PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1859655

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1859655

Flame Retardants for Engineering Resins Market by Type (Brominated, Phosphorous), Application (Polyamide, ABS, PET & PBT, PC/ABS Blends), End-use Industries (Electrical & Electronics, Automotive & Transportation), and Region - Global Forecast to 2030

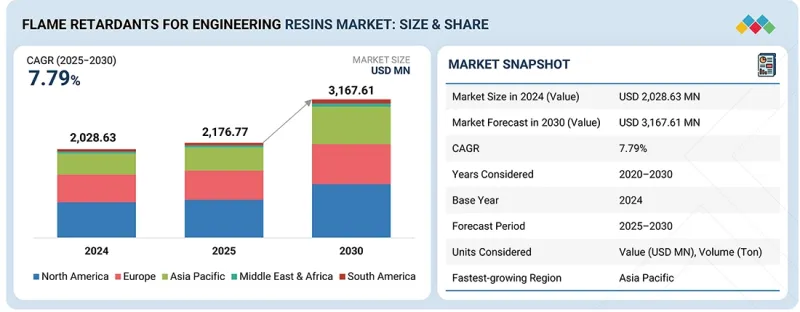

The flame retardants for engineering resins market is poised for significant growth, with a projected value of USD 3.2 billion by 2030 from the estimated USD 2.2 billion in 2025, exhibiting a robust CAGR of 7.79%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The superior properties of flame retardants for engineering resins, such as thermal stability, enhanced fire resistance, and the ability to effectively reduce flammability and slow the spread of flames, are fueling the adoption of flame retardants for engineering resins. Innovations in electrical devices, application methods, and materials have significantly enhanced the performance, functionality, and flexibility of flame retardants for engineering resins. These factors are propelling the demand for flame retardants for engineering resins in various end-use industries.

"Brominated flame retardant segment to account for largest market share in 2025"

The brominated flame retardants segment accounts for the largest share of the overall flame retardants for engineering resins market due to their established efficacy and wide availability. Despite growing environmental concerns, their proven ability to effectively reduce flammability and their relatively lower cost compared to alternatives sustained their dominance. Additionally, their compatibility with various engineering resin formulations and stringent industry standards further solidified their leading position in the market segment.

"Polyamide to be largest application of flame retardants for engineering resins in 2025"

The polyamide segment is the largest application of flame retardants for engineering resins market, primarily due to its compatibility with a broad range of flame retardant additives. Polyamide resins offer flexibility in formulation, allowing manufacturers to incorporate various flame retardant agents while maintaining desirable mechanical and thermal properties. This versatility makes polyamide-based engineering resins a preferred choice for applications where both flame resistance and material performance are critical.

"Electrical & electronics to be largest end-use industry of flame retardants for engineering resins market in 2025"

The electrical & electronics sector asserts its dominance as the leading end user of flame retardants for engineering resins. The ubiquitous integration of electronic components across various sectors necessitated flame-retardant materials for enhanced safety and regulatory compliance. Moreover, the global surge in demand for electronic devices, coupled with technological advancements, fueled the requirement for engineering resins with superior fire resistance properties. Stringent industry standards and regulations mandated the incorporation of flame-retardant additives in engineering resin formulations, solidifying its position as the largest end-use industry.

"Asia Pacific to be fastest-growing flame retardants for engineering resins market during forecast period"

Asia Pacific is projected to be the fastest-growing market for flame retardants for engineering resins. The region's expanding automotive, electronics, and construction sectors are driving escalated demand for flame-retardant materials integrated into engineering resins. Robust industrialization and urbanization across Asia Pacific are fostering infrastructure development, thereby intensifying the requirement for flame retardants for engineering resins in construction applications.

In the process of determining and verifying market sizes for multiple segments and subsegments, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: - Director Level - 27%, C-Level - 25%, and Others - 48%

- By Region: North America - 32%, Europe - 28%, Asia Pacific - 21%, South America - 12%, and Middle East & Africa - 7%

The key market players profiled in the report include Albemarle Corporation (US), LANXESS AG (Germany), BASF SE (Germany), Israel Chemicals Ltd. (Israel), Huber Engineered Materials (US), Clariant AG (Switzerland), Nabaltec AG (Germany), Italmatch Chemicals S.p.A (Italy), RTP Company (US), and Chemische Fabrik Budenheim KG (Germany).

Research Coverage

This report segments the market for flame retardants for engineering resins based on type, application, end-use industry, and region, and provides estimations for the overall value (USD million) of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for flame retardants for engineering resins.

Reasons to Buy this Report

This research report is focused on various levels of analysis-industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the flame retardants for engineering resins; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Global rise in fire incidents, Stringent fire safety regulations, Increasing demand for engineering plastics in various industries), restraints (High loading levels of mineral-based flame retardants, Harmful chemicals used in flame retardants, Fluctuation in raw materials cost), opportunities (Introduction of more effective synergist compounds, Rising demand in consumer electronics), and challenges (Emphasis on environmental protection, Health risks associated with flame retardant chemicals)

- Market Penetration: Comprehensive information on the flame retardants for engineering resins offered by top players in the global flame retardants for engineering resins market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the flame retardants for engineering resins market.

- Market Development: Comprehensive information about lucrative emerging markets-the report analyzes the markets for flame retardants for engineering resins across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global flame retardants for engineering resins market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the flame retardants for engineering resins market

- Impact of recession on the flame retardants for engineering resins market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLAME RETARDANTS FOR ENGINEERING RESINS MARKET

- 4.2 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION

- 4.3 NORTH AMERICA FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.4 REGIONAL FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE

- 4.5 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High rate of fire incidents worldwide

- 5.2.1.2 Implementation of stringent fire safety standards and regulations

- 5.2.1.3 Increasing demand for engineering plastics in various industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High loading levels of mineral-based flame retardants

- 5.2.2.2 Use of harmful chemicals in flame retardants

- 5.2.2.3 Fluctuation of raw materials costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Introduction of synergist compounds with high efficacy

- 5.2.3.2 Rising demand for consumer electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Emphasis on environmental protection

- 5.2.4.2 Health risks associated with flame retardant chemicals

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE, BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF FLAME RETARDANTS FOR ENGINEERING RESINS, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 ENHANCING SAFETY AND DURABILITY IN FLUID LEVEL MONITORING WITH RTP COMPANY'S FLAME RETARDANT COMPOUND

- 6.5.2 SUSTAINABLE FLAME RETARDANCY IN POLYOLEFIN FILM AND SHEET PRODUCTION WITH CLARIANT AG'S ADDWORKS LXR 920

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Halogenated flame retardants (HFRs)

- 6.6.1.2 Phosphorus-based flame retardants for engineering resins

- 6.6.2 COMPLIMENTARY TECHNOLOGIES

- 6.6.2.1 Synergists

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 382490)

- 6.7.2 EXPORT SCENARIO (HS CODE 382490)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 ISO 16000-31:2010

- 6.8.2.2 EU Regulation (EU) No 2019/1021 - Persistent Organic Pollutants (POPs)

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRIES/REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON FLAME RETARDANTS FOR ENGINEERING RESINS MARKET

7 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 BROMINATED FLAME RETARDANTS

- 7.2.1 WIDE ADOPTION IN VARIOUS APPLICATIONS FUELING MARKET GROWTH

- 7.2.2 BROMINATED EPOXY OLIGOMER

- 7.2.3 TETRABROMOBISPHENOL A

- 7.2.4 BROMINATED CARBONATE OLIGOMERS

- 7.2.5 1,2-BIS (2,4,6-TRIBROMOPHENOXY) ETHANE

- 7.2.6 DECABROMODIPHENYL ETHANE (DBDPE)

- 7.2.7 DECABROMODIPHENYL ETHER

- 7.2.8 TETRADECABROMODIPHENYL OXIDE

- 7.2.9 TETRADECABROMODIPHENOXY BENZENE

- 7.2.10 POLYDIBROMOSTYRENE (PDBS)

- 7.2.11 2,4,6 TRIS(2,4,6 TRIBROMOPHONXY)1,3,5 TRIAZINE

- 7.2.12 ETHYLENE BIS (TETRABROMOPHTHALTMIDE)

- 7.3 PHOSPHORUS FLAME RETARDANTS

- 7.3.1 HIGH THERMAL STABILITY AND LOW TOXICITY FUELING INCREASED ADOPTION

- 7.3.2 PHOSPHATE

- 7.3.3 PHOSPHINATE

- 7.3.4 RED PHOSPHORUS

- 7.3.5 PHOSPHITE

- 7.3.6 PHOSPHONATE

- 7.4 OTHER FLAME RETARDANTS

- 7.4.1 ANTIMONY OXIDE

- 7.4.2 CHLORINATED FLAME RETARDANTS

- 7.4.3 OTHERS

8 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 POLYAMIDE

- 8.2.1 GROWING DEMAND FROM TRANSPORTATION SECTOR TO DRIVE MARKET

- 8.3 ABS

- 8.3.1 VERSATILITY OF ABS FUELING ADOPTION IN VARIOUS END-USE INDUSTRIES

- 8.4 PET & PBT

- 8.4.1 HIGH STABILITY AND EXCELLENT PROCESSING CHARACTERISTICS TO DRIVE DEMAND IN AUTOMOTIVE INDUSTRY

- 8.5 POLYCARBONATE

- 8.5.1 EXPANSION OF MEDICAL AND AUTOMOTIVE INDUSTRIES TO DRIVE DEMAND

- 8.6 PC/ABS BLENDS

- 8.6.1 GOOD MISCIBILITY AND HEAT-RESISTANT PROPERTIES TO DRIVE SEGMENTAL GROWTH

- 8.7 OTHER APPLICATIONS

9 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 ELECTRICAL & ELECTRONICS

- 9.2.1 GROWING USE OF PLASTIC PARTS TO DRIVE DEMAND DURING FORECAST PERIOD

- 9.3 AUTOMOTIVE & TRANSPORTATION

- 9.3.1 INCREASING FOCUS ON LIGHTWEIGHT AND FIRE-SAFE COMPONENTS TO BOOST DEMAND

- 9.4 OTHER END-USE INDUSTRIES

10 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Large presence of local manufacturers and distributors catering to growing international demand to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Rising demand from automotive sector to support market growth

- 10.2.3 INDIA

- 10.2.3.1 Rising industrialization to drive demand

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Growth of automotive industry to drive market

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Presence of dynamic electronics industry to support market growth

- 10.3.2 CANADA

- 10.3.2.1 Increased automotive sales to drive demand

- 10.3.3 MEXICO

- 10.3.3.1 Rising industrialization to drive market growth

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Rising government expenditure on manufacturing sector to drive market

- 10.4.2 FRANCE

- 10.4.2.1 Expansion of electronics industry to be key driver for market growth

- 10.4.3 UK

- 10.4.3.1 Growth in automotive and construction industries to drive demand

- 10.4.4 ITALY

- 10.4.4.1 Strong automotive industry to drive market growth

- 10.4.5 RUSSIA

- 10.4.5.1 Rising demand from automotive sector to drive market

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Government investments in infrastructure development to drive market

- 10.5.1.1 Saudi Arabia

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Increase in domestic automotive sales to drive demand

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS' STRATEGIES

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End-use industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUP/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ALBEMARLE CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 CLARIANT AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 LANXESS AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BASF SE

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM View

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 ISRAEL CHEMICALS LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 NABALTEC AG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 HUBER ENGINEERED MATERIALS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 ITALMATCH CHEMICALS S.P.A.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.9 RTP COMPANY

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.10 CHEMISCHE FABRIK BUDENHEIM KG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 ARKEMA S.A.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.1 ALBEMARLE CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 GREENCHEMICALS SRL

- 12.2.2 STAHL HOLDINGS B.V.

- 12.2.3 GULEC CHEMICALS GMBH

- 12.2.4 FRX POLYMERS, INC.

- 12.2.5 CELANESE CORPORATION

- 12.2.6 AMFINE CHEMICAL CORPORATION

- 12.2.7 THOR GROUP LTD.

- 12.2.8 AXIPOLYMER INC.

- 12.2.9 DONGYING JINGDONG CHEMICAL CO., LTD.

- 12.2.10 OTSUKA CHEMICAL CO., LTD.

- 12.2.11 POLYPLASTICS CO., LTD.

- 12.2.12 CENTURY MULTECH, INC.

- 12.2.13 PRESAFER (QINGYUAN) PHOSPHOR CHEMICAL CO., LTD.

- 12.2.14 QINGDAO FUNDCHEM CO., LTD.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATION

- 13.3 FLAME RETARDANTS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 FLAME RETARDANTS MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 WESTERN EUROPE

- 13.4.4 CENTRAL & EASTERN EUROPE

- 13.4.5 MIDDLE EAST & AFRICA

- 13.4.6 SOUTH AMERICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- TABLE 3 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 4 CODES OF NATIONAL FIRE PROTECTION ASSOCIATION

- TABLE 5 ENGINEERING PLASTIC DEMAND, 2014-2024

- TABLE 6 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 9 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 10 AVERAGE SELLING PRICE IN MAJOR END-USE INDUSTRIES, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE TREND OF FLAME RETARDANTS FOR ENGINEERING RESINS, BY REGION, 2023-2030 (USD/KG)

- TABLE 12 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 13 IMPORT DATA FOR HS CODE 382490-COMPLIANT PRODUCTS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 382490-COMPLIANT PRODUCTS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: FUNDING/ INVESTMENT SCENARIO, 2020-2025

- TABLE 21 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 22 LIST OF MAJOR PATENTS RELATED TO FLAME RETARDANTS FOR ENGINEERING RESINS, 2014-2024

- TABLE 23 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 24 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 26 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 28 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 29 BROMINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 BROMINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 BROMINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 32 BROMINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 33 BROMINATED EPOXY OLIGOMER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 BROMINATED EPOXY OLIGOMER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 BROMINATED EPOXY OLIGOMER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 36 BROMINATED EPOXY OLIGOMER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 37 TETRABROMOBISPHENOL A: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 TETRABROMOBISPHENOL A: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 TETRABROMOBISPHENOL A: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 40 TETRABROMOBISPHENOL A: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 41 BROMINATED CARBONATE OLIGOMERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 BROMINATED CARBONATE OLIGOMERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 BROMINATED CARBONATE OLIGOMERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 44 BROMINATED CARBONATE OLIGOMERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 45 1,2-BIS (2,4,6-TRIBROMOPHENOXY) ETHANE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 1,2-BIS (2,4,6-TRIBROMOPHENOXY) ETHANE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 1,2-BIS (2,4,6-TRIBROMOPHENOXY) ETHANE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 48 1,2-BIS (2,4,6-TRIBROMOPHENOXY) ETHANE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 49 DECABROMODIPHENYL ETHANE (DBDPE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 DECABROMODIPHENYL ETHANE (DBDPE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 DECABROMODIPHENYL ETHANE (DBDPE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 52 DECABROMODIPHENYL ETHANE (DBDPE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 53 DECABROMODIPHENYL ETHER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 DECABROMODIPHENYL ETHER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 DECABROMODIPHENYL ETHER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 56 DECABROMODIPHENYL ETHER: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 57 TETRADECABROMODIPHENYL OXIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 TETRADECABROMODIPHENYL OXIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 TETRADECABROMODIPHENYL OXIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 60 TETRADECABROMODIPHENYL OXIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 61 TETRADECABROMODIPHENOXY BENZENE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 TETRADECABROMODIPHENOXY BENZENE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 TETRADECABROMODIPHENOXY BENZENE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 64 TETRADECABROMODIPHENOXY BENZENE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 65 POLYDIBROMOSTYRENE (PDBS): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 POLYDIBROMOSTYRENE (PDBS): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 POLYDIBROMOSTYRENE (PDBS): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 68 POLYDIBROMOSTYRENE (PDBS): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 69 2,4,6 TRIS(2,4,6 TRIBROMOPHONXY)1,3,5 TRIAZINE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 2,4,6 TRIS(2,4,6 TRIBROMOPHONXY)1,3,5 TRIAZINE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 2,4,6 TRIS(2,4,6 TRIBROMOPHONXY)1,3,5 TRIAZINE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 72 2,4,6 TRIS(2,4,6 TRIBROMOPHONXY)1,3,5 TRIAZINE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 73 ETHYLENE BIS (TETRABROMOPHTHALTMIDE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 ETHYLENE BIS (TETRABROMOPHTHALTMIDE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 ETHYLENE BIS (TETRABROMOPHTHALTMIDE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 76 ETHYLENE BIS (TETRABROMOPHTHALTMIDE): FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 77 PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 80 PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 81 PHOSPHATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 PHOSPHATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 PHOSPHATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 84 PHOSPHATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 85 PHOSPHINATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 PHOSPHINATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 PHOSPHINATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 88 PHOSPHINATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 89 RED PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 RED PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 RED PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 92 RED PHOSPHORUS FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 93 PHOSPHITE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 PHOSPHITE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 PHOSPHITE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 96 PHOSPHITE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 97 PHOSPHONATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 PHOSPHONATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 PHOSPHONATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 100 PHOSPHONATE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 101 OTHER FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 OTHER FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 OTHER FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 104 OTHER FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 105 ANTIMONY OXIDE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 ANTIMONY OXIDE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 ANTIMONY OXIDE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 108 ANTIMONY OXIDE FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 109 CHLORINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 CHLORINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 CHLORINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 112 CHLORINATED FLAME RETARDANTS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 113 OTHERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 OTHERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 OTHERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 116 OTHERS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 117 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 118 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 120 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 121 POLYAMIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION 2020-2024 (USD MILLION)

- TABLE 122 POLYAMIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION 2025-2030 (USD MILLION)

- TABLE 123 POLYAMIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 124 POLYAMIDE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 125 ABS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 ABS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 ABS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 128 ABS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 129 PET & PBT: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 PET & PBT: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 PET & PBT: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 132 PET & PBT: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 133 POLYCARBONATE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 134 POLYCARBONATE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 POLYCARBONATE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 136 POLYCARBONATE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 137 PC/ABS BLENDS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 138 PC/ABS BLENDS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 PC/ABS BLENDS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 140 PC/ABS BLENDS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 141 OTHER APPLICATIONS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 142 OTHER APPLICATIONS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 OTHER APPLICATIONS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 144 OTHER APPLICATIONS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 145 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 146 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SIZE, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 148 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SIZE, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 149 ELECTRICAL & ELECTRONICS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 150 ELECTRICAL & ELECTRONICS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 151 ELECTRICAL & ELECTRONICS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 152 ELECTRICAL & ELECTRONICS: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 153 AUTOMOTIVE & TRANSPORTATION: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 154 AUTOMOTIVE & TRANSPORTATION: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 155 AUTOMOTIVE & TRANSPORTATION: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 156 AUTOMOTIVE & TRANSPORTATION: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 157 OTHER END-USE INDUSTRIES: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 158 OTHER END-USE INDUSTRIES: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 159 OTHER END-USE INDUSTRIES: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 160 OTHER END-USE INDUSTRIES: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 161 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 162 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 164 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 165 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 168 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 169 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 172 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 173 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 176 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 177 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 180 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 181 CHINA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 182 CHINA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 CHINA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 184 CHINA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 185 JAPAN: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 186 JAPAN: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 JAPAN: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 188 JAPAN: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 189 INDIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 190 INDIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 INDIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 192 INDIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 193 SOUTH KOREA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 194 SOUTH KOREA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH KOREA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 196 SOUTH KOREA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 197 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 198 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 199 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 200 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 201 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 202 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 204 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 205 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 206 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 208 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 209 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 210 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 212 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 213 US: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 214 US: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 US: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 216 US: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 217 CANADA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 218 CANADA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 219 CANADA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 220 CANADA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 221 MEXICO: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 222 MEXICO: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 223 MEXICO: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 224 MEXICO: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 225 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 226 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 227 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 228 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 229 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 230 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 231 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 232 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 233 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 234 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 235 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 236 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 237 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 238 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 239 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 240 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 241 GERMANY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 242 GERMANY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 243 GERMANY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 244 GERMANY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 245 FRANCE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 246 FRANCE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 247 FRANCE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 248 FRANCE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 249 UK: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 250 UK: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 251 UK: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 252 UK: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 253 ITALY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 254 ITALY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 255 ITALY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 256 ITALY: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 257 RUSSIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 258 RUSSIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 259 RUSSIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 260 RUSSIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 261 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 265 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 269 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 273 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 276 MIDDLE EAST & AFRICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 277 SAUDI ARABIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 278 SAUDI ARABIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 279 SAUDI ARABIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 280 SAUDI ARABIA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 281 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 282 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 283 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 284 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 285 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 286 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 287 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 288 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 289 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 290 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 291 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 292 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 293 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 294 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 295 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 296 SOUTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 297 BRAZIL: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 298 BRAZIL: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 299 BRAZIL: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 300 BRAZIL: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 301 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF FLAME RETARDANTS FOR ENGINEERING RESINS

- TABLE 302 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DEGREE OF COMPETITION

- TABLE 303 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: REGION FOOTPRINT

- TABLE 304 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: TYPE FOOTPRINT

- TABLE 305 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: APPLICATION FOOTPRINT

- TABLE 306 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 307 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 308 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 309 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2025

- TABLE 310 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 311 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: EXPANSIONS, JANUARY 2020-SEPTEMBER 2025

- TABLE 312 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- TABLE 313 ALBEMARLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 CLARIANT AG: COMPANY OVERVIEW

- TABLE 315 CLARIANT AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 CLARIANT AG: EXPANSIONS

- TABLE 317 LANXESS AG: COMPANY OVERVIEW

- TABLE 318 LANXESS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 LANXESS AG: DEALS

- TABLE 320 BASF SE: COMPANY OVERVIEW

- TABLE 321 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 BASF SE: PRODUCT LAUNCHES

- TABLE 323 BASF SE: DEALS

- TABLE 324 ISRAEL CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 325 ISRAEL CHEMICALS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 NABALTEC AG: COMPANY OVERVIEW

- TABLE 327 NABALTEC AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 NABALTEC AG: EXPANSIONS

- TABLE 329 HUBER ENGINEERED MATERIALS: COMPANY OVERVIEW

- TABLE 330 HUBER ENGINEERED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 HUBER ENGINEERED MATERIALS: DEALS

- TABLE 332 ITALMATCH CHEMICALS S.P.A.: COMPANY OVERVIEW

- TABLE 333 ITALMATCH CHEMICALS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 ITALMATCH CHEMICALS S.P.A.: EXPANSIONS

- TABLE 335 RTP COMPANY: COMPANY OVERVIEW

- TABLE 336 RTP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 RTP COMPANY: EXPANSIONS

- TABLE 338 CHEMISCHE FABRIK BUDENHEIM KG: COMPANY OVERVIEW

- TABLE 339 CHEMISCHE FABRIK BUDENHEIM KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 340 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 341 ARKEMA S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 ARKEMA S.A.: DEALS

- TABLE 343 GREENCHEMICALS SRL: COMPANY OVERVIEW

- TABLE 344 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 345 GULEC CHEMICALS GMBH: COMPANY OVERVIEW

- TABLE 346 FRX POLYMERS, INC.: COMPANY OVERVIEW

- TABLE 347 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 348 AMFINE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 349 THOR GROUP LTD.: COMPANY OVERVIEW

- TABLE 350 AXIPOLYMER INC.: COMPANY OVERVIEW

- TABLE 351 DONGYING JINGDONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 352 OTSUKA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 353 POLYPLASTICS CO., LTD.: COMPANY OVERVIEW

- TABLE 354 CENTURY MULTECH, INC.: COMPANY OVERVIEW

- TABLE 355 PRESAFER (QINGYUAN) PHOSPHOR CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 356 QINGDAO FUNDCHEM CO., LTD.: COMPANY OVERVIEW

- TABLE 357 ASIA PACIFIC: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 358 ASIA PACIFIC: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 359 ASIA PACIFIC: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 360 ASIA PACIFIC: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 361 NORTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 362 NORTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 363 NORTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 364 NORTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 365 WESTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 366 WESTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 367 WESTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 368 WESTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 369 CENTRAL & EASTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 370 CENTRAL & EASTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 371 CENTRAL & EASTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 372 CENTRAL & EASTERN EUROPE: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 373 MIDDLE EAST & AFRICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 376 MIDDLE EAST & AFRICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 377 SOUTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 378 SOUTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 379 SOUTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 380 SOUTH AMERICA: FLAME RETARDANTS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

List of Figures

- FIGURE 1 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- FIGURE 7 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 BROMINATED FLAME RETARDANTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 ABS TO LEAD FLAME RETARDANTS FOR ENGINEERING RESINS MARKET DURING FORECAST PERIOD

- FIGURE 12 ELECTRICAL & ELECTRONICS TO DOMINATE FLAME RETARDANTS FOR ENGINEERING RESINS MARKET

- FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF FLAME RETARDANTS FOR ENGINEERING RESINS MARKET IN 2024

- FIGURE 14 GROWING ELECTRICAL & ELECTRONICS INDUSTRY TO DRIVE FLAME RETARDANTS FOR ENGINEERING RESINS MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING FLAME RETARDANTS FOR ENGINEERING RESINS MARKET DURING FORECAST PERIOD

- FIGURE 16 US ACCOUNTED FOR LARGEST SHARE OF FLAME RETARDANTS FOR ENGINEERING RESINS MARKET IN 2024

- FIGURE 17 BROMINATED FLAME RETARDANTS SEGMENT DOMINATED FLAME RETARDANTS FOR ENGINEERING RESINS MARKET IN 2024

- FIGURE 18 INDIA AND CHINA TO BE FASTEST-GROWING FLAME RETARDANTS FOR ENGINEERING RESINS MARKETS DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLAME RETARDANTS FOR ENGINEERING RESINS MARKET

- FIGURE 20 NUMBER OF FIRE ACCIDENTS REPORTED, 2014-2024

- FIGURE 21 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 24 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF FLAME RETARDANTS FOR ENGINEERING RESINS OFFERED BY KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES, 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF FLAME RETARDANTS FOR ENGINEERING RESINS, BY REGION, 2023-2030

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 IMPORT SCENARIO FOR HS CODE 382490-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2019-2024

- FIGURE 30 EXPORT SCENARIO FOR HS CODE 382490-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2019-2024

- FIGURE 31 PATENTS REGISTERED FOR FLAME RETARDANTS FOR ENGINEERING RESINS, 2014-2024

- FIGURE 32 MAJOR PATENTS RELATED TO FLAME RETARDANTS FOR ENGINEERING RESINS, 2014-2024

- FIGURE 33 LEGAL STATUS OF PATENTS RELATED TO FLAME RETARDANTS FOR ENGINEERING RESINS, 2014-2024

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF US, 2014-2024

- FIGURE 35 IMPACT OF AI/GEN AI ON FLAME RETARDANTS FOR ENGINEERING RESINS MARKET

- FIGURE 36 BROMINATED FLAME RETARDANTS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ABS SEGMENT TO LEAD FLAME RETARDANTS FOR ENGINEERING RESINS MARKET DURING FORECAST PERIOD

- FIGURE 38 ELECTRICAL & ELECTRONICS TO LEAD FLAME RETARDANTS FOR ENGINEERING RESINS MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN FLAME RETARDANTS FOR ENGINEERING RESINS MARKET BETWEEN 2025 AND 2030

- FIGURE 40 ASIA PACIFIC: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SNAPSHOT

- FIGURE 42 EUROPE: FLAME RETARDANTS FOR ENGINEERING RESINS MARKET SNAPSHOT

- FIGURE 43 ALBEMARLE CORPORATION LED FLAME RETARDANTS FOR ENGINEERING RESINS MARKET IN 2024

- FIGURE 44 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024

- FIGURE 45 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 46 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: COMPANY FOOTPRINT

- FIGURE 47 FLAME RETARDANTS FOR ENGINEERING RESINS MARKET: COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 48 COMPANY VALUATION

- FIGURE 49 EV/EBITDA

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 53 LANXESS AG: COMPANY SNAPSHOT

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- FIGURE 55 ISRAEL CHEMICALS LTD.: COMPANY SNAPSHOT

- FIGURE 56 NABALTEC AG: COMPANY SNAPSHOT

- FIGURE 57 ITALMATCH CHEMICALS S.P.A.: COMPANY SNAPSHOT

- FIGURE 58 ARKEMA S.A.: COMPANY SNAPSHOT