity of integrating them into existing systems, has slowed market growth over the past few years. However, as digital transformation continues to expand globally, enterprises and industries are increasing IoT ecosystems to meet industry 4.0 goals; accelerating the deployments of private 5G and driving trends such as AI-driven networks.

Delivering an insightful analysis of the strategic opportunities for private network vendors and operators, as the report provides strategic recommendations for overcoming emerging market challenges. It also includes evaluation of key technology segment opportunities for private network vendors and operators, underlining key vertical markets with the highest potential for growth.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 17 leading vendors in the private networks space. The vendors are positioned as an established leader, leading challenger, or disruptor and challenger, based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard, a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

MARKET TRENDS & STRATEGIES

1. Key Takeaways and Strategic Recommendations

- 1.1. The Private Cellular Networks Market: Key Takeaways

- 1.2. The Private Cellular Networks Market: Strategic Recommendations

2. Future Market Outlook, Driver & Challenges

- 2.1. Introduction

- Figure 2.1: Summary of a Private Network Infrastructure

- 2.1.1. Market Drivers

- 2.1.2. Challenges

- Table 2.2: Countries That Have Allocated Spectrum for Private Network Use

- 2.1.3. Regulatory Landscape

- i. Trends

- ii. Multi-Access Edge Computing

- iii. AI and Automation

- Figure 2.3: The Benefits of AI and Automation in Private Networks

- iv. Open RAN

- v. Neutral Hosts

- 2.2. Types of Private Networks

- i. 4G/LTE

- Figure 2.4: Total Number of Private Networks in Operation That Are 4G/LTE Per Annum, Split by 8 Key Regions, 2025-2030

- Figure 2.5: Total Spend on Private Networks in 4G/LTE Private Networks Per Annum ($m), Split by 8 Key Regions, 2025-2030

- ii. 5G

- Figure 2.6: Total Number of Private Networks in Operation That Are 5G Per Annum, Split by 8 Key Regions, 2025-2030

- Figure 2.7: Total Spend on 5G Private Networks Per Annum ($m), Split by 8 Key Regions, 2025-2030

- iii. Summary

- Figure 2.8: A Summary of 5G Versus 4G

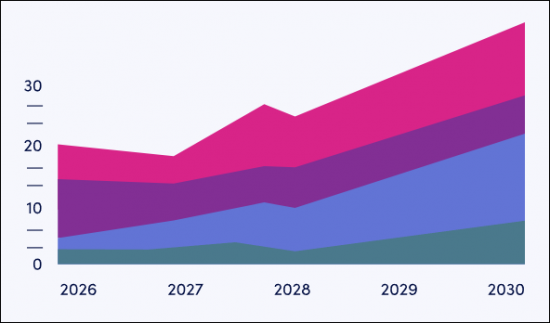

- Figure 2.9: Total Number of Private Networks in Operation Per Annum ($m), Split by Key Cellular Technology, 2025-2030

- i. 4G/LTE

3. Monetisation Model Analysis

- 3.1. Introduction

- 3.1.1. Deployment Models

- i. On-premises Deployment

- ii. Cloud-based Deployments

- iii. Integrated Deployments

- iv. Standalone Deployments

- v. Neutral Host Deployments

- Figure 3.1: Summary of How Vendors can Monetise Neutral Host Deployments

- vi. Summary

- 3.1.2. Monetisation Models

- i. Network-as-a-Service

- ii. Wholly Owned Networks

- iii. Summary

- 3.1.1. Deployment Models

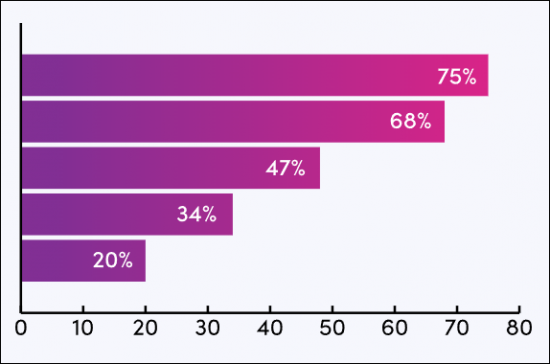

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: Private Cellular Networks Market Country Readiness Index, Regional Definitions

- Figure 4.2: Juniper Research Country Readiness Index Scoring Criteria: Private Cellular Networks Market

- Figure 4.3: Juniper Research Country Readiness Index: Private Cellular Networks Market

- Figure 4.4: Private Cellular Networks Market Country Readiness Index: Market Segments

- 4.2. Focus Markets

- i. Industry 4.0 and 5.0

- Figure 4.5: Total Private Networks Revenue ($m), Split by Top 7 Countries, 2025-2030

- ii. 5G

- Figure 4.6: Total Number of Private Networks in Operation that are 5G, Split by Top 4 Countries, 2025-2030

- iii. Remaining Competitive in Focus Markets

- i. Industry 4.0 and 5.0

- 4.3. Growth Markets

- Figure 4.7: Total Private Networks Revenue ($m), Split by Top 3 Countries, 2025-2030

- 4.4. Saturated Markets

- Figure 4.8: Total Private Networks Revenue ($m), Split by Top 5 Countries, 2025-2030

- 4.5. Developing Markets

- Figure 4.9: Total Private Networks Revenue ($m), Split by Top 3 Countries, 2025-2030

- Figure 4.10: Juniper Research's Country Readiness Index Heatmap: North America

- Figure 4.11: Juniper Research's Country Readiness Index Heatmap: Latin America

- Figure 4.12: Juniper Research's Country Readiness Index Heatmap: West Europe

- Figure 4.13: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Figure 4.14: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Figure 4.15: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Figure 4.16: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Figure 4.17: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

COMPETITOR LEADERBOARD

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read this Report

- Table 1.1: Juniper Research Competitor Leaderboard: Private Cellular Network Providers: Products & Portfolio (Part One)

- Figure 1.2: Juniper Research Competitor Leaderboard: Private Cellular Network Providers: Product & Portfolio (Part Two)

- Figure 1.3: Juniper Research Competitor Leaderboard: Private Network Vendors

- Table 1.4: Juniper Research Competitor Leaderboard: Private Network Vendors & Position

- Table 1.5: Juniper Research Competitor Leaderboard Heatmap: Private Cellular Network Vendors

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. Airspan Networks

- i. Corporate Information

- Table 2.1: Airspan's Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. AT&T

- i. Corporate

- Table 2.2: AT&T Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.3: Summary of How AT&T's Private Cellular Network Solutions Work

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.3. AWS

- i. Corporate

- Table 2.4: AWS Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.4. Baicells

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- 2.1.5. Celona

- i. Corporate information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: Summary of Celona's 5G LAN Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Cisco

- i. Corporate

- Table 2.6: Cisco's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.7. CommScope

- i. Corporate

- Table 2.7: CommScope's Financial Information ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.8. Druid Software

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.8: Raemis Cellular Network Technology

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Ericsson

- i. Corporate information

- Table 2.9: Ericsson's Financial Information ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate information

- 2.1.10. Huawei

- i. Corporate information

- Table 2.10: Huawei's Financial Information ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate information

- 2.1.11. Nokia

- i. Corporate Information

- Table 2.11: Nokia's Financial Information ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.12. NTT Data

- i. Corporate

- Table 2.12: NTT Data's Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.13. Qualcomm

- i. Corporate Information

- Table 2.13: Qualcomm's Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.14. Samsung

- i. Corporate Information

- Table 2.14: Samsung's Financial Information ($b), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.15: Diagram of Samsung's Private Network Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.15. Semtech

- i. Corporate information

- Table 2.16: Semtech's Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.17: Summary of Semtech's Private Networking Solutions

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate information

- 2.1.16. Vodafone

- i. Corporate

- Table 2.18: Vodafone's Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.17. ZTE Corporation

- i. Corporate

- Table 2.19: ZTE Corporation's Financial Information ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- i. Corporate

- 2.1.1. Airspan Networks

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitation & Interpretations

- Table 2.20: Juniper Research Competitor Leaderboard: Private Cellular Networks

- 2.2.1. Limitation & Interpretations

- 2.3. Related Research

MARKET DATA & FORECASTS

1. Introduction and Methodology

- 1.1. Private Cellular Networks Market Summary and Future Outlook

- 1.2. Forecast Methodology

- Figure 1.1: Private Networks Forecast Methodology per Cellular Technology (4G/5G)

- Figure 1.2: Industry-specific Private Networks Forecast Methodology (Part One)

- Figure 1.3: Industry-specific Private Networks Forecast Methodology (Part Two)

2. Private Networks Market Summary

- 2.1. Total Number of Private Networks in Operation, per annum

- Figure and Table 2.1: Total Number of Private Networks in Operation per annum, Split by 8 Key Regions, 2025-2030

- 2.2. Total Private Networks Spend

- Figure and Table 2.2: Total Private Networks Spend ($m), Split by 8 Key Regions, 025-2030

3. Cellular Technology Forecasts

- 3.1. Total Number of Private Networks in Operation That are 4G/LTE per annum

- Figure 3.1: Total Number of Private Networks in Operation That are 4G/LTE per annum, Split by 8 Key Regions, 2025-2030

- 3.1. Total Private Network Spend in 4G/LTE Private Networks per annum

- Figure and Table 3.2: Total Private Network Spend in 4G/LTE Private Networks per annum ($m), Split by 8 Key Regions, 2025-2030

- 3.2. Total Number of Private Networks in Operation That are 5G per annum

- Figure and Table 3.3: Total Number of Private Networks in Operation That are 5G per annum, Split by 8 Key Regions, 2025-2030

- 3.1. Total Private Network Spend in 5G Private Networks per annum

- Figure and Table 3.4: Total Private Network Spend in 5G Private Networks per annum ($m), Split by 8 Key Regions, 2025-2030

4. Industry Forecasts

- 4.1. Total Spend on Private Networks in The Energy Sector per annum

- Figure and Table 4.1: Total Private Network Spend in The Energy Sector per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.2. Total Spend on Private Networks in the Government and Public Sector per annum

- Figure and Table 4.2: Total Private Networks Spend in the Government and Public Sector per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.3. Total Spend on Private Networks in the Healthcare Sector per annum

- Figure and Table 4.3: Total Spend on Private Networks in the Healthcare Sector per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.4. Total Spend on Private Networks in the Logistics Sector per annum

- Figure and Table 4.4: Total Spend on Private Networks in the Logistics Sector per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.5. Total Spend on Private Networks in the Manufacturing Sector per annum

- Figure and Table 4.5: Total Spend on Private Networks in the Manufacturing Sector per annum, ($m) Split by 8 Key Regions, 2025-2030

- 4.6. Total Spend on Private Networks in the Mining Sector per annum

- Figure and Table 4.6: Total Spend on Private Networks in the Mining Sector per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.7. Total Spend on Private Networks in Other Sectors per annum

- Figure and Table 4.7: Total Spend on Private Networks in Other Sectors per annum ($m), Split by 8 Key Regions, 2025-2030