PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1793327

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1793327

Edge Computing Market by Component (Edge Hardware (Servers, Gateways, Sensors, Devices), Edge Software (Data Management)), Edge Application (Edge AI & Inference, Real-Time Processing & Control, Immersive & Interactive Experiences) - Forecast to 2030

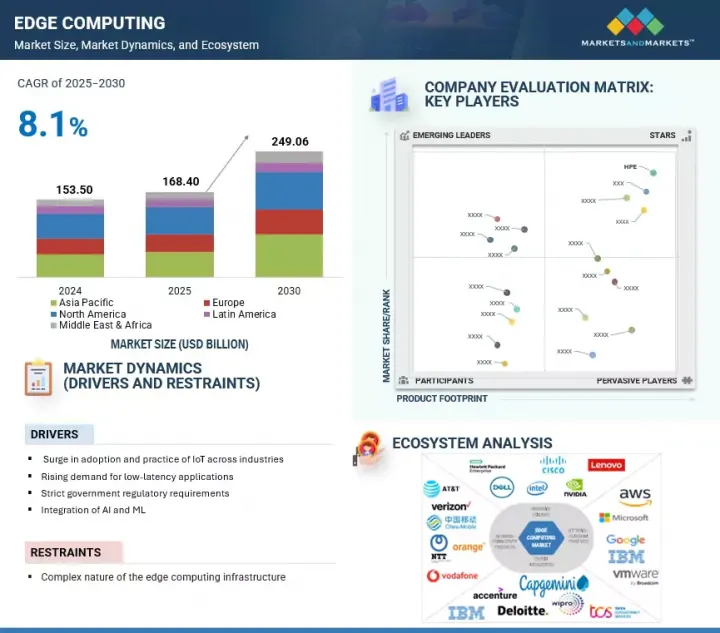

The global edge computing market is expanding rapidly, with a projected market size expected to rise from about USD 168.40 billion in 2025 to USD 249.06 billion by 2030, at a CAGR of 8.1%. Several key drivers and restraints primarily shape the growth of the edge computing market. Drivers include the surge in adoption and practice of Internet of Things (IoT) solutions across various industries, driving the need for real-time data processing and analytics at the network's edge.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Component, application, organization size, deployment mode, and vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Rising demand for low-latency applications further propels market expansion, alongside strict government regulatory requirements that encourage secure and compliant edge deployments. Additionally, integrating artificial intelligence (AI) and machine learning (ML) empowers organizations to realize smarter, autonomous operations directly at the edge. On the other hand, restraints center around the complex nature of edge computing infrastructure, which poses significant challenges in deployment, management, and seamless integration with legacy systems.

By edge software, network management to account for the highest growth rate during the forecast period

Network management is expected to account for the highest growth rate during the forecast period. This growth is driven by edge deployments' rising complexity and scale, where maintaining seamless connectivity, secure communication, and consistent performance is critical to business operations. Network management at the edge includes connectivity management, performance monitoring, network optimization, and network security, all of which are essential to ensure the reliability and efficiency of distributed infrastructure. As organizations deploy many edge devices across diverse environments, real-time network visibility and control become increasingly important to prevent data bottlenecks, detect threats early, and reduce latency. Vendors that deliver advanced network management solutions enable enterprises to support continuous workflows, achieve faster issue resolution, and ensure high service availability even in remote or bandwidth-constrained locations. The increase in 5G adoption and the integration of IoT and AI across industries add to the pressure on networks, making robust management tools a strategic investment. This presents a strong opportunity for solution providers to offer platform-agnostic, secure, and scalable network management capabilities tailored to industry-specific needs. Those focusing on automation, simplified orchestration, and proactive troubleshooting are expected to be better positioned to meet enterprise demand and play a central role in the expanding edge computing ecosystem.

On-premises edge deployment mode to hold the largest market share during the forecast period

On-premises edge is expected to maintain the largest share of the edge computing market during the forecast period, reflecting a strong demand from enterprises and organizations that require localized data processing, heightened privacy, and direct control over their digital infrastructure. This growth is particularly evident in sectors where operational continuity, regulatory compliance, and rapid response are non-negotiable, such as healthcare, advanced manufacturing, and critical infrastructure. By deploying edge resources within their facilities, organizations bypass the potential risks of cloud dependency, such as network outages and data sovereignty concerns, while securing the lowest possible latency for applications such as real-time analytics, automation, and quality control. As digital transformation accelerates, the balance between investment and benefit shifts, with the total cost of ownership for on-premises edge being justified by tangible gains in security, reliability, and operational agility. Today's edge offerings are increasingly modular and scalable, making it feasible for enterprises of all sizes to adopt dedicated edge nodes that fit their precise requirements. For vendors and solution providers, this means steady demand for robust, interoperable platforms, seamless integration tools, and managed services that simplify deployment and lifecycle management. The market's trajectory signals ongoing opportunities to deepen client partnerships, develop sector-specific edge solutions, and establish leadership in markets where trust, performance, and resilience define competitive advantage. As enterprises invest in distributed architectures, vendors prioritizing ease of adoption, transparent security, and fit-for-purpose solutions will differentiate their offerings and secure long-term growth in this dynamic environment.

North America leads the edge computing market with advanced infrastructure, strong 5G coverage, and high enterprise demand for real-time solutions, while Asia Pacific is the fastest-growing region driven by rapid cloud adoption, large-scale IoT deployments, and government-backed investments in localized edge infrastructure.

North America is expected to lead the edge computing market, driven by increasing enterprise demand for real-time data processing, low-latency applications, and secure distributed architectures. For vendors and solution providers, this means significant opportunities to deliver scalable platforms and services that support industries such as manufacturing, healthcare, telecommunications, and autonomous vehicles. The region's mature 5G infrastructure and growing IoT deployments enable the shift from centralized cloud to edge-based processing, creating a critical need for localized solutions that ensure compliance with data sovereignty regulations. Strategic partnerships, such as integrating edge capabilities into telecommunications networks, demonstrate how edge computing enhances operational efficiency and user experience. Capitalizing on these trends allows vendors to address evolving customer requirements, reduce latency challenges, and establish strong footholds in a market poised for rapid growth and innovation.

Breakdown of Primary interviews

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the edge computing market.

- By Company: Tier I - 35%, Tier II - 25%, and Tier III - 40%

- By Designation: C-Level Executives - 25%, D-Level Executives -30%, and Others - 45%

- By Region: North America - 42%, Europe - 25%, Asia Pacific - 18%, and Rest of the World - 15%

The report includes a study of key players offering edge computing services. It profiles major vendors in the edge computing market. The major market players include HPE (US), AWS (US), Dell Technologies (US), Cisco (US), Microsoft (US), IBM (US), Google (US), Nvidia (US), Intel (US), Huawei (China), Nokia (Finland), VMware (US), Fastly (US), Adlink (Taiwan), Oracle (US), Semtech (US), Moxa (US), Belden (US), GE Digital (US), DG International (US), Litmus Automation (US), Zededa (US), Clearblade (US), and Vapor IO (US).

Research Coverage

This research report categorizes the edge computing market based on Component (edge hardware (edge servers, edge gateways, edge sensors, edge devices)), edge software (data management, device management, application management, network management), and services (professional services, and managed services)), Application (real-time processing & control, edge-AI & inference, IoT & industrial automation, content delivery & media, immersive & interactive experiences, and other applications (security & access control, healthcare & telemedicine, consumer & smart living)), Organization size (large enterprises, small & medium sized enterprises), Deployment mode (cloud edge, on-premises edge, device edge), Vertical (manufacturing/industrial, energy & utilities, software & IT services, telecommunications, automotive, media & entertainment, retail & consumer goods, transportation & logistics, healthcare & life sciences, and other verticals (education, government & public sector, BFSI)) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the edge computing market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the edge computing market. This report also covers the competitive analysis of upcoming startups in the edge computing market ecosystem.

Reason to buy this Report

The report provides market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall edge computing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Surge in adoption and practice of IoT across industries, Rising demand for low-latency applications, Strict government regulatory requirements, Integration of AI and ML), restraints (Complex nature of the edge computing infrastructure ), opportunities (Advent of 5G network to provide open avenues for large-scale 5G network deployment, Proliferation of IoT, Rapid adoption of edge computing solutions across sectors, Emergence of autonomous automobiles and connected car infrastructure), and challenges (Increasing data privacy and security concerns, Challenges in compatibility or interoperability).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the edge computing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the edge computing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the edge computing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such HPE (US), AWS (US), Dell Technologies (US), Cisco (US), Microsoft (US), IBM (US), Google (US), Nvidia (US), Intel (US), Huawei (China), Nokia (Finland), VMware (US), Fastly (US), Adlink (Taiwan), Oracle (US), Semtech (US), Moxa (US), Belden (US), GE Digital (US), DG International (US), Litmus Automation (US), Zededa (US), Clearblade (US), and Vapor IO (US). The report also helps stakeholders understand the edge computing market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDGE COMPUTING MARKET

- 4.2 EDGE COMPUTING MARKET, BY COMPONENT (2025 VS 2030)

- 4.3 EDGE COMPUTING MARKET, BY APPLICATION (2025 VS 2030)

- 4.4 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE (2025 VS 2030)

- 4.5 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE (2025 VS 2030)

- 4.6 EDGE COMPUTING MARKET, BY VERTICAL (2025 VS 2030)

- 4.7 EDGE COMPUTING MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Exponential scale of IoT and endpoint intelligence

- 5.2.1.2 Rising demand for low-latency applications

- 5.2.1.3 Integration of edge AI/ML for autonomous decision-making

- 5.2.1.4 Stringent government regulatory requirements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Economic and policy constraints in emerging markets

- 5.2.2.2 Complex nature of edge computing infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of 5G network to provide open avenues for large-scale 5G network deployment

- 5.2.3.2 Remote and mission-critical edge deployment

- 5.2.3.3 Rapid adoption of edge computing solutions across sectors

- 5.2.3.4 Emergence of autonomous automobiles and connected car infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing data privacy and security concerns

- 5.2.4.2 Skill gap and operational expertise

- 5.2.4.3 Challenges in compatibility or interoperability

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 AKAMAI HELPED MATRIMONY.COM ACHIEVE WEBSITE OPTIMIZATION AND INCREASED USER RETENTION

- 5.3.2 ESPN ADOPTED MICROSOFT'S INNOVATIVE TECHNOLOGIES TO RESHAPE FUTURE OF SPORTS PRODUCTION

- 5.3.3 VMWARE HELPED NORTHERN BEACHES COUNCIL BE PACESETTER TO DRIVE AND DIGITALIZE REGIONAL MUNICIPAL SERVICES

- 5.3.4 MASERATI MSG RACING AUTOMATED WORKFLOW ENABLEMENT WITH HEWLETT-PACKARD ENTERPRISE TO OPTIMIZE TEAM PERFORMANCE

- 5.3.5 99BRIDGES HELPED HUMAN HABITS RESTORE AND PROTECT ENVIRONMENT WITH CISCO'S IOT OPERATIONS DASHBOARD

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 EDGE COMPUTING TECHNOLOGY PROVIDERS

- 5.5.2 EDGE COMPUTING HARDWARE VENDORS

- 5.5.3 NETWORK SERVICE PROVIDERS

- 5.5.4 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Edge AI

- 5.6.1.2 Virtual Network Functions

- 5.6.1.3 Content Delivery Network

- 5.6.1.4 Container Orchestration

- 5.6.1.5 Containerization

- 5.6.1.6 Zero-trust Security

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Internet of Things (IoT)

- 5.6.2.2 Digital Twin

- 5.6.2.3 Remote Device Management

- 5.6.2.4 Multi-access Edge Computing

- 5.6.2.5 Computer vision SDKs

- 5.6.2.6 Cybersecurity For Edge

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Cloud Computing

- 5.6.3.2 Blockchain

- 5.6.3.3 AR/VR

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2025

- 5.8.2 INDICATIVE PRICING ANALYSIS OF EDGE COMPUTING SOLUTIONS

- 5.9 PATENT ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 Regulatory implications and industry standards

- 5.10.1.2 General Data Protection Regulation

- 5.10.1.3 SEC Rule 17a-4

- 5.10.1.4 ISO/IEC 27001

- 5.10.1.5 System and Organization Controls 2 Type II compliance

- 5.10.1.6 Financial Industry Regulatory Authority

- 5.10.1.7 Freedom of Information Act

- 5.10.1.8 Health Insurance Portability and Accountability Act

- 5.10.2 REGULATIONS, BY REGION

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO

- 5.14.2 EXPORT SCENARIO

- 5.15 IMPACT OF GENERATIVE AI ON EDGE COMPUTING MARKET

- 5.15.1 TOP USE CASES & MARKET POTENTIAL

- 5.15.2 KEY USE CASES

- 5.15.3 CASE STUDIES

- 5.15.3.1 Case Study: McDonald's with Google Cloud: AI-powered Edge at Scale

- 5.15.4 VENDOR INITIATIVE

- 5.15.4.1 ADLINK Technology

- 5.16 BUSINESS MODELS

- 5.16.1 BUSINESS MODELS FOR HARDWARE VENDORS

- 5.16.2 BUSINESS MODELS FOR SOFTWARE PROVIDERS

- 5.16.3 BUSINESS MODELS FOR SERVICE PROVIDERS

- 5.17 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON COUNTRY/REGION

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.4 IMPACT ON END-USE INDUSTRIES

- 5.18.4.1 Manufacturing & Industrial (Industrial IoT)

- 5.18.4.2 Telecommunications & 5G Networks

- 5.18.4.3 Healthcare & Life Sciences

- 5.18.4.4 Retail

- 5.18.4.5 Transportation & Automotive

- 5.18.4.6 Energy & Utilities

- 5.18.4.7 Government & Defense

- 5.19 TYPES OF DATA PROCESSED AT EDGE

- 5.19.1 UNSTRUCTURED DATA

- 5.19.1.1 Text

- 5.19.1.2 Images

- 5.19.1.3 Audio

- 5.19.1.4 Video

- 5.19.1.5 Logs

- 5.19.1.6 Social Media Content

- 5.19.2 STRUCTURED DATA

- 5.19.2.1 Sensor Data

- 5.19.2.2 Transaction Data

- 5.19.2.3 Tabular Data

- 5.19.2.4 Temporal Data

- 5.19.2.5 Spatial Data

- 5.19.2.6 Multimedia Data

- 5.19.1 UNSTRUCTURED DATA

6 EDGE COMPUTING MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: EDGE COMPUTING MARKET DRIVERS

- 6.2 EDGE HARDWARE

- 6.2.1 NEED FOR REDUCING BURDEN ON CLOUD AND DATA CENTERS TO DRIVE ADOPTION OF EDGE COMPUTING HARDWARE

- 6.2.2 EDGE SERVERS

- 6.2.2.1 Enhancing data processing and security with strategically deployed edge servers

- 6.2.2.2 Edge compute nodes

- 6.2.2.3 Edge storage devices

- 6.2.3 EDGE GATEWAYS

- 6.2.3.1 Enabling efficient, secure data processing through advanced edge gateway solutions

- 6.2.3.2 Industrial edge gateways

- 6.2.3.3 IoT edge gateways

- 6.2.3.4 Cloud edge gateways

- 6.2.4 EDGE SENSORS

- 6.2.4.1 Driving innovation with real-time data processing using edge sensors efficiently

- 6.2.4.2 Temperature sensors

- 6.2.4.3 Humidity sensors

- 6.2.4.4 Pressure sensors

- 6.2.4.5 Motion sensors

- 6.2.5 EDGE DEVICES

- 6.2.5.1 Unlocking edge device potential for real-time, secure, and efficient computing

- 6.2.5.2 Industrial PCs (IPCs)

- 6.2.5.3 Single-board computers (SBCs)

- 6.2.5.4 Microcontrollers

- 6.3 EDGE SOFTWARE

- 6.3.1 EDGE COMPUTING SOFTWARE PROVIDES COMPREHENSIVE VISIBILITY AND CONTROL OVER REMOTE EDGE ENVIRONMENT

- 6.3.2 DATA MANAGEMENT

- 6.3.2.1 Empowering efficient edge data management for security, scalability, and innovation

- 6.3.2.2 Data processing

- 6.3.2.3 Data analytics

- 6.3.2.4 Data storage

- 6.3.2.5 Data security

- 6.3.3 DEVICE MANAGEMENT

- 6.3.3.1 Optimizing edge device management for reliability, performance, and operational insight

- 6.3.3.2 Device provisioning

- 6.3.3.3 Firmware and software updates

- 6.3.3.4 Device monitoring

- 6.3.3.5 Device security

- 6.3.4 APPLICATION MANAGEMENT

- 6.3.4.1 Centralized edge application deployment for enhanced reliability and operational efficiency

- 6.3.4.2 Application deployment

- 6.3.4.3 Workflow automation

- 6.3.4.4 Service orchestration

- 6.3.4.5 Application security

- 6.3.5 NETWORK MANAGEMENT

- 6.3.5.1 Maximizing edge network performance through proactive and efficient resource management

- 6.3.5.2 Connectivity management

- 6.3.5.3 Performance monitoring

- 6.3.5.4 Network optimization

- 6.3.5.5 Network security

- 6.4 SERVICES

- 6.4.1 FOCUS ON LOWERING RISKS ASSOCIATED WITH OPERATIONAL MISTAKES AND DELIVERING MAXIMUM PRODUCT ASSURANCE TO BOOST MARKET

- 6.4.2 PROFESSIONAL SERVICES

- 6.4.2.1 Maximizing edge computing success with specialized professional services and expertise

- 6.4.2.2 Consulting

- 6.4.2.3 Implementation

- 6.4.2.4 Support & maintenance

- 6.4.3 MANAGED SERVICES

- 6.4.3.1 Enhancing edge infrastructure efficiency through comprehensive managed services and support

7 EDGE COMPUTING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATIONS: EDGE COMPUTING MARKET DRIVERS

- 7.2 REAL-TIME PROCESSING & CONTROL

- 7.2.1 ENABLING INSTANT AUTONOMOUS DECISIONS THROUGH ON-PREMISES INTELLIGENCE FOR CRITICAL INDUSTRIAL AND FIELD APPLICATIONS

- 7.2.2 INDUSTRIAL PROCESS CONTROL

- 7.2.3 AUTONOMOUS ACTUATION

- 7.2.4 PRECISION AGRICULTURE

- 7.3 EDGE AI & INFERENCE

- 7.3.1 ENABLE LOCALIZED AI DECISIONS AT SCALE TO ACCELERATE RESPONSE TIME AND PRESERVE DATA PRIVACY

- 7.3.2 COMPUTER VISION

- 7.3.3 PREDICTIVE MAINTENANCE

- 7.3.4 LOCALIZED NLP

- 7.4 IOT & INDUSTRIAL AUTOMATION

- 7.4.1 STREAMLINE OPERATIONAL INTELLIGENCE BY EMBEDDING EDGE LOGIC ACROSS DISTRIBUTED IOT AND INDUSTRIAL AUTOMATION SYSTEMS

- 7.4.2 DEVICE MANAGEMENT & PROTOCOL BRIDGING

- 7.4.3 ROBOTICS COORDINATION

- 7.4.4 ASSET & INVENTORY TRACKING

- 7.5 CONTENT DELIVERY & MEDIA

- 7.5.1 ENHANCE CONTENT QUALITY AND REACH WITH EDGE-BASED MEDIA PROCESSING AND DISTRIBUTION INFRASTRUCTURE

- 7.5.2 VCDN CACHING

- 7.5.3 DYNAMIC SIGNAGE

- 7.5.4 LIVE-EVENT TRANSCODING

- 7.6 IMMERSIVE & INTERACTIVE EXPERIENCES

- 7.6.1 DELIVER REAL-TIME IMMERSION BY MOVING COMPUTE CLOSER TO USERS FOR AR/VR, DIGITAL TWINS, AND HAPTICS

- 7.6.2 AR/VR RENDERING

- 7.6.3 DIGITAL-TWIN COLLABORATION

- 7.6.4 HAPTIC-FEEDBACK SYSTEMS

- 7.7 OTHER APPLICATIONS

8 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZES: EDGE COMPUTING MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 ADOPTION OF EDGE COMPUTING SOLUTIONS TO ENHANCE OPERATIONAL EFFICIENCY IN LARGE ENTERPRISES

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- 8.3.1 DEMAND FOR SOLUTIONS TO RESOLVE COMPLEXITIES AND OPTIMIZE THE COST OF BUSINESS PROCESSES TO DRIVE MARKET

9 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT TYPES: EDGE COMPUTING MARKET DRIVERS

- 9.2 CLOUD EDGE

- 9.2.1 UNLOCKING SCALABILITY AND CONNECTIVITY BENEFITS THROUGH CLOUD EDGE INTEGRATION

- 9.3 ON-PREMISES EDGE

- 9.3.1 MAXIMIZING SECURITY AND CONTROL WITH LOCAL EDGE INFRASTRUCTURE SETUPS

- 9.4 DEVICE EDGE

- 9.4.1 ENABLE REAL-TIME DECISION-MAKING AT SOURCE WITH EMBEDDED PROCESSING AT EDGE OF DEVICES

10 EDGE COMPUTING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: EDGE COMPUTING MARKET DRIVERS

- 10.2 MANUFACTURING

- 10.2.1 EDGE COMPUTING OFFERS COST-EFFECTIVE WAYS OF ACHIEVING REMOTE MONITORING IN MANUFACTURING COMPANIES

- 10.2.2 MANUFACTURING: USE CASES

- 10.2.2.1 Quality control

- 10.2.2.2 Process optimization

- 10.2.2.3 Remote equipment monitoring

- 10.2.2.4 Condition-based monitoring

- 10.2.2.5 Supply chain optimization

- 10.3 ENERGY & UTILITIES

- 10.3.1 EDGE COMPUTING DEVICES HELP ADDRESS ISSUES IN MIDSTREAM SECTOR RELATED TO CRUDE OIL STORAGE AND TRANSPORTATION

- 10.3.2 ENERGY & UTILITIES: USE CASES

- 10.3.2.1 Smart grids

- 10.3.2.2 Fault detection

- 10.3.2.3 Distributed energy management

- 10.3.2.4 Energy optimization

- 10.3.2.5 Pipeline optimization

- 10.4 SOFTWARE & IT SERVICES

- 10.4.1 DELIVERING COMPREHENSIVE EDGE SOFTWARE AND IT SERVICE SOLUTIONS GLOBALLY

- 10.4.2 SOFTWARE & IT SERVICES: USE CASES

- 10.4.2.1 Infrastructure as Code (IaC) and edge orchestration

- 10.4.2.2 Low-latency content delivery & caching

- 10.4.2.3 Edge-based DevOps & CI/CD

- 10.4.2.4 Edge-based disaster recovery & failover

- 10.5 TELECOMMUNICATIONS

- 10.5.1 EDGE COMPUTING HELPS TELECOM PROVIDERS EXPAND NETWORK REACH WITH LOWER LATENCY

- 10.5.2 TELECOMMUNICATIONS: USE CASES

- 10.5.2.1 Network optimization

- 10.5.2.2 Mobile edge computing (MEC)

- 10.5.2.3 Content delivery networks (CDNs)

- 10.5.2.4 Network slicing

- 10.5.2.5 Edge caching

- 10.6 AUTOMOTIVE

- 10.6.1 DRIVING REAL-TIME INTELLIGENCE FOR SAFE, CONNECTED, AND AUTONOMOUS VEHICLES

- 10.6.2 AUTOMOTIVE: USE CASES

- 10.6.2.1 Autonomous driving and advanced driver assistance (ADAS)

- 10.6.2.2 Vehicle-to-everything (V2X) communication and smart mobility

- 10.6.2.3 In-vehicle infotainment and personalized experiences

- 10.7 MEDIA & ENTERTAINMENT

- 10.7.1 EDGE COMPUTING PROVIDES INSTANTANEOUS CONNECTION AND BETTER SCALABILITY FOR CONTENT CREATION AND DISTRIBUTION

- 10.7.2 MEDIA & ENTERTAINMENT: USE CASES

- 10.7.2.1 Personalized content recommendation

- 10.7.2.2 Real-time video streaming

- 10.7.2.3 Edge-based gaming

- 10.7.2.4 Virtual production

- 10.7.2.5 Interactive live events

- 10.8 RETAIL & CONSUMER GOODS

- 10.8.1 EDGE COMPUTING LEVERAGES NEW TECHNOLOGIES TO GATHER INSIGHTS ON PURCHASING PREFERENCES OF CONSUMERS

- 10.8.2 RETAIL & CONSUMER GOODS: USE CASES

- 10.8.2.1 Real-time inventory management

- 10.8.2.2 Personalized marketing

- 10.8.2.3 In-store analytics

- 10.8.2.4 Smart checkout

- 10.8.2.5 Dynamic pricing

- 10.9 TRANSPORTATION & LOGISTICS

- 10.9.1 EDGE COMPUTING REDUCES DATA SHARING AND LATENCY, FACILITATING EFFECTIVE AND EFFICIENT CONNECTION WITH DEVICES AND SENSORS IN VEHICLES AND DATABASES

- 10.9.2 TRANSPORTATION & LOGISTICS: USE CASES

- 10.9.2.1 Fleet management

- 10.9.2.2 Route optimization

- 10.9.2.3 Real-time cargo monitoring

- 10.9.2.4 Warehouse automation

- 10.10 HEALTHCARE & LIFE SCIENCES

- 10.10.1 IOT AND SMART WEARABLE EDGE DEVICES RECORD REAL-TIME VITAL INFORMATION

- 10.10.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.10.2.1 Remote patient monitoring

- 10.10.2.2 Smart hospitals

- 10.10.2.3 Secure data processing

- 10.10.2.4 Wearable health devices

- 10.10.2.5 Genomic analysis at the edge

- 10.11 OTHER VERTICALS

11 EDGE COMPUTING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: EDGE COMPUTING MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Higher adoption of edge computing solutions and associated services (professional, managed) to drive US market

- 11.2.4 CANADA

- 11.2.4.1 Enhanced data security and operational efficiency achieved by practicing edge computing software and services

- 11.3 EUROPE

- 11.3.1 EUROPE: EDGE COMPUTING MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Real-time data processing by companies to drive market in UK

- 11.3.4 GERMANY

- 11.3.4.1 Strong emphasis on Industry 4.0 and digital transformation initiatives taken to propel market

- 11.3.5 FRANCE

- 11.3.5.1 Real-time data processing and analytics, and personalized customer experiences to drive the French market

- 11.3.6 ITALY

- 11.3.6.1 Presence of key edge computing vendors with plans to implement smart cities and industrial automation to leverage market proliferation

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: EDGE COMPUTING MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Rapid proliferation and surge in adoption of edge computing solutions to drive Chinese market

- 11.4.4 JAPAN

- 11.4.4.1 Fusion of technologies such as AI & robotics with edge computing to propel market growth

- 11.4.5 AUSTRALIA & NEW ZEALAND (ANZ)

- 11.4.5.1 Extensive adoption of edge computing products to leverage market proliferation in ANZ, increasing agility in application deployment

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL (GCC)

- 11.5.3.1 kingdom of Saudi Arabia

- 11.5.3.1.1 Fueling Vision 2030 goals using edge computing software and services to drive market adoption

- 11.5.3.2 United Arab Emirates (UAE)

- 11.5.3.2.1 Edge computing products to leverage data-driven insights to gain competitive advantage for UAE businesses

- 11.5.3.3 Other GCC Countries

- 11.5.3.1 kingdom of Saudi Arabia

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Edge computing software solves challenges such as lower latency, bandwidth, and data sovereignty

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: EDGE COMPUTING MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Innovative edge computing practices across agriculture, healthcare, and urban infrastructure to fuel market growth

- 11.6.4 MEXICO

- 11.6.4.1 Comprehensive edge computing solutions designed to meet diverse needs of Mexican enterprises to drive market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 PRODUCT/BRAND COMPARISON

- 12.4.1 HEWLETT-PACKARD ENTERPRISE (HPE)

- 12.4.2 AMAZON WEB SERVICES (AWS)

- 12.4.3 DELL TECHNOLOGIES

- 12.4.4 CISCO

- 12.4.5 MICROSOFT

- 12.5 REVENUE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION OF KEY VENDORS

- 12.8.2 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 DELL TECHNOLOGIES

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 AWS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 MICROSOFT

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 CISCO

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 HPE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.4 Deals

- 13.2.5.5 MnM view

- 13.2.5.5.1 Right to win

- 13.2.5.5.2 Strategic choices

- 13.2.5.5.3 Weaknesses and competitive threats

- 13.2.6 IBM

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.7 GOOGLE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.8 NVIDIA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.9 INTEL

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.10 HUAWEI

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.1 DELL TECHNOLOGIES

- 13.3 OTHER COMPANIES

- 13.3.1 NOKIA

- 13.3.2 VMWARE

- 13.3.3 FASTLY

- 13.3.4 ADLINK

- 13.3.5 ORACLE

- 13.3.6 SEMTECH

- 13.3.7 MOXA

- 13.3.8 BELDEN

- 13.3.9 GE DIGITAL

- 13.3.10 DIGI INTERNATIONAL

- 13.3.11 LITMUS AUTOMATION

- 13.3.12 ZEDEDA

- 13.3.13 CLEARBLADE

- 13.3.14 VAPOR IO

- 13.3.15 SIXSQ

- 13.3.16 EDGEWORX

- 13.3.17 SUNLIGHT.IO

- 13.3.18 SAGUNA NETWORKS

- 13.3.19 ALEF EDGE

- 13.3.20 MUTABLE 326 13.3.21 ZTE CORPORATION

- 13.3.22 ADVANTECH CO., LTD.

- 13.3.23 LENOVO GROUP LTD

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 CLOUD COMPUTING MARKET

- 14.3 EDGE AI SOFTWARE MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 EDGE COMPUTING MARKET SIZE AND GROWTH, 2020-2024 (USD MILLION, YOY GROWTH %)

- TABLE 4 EDGE COMPUTING MARKET SIZE AND GROWTH, 2025-2030 (USD MILLION, YOY GROWTH %)

- TABLE 5 EDGE COMPUTING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON EDGE COMPUTING MARKET

- TABLE 7 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY REGION

- TABLE 8 INDICATIVE PRICING ANALYSIS OF EDGE COMPUTING SOLUTIONS, BY KEY PLAYER

- TABLE 9 PATENTS GRANTED TO VENDORS IN EDGE COMPUTING MARKET

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 EDGE COMPUTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 IMPORT DATA, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 18 EXPORT DATA, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 21 EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 22 COMPONENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 COMPONENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 25 EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 26 EDGE HARDWARE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 EDGE HARDWARE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 EDGE SERVERS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 EDGE SERVERS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 EDGE GATEWAYS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 EDGE GATEWAYS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 EDGE SENSORS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 EDGE SENSORS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 EDGE DEVICES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 EDGE DEVICES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 37 EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 38 EDGE SOFTWARE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 EDGE SOFTWARE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 DATA MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 DATA MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 DEVICE MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 DEVICE MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 APPLICATION MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 APPLICATION MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 NETWORK MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 NETWORK MANAGEMENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 49 EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 50 SERVICES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 SERVICES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 PROFESSIONAL SERVICES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 PROFESSIONAL SERVICES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 MANAGED SERVICES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 MANAGED SERVICES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 57 EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 REAL-TIME PROCESSING & CONTROL: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 REAL-TIME PROCESSING & CONTROL: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 EDGE AI & INFERENCE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 EDGE AI & INFERENCE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 IOT & INDUSTRIAL AUTOMATION: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 IOT & INDUSTRIAL AUTOMATION: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 CONTENT DELIVERY & MEDIA: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 CONTENT DELIVERY & MEDIA: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 IMMERSIVE & INTERACTIVE EXPERIENCES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 IMMERSIVE & INTERACTIVE EXPERIENCES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 OTHER APPLICATIONS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 71 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 72 LARGE ENTERPRISES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 LARGE ENTERPRISES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 SMES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 SMES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 77 EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 78 CLOUD EDGE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 CLOUD EDGE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 ON-PREMISES EDGE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 ON-PREMISES EDGE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 DEVICE EDGE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 DEVICE EDGE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 85 EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 86 MANUFACTURING: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 MANUFACTURING: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 ENERGY & UTILITIES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 ENERGY & UTILITIES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 SOFTWARE & IT SERVICES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 SOFTWARE & IT SERVICES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 TELECOMMUNICATIONS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 TELECOMMUNICATIONS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 AUTOMOTIVE: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 AUTOMOTIVE: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 MEDIA & ENTERTAINMENT: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 MEDIA & ENTERTAINMENT: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 RETAIL & CONSUMER GOODS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 RETAIL & CONSUMER GOODS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 TRANSPORTATION & LOGISTICS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 TRANSPORTATION & LOGISTICS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 HEALTHCARE & LIFE SCIENCES: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 HEALTHCARE & LIFE SCIENCES: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 OTHER VERTICALS: EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 OTHER VERTICALS: EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 EDGE COMPUTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 EDGE COMPUTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 US: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 127 US: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 128 US: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 129 US: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 CANADA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 131 CANADA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 132 CANADA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 133 CANADA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 149 EUROPE: EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 151 EUROPE: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 UK: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 153 UK: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 154 UK: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 155 UK: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 156 GERMANY: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 157 GERMANY: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 158 GERMANY: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 159 GERMANY: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 160 FRANCE: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 161 FRANCE: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 162 FRANCE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 163 FRANCE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 164 ITALY: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 165 ITALY: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 166 ITALY: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 167 ITALY: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 169 REST OF EUROPE: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 171 REST OF EUROPE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 177 ASIA PACIFIC: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 181 ASIA PACIFIC: EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 183 ASIA PACIFIC: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 185 ASIA PACIFIC: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 187 ASIA PACIFIC: EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 189 ASIA PACIFIC: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 CHINA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 191 CHINA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 192 CHINA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 193 CHINA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 194 JAPAN: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 195 JAPAN: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 196 JAPAN: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 197 JAPAN: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 198 AUSTRALIA & NEW ZEALAND: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 199 AUSTRALIA & NEW ZEALAND: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 200 AUSTRALIA & NEW ZEALAND: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 201 AUSTRALIA & NEW ZEALAND: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 224 GCC COUNTRIES: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 225 GCC COUNTRIES: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 226 GCC COUNTRIES: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 227 GCC COUNTRIES: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 229 GCC COUNTRIES: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 230 SAUDI ARABIA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 231 SAUDI ARABIA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 232 SAUDI ARABIA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 233 SAUDI ARABIA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 234 UAE: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 235 UAE: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 236 UAE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 237 UAE: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 238 OTHER GCC COUNTRIES: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 239 OTHER GCC COUNTRIES: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 240 OTHER GCC COUNTRIES: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 241 OTHER GCC COUNTRIES: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 242 SOUTH AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 243 SOUTH AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 244 SOUTH AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 245 SOUTH AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 247 REST OF MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 248 REST OF MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST & AFRICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 250 LATIN AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 251 LATIN AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2020-2024 (USD MILLION)

- TABLE 253 LATIN AMERICA: EDGE COMPUTING MARKET, BY EDGE HARDWARE, 2025-2030 (USD MILLION)

- TABLE 254 LATIN AMERICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 255 LATIN AMERICA: EDGE COMPUTING MARKET, BY EDGE SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 256 LATIN AMERICA: EDGE COMPUTING MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 257 LATIN AMERICA: EDGE COMPUTING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 258 LATIN AMERICA: EDGE COMPUTING MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 259 LATIN AMERICA: EDGE COMPUTING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 261 LATIN AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 263 LATIN AMERICA: EDGE COMPUTING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 264 LATIN AMERICA: EDGE COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 265 LATIN AMERICA: EDGE COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 266 LATIN AMERICA: EDGE COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 267 LATIN AMERICA: EDGE COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 268 BRAZIL: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 269 BRAZIL: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 270 BRAZIL: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 271 BRAZIL: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 272 MEXICO: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 273 MEXICO: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 274 MEXICO: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 275 MEXICO: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: EDGE COMPUTING MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 280 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 281 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 282 EDGE COMPUTING MARKET: REGION FOOTPRINT

- TABLE 283 EDGE COMPUTING MARKET: COMPONENT FOOTPRINT

- TABLE 284 EDGE COMPUTING MARKET: APPLICATION FOOTPRINT

- TABLE 285 EDGE COMPUTING MARKET: VERTICAL FOOTPRINT

- TABLE 286 EDGE COMPUTING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 287 EDGE COMPUTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 288 EDGE COMPUTING MARKET: PRODUCT LAUNCHES, MARCH 2022-JUNE 2025

- TABLE 289 EDGE COMPUTING MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 290 DELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 291 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 DELL TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 293 DELL TECHNOLOGIES: DEALS

- TABLE 294 AWS: COMPANY OVERVIEW

- TABLE 295 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 AWS: PRODUCT LAUNCHES

- TABLE 297 AWS: DEALS

- TABLE 298 AWS: EXPANSIONS

- TABLE 299 MICROSOFT: COMPANY OVERVIEW

- TABLE 300 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 MICROSOFT: PRODUCT LAUNCHES

- TABLE 302 MICROSOFT: DEALS

- TABLE 303 CISCO: COMPANY OVERVIEW

- TABLE 304 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 CISCO: PRODUCT LAUNCHES

- TABLE 306 CISCO: DEALS

- TABLE 307 CISCO: EXPANSIONS

- TABLE 308 HPE: COMPANY OVERVIEW

- TABLE 309 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 HPE: PRODUCT LAUNCHES

- TABLE 311 HPE: DEALS

- TABLE 312 IBM: COMPANY OVERVIEW

- TABLE 313 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 IBM: PRODUCT LAUNCHES

- TABLE 315 IBM: DEALS

- TABLE 316 IBM: EXPANSIONS

- TABLE 317 GOOGLE: COMPANY OVERVIEW

- TABLE 318 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 GOOGLE: PRODUCT LAUNCHES

- TABLE 320 GOOGLE: DEALS

- TABLE 321 NVIDIA: COMPANY OVERVIEW

- TABLE 322 NVIDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 NVIDIA: PRODUCT LAUNCHES

- TABLE 324 NVIDIA: DEALS

- TABLE 325 INTEL: COMPANY OVERVIEW

- TABLE 326 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 INTEL: PRODUCT LAUNCHES

- TABLE 328 INTEL: DEALS

- TABLE 329 HUAWEI: COMPANY OVERVIEW

- TABLE 330 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 HUAWEI: PRODUCT LAUNCHES

- TABLE 332 HUAWEI: DEALS

- TABLE 333 CLOUD COMPUTING MARKET, BY OFFERING, 2020-2024 (USD BILLION)

- TABLE 334 CLOUD COMPUTING MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 335 EDGE AI SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 336 EDGE AI SOFTWARE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

List of Figures

- FIGURE 1 EDGE COMPUTING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 EDGE COMPUTING MARKET: DATA TRIANGULATION

- FIGURE 4 EDGE COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF EDGE COMPUTING VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): EDGE COMPUTING MARKET

- FIGURE 10 GLOBAL EDGE COMPUTING MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN EDGE COMPUTING MARKET, 2025-2030

- FIGURE 12 EDGE COMPUTING MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING DIGITAL INFRASTRUCTURE DEMANDS AND AI WORKLOADS TO ACCELERATE MARKET GROWTH

- FIGURE 14 EDGE HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 EDGE AI & INFERENCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 DEVICE EDGE TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 17 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 MANUFACTURING SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS FASTEST-GROWING MARKET FOR NEXT FIVE YEARS

- FIGURE 20 EDGE COMPUTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 EDGE COMPUTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 EDGE COMPUTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 EDGE COMPUTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE, BY REGION

- FIGURE 25 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2025

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN EDGE COMPUTING MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 29 IMPORT SCENARIO FOR HS CODE 9031

- FIGURE 30 EXPORT SCENARIO FOR HS CODE 9031

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING EDGE COMPUTING ACROSS KEY USE CASES

- FIGURE 32 EDGE COMPUTING MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 EDGE SENSORS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 DEVICE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 PROFESSIONAL SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 IMMERSIVE & INTERACTIVE EXPERIENCES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 38 LARGE ENTERPRISES SEGMENT TO LEAD MARKET BY 2030

- FIGURE 39 ON-PREMISES EDGE SEGMENT TO LEAD MARKET BY 2030

- FIGURE 40 MANUFACTURING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 44 EDGE COMPUTING MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 45 EDGE COMPUTING MARKET: VENDOR PRODUCT/BRAND COMPARISON

- FIGURE 46 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 47 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 48 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 49 EDGE COMPUTING MARKET: COMPANY FOOTPRINT

- FIGURE 50 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 51 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 52 COMPANY VALUATION OF KEY VENDORS

- FIGURE 53 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 55 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 56 AWS: COMPANY SNAPSHOT

- FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 58 CISCO: COMPANY SNAPSHOT

- FIGURE 59 HPE: COMPANY SNAPSHOT

- FIGURE 60 IBM: COMPANY SNAPSHOT

- FIGURE 61 GOOGLE: COMPANY SNAPSHOT

- FIGURE 62 NVIDIA: COMPANY SNAPSHOT

- FIGURE 63 INTEL: COMPANY SNAPSHOT

- FIGURE 64 HUAWEI: COMPANY SNAPSHOT