PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1469870

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1469870

Global Banking-as-a-Service Market: 2024-2028

| KEY STATISTICS | |

|---|---|

| Total BaaS platform revenue in 2024: | $36.4bn |

| Total BaaS platform revenue in 2028: | $94.0bn |

| 2024 to 2028 market growth: | 158% |

| Forecast period: | 2024-2028 |

Overview

Our 'Banking-as-a-Service' research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from traditional banks, fintech companies, infrastructure providers, regulators and technology companies to understand future growth, key trends and the competitive environment.

The suite includes several different options that can be purchased separately, including access to data mapping the deployment and future growth of BaaS (Banking-as-a-Service), an insightful study uncovering the latest trends and opportunities within the financial landscape, and a document containing extensive analysis of the 17 market leaders in the BaaS space. The coverage can also be purchased as a Full Research Suite, containing all of these elements, and including a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly emerging market; allowing financial institutions and tech companies to shape their future strategy. The unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such an uncertain and rapidly growing market.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the BaaS market; addressing the flexibility of the BaaS model, and the scope of financial offerings and technology stack platform banking can deploy. The report examines the many BaaS use cases across different industries and service platforms, and includes segment analysis across different segments which are adopting BaaS strategies, such as non-bank businesses. The BaaS market share research also includes a regional market growth analysis on the current development and segment growth of the BaaS market; featuring a Juniper Research Country Readiness Index covering 8 key regions and 60 countries. This also includes a technological approach assessment analysing the benefits of API (Application Programming Interface) and Cloud technology in the BaaS space, as well as the future outlook of the market.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the BaaS market, accompanied by strategic recommendations for stakeholders.

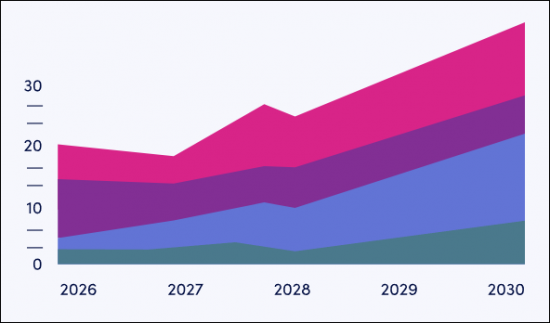

- Benchmark Industry Forecasts: The business overview into financial service providers includes forecasts for total revenue for BaaS, split by offerings spanning current accounts, card issuing, wealth management & savings, prepaid cards, and business accounts.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 17 BaaS vendors, via the Juniper Research Competitor Leaderboard; featuring banking market size for major players in the banking industry.

Market Data & Forecasts Report

The market-leading research suite for the Banking-as-a-Service market includes access to the full set of forecast data of 47 tables and over 21,000 datapoints. Metrics in the research suite include:

- Total BaaS Platform Revenue

- Total BaaS Consumer Users

- Total BaaS Consumer Transactions Volume

BaaS Platform Revenue is further split across the following key market verticals:

- Current Accounts

- Card Issuing

- Wealth Management & Savings

- Prepaid Cards

- Business Accounts

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios

SAMPLE VIEW

Market Data & Forecasts Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Trends & Strategies Report

This report examines the 'Banking-as-a-Service' market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for BaaS providers; addressing key verticals and developing challenges, and how financial institutions and non-financial businesses should navigate these. It also Includes evaluation of key country-level opportunities for BaaS deployment and growth.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 17 leading vendors in the BaaS space. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers based on capacity and capability assessments:

|

|

|

Table of Contents

Market Trends & Strategies

1. Banking-as-a-Service: Key Takeaway & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Banking-as-a-Service - Market Landscape

- 2.1. Introduction

- 2.1.1. Definitions & Scope

- 2.1.2. Functionalities of BaaS

- Figure 2.1: BaaS Concept Outline

- Figure 2.2: How APIs Work

- 2.2. Current Market Landscape

- 2.2.1. BaaS versus BaaP

- Figure 2.3: BaaS versus BaaP

- 2.2.2. BaaS & Open Banking

- Figure 2.4: How Open Banking Works

- 2.2.3. How Is BaaS Offered?

- Figure 2.5: How Is BaaS Offered?

- 2.2.4. BaaS Applications: Product Offerings

- Figure 2.6: BaaS Core Product Offerings

- i. Payment Processing

- ii. Account Management

- iii. Cards Issuing

- iv. Wealth Management & Savings

- v. Onboarding

- vi. Lending

- vii. Loyalty & Rewards

- viii. Compliance and Regulatory Support

- ix. Accounting Services

- x. Customer Support

- 2.2.5. BaaS Applications: Effective Use Cases

- Figure 2.7: BaaS Platform Industry Applications

- i. Fintech Startups

- ii. eCommerce Platforms

- iii. Retail and Consumer Goods

- iv. Gig Economy and Freelance Platforms

- v. Insurance

- vi. Travel and Hospitality

- vii. Property Tech

- viii. HR Tech

- 2.2.6. Banking-as-a-Service Regulations

- i. PSD2 (EU)

- ii. Open Banking (UK)

- iii. US

- iv. Open Banking (Brazil)

- v. Consumer Data Right Rules (Australia)

- vi. Unified Payments Interface (India)

- vii. Open API Framework (Hong Kong)

- viii. The Future of Open Banking

- 2.2.1. BaaS versus BaaP

- 2.3. Current Trends

- 2.4. Technological Approach Assessment

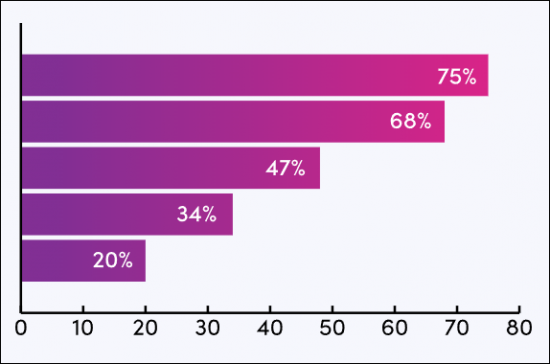

- 2.4.1. BaaS Technological Approach Assessment

- i. APIs

- Figure 2.10: Distribution of APIs by Product Area

- ii. Cloud Computing

- i. APIs

- 2.4.1. BaaS Technological Approach Assessment

- 2.5. Future Outlook

- 2.5.1. BaaS for BNPL & POS Financing

- 2.5.2. B2B BaaS

- 2.5.3. Monetisation Opportunities

3. Banking-as-a-Service: Segment Analysis

- 3.1. Introduction

- 3.1.1. Small/Medium Enterprises

- 3.1.2. Large Enterprises

- 3.1.3. Fintechs

- 3.1.4. Banks

- 3.1.5. Consumers

4. Country Readiness Index & Regional Analysis

- 4.1.1. Country Readiness Index

- Figure 4.1: Juniper Research's: 8 Key Regions Definitions

- Table 4.2: Juniper Research's BaaS Country Readiness Index: Scoring Criteria

- Figure 4.3: Juniper Research BaaS Country Readiness Index

- Figure 4.4: Juniper Research Competitive Web: BaaS Regional Opportunities

- 4.1.2. North America

- Figure 4.5: Total Number of Banked Individuals with Current/Checking Accounts Accessed via BaaS in North America (m), 2024

- i. US

- 4.1.3. Latin America

- Figure 4.6: Total BaaS Platform Revenue ($m), Split by Select Countries in Latin America, 2024

- i. Brazil

- 4.1.4. West Europe

- Figure 4.7: Total BaaS Platform Revenue ($m), Split by Select Countries in West Europe, 2024

- i. France

- ii. Germany

- iii. UK

- 4.1.5. Central & East Europe

- Figure 4.8: Total BaaS Platform Revenue ($m), Split by Select Countries, 2023-2028

- 4.1.6. Far East & China

- Figure 4.9: Total BaaS Platform Revenue in the Far East & China ($m), Split by Select Countries, 2024

- 4.1.7. Indian Subcontinent

- Figure 4.10: Total BaaS Platform Revenue in Indian Subcontinent ($m), Split by Select Countries, 2023-2028

- 4.1.8. Rest of Asia Pacific

- Figure 4.11: Total BaaS Platform Revenue in Rest of Asia Pacific ($m), Split by Select Countries, 2024

- 4.1.9. Africa & Middle East

- Figure 4.12: Total BaaS Platform Revenue in Africa & Middle East ($m), Split by Select Countries, 2023-2028

- 4.1.10. BaaS Regional Opportunities: Heatmap Analysis Results

- Table 4.13: Juniper Research Country Readiness Index: North America

- Table 4.14: Juniper Research Country Readiness Index: Latin America

- Table 4.15: Juniper Research Country Readiness Index: West Europe

- Table 4.16: Juniper Research Country Readiness Index: Central & East Europe

- Table 4.17: Juniper Research Country Readiness Index: Far East & China

- Table 4.18: Juniper Research Country Readiness Index: Indian Subcontinent

- Table 4.19: Juniper Research Country Readiness Index: Rest of Asia Pacific

- Table 4.20: Juniper Research Country Readiness Index: Africa & Middle East

Competitor Leaderboard

1. Juniper Research BaaS Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard BaaS Vendors and Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard for BaaS

- Table 1.3: Juniper Research Competitor Leaderboard BaaS Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: BaaS Vendors

- Table 1.5: Juniper Research Competitor Leaderboard Heatmap: BaaS Vendors (Continued)

- 1.2. BaaS Vendor Profiles

- 1.2.1. 11:FS Foundry

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.2. Anchor

- i. Corporate

- Table 1.6: Anchor's Investment Rounds ($m), 2022-2023

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.3. Bankable

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.4. BBVA

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.5. ConnectPay

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.6. Green Dot

- i. Corporate

- Table 1.7: Green Dot's Financial Snapshot ($m), 2022-2023

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.7. Intergiro

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.8. Marqeta

- i. Corporate

- Table 1.8: Marqeta's Financial Performance ($), 2022-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.9. MatchMove Pay

- i. Corporate

- Table 1.9: MatchMove Pay's Investment Rounds ($m), 2013-2021

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.10. Railsr

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.11. Raisin Bank

- i. Corporate

- Table 1.10: Raisin's Investment Rounds ($m), 2014-2023

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.12. Solaris

- i. Corporate

- Table 1.11: Solaris' Investment Rounds ($m), 2016-2024

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.13. Starling Bank

- i. Corporate

- Table 1.12: Starling's Investment Rounds ($m), 2018-2022

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.14. Swan

- i. Corporate

- Table 1.13: Swan's Investment Rounds ($m), 2020-2023

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.15. Treezor

- i. Corporate

- Table 1.14: Treezor's Investment Rounds ($m) 2015

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.16. Vodeno

- i. Corporate

- Table 1.15: Voden's Investment Rounds ($m), 2022

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.17. Xpollens

- i. Corporate

- ii. Geographical Reach

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- Table 1.16: Juniper Research Competitor Leaderboard Scoring Criteria: BaaS

- 1.2.1. 11:FS Foundry

Data & Forecasting

1. Introduction & Methodology

- 1.1. Introduction

- 1.2. Methodology & Assumptions

- Figure 1.1: BaaS Forecast Methodology, Current Accounts

- Figure 1.2: BaaS Forecast Methodology, Card Issuing

- Figure 1.3: BaaS Forecast Methodology, Wealth Management & Savings

- Figure 1.4: BaaS Forecast Methodology, Prepaid Cards

- Figure 1.5: BaaS Forecast Methodology, Business Accounts

2. Global Banking-as-a-Service Market

- 2.1. BaaS Forecasts

- 2.1.1. Total BaaS Platform Revenue

- Figure & Table 2.1: Total BaaS Platform Revenue ($m), Split by 8 Key Regions, 2023-2028

- Table 2.2: Total BaaS Platform Revenue ($m), Split by Category, 2023-2028

- 2.1.1. Total BaaS Platform Revenue

3. Current Accounts

- 3.1. Current Accounts

- 3.1.1. Total BaaS Consumer Users

- Figure & Table 3.1: Total Number of B2C BaaS Users (m), Split by 8 Key Regions, 2023-2028

- 3.1.2. Total BaaS Consumer Transaction Volume

- Figure & Table 3.2: Total BaaS Consumer Current/Checking Account Transaction Volume (m), Split by 8 Key Regions, 2023-2028

- 3.1.3. Total Value of Consumer Account Transactions

- Figure & Table 3.3: Total BaaS Consumer Current/Checking Account Transaction Value ($m), Split by 8 Key Regions, 2023-2028

- 3.1.4. Total Revenue of Consumer Account Transactions

- Figure & Table 3.4: Total BaaS Consumer Account Revenue ($m), Split by 8 Key Regions, 2023-2028

- 3.1.1. Total BaaS Consumer Users

4. Card Issuing

- 4.1.1. Total Number of Cards Issued Through BaaS

- Figure & Table 4.1: Total Number of Credit/Debit Cards Issued through BaaS Platforms (m), Split by 8 Key Regions, 2023-2028

- 4.1.2. Total Card Issuing Revenue

- Figure & Table 4.2: Total BaaS Card Issuing Revenue ($m), Split by 8 Key Regions, 2023-2028

5. Wealth Management & Savings Account

- 5.1.1. Total of Number of Wealth Management & Savings Accounts Issued through BaaS

- Figure & Table 5.1: Total Number of Wealth Management/Saving Account Users Accessing the Service through a BaaS platform (m), Split by 8 Key Regions, 2023-2028

- 5.1.2. Total Wealth Management & Savings Account Revenue

- Figure & Table 5.2: Total BaaS Revenue from Wealth Management & Savings Accounts ($m), Split by 8 Key Regions, 2023-2028

6. Prepaid Cards

- 6.1.1. Total Number of Users Accessing Prepaid Cards through a BaaS Platform

- Figure & Table 6.1: The Number of Users Accessing Prepaid Card through a BaaS Platform (m), Split 8 Key Regions, 2023-2028

- 6.1.2. Total Prepaid Cards Revenue

- Figure & Table 6.2: Total BaaS Revenue from Prepaid Cards ($m), Split by 8 Key Regions, 2023-2028

7. Business Accounts

- 7.1.1. Total Number of Businesses with Bank Accounts Issued Through BaaS

- Figure & Table 7.1: The Total Number of Businesses with Bank Accounts Issued through BaaS Providers (m), Split by 8 Key Regions, 2023-2028

- 7.1.2. Total Business Account Transaction Revenue

- Figure & Table 7.2: Total BaaS Revenue from Business Account Transactions ($m), Split by 8 Key Regions, 2023-2028