PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1827029

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1827029

Direct to Satellite Market: 2025-2030

'Satellite Broadband Market to Break $20 Billion by 2030, as Satellite Constellations Disrupt Established Services'

| KEY STATISTICS | |

|---|---|

| Global satellite provider revenue from satellite broadband in 2030: | $21bn |

| Global satellite provider revenue from direct to cell in 2030: | $1.6bn |

| Global satellite provider revenue from satellite IoT connectivity in 2030: | $2.3bn |

| Forecast period: | 2025-2030 |

Overview

Juniper Research's "Direct to Satellite" research suite provides satellite providers, investors, and partners, such as Mobile Network Operators, with an extensive analysis and insights into the direct to satellite market. It breaks down three critical services to the future of direct to satellite which are:

|

|

|

Juniper Research expects each of these services to experience significant growth over the next five years, with direct to satellite services becoming increasing available to both consumers and enterprises. The report provides strategic advice and data that allows stakeholders in the market to make informed decisions on their business strategy and service development over the next five years.

Each service has its own section within the report; covering key areas such as monetisation strategies, partnerships, forecast data, and market analysis of the major challenges facing satellite providers.

The research suite includes four case studies on leading players in the direct to satellite market, as well as analysis of key technologies and strategies including Low Earth Orbit (LEO) and Very Low Earth Orbit (VLEO), multi-orbit strategies, and the spectrum used by different satellite services.

Within the research suite, the market data and forecasting report comprises several different options that can be purchased separately, including a forecast document and access to data mapping. The strategy and trends report in the suite details critical trends in the market, in addition to strategic recommendations for monetising and innovating services in the direct to satellite market.

Furthermore, the suite includes a Competitor Leaderboard, which can be purchased separately, containing analysis and market sizing for 8 leading satellite providers in the satellite broadband market; each of which provides satellite broadband services for consumers or enterprises.

Collectively, the suite provides a critical tool for understanding the direct to satellite market; enabling satellite providers and other stakeholders to optimise their future business strategies and service development, and offering them a competitive advantage.

All report content is delivered in the English language.

Key Features

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the direct to satellite market. This is accompanied by strategic recommendations for satellite providers and other stakeholders in the market seeking to increase their revenue and market share in this quickly growing market.

- Market Dynamics: Insights into key trends and opportunities in the direct to satellite market, including analysis of key APIs. The report also includes a strategic analysis of the different business models that satellite providers can leverage to monetise their direct to satellite services.

- Benchmark Industry Forecasts: The suite provides five-year forecasts for the global direct to satellite market, with data provided for the following services: Fixed Satellite Broadband, Direct to Cell, and Satellite IoT.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 8 leading vendors in the satellite broadband market, with market sizing and detailed analysis of each vendor's offering.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research for the "Direct to Satellite" market includes access to the full set of forecast data of over 10,500 datapoints and 23 tables.

Metrics in the research suite include:

- Fixed Satellite Broadband

- Fixed Broadband Subscriptions

- Satellite Fixed Broadband Subscriptions

- Satellite Provider Revenue from Fixed Broadband Subscriptions

- Direct to Cell

- Direct to Cell Subscribers

- Monthly Active Direct to Cell Subscribers

- Satellite Provider Revenue from Direct to Cell Services

- Satellite IoT

- Satellite IoT Connections

- Revenue from Satellite IoT Connectivity

- Data Generated by Satellite IoT Connections

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool enables users to look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via three interactive scenarios.

Market Trends & Strategies Report

This report thoroughly examines the global "Direct to Satellite" market; assessing market trends, monetisation strategies and business models, and the different partnerships available to satellite providers and other stakeholders. Alongside this analysis, the report provides a comprehensive evaluation of the different services which will drive revenue in the direct to satellite market, and how these services can best meet the needs of customers around the world.

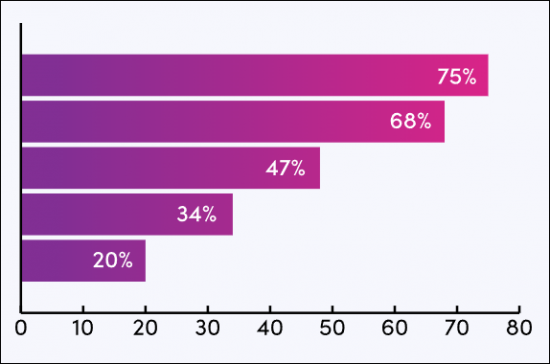

Competitor Leaderboard Report

The Competitor Leaderboard included in this report provides detailed evaluation and market positioning for 8 satellite providers in the satellite broadband market. These companies are positioned as established leaders, leading challengers, or disruptors and challengers; based on a capacity, capability, and product assessment.

This includes analysis of their key advantages in the market, future development plans, and key partnerships. The following providers are included:

|

|

|

The Competitor Leaderboard gives a comprehensive guide to the competitive landscape within the direct to satellite market; providing an important resource for stakeholders.

Table of Contents

Market Trends & Strategies

1. Key Trends and Recommendations

- 1.1. Key Takeaways

- 1.2. Key Recommendations

2. Direct to Satellite Market Outlook

- 2.1. Introduction to Direct to Satellite

- Figure 2.1: Total Number of Space Launches, (2020-2024)

- 2.2. Types of Satellite Orbits

- Figure 2.2: Different Satellite Orbits

- 2.2.1. VLEO

- Table 2.3: Total Number of LEO and VLEO Satellites in Orbit, 2025-2030

- 2.2.2. Trend Towards Multi-orbit

- 2.3. Spectrum Used by Satellite

- Figure 2.4: Key Satellite Spectrum Bands

3. Satellite Broadband

- 3.1. Satellite Broadband

- 3.1.1. Satellite Broadband Introduction

- Figure 3.1: Key Satellite IoT Use Cases

- 3.1.2. Satellite Broadband Market Outlook

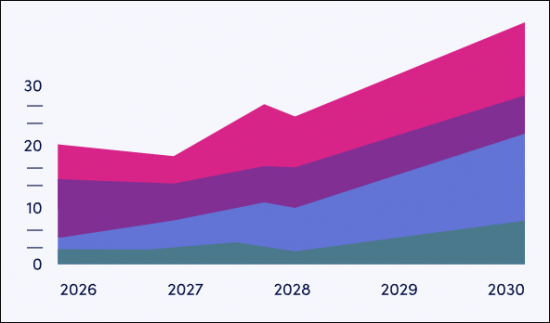

- Figure 3.2: Total Revenue from Satellite Broadband ($m), Split by 8 Key Regions, 2025-2030

- Figure 3.3: Global Rural Population in 2025 (m), Split by 8 Key Regions

- i. Satellite Narrowband

- 3.1.3. Partnerships

- i. Mobile Network Operators

- ii. Terrestrial Internet Service Providers

- 3.1.4. Monetising Satellite Broadband

- i. Partnership Business Models

- 3.1.5. Fixed Satellite Broadband

- i. Consumer

- ii. Enterprise

- 3.1.6. Mobile Satellite Broadband

- i. Key Market Verticals

- Table 3.4: Total Inbound Travellers by Air (m), Split by 8 Key Regions, 2025-2030

- i. Key Market Verticals

- 3.1.1. Satellite Broadband Introduction

4. Satellite IoT

- 4.1. Satellite IoT

- 4.1.1. Introduction

- Figure 4.1: Total Number of Satellite IoT Connections (m), Split by 8 Key Regions, 2025-2030

- 4.1.2. Market Outlook

- Figure 4.2: Total Revenue from Satellite IoT ($m), Split by 8 Key Regions, 2025-2030

- 4.1.3. Monetising Satellite IoT

- 4.1.4. Partnerships

- i. Mobile Network Operators

- ii. IoT MVNOs

- 4.1.5. Key Market Verticals for Satellite IoT

- i. Agriculture

- ii. Asset Tracking

- iii. Construction

- iv. Energy and Utilities

- v. Environmental Monitoring

- vi. Government and Defence

- vii. Maritime

- viii. Mining

- 4.1.1. Introduction

5. Direct to Cell

- 5.1. Direct to Cell

- 5.1.1. Introduction

- Figure 5.1: How Direct to Cell Works

- 5.1.2. Direct to Cell Market Outlook

- Figure 5.2: Total Number of Mobile Subscribers (m), Split by 8 Key Regions, 2025-2030

- Figure 5.3: Total Number of Direct to Cell Subscribers in 2030 (m), Split by 8 Key Regions: 962 million

- 5.1.3. Spectrum Approaches

- 5.1.4. Will Satellite Providers Compete with Mobile Network Operators?

- i. How Can Satellite Providers Actually Service Mobile Subscribers Directly

- ii. Key Services for Direct to Cell

- Figure 5.4: Total OTT Messaging Traffic (bn), 2025-2029

- Figure 5.5: Total Cellular Data Generation in 2030 (EB), Split by 8 Key Regions: 2,150 EB

- 5.1.5. Monetising Direct to Cell

- Figure 5.6: Total Operator Revenue from Direct to Cell Services ($m), Split by 8 Key Regions, 2025-2030

- i. Passes and Temporary Access

- 5.1.6. Partnering With Mobile Operators

- 5.1.1. Introduction

Competitor Leaderboard

1. Competitor Leaderboard

- 1.1. Why Read This Report

- Figure 1.1: Juniper Research Direct to Satellite Competitor Leaderboard: Vendors and Product Portfolios

- Figure 1.2: Juniper Research Direct to Satellite Competitor Leaderboard: Vendors

- Figure 1.3: Juniper Research Direct to Satellite Competitor Leaderboard: Vendors Positioning

- Table 1.4: Juniper Research Direct to Satellite Competitor Leaderboard: Vendor Heatmap

2. Vendor Profiles

- 2.1. Vendor Profiles

- 2.1.1. Amazon Project Kuiper

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Eutelsat OneWeb

- i. Corporate Information

- Figure 2.1: Eutelsat OneWeb

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.3. Hughes

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: Maritime Mobility Architecture

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. SES

- i. Corporate Information

- Table 2.3: SES Financial Information (Euro-m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.4: O3b Coverage Map

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.5. SKY Perfect JSAT

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: SKY Perfect JSAT Maritime Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Starlink

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Telesat

- i. Corporate Information

- Table 2.6: Telesat Revenue (Canadian $m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.8. Viasat

- i. Corporate Information

- Figure 2.7: Viasat Select Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.1. Amazon Project Kuiper

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

- Table 2.8: Juniper Research Competitor Leaderboard: Direct to Satellite Market

- 2.4. Related Research

Data & Forecasting

1. Fixed Satellite Broadband

- 1.1. Introduction to Satellite Broadband

- Figure 1.1: Total Number of Global Fixed Satellite Broadband Subscribers (m), 2025-2030

- 1.2. Forecast Methodology

- Figure 1.2: Satellite Broadband Forecast Methodology

- 1.3. Total Number of Fixed Satellite Broadband Subscriptions

- Figure & Table 1.3: Total Number of Fixed Satellite Broadband Subscriptions (m), Split by 8 Key Regions, 2025-2030

- 1.4. Total Satellite Provider Revenue from Fixed Satellite Broadband

- Figure & Table 1.4: Total Satellite Provider Revenue from Fixed Satellite Broadband ($m), Split by 8 Key Regions, 2025-2030

2. Direct to Cell

- 2.1. Introduction

- Figure 2.1: Total Number of Global Monthly Active Direct to Cell Subscribers (m), 2025-2030

- 2.2. Forecast Methodology

- Figure 2.2: Direct to Cell Forecast Methodology

- 2.3. Total Number of 4G LTE Capable Mobile Subscribers

- Figure & Table 2.3: Total Number of 4G LTE Capable Mobile Subscribers (m), Split by 8 Key Regions, 2025-2030

- 2.4. Total Number of Direct to Cell Subscribers

- Figure & Table 2.4: Total Number of Mobile Subscribers with Access to Direct to Cell (m), Split by 8 Key Regions, 2025-2030

- 2.5. Total Number of Monthly Active Direct to Cell Subscribers

- Figure & Table 2.5: Total Number of Monthly Active Direct to Cell Mobile Subscribers (m), Split by 8 Key Regions, 2025-2030

- 2.6. Total Satellite Provider Revenue from Direct to Cell Services

- Figure & Table 2.6: Total Satellite Provider Revenue from Direct to Cell Services ($m), Split by 8 Key Regions, 2025-2030

3. Satellite IoT

- 3.1. Introduction

- Figure 3.1: Total Number of Satellite IoT Connections (m), Split by 8 Key Regions, 2025-2030

- 3.2. Forecast Methodology

- Figure 3.2: Satellite IoT Forecast Methodology

- 3.3. Total Number of Satellite IoT Connections

- Figure & Table 3.3: Total Number of Satellite IoT Connections (m), Split by 8 Key Regions, 2025-2030

- 3.4. Total Satellite Provider Revenue from Satellite IoT

- Figure & Table 3.4: Total Satellite Provider Revenue from Satellite IoT ($m), Split by 8 Key Regions, 2025-2030

- 3.5. Total Data Generated by Satellite IoT Connections

- Figure & Table 3.5: Total Data Generated by Satellite IoT Connections (PB), Split by 8 Key Regions, 2025-2030

- Table 3.6: Average Monthly Data Generated per Satellite IoT Connection (KB), Split by 8 Key Regions, 2025-2030