PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1790689

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1790689

Power Electronics Market by Power Discrete (Diode, Transistor, Thyristor), Power Module (FET, IGBT, Intelligent Power Module, Standard and Power Integrated Module), Power IC, Silicon, Silicon Carbide, Gallium Nitride - Global Forecast to 2030

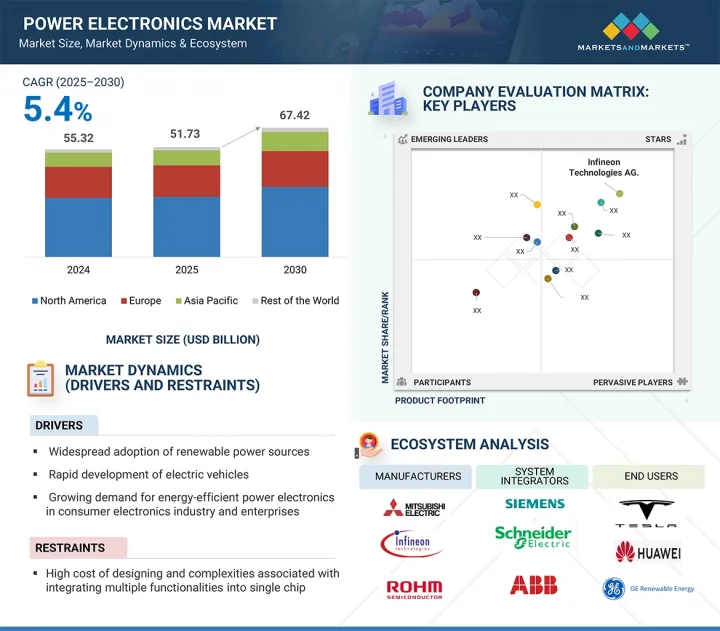

The global power electronics market was valued at USD 51.73 billion in 2025 and is projected to reach USD 67.42 billion by 2030, at a CAGR of 5.4% during the forecast period. Power electronics systems are witnessing growing demand across diverse industries due to the rising adoption of energy-efficient technologies, electrification trends, and advancements in semiconductor components. These systems play a vital role in controlling and converting electrical power in applications such as electric vehicles (EVs), renewable energy systems, industrial automation, and consumer electronics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Device Type, Material, Voltage Level, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Automotive manufacturers are increasingly integrating power electronics components like inverters, converters, and battery management systems to enhance vehicle performance and reduce emissions. Simultaneously, the rise of solar and wind energy installations is accelerating the deployment of power electronic inverters and controllers to ensure grid stability and energy optimization. Technological advancements in wide bandgap semiconductors (such as SiC and GaN), compact ICs, and intelligent power modules are boosting system efficiency, reliability, and thermal performance. Furthermore, ongoing investments in 5G infrastructure, smart grids, and industrial IoT are contributing to increased adoption of power electronics in telecommunications and factory automation.

"Low voltage segment to account for largest market share during the forecast period"

The low voltage segment is estimated to account for the largest market share during the forecast period due to its widespread use in consumer electronics and automotive applications, rapid adoption in industrial automation and IoT devices, and increasing demand for compact, energy-efficient power management solutions. Widespread use in consumer electronics and automotive applications drives consistent, high-volume demand for low-voltage components like power ICs and converters, which are essential for battery-powered devices such as smartphones, laptops, and onboard vehicle systems in electric and hybrid vehicles. As global demand for these devices continues to rise, so does the consumption of low-voltage power electronics. Additionally, the rapid adoption of industrial automation and IoT technologies requires low-voltage solutions to ensure safe and efficient operation of smart sensors, controllers, actuators, and connected devices. These components play a critical role in enabling real-time control, communication, and energy optimization across manufacturing and industrial environments. Furthermore, the rising demand for compact and energy-efficient power management solutions supports the integration of low-voltage power electronics in space-constrained and portable applications. With increasing emphasis on energy savings and sustainability, industries across the board are driving the demand for low-voltage systems, solidifying their dominant position in the power electronics market.

"Power modules segment projected to register highest CAGR during forecast period"

The power modules segment is expected to witness the highest CAGR during the forecast period due to the rising adoption of electric vehicles (EVs) and renewable energy systems, increasing demand for compact and high-efficiency power solutions, and advancements in wide bandgap semiconductor materials like SiC and GaN. Rising EV and renewable energy adoption is significantly boosting demand for power modules, as they are critical for managing high power loads in electric drivetrains, battery management systems, and solar/wind inverters. Their high efficiency, thermal stability, and reliability make them ideal for these applications. The increasing demand for compact and efficient power solutions across industries, particularly in automotive, industrial automation, and telecommunications, is driving the adoption of power modules, which integrate multiple power components into a single, streamlined package. This integration helps minimize power loss, reduce space requirements, and enhance overall system performance. Furthermore, advancements in wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) are transforming power module capabilities by enabling higher voltage tolerance, faster switching speeds, and improved energy efficiency compared to conventional silicon-based modules. These innovations make power modules increasingly attractive for high-performance and high-frequency applications, accelerating their adoption and driving strong growth in the power electronics market during the forecast period.

" North America to register second-highest CAGR during forecast period"

North America is anticipated to experience the second-highest CAGR during the forecast period, driven by robust developments in electric vehicle (EV) and charging infrastructure, growing uptake of renewable energy systems, and accelerating investments in industrial automation and smart grid technologies. Technological developments in EVs and charging infrastructure are driving the demand for inverters, converters, and battery management systems to a great extent, which are key to improving vehicle performance, optimizing energy conversion, and achieving charging efficiency. At the same time, increasing adoption of renewable energy systems, especially solar and wind, has generated demand for power converters and grid integration technologies that support efficient, stable, and smooth energy transmission between regional grids. In addition, North America is witnessing robust investments in industrial automation and power grid modernization. These trends are fueling broader adoption of advanced power management solutions to monitor in real-time, achieve energy efficiency, and balance loads. The installation of smart grid technologies and automated industrial systems is heavily dependent on high-performance, efficient power electronics, which contribute to the growth of the regional market. Overall, these factors contribute to making North America a key growth hub for the power electronics market during the forecast period.

Extensive primary interviews were conducted with key industry experts in the power electronics market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - Asia Pacific - 45%, Europe - 30%, North America - 20%, and RoW - 5%

The power electronics market is dominated by a few globally established players, such as Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Semiconductor Components Industries, LLC (US), STMicroelectronics (Switzerland), Analog Devices, Inc. (US), NXP Semiconductors (Netherlands), ROHM Co., LTD. (Japan), Mitsubishi Electric Corporation (Japan), Wolfspeed, Inc. (US), Transphorm Inc. (US), Qorvo, Inc. (US), Renesas Electronics Corporation (Japan), TOSHIBA CORPORATION (Japan), Fuji Electric Co., Ltd. (Japan), and Vishay Intertechnology, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the power electronics market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the power electronics market and forecasts its size by device type (Power Discrete, Power Module, Power ICs), material (Silicon, Silicon Carbide, Gallium Nitride), and vertical (ICT, Consumer Electronics, Industrial, Automotive & Transportation, Aerospace & Defense, Other Verticals). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the power electronics ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Widespread adoption of renewable power sources, Rapid development of electric vehicles, Growing demand for energy-efficient power electronics in consumer electronics industry and enterprises), restraints (High cost of designing and complexities associated with integrating multiple functionalities into single chip), opportunities (Emergence of wide bandgap semiconductors, Growing adoption of SiC power switches), challenges (Difficulties in designing and packaging SiC power devices)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the power electronics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the power electronics market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the power electronics market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Semiconductor Components Industries, LLC (US), STMicroelectronics (Switzerland), Analog Devices, Inc. (US), NXP Semiconductors (Netherlands), ROHM Co., LTD. (Japan), Mitsubishi Electric Corporation (Japan), Wolfspeed, Inc. (US), Transphorm Inc. (US), Qorvo, Inc. (US), Renesas Electronics Corporation (Japan), TOSHIBA CORPORATION (Japan), Fuji Electric Co., Ltd. (Japan), and Vishay Intertechnology, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWER ELECTRONICS MARKET

- 4.2 POWER ELECTRONICS MARKET, BY DEVICE TYPE

- 4.3 POWER ELECTRONICS MARKET, BY MATERIAL

- 4.4 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL

- 4.5 POWER ELECTRONICS MARKET, BY VERTICAL

- 4.6 POWER ELECTRONICS MARKET, BY REGION

- 4.7 POWER ELECTRONICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Widespread adoption of renewable power sources

- 5.2.1.2 Rapid development of electric vehicles

- 5.2.1.3 Growing demand for energy-efficient power electronics in consumer electronics industry and enterprises

- 5.2.2 RESTRAINT

- 5.2.2.1 High cost of designing and complexities associated with integrating multiple functionalities into single chip

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of wide bandgap semiconductor materials

- 5.2.3.2 Growing adoption of SiC power switches

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in designing and packaging SiC power devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION (2021-2024)

- 5.4.2 AVERAGE SELLING PRICE TREND OF POWER ELECTRONIC DEVICES, BY KEY PLAYERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Wide bandgap semiconductors

- 5.7.1.2 Advanced power modules

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Digital control systems

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Battery energy storage systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8541)

- 5.9.2 EXPORT DATA (HS CODE 8541)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDIES

- 5.11.1 SEMIPOWEREX DEVELOPED OPTIMIZED SIC POWER MODULES FOR STABLE OPERATION AT HIGH FREQUENCIES WITH ASSISTANCE FROM UNITEDSIC

- 5.11.2 CORSAIR DEPLOYED GAN FETS BY TRANSPHORM TO OFFER HIGH-PERFORMANCE POWER SUPPLY UNITS

- 5.11.3 DELTA ELECTRONICS POWERED DATA CENTERS WITH GALLIUM NITRIDE FROM TEXAS INSTRUMENTS INCORPORATED

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8541)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON POWER ELECTRONICS MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON POWER ELECTRONICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 WAFER SIZES OF POWER ELECTRONICS

- 6.1 INTRODUCTION

- 6.2 UP TO 200 MM

- 6.3 ABOVE 200 MM

7 CURRENT LEVELS OF POWER ELECTRONICS

- 7.1 INTRODUCTION

- 7.2 UP TO 25 A

- 7.3 26 TO 40 A

- 7.4 ABOVE 40 A

8 POWER ELECTRONICS MARKET, BY DEVICE TYPE

- 8.1 INTRODUCTION

- 8.2 POWER DISCRETE

- 8.2.1 ADVANCEMENTS IN ENERGY-EFFICIENT AND HIGH-PERFORMANCE DISCRETE DEVICES DRIVING MARKET GROWTH

- 8.2.2 DIODE

- 8.2.2.1 Mounting type and diode packaging

- 8.2.2.1.1 Through-hole

- 8.2.2.1.2 Surface mount

- 8.2.2.1.3 Packaging categories

- 8.2.2.2 PIN diode

- 8.2.2.3 Zener diode

- 8.2.2.4 Schottky diode

- 8.2.2.5 Switching diode

- 8.2.2.6 Rectifier diode

- 8.2.2.1 Mounting type and diode packaging

- 8.2.3 TRANSISTOR

- 8.2.3.1 Use of smart power transistors in augmenting system reliability and effective power management to propel market growth

- 8.2.3.2 Field-effect transistor (FET)

- 8.2.3.3 Bipolar junction transistor (BJT)

- 8.2.3.4 Insulated gate bipolar transistor (IGBT)

- 8.2.3.4.1 NPT IGBT

- 8.2.3.4.2 PT IGBT

- 8.2.4 THYRISTOR

- 8.3 POWER MODULE

- 8.3.1 RISING DEMAND FOR COMPACT AND HIGH-EFFICIENCY SOLUTIONS DRIVING MARKET GROWTH

- 8.3.2 POWER MODULE, BY DEVICE TYPE

- 8.3.2.1 FET

- 8.3.2.1.1 MOSFET module

- 8.3.2.1.1.1 MOSFET module, by type

- 8.3.2.1.1.2 MOSFET module, by mode

- 8.3.2.1.1 MOSFET module

- 8.3.2.2 IGBT

- 8.3.2.3 Other power module device types

- 8.3.2.1 FET

- 8.3.3 TYPES OF POWER MODULES

- 8.3.3.1 Intelligent power module

- 8.3.3.2 Standard and power integrated module

- 8.4 POWER INTEGRATED CIRCUITS

- 8.4.1 RISING DEMAND FOR COMPACT AND ENERGY-EFFICIENT DESIGNS TO FUEL MARKET GROWTH

9 POWER ELECTRONICS MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 SILICON

- 9.3 SILICON CARBIDE (SIC)

- 9.4 GALLIUM NITRIDE (GAN)

10 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL

- 10.1 INTRODUCTION

- 10.2 LOW

- 10.3 MEDIUM

- 10.4 HIGH

11 POWER ELECTRONICS MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 ICT

- 11.2.1 RISING DATA DEMANDS AND 5G DEPLOYMENT DRIVING MARKET GROWTH

- 11.3 CONSUMER ELECTRONICS

- 11.3.1 DEMAND FOR COMPACT, ENERGY-EFFICIENT DEVICES BOOSTS MARKET GROWTH

- 11.4 INDUSTRIAL

- 11.4.1 AUTOMATION AND ENERGY EFFICIENCY INITIATIVES PROPELLING MARKET GROWTH

- 11.4.2 ENERGY & POWER

- 11.4.2.1 Photovoltaics

- 11.4.2.2 Wind turbines

- 11.5 AUTOMOTIVE & TRANSPORTATION

- 11.5.1 INCREASING ADOPTION OF FAST-CHARGING ELECTRIC VEHICLES TO CONTRIBUTE TO MARKET GROWTH

- 11.5.1.1 Powertrain

- 11.5.1.2 Body and convenience

- 11.5.1.3 Chassis and safety systems

- 11.5.1.4 Infotainment systems

- 11.5.1 INCREASING ADOPTION OF FAST-CHARGING ELECTRIC VEHICLES TO CONTRIBUTE TO MARKET GROWTH

- 11.6 AEROSPACE & DEFENSE

- 11.6.1 GROWING DEMAND FOR ELECTRIC AIRCRAFT AND HIGH-FREQUENCY WARFARE SYSTEMS TO FUEL MARKET GROWTH

- 11.7 OTHER VERTICALS

12 POWER ELECTRONICS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Surging electrification trends and federal initiatives boost market growth

- 12.2.3 CANADA

- 12.2.3.1 Government sustainability policies and electrification goals driving market growth

- 12.2.4 MEXICO

- 12.2.4.1 Electrification initiatives and industrial modernization fueling demand

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 UK

- 12.3.2.1 Active government support to reduce carbon footprint across various verticals to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Stringent environmental regulations and electrification goals to fuel market

- 12.3.4 FRANCE

- 12.3.4.1 Increasing adoption of EVs to reduce pollution to boost market growth

- 12.3.5 ITALY

- 12.3.5.1 Electricity production from renewable energy sources to support market growth

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Adoption of EVs and development of renewable energy sources to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Focus on renewable energy production and adoption of SiC technology to contribute to market growth

- 12.4.4 INDIA

- 12.4.4.1 Rapid urbanization and infrastructure modernization to drive market

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Government-driven electrification and semiconductor innovation to fuel demand

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 ROW: MACROECONOMIC OUTLOOK

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Rising demand from energy and industrial sectors in Brazil to contribute to market growth

- 12.5.3 MIDDLE EAST & AFRICA

- 12.5.3.1 GCC countries

- 12.5.3.2 Rest of Middle East & Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Device type footprint

- 13.7.5.4 Vertical footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 List of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 INFINEON TECHNOLOGIES AG

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product Launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 STMICROELECTRONICS

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.3.3 Expansions

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 TEXAS INSTRUMENTS INCORPORATED

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 ANALOG DEVICES, INC.

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 MITSUBISHI ELECTRIC CORPORATION

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product Launches

- 14.2.6.3.2 Deals

- 14.2.7 VISHAY INTERTECHNOLOGY, INC.

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product Launches

- 14.2.7.3.2 Deals

- 14.2.8 FUJI ELECTRIC CO., LTD.

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product Launches

- 14.2.8.3.2 Deals

- 14.2.9 TOSHIBA CORPORATION

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product Launches

- 14.2.9.3.2 Deals

- 14.2.10 RENESAS ELECTRONICS CORPORATION

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product Launches

- 14.2.10.3.2 Deals

- 14.2.1 INFINEON TECHNOLOGIES AG

- 14.3 OTHER PLAYERS

- 14.3.1 ABB

- 14.3.2 LITTELFUSE, INC.

- 14.3.3 NXP SEMICONDUCTORS

- 14.3.4 MICROCHIP TECHNOLOGY INC.

- 14.3.5 ROHM CO., LTD.

- 14.3.6 SEMIKRON

- 14.3.7 TRANSPHORM INC.

- 14.3.8 QORVO, INC.

- 14.3.9 WOLFSPEED, INC.

- 14.3.10 EUCLID TECHLABS

- 14.3.11 NAVITAS SEMICONDUCTOR

- 14.3.12 EFFICIENT POWER CONVERSION CORPORATION

- 14.3.13 POWDEC

- 14.3.14 GANPOWER

- 14.3.15 NEXGEN POWER

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 POWER ELECTRONICS MARKET: RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE TREND OF MOSFET MODULE, BY REGION, 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF DIODE MODULE, BY REGION, 2021-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF MOSFET MODULES OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF DIODE MODULE OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 6 POWER ELECTRONICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 8 IMPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 MFN IMPORT TARIFFS FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 POWER ELECTRONICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 17 KEY BUYING CRITERIA, BY VERTICAL

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 20 POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 21 POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 22 POWER DISCRETE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 23 POWER DISCRETE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 24 POWER DISCRETE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (MILLION UNITS)

- TABLE 25 POWER DISCRETE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (MILLION UNITS)

- TABLE 26 POWER DISCRETE: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 27 POWER DISCRETE: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 28 TRANSISTOR: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 TRANSISTOR: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 30 POWER MODULE: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 31 POWER MODULE: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 32 POWER MODULE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 33 POWER MODULE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 34 POWER MODULE: POWER ELECTRONICS MARKET, BY MODULE TYPE, 2021-2024 (USD MILLION)

- TABLE 35 POWER MODULE: POWER ELECTRONICS MARKET, BY MODULE TYPE, 2025-2030 (USD MILLION)

- TABLE 36 POWER INTEGRATED CIRCUITS: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 37 POWER INTEGRATED CIRCUITS: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 38 POWER ELECTRONICS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 39 POWER ELECTRONICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 40 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL, 2021-2024 (USD MILLION)

- TABLE 41 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL, 2025-2030 (USD MILLION)

- TABLE 42 POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 43 POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 44 ICT: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 45 ICT: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 46 ICT: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 ICT: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 ICT: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 ICT: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 ICT: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 ICT: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 ICT: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 ICT: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 ICT: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 ICT: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 ICT: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 57 ICT: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 INDUSTRIAL: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 73 INDUSTRIAL: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 74 INDUSTRIAL: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 INDUSTRIAL: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 INDUSTRIAL: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 INDUSTRIAL: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 INDUSTRIAL: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 INDUSTRIAL: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 INDUSTRIAL: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 INDUSTRIAL: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 INDUSTRIAL: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 INDUSTRIAL: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 INDUSTRIAL: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 INDUSTRIAL: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 87 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 88 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 AUTOMOTIVE & TRANSPORTATION: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 101 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 102 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 AEROSPACE & DEFENSE: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 OTHER VERTICALS: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 115 OTHER VERTICALS: POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 116 OTHER VERTICALS: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 OTHER VERTICALS: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 OTHER VERTICALS: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 OTHER VERTICALS: POWER ELECTRONICS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 OTHER VERTICALS: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 OTHER VERTICALS: POWER ELECTRONICS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 OTHER VERTICALS: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 OTHER VERTICALS: POWER ELECTRONICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 OTHER VERTICALS: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 OTHER VERTICALS: POWER ELECTRONICS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 OTHER VERTICALS: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 OTHER VERTICALS: POWER ELECTRONICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: POWER ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: POWER ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: POWER ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: POWER ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: POWER ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: POWER ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 142 ROW: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 ROW: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 ROW: POWER ELECTRONICS MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 145 ROW: POWER ELECTRONICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: POWER ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: POWER ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 148 POWER ELECTRONICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 149 POWER ELECTRONICS MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 150 POWER ELECTRONICS MARKET: REGION FOOTPRINT

- TABLE 151 POWER ELECTRONICS MARKET: DEVICE TYPE FOOTPRINT

- TABLE 152 POWER ELECTRONICS MARKET: VERTICAL FOOTPRINT

- TABLE 153 POWER ELECTRONICS MARKET: LIST OF STARTUPS/SMES

- TABLE 154 POWER ELECTRONICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 155 POWER ELECTRONICS MARKET: PRODUCT LAUNCHES, JUNE 2021-JUNE 2025

- TABLE 156 POWER ELECTRONICS MARKET: DEALS, JUNE 2021-JUNE 2025

- TABLE 157 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 158 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 160 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 161 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 162 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCT LAUNCHES

- TABLE 164 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: DEALS

- TABLE 165 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 166 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 168 STMICROELECTRONICS: DEALS

- TABLE 169 STMICROELECTRONICS: EXPANSIONS

- TABLE 170 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 171 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 173 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 174 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 175 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 177 ANALOG DEVICES, INC.: DEALS

- TABLE 178 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 179 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 181 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 182 VISHAY INTERTECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 183 VISHAY INTERTECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 VISHAY INTERTECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 185 VISHAY INTERTECHNOLOGY, INC.: DEALS

- TABLE 186 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 187 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 FUJI ELECTRIC CO., LTD.: PRODUCT LAUNCHES

- TABLE 189 FUJI ELECTRIC CO., LTD.: DEALS

- TABLE 190 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 191 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 193 TOSHIBA CORPORATION: DEALS

- TABLE 194 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 195 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 197 RENESAS ELECTRONICS CORPORATION: DEALS

List of Figures

- FIGURE 1 POWER ELECTRONICS MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 POWER ELECTRONICS MARKET: RESEARCH DESIGN

- FIGURE 3 POWER ELECTRONICS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 POWER ELECTRONICS MARKET: TOP-DOWN APPROACH

- FIGURE 5 POWER ELECTRONICS MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 6 POWER ELECTRONICS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 POWER ELECTRONICS MARKET: DATA TRIANGULATION

- FIGURE 8 POWER ELECTRONICS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 POWER ELECTRONICS MARKET SNAPSHOT

- FIGURE 10 POWER ICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 SILICON MATERIAL TO LEAD POWER ELECTRONICS MARKET IN 2025

- FIGURE 12 LOW VOLTAGE LEVEL TO LEAD POWER ELECTRONICS MARKET IN 2025

- FIGURE 13 CONSUMER ELECTRONICS SECTOR TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 RISING DEMAND FOR ENERGY-EFFICIENT SOLUTIONS, ELECTRIC VEHICLES, AND RENEWABLE ENERGY SYSTEMS TO DRIVE MARKET GROWTH

- FIGURE 16 POWER INTEGRATED CIRCUITS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 17 SILICON MATERIAL TO DOMINATE POWER ELECTRONICS MARKET IN 2030

- FIGURE 18 LOW VOLTAGE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 AUTOMOTIVE & TRANSPORTATION TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET FOR POWER ELECTRONICS IN 2030

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 22 POWER ELECTRONICS MARKET DYNAMICS

- FIGURE 23 IMPACT ANALYSIS OF DRIVERS ON POWER ELECTRONICS MARKET

- FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS ON POWER ELECTRONICS MARKET

- FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES IN POWER ELECTRONICS MARKET

- FIGURE 26 IMPACT ANALYSIS OF CHALLENGES IN POWER ELECTRONICS MARKET

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF MOSFET MODULE, BY REGION, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF DIODE MODULE, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE OF MOSFET MODULES OFFERED BY KEY PLAYERS, 2024

- FIGURE 31 AVERAGE SELLING PRICE OF DIODE MODULE OFFERED BY KEY PLAYERS, 2024

- FIGURE 32 VALUE CHAIN ANALYSIS: POWER ELECTRONICS MARKET

- FIGURE 33 ECOSYSTEM ANALYSIS: POWER ELECTRONICS MARKET

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 8541-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2020-2024

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 38 POWER ELECTRONICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 POWER ELECTRONICS MARKET: IMPACT OF PORTER'S FIVE FORCES

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 42 IMPACT OF AI/GEN AI ON POWER ELECTRONICS MARKET

- FIGURE 43 POWER ICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 44 SILICON TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 45 LOW VOLTAGE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 46 AUTOMOTIVE & TRANSPORTATION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: POWER ELECTRONICS MARKET SNAPSHOT

- FIGURE 49 EUROPE: POWER ELECTRONICS MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: POWER ELECTRONICS MARKET SNAPSHOT

- FIGURE 51 POWER ELECTRONICS MARKET SHARE ANALYSIS, 2024

- FIGURE 52 POWER ELECTRONICS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 53 POWER ELECTRONICS MARKET: COMPANY VALUATION (2025)

- FIGURE 54 POWER ELECTRONICS MARKET: FINANCIAL METRICS (2025)

- FIGURE 55 POWER ELECTRONICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 56 POWER ELECTRONICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 POWER ELECTRONICS MARKET: COMPANY FOOTPRINT

- FIGURE 58 POWER ELECTRONICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 59 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 60 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

- FIGURE 61 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 62 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 63 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 64 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 66 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT