PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1719509

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1719509

Global Smart Traffic Management Market: 2025-2030

'Smart Traffic Management Market Growth Fuelled by Sustainability & Urbanisation, Reaching $20 Billion by 2027'

| KEY STATISTICS | |

|---|---|

| Total revenue in 2025: | $14.8bn |

| Total revenue in 2030: | $32.7bn |

| 2025 to 2030 market growth: | 121% |

| Forecast period: | 2025-2030 |

Overview

Juniper Research's "Smart Traffic Management" research suite provides a detailed and insightful analysis of this progressing market; enabling stakeholders, from smart traffic management providers to regulators and technology vendors, to understand future growth, key trends and the competitive environment. The market-leading study includes monetisation model analysis that evaluates the key deployment models in the market; providing strategic recommendations for private network vendors and operators to maximise revenue. Additionally, it features Juniper Research's Future Leaders Index, which examines emerging smart traffic vendors who are challenging dominant players in the market. The coverage can also be purchased as a full research suite, containing all these elements and a substantial discount.

The research suite includes several different options that can be purchased separately, including access to data mapping the adoption and future growth of the smart traffic management market over the next five years, split by the following smart traffic technologies:

|

|

|

It also provides an insightful study uncovering the latest trends and opportunities within the smart traffic management market, including the use of AI and automation in smart traffic management solutions and the rising adoption of vehicle-to-everything (V2X) technologies that enable real-time traffic management by connecting vehicles to their surrounding environment. It also features an extensive analysis of the 15 market leaders in the smart traffic management space.

Collectively, these documents provide a critical tool for understanding this fast-evolving market. They allow smart traffic management vendors and operators to shape their future strategy and capitalise on future growth opportunities in digitally transforming regions. This research suite's extensive coverage makes it a valuable tool for navigating this rapidly growing market.

All report content is delivered in the English language.

Key Features

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities, key findings and key strategic recommendations for smart traffic management vendors, technology vendors and regulators.

- Market Outlook: Insights into key drivers and market challenges within the smart traffic management market, addressing challenges posed by integration complexity and budget constraints and how these can be overcome. It also provides an analysis into the current and future trends in smart traffic management technology, providing strategic recommendations for smart traffic management vendors, technology companies and regulators, to overcome the current market challenges. It highlights the key monetisation opportunities for smart traffic management technologies, including data monetisation.

- Benchmark Industry Forecasts: The market size and forecast for the smart traffic management market, including total revenue, total smart traffic management systems deployed, and total number of deployed smart traffic management sensors. The forecast further breaks down total revenue and smart traffic management systems deployed by the three technology segments (smart intersections, smart parking and smart highways).

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 15 smart traffic management vendors via the Juniper Research Competitor Leaderboard; featuring smart traffic management market size for major players in the smart traffic management industry.

SAMPLE VIEW

Market Trends & Strategies PDF Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

SAMPLE VIEW

Market Data & Forecasting

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies

This report provides a detailed outlook for the market, assessing market trends and the factors shaping the evolution of this growing market. Technological developments, particularly in AI, have led to real-time traffic monitoring capabilities, enhancing traffic flows, increasing road safety, and reducing congestion and emissions from vehicles. It also evaluates challenges posed by older infrastructure and existing systems which have hindered modern solutions adoption, given the cost of enabling these to integrate with existing systems.

This report delivers an insightful analysis of the strategic opportunities for smart traffic management vendors and operators, as well as strategic recommendations to overcome emerging market challenges such as interoperability. It also includes an evaluation of key technology segment opportunities for smart traffic management vendors and operators, highlighting key markets with the highest growth potential.

Market Data & Forecasting

The market-leading research suite for the "Smart Traffic Management" market includes access to the full set of forecast data of 82 tables and over 37,000 datapoints. Metrics in the research suite include:

- Deployed Smart Traffic Management Systems

- Deployed Smart Traffic Management Sensors

- Smart Traffic Management Revenue

- Congestion & Emissions Cost Savings by Smart Traffic Management Systems

These metrics are provided for the following key technologies:

- Smart Highways

- Smart Intersections

- Smart Parking

The forecast further splits the total congestion and emissions cost savings by the following:

- Congestion Management

- Emissions Reduction

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 15 leading vendors in the smart traffic management space. The vendors are positioned as an established leader, leading challenger, or disruptor and challenger based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard, a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways and Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Future Market Outlook, Drivers and Challenges

- 2.1. Future Market Outlook

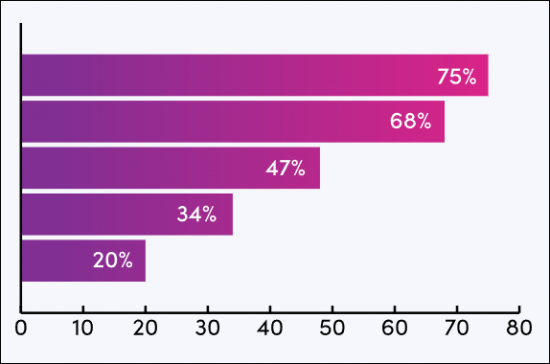

- Figure 2.1: Key Benefits of Smart Traffic Technology

- 2.1.1. Drivers

- i. Urbanisation and Population Growth

- ii. Technological Advancements

- iii. Government Investment

- iv. Environmental and Regulatory Pressures

- Figure 2.2: Total City Vehicle Emissions Cost Savings ($m), Split by 4 Key Countries, 2025-2030

- 2.1.2. Challenges

- i. Budget Constraints

- ii. Interoperability

- iii. Data Privacy and Cybersecurity Concerns

- 2.1.3. Trends

- i. Vehicle-to-Everything Communication

- Figure 2.3: Types of V2X

- ii. Multimodal Traffic Ecosystems

- iii. Connectivity

- i. Vehicle-to-Everything Communication

- 2.1.4. Technology Analysis

- i. Smart Intersections

- Figure 2.4: Total Number of Smart Intersections, Split by 8 Key Regions, 2025-2030

- Figure 2.5: Total Smart Intersection Spend ($m), Split by 5 Key Countries, 2025-2030

- ii. Smart Highways

- Figure 2.6: Total Length of Highways Converted to Smart Highways (km), Split by 8 Key Regions, 2025-2030

- iii. Smart Parking

- Figure 2.7: Total Smart Parking Spend ($m), Split by 8 Key Regions, 2025-2030

- iv. Summary

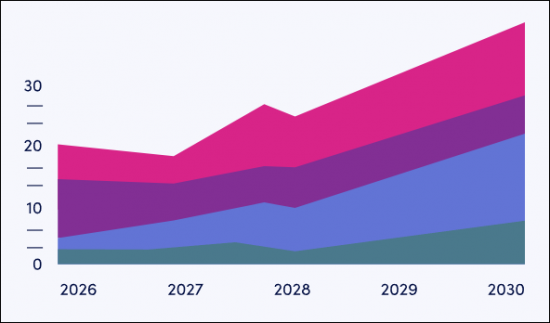

- Figure 2.8: Total Smart Traffic Management Spend ($m), Split by Sector, 2025-2030

- i. Smart Intersections

3. Business Model Analysis

- 3.1. Business Model Analysis

- 3.1.1. Deployment Models

- i. On-premises Deployment

- Table 3.1: Mitigation Strategies for On-premises Deployments

- ii. Cloud-based Deployment

- iii. Edge-based Deployments

- iv. Hybrid Deployments

- v. Modular Deployments

- vi. Summary

- i. On-premises Deployment

- 3.1.1. Deployment Models

4. Future Leaders Index

- 4.1. Why Read This Report

- Figure 4.1: Juniper Research Future Leaders Index: Smart Traffic Management Vendor Solutions

- Figure 4.2: Juniper Research Future Leaders Index: Smart Traffic Management Vendors

- Table 4.3: Juniper Research Smart Traffic Management Vendors Ranking

- Figure 4.4: Juniper Research Future Leaders Index Heatmap: Smart Traffic Management Vendors

- 4.2. Vendor Profiles

- 4.2.1. AISP

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.2. Asura Technologies

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.3. Autilent

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.4. Flow Labs

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.5. GridMatrix

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.6. NoTraffic

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.7. Pushpak AI

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.8. Simplifai Systems

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.2.1. AISP

- 4.3. Juniper Research Future Leaders Index Assessment Methodology

- 4.4. Limitations & Interpretations

- Figure 4.5: Juniper Research Future Leaders Index: Smart Traffic Management Services Criteria

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- Why Read this Report

- Table 1.1: Juniper Research Competitor Leaderboard: Smart Traffic Management Providers: Product & Portfolio (Part 1)

- Table 1.1: Juniper Research Competitor Leaderboard: Smart Traffic Management Providers: Product & Portfolio (Part 2)

- Figure 1.2: Juniper Research Competitor Leaderboard: Smart Traffic Management Vendors

- Source: Juniper Research

- Table 1.3: Juniper Research Competitor Leaderboard: Vendor & Position

- Figure 1.4: Juniper Research Competitor Leaderboard Heatmap: Smart Traffic Management Vendors

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. AtkinsRealis

- i. Corporate Information

- Table 2.1: AtkinsRealis's Financial Summary ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. Cubic Corporation

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Huawei Technologies

- i. Corporate Information

- Table 2.2: Huawei's Financial Information ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.3: Diagram of Huawei's Intelligent Transportation System

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.4. IBM

- i. Corporate Information

- Table 2.4: IBM's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.5. Indra Group

- i. Corporate Information

- Table 2.5: Indra's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.6. INRIX

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Iteris

- i. Corporate

- Table 2.6: Iteris's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.7: Diagram of Iteris's ClearMobility Platform

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.8. Kapsch TrafficCom

- i. Corporate Information

- Table 2.8: Kapsch TrafficCom's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.9. Miovision

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Q-Free

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Thales

- i. Corporate Information

- Table 2.9: Thales's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.12. TomTom

- i. Corporate Information

- Table 2.10: TomTom's Financial Summary ($m), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.13. TransCore

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.14. Transoft Solutions

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Umovity

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. AtkinsRealis

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitation & Interpretations

- Table 2.11: Juniper Research Competitor Leaderboard Scoring Criteria: Smart Traffic Management Vendors

- 2.2.1. Limitation & Interpretations

- 2.3. Related Research

Data & Forecasting

1. Introduction and Methodology

- 1.1. Smart Traffic Management Market Summary and Future Outlook

- 1.2. Forecast Methodology

- Figure 1.1: Smart Intersections Methodology

- Figure 1.2: Smart Parking Methodology

- Figure 1.3: Smart Highway Forecast Methodology

- Figure 1.4: Congestion Management Forecast Methodology

- Figure 1.5: Emissions Reduction Forecast Methodology

2. Market Overview

- 2.1. Total Number of Deployed Smart Traffic Management Systems

- Figure and Table 2.1: Total Number of Deployed Smart Traffic Management Systems (m), Split by 8 Key Regions, 2025-2030

- 2.2. Total Smart Traffic Management Spend

- Figure and Table 2.2: Total Smart Traffic Management Spend ($m), Split by 8 Key Regions, 2025-2030

3. Smart Intersections

- 3.1. Total Number of Smart Intersections

- Figure and Table 3.1: Total Number of Smart Traffic Intersections (m), Split by 8 Key Regions, 2025-2030

- 3.1.1. Total Smart Intersection Spend

- Figure and Table 3.2: Total Smart Intersection Spend ($m), Split by 8 Key Regions, 2025-2030

4. Smart Parking

- 4.1. Total Number of Smart Parking Spaces

- Figure and Table 4.1: Total Smart Parking Spaces (m), Split by 8 Key Regions, 2025-2030

- 4.2. Total Smart Parking Spend

- Figure and Table 4.2: Total Smart Parking Spend ($m), Split by 8 Key Regions, 2025-2030

5. Smart Highways

- 5.1. Total Length of Highways Converted to Smart Highways

- Figure and Table 5.1: Total Length of Highways Converted to Smart Highways (km), Split by 8 Key Regions, 2025-2030

- 5.2. Total Smart Highway Spend

- Figure and Table 5.2: Total Smart Highway Spend ($m), Split by 8 Key Regions, 2025-2030

6. Congestion Management

- 6.1. Total Cost of Congestion Saved by Smart Traffic Management Systems

- Figure and Table 6.1: Total Cost of Congestion Saved by Smart Traffic Management Systems ($m), Split by 8 Key Regions, 2025-2030

7. Emissions Reduction

- 7.1. Total City Vehicle Emissions Cost Savings

- Figure and Table 7.1: Total City Vehicle Emissions Cost Savings ($m), Split by 8 Key Regions, 2025-2030